Edit Your Comment

Any Volume spread analysis / Wyckoff traders?

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 18:16

Členem od Nov 02, 2009

85 příspěvků

By the way, my stop loss got hit at breakeven point, another fake break and there she goes.

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 18:18

Členem od Nov 02, 2009

85 příspěvků

Rubn posted:

By the way, my stop loss got hit at breakeven point, another fake break and there she goes.

@felotus That's what I was saying, the method works, the rest depends on you.

Preservation of capital and home runs.

Členem od Mar 29, 2012

192 příspěvků

Nov 26, 2013 at 18:37

Členem od Mar 29, 2012

192 příspěvků

felotus posted:

Yeah I guess. Sometimes makes me wonder why we waste our time on fighting for a price that moves up or down, rather than curing cancer.

That is exactly one of the point discussed in the documentary with Bodek...one of the Quant had people from Top BS trading with him and that were there hunting for pennies instead of doing something greater for the world.

As Ruben highlighted, curing deceases can be personally rewarding but it won't bring you even close to the financial security that those 'fancy' positions in the top hedge funds can give you.

I don't think any Trader would do this job/hobbies for anything related to altruism. This is pure personal enrichment. We don't 'add any liquidity', like HFT advertise themselves, we just try to make money on nothingness.

Anyway let's be optimistic and think that traders will capitalize on the money they make to do good things 😉

A smooth sea never made a skillful sailor.

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 18:42

Členem od Nov 02, 2009

85 příspěvků

@Thalantas Im watching the documentary right now, it's really eye opener, thanks for sharing it again!! :-)

Preservation of capital and home runs.

Členem od Nov 21, 2011

1718 příspěvků

Nov 26, 2013 at 19:18

Členem od Nov 21, 2011

1718 příspěvků

Rubn posted:

By the way, my stop loss got hit at breakeven point, another fake break and there she goes.

'The rest depends on you' => Yes you exited B/E because you forgot what the market was doing while it's clear on your Timeframe.

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 20:23

Členem od Nov 02, 2009

85 příspěvků

CrazyTrader posted:Rubn posted:

By the way, my stop loss got hit at breakeven point, another fake break and there she goes.

'The rest depends on you' => Yes you exited B/E because you forgot what the market was doing while it's clear on your Timeframe.

Exactly that what I said, it was my mistake, the methodology was correct :-) But I don't get this part 'you forgot what the market was doing while it's clear on your Timeframe. ' What was the thing I forgot? Can you tell me? What the market was doing? Waiting for your answer. => Look at the chart now, After the 2nd fake break (hunting for stops) the price went up (and it's up right now). So, as you can see, VSA / Wyckoff is a sound methodology, the methodology wasn't wrong, I was wrong in putting the SL at breakeven too early, I was caught in a typical Stop Loss hunting maneuver that you see everyday in every market.

Regards.

Preservation of capital and home runs.

Členem od Nov 21, 2011

1718 příspěvků

Nov 26, 2013 at 21:51

Členem od Nov 21, 2011

1718 příspěvků

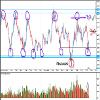

Hope this help you to see what I mean:

You haven't noticed that market was ranging on purple cercles. So I guess your TP was higher from where it should have been placed.

Don't expect 100 pips/trades if market conditions doesn't seem that way.

Using my Money Management in a range market can be awesome.

You haven't noticed that market was ranging on purple cercles. So I guess your TP was higher from where it should have been placed.

Don't expect 100 pips/trades if market conditions doesn't seem that way.

Using my Money Management in a range market can be awesome.

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 22:53

Členem od Nov 02, 2009

85 příspěvků

CrazyTrader posted:

Hope this help you to see what I mean:

You haven't noticed that market was ranging on purple cercles. So I guess your TP was higher from where it should have been placed.

Don't expect 100 pips/trades if market conditions doesn't seem that way.

Using my Money Management in a range market can be awesome.

I really appreciate this, thanks for the answer. Yes you are right, a good scapler/day trader would have closed his/her position at top of the range. I should have explained earlier in this thread (my apologies) but here it goes:

I don't consider myself a scalper nor daytrader. You could say that I tend to do more swing trades but what I consider myself its just a speculator. With this in mind, I follow what conventional trading call 'trends', I (and other VSA/ Wyckoff traders) call this market flow. Let me explain it a little bit: If I spot what in my opinion is strenght in the background I will look for buying opportunities, and vice verse with weakness in the background. I look close to 5min charts because it gives me true price action + volume action, in my opinion these short-timeframe-charts give you exactly the beggining of a nice move, for example, strenght coming in on 5 minutes chart, then strenght in 15min and then in H1 (after you've missed some important pips earlier in the beginning of the move).

In this way, I do not like to close trades by hand (not even 1/3 of a position) in situations like this, I like to let my trades run as far as possible (until I see serious signs of strenght/weakness in major timeframes). In situations like this (when you can see in the charts that at the top of the range supply was entering the market) I like to put my stop loss at break even (sometimes even locking in some pips in profit) and let the no risk trade run. In my humble opinion if I close a trade because price is at top of some range and a few bars later breaks to the upside my psicology will start to eat me and I will want to re-enter, but this time at price that maybe isn't the best, increasing the risk. If I instead am in a good position(i.e. bought at the bottom, stop loss locking some profits) and the price breaks to the upside I could enter another trade without risking more money, for example:

-Bought at the bottom risking 50 pips or 5% of the account

- price moves upwards reaching the top channel, stop loss moves to break even

- Price breaks the upper channel

- Enter second buy order, stop loss at 5% of the account where the 1st order's stop loss is

In this way I am still risking 5% of the account for 50 pips BUT if price moves 50 pips more in my direction I will gain 10% of the account instead of just 5%

Trading is very perspective based, maybe this money management method is trash to you but is what I have worked out from several years of doing the same thing. Please let me know what you think.

Regards. :-)

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 23:02

Členem od Nov 02, 2009

85 příspěvků

This are called shakeouts, they are maneuver done by Professional Money to catch stop losses and to shake weak traders out of positions and force them to cover. They tend to drive prices down and then before the close dive them back up rapidly generating volume spikes.

Btw, I was caught earlier this day in one of those, lol.

Btw, I was caught earlier this day in one of those, lol.

Preservation of capital and home runs.

Členem od Nov 21, 2011

1718 příspěvků

Nov 26, 2013 at 23:06

Členem od Nov 21, 2011

1718 příspěvků

Your method is good and you stick to it so you must be profitable.

But with swing trading I don't think there are opportunities everyday. So if you do every single day, a lot of trades will be aborted... but that's the game. ^^

But with swing trading I don't think there are opportunities everyday. So if you do every single day, a lot of trades will be aborted... but that's the game. ^^

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 23:16

(Upravené Nov 26, 2013 at 23:21)

Členem od Nov 02, 2009

85 příspěvků

CrazyTrader posted:

Your method is good and you stick to it so you must be profitable.

But with swing trading I don't think there are opportunities everyday. So if you do every single day, a lot of trades will be aborted... but that's the game. ^^

Thanks for the kind words my friend. I surely will stick to it, I have still so much to learn, and always will, but its like an addiction to be improving.

Yes, I don't trade everyday, I do watch 5min price action every day but I open just 1 or 2 positions per week in average.

Regards

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 26, 2013 at 23:24

Členem od Nov 02, 2009

85 příspěvků

Rubn posted:

This are called shakeouts, they are maneuver done by Professional Money to catch stop losses and to shake weak traders out of positions and force them to cover. They tend to drive prices down and then before the close dive them back up rapidly generating volume spikes.

Btw, I was caught earlier this day in one of those, lol.

Here is the from-book-definition of a shakeout.

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 27, 2013 at 13:48

Členem od Nov 02, 2009

85 příspěvků

Rubn posted:

This are called shakeouts, they are maneuver done by Professional Money to catch stop losses and to shake weak traders out of positions and force them to cover. They tend to drive prices down and then before the close dive them back up rapidly generating volume spikes.

Btw, I was caught earlier this day in one of those, lol.

Remember, 'shakeouts' happen for a reason. If someone is shaking out weak holders (like I was shaken out yesterday, lol) it's because they have already bought at the bottom, they want to re-accumulate buy orders by forcing the retail traders to cover (and buy from them!). They know where the stop losses are and they will get em. Smart Money/Professional Money manipulations are a reality.

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 27, 2013 at 14:01

Členem od Nov 02, 2009

85 příspěvků

I don't like to post hindsight analysis in forums, but I think its a good learning experience. So here it goes:

Yesterday 'they' shaked out weak holders, and today we already broke thru all tops.

I could not trade these breaks because I was sleeping (I live in America), but in hindsight (for what is worth) the break of the first top was a 'buying opportunity'. Basically increasing volume on the break and a low volume test of the broken level (also a nice no supply bar barealy touching that level). This pattern repeats over and over again!

I pretend to use this thread for my own learning experience and everyone who wants to join.

Regards.

Yesterday 'they' shaked out weak holders, and today we already broke thru all tops.

I could not trade these breaks because I was sleeping (I live in America), but in hindsight (for what is worth) the break of the first top was a 'buying opportunity'. Basically increasing volume on the break and a low volume test of the broken level (also a nice no supply bar barealy touching that level). This pattern repeats over and over again!

I pretend to use this thread for my own learning experience and everyone who wants to join.

Regards.

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 27, 2013 at 15:25

Členem od Nov 02, 2009

85 příspěvků

This are examples of more fake breaks and true breaks. You can spot if they are true or fake by looking at the volume and the price action that comes with it.

Maybe I will buy this thing if it pulls back on low volume to the broken level.

Maybe I will buy this thing if it pulls back on low volume to the broken level.

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 28, 2013 at 14:24

Členem od Nov 02, 2009

85 příspěvků

Volume spread analysis and Wyckoff explain the London sesion's price action.

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 28, 2013 at 14:26

Členem od Nov 02, 2009

85 příspěvků

Wyckoff's laws are a must to understand how markets work.

Preservation of capital and home runs.

Členem od Nov 02, 2009

85 příspěvků

Nov 28, 2013 at 14:32

Členem od Nov 02, 2009

85 příspěvků

BTW, couldnt catch that opportunity because of my timezone. I was sleeping :-(

Preservation of capital and home runs.

Členem od Mar 29, 2012

192 příspěvků

Nov 28, 2013 at 16:35

Členem od Mar 29, 2012

192 příspěvků

Rubn posted:

@Thalantas Im watching the documentary right now, it's really eye opener, thanks for sharing it again!! :-)

You're welcome :)

About your system, most of your chart posted here were on GBPJPY, any reason for that? Is it dependent to certain currencies?

A smooth sea never made a skillful sailor.

Členem od Nov 21, 2011

1718 příspěvků

Nov 28, 2013 at 17:21

Členem od Nov 21, 2011

1718 příspěvků

All we need it's Price Action... it doesn't matter the pair.

*Komerční použití a spam nebudou tolerovány a mohou vést ke zrušení účtu.

Tip: Zveřejněním adresy URL obrázku /služby YouTube se automaticky vloží do vašeho příspěvku!

Tip: Zadejte znak @, abyste automaticky vyplnili jméno uživatele, který se účastní této diskuse.