Edit Your Comment

big losses the last few weeks

forex_trader_139412

Medlem sedan Jul 16, 2013

385 inlägg

Aug 25, 2015 at 13:18

Medlem sedan Jul 16, 2013

385 inlägg

The last few weeks were exceptionally hard on my accounts. I also saw some pretty stable accounts of other traders go bust.

I was testing some new ways, which did well for weeks and then ....BOOM...out of the blue false signals were produced and I acted on them. Too many stoplosses were hit and just more and more false signals came out. Some of my real accounts suffered unrecoverable (in short term) damage.

Did you guys also experience hard times?

I was testing some new ways, which did well for weeks and then ....BOOM...out of the blue false signals were produced and I acted on them. Too many stoplosses were hit and just more and more false signals came out. Some of my real accounts suffered unrecoverable (in short term) damage.

Did you guys also experience hard times?

Medlem sedan Oct 02, 2014

909 inlägg

Aug 25, 2015 at 15:35

Medlem sedan Oct 02, 2014

909 inlägg

Yes. I believe everyone of us has had bad trades and bad periods. It's important not to give in to this emotion. Tough times don't last, tough people do.

Positivity

forex_trader_139412

Medlem sedan Jul 16, 2013

385 inlägg

Aug 25, 2015 at 16:03

Medlem sedan Jul 16, 2013

385 inlägg

Yes, the usual ups and downs are fine.. I can cope with that, but I would like to know if anyone experienced 'exceptional' difficult times in the very recent past or just me? Or did my accounts buckle with the usual ups and downs?

forex_trader_186239

Medlem sedan Apr 15, 2014

224 inlägg

Aug 25, 2015 at 21:15

Medlem sedan Apr 15, 2014

224 inlägg

market was hunting the super-leveraged accounts trying to hit its stop losses... usual story

forex_trader_264753

Medlem sedan Jul 25, 2015

20 inlägg

Aug 26, 2015 at 06:53

Medlem sedan Jul 25, 2015

20 inlägg

Rihan i feel you.

I have since last week like 90% loosing trades and normally i got always around 80% winning trades. I even almost grilled one of my accounts last week because i got demotivated and angry and wanted to earn fast the lost money back so i traded big lots. Usual beginner mistake 😁

Have as well a feeling like i have now a bad period.

Maybe its the best to just go to vacation or just concentrate on something else when you think you got a bad period and just relax for a while and think about something else and try it a while later again 😄

I have since last week like 90% loosing trades and normally i got always around 80% winning trades. I even almost grilled one of my accounts last week because i got demotivated and angry and wanted to earn fast the lost money back so i traded big lots. Usual beginner mistake 😁

Have as well a feeling like i have now a bad period.

Maybe its the best to just go to vacation or just concentrate on something else when you think you got a bad period and just relax for a while and think about something else and try it a while later again 😄

Aug 29, 2015 at 09:21

Medlem sedan Aug 14, 2015

19 inlägg

RSTrading posted:Practically in the forex, we all know that fiinding a good forex signals provider that will work well is not easy. Experience has shown that the Internet is full of unreliable third party signal providers who boast very attractive websites with high subscription service rates and testimonial references which could you get you believing but still is not worth it. Here is an advice I will give you: when you are convinced that you have found a potential good forex signal service provider, make sure that they should present to you their last trading history results. It is punishable offence of they give you information on this that is not true.And most importantly, a reliable signal provider wouldn't be reluctant to give you a free trial.

....BOOM...out of the blue false signals were produced and I acted on them. Too many stoplosses were hit and just more and more false signals came out. Some of my real accounts suffered unrecoverable (in short term) damage.

Aug 29, 2015 at 09:23

Medlem sedan May 01, 2015

5 inlägg

last month and this month are summer trading months, low liquidity, and lots of air pockets, TP and stoploss is not respected in this kind of market

one shot one kill

Aug 29, 2015 at 09:57

Medlem sedan Mar 02, 2010

97 inlägg

nope, do an async hedge to minimize your (open/closed) loss

ixbone@

Medlem sedan Sep 20, 2014

365 inlägg

Aug 29, 2015 at 12:52

(redigerad Aug 29, 2015 at 13:17)

Medlem sedan Sep 20, 2014

365 inlägg

We're in trending markets. Mean return systems will fail. All my position building systems have literally exploded. You should try have both in the market at all times. There are really only two systems you can do, regardless of how you do it.

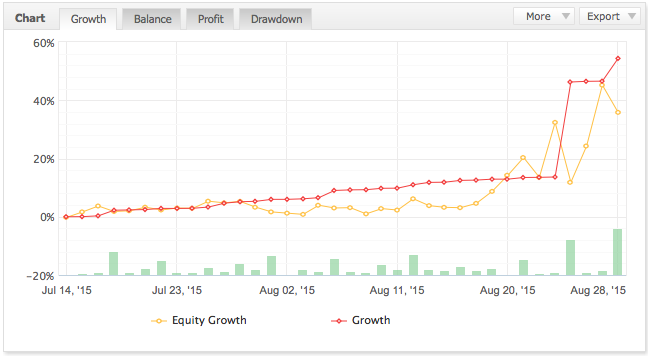

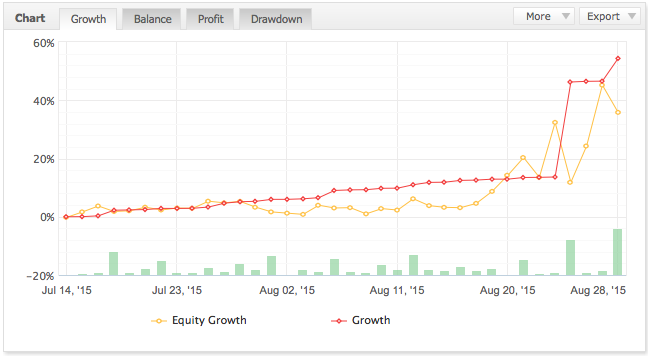

You can see below exactly where the trending started here. I was wafting around and then all of a sudden...

It does look a bit rough, but I think that was due to that NZD spike. That was a very unusual event. Doesn't happen often.

You can see below exactly where the trending started here. I was wafting around and then all of a sudden...

It does look a bit rough, but I think that was due to that NZD spike. That was a very unusual event. Doesn't happen often.

Medlem sedan Sep 20, 2014

365 inlägg

Aug 29, 2015 at 12:58

(redigerad Aug 29, 2015 at 13:23)

Medlem sedan Sep 20, 2014

365 inlägg

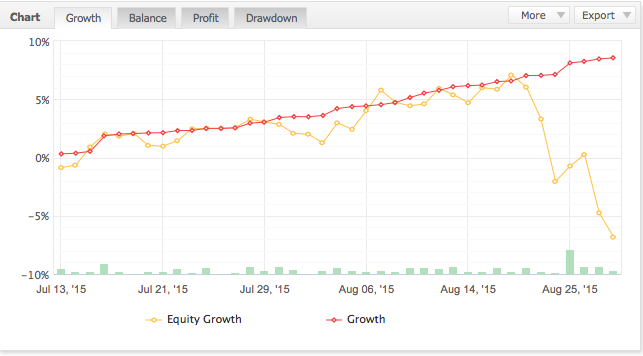

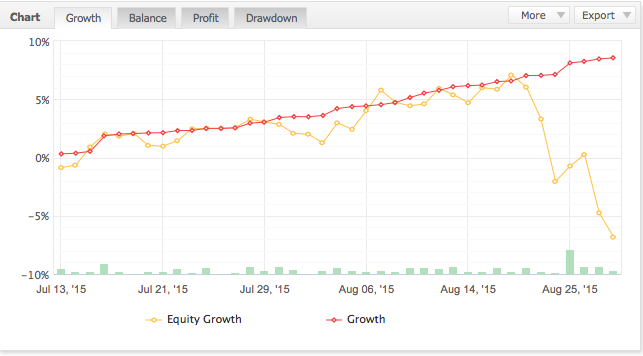

And here's my mean return, between these two I can pinpoint the change closely, 21-22 Aug the market started trending.

It will recover in due course when the markets return to ranges. Then the trending one will flatline again. And so it goes. Just keep making sure you have systems running for both markets and that way you won't have to do threads like these.

Regardless of the loss here, I'm up 30% net in 2 weeks. Position building systems don't build positions in mean return markets, but they are frustrating as hell to watch. So this way I always have something that's working.

The idea is to hedge systems. Not trades or positions.

It will recover in due course when the markets return to ranges. Then the trending one will flatline again. And so it goes. Just keep making sure you have systems running for both markets and that way you won't have to do threads like these.

Regardless of the loss here, I'm up 30% net in 2 weeks. Position building systems don't build positions in mean return markets, but they are frustrating as hell to watch. So this way I always have something that's working.

The idea is to hedge systems. Not trades or positions.

Aug 29, 2015 at 21:00

Medlem sedan Jan 12, 2015

51 inlägg

In the month of August, the EURUSD pair seen swing of 500 points within 30 minutes not seen since the Lehman incident. This has been arguably the most volatile month for Euro since the 2008 crisis. We have managed to survive this while shorting the pair without incurring a substantial loss to our accounts.

https://www.signalstart.com/analysis/fusionpro/726

https://www.signalstart.com/analysis/fusionpro/726

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” - Warren Buffet

Aug 30, 2015 at 06:33

Medlem sedan Jul 15, 2015

52 inlägg

Yes August has certainly been a turbulent time for a lot of pairs. EURUSD seen 500 point swings in half an hour which have not been seen since the Lehman incident. We were still shorting the market during 'Black Monday' and we have managed to get out with no substantial loss to our account in which some could argue was the most volatile month for the Euro since 2008.

https://www.signalstart.com/analysis/fusionpro/726

https://www.signalstart.com/analysis/fusionpro/726

Medlem sedan Sep 20, 2014

365 inlägg

Aug 30, 2015 at 12:39

Medlem sedan Sep 20, 2014

365 inlägg

forex_trader_186239

Medlem sedan Apr 15, 2014

224 inlägg

Aug 30, 2015 at 14:29

Medlem sedan Apr 15, 2014

224 inlägg

FusionPRO posted:

Yes August has certainly been a turbulent time for a lot of pairs. EURUSD seen 500 point swings in half an hour which have not been seen since the Lehman incident. We were still shorting the market during 'Black Monday' and we have managed to get out with no substantial loss to our account in which some could argue was the most volatile month for the Euro since 2008.

https://www.signalstart.com/analysis/fusionpro/726

Hello, may I ask what is your SL for every trade ?

forex_trader_139412

Medlem sedan Jul 16, 2013

385 inlägg

Aug 30, 2015 at 14:50

Medlem sedan Jul 16, 2013

385 inlägg

I guess it is like many things in life.. It depends on what side of the fence you were at that time...

Aug 30, 2015 at 16:13

Medlem sedan Jan 12, 2015

51 inlägg

Hello Alex,

Thanks for your comment. Our stop losses are dynamic being based upon price action and news releases at the time. We have stop loss targets set for each individual trade so it differs with the trade itself some may be 50 pips SL some may be 200 pips SL and so on.

Our best trade is currently 90 pips and our worst trade is sitting at -9.7 pips.

Thanks for your comment. Our stop losses are dynamic being based upon price action and news releases at the time. We have stop loss targets set for each individual trade so it differs with the trade itself some may be 50 pips SL some may be 200 pips SL and so on.

Our best trade is currently 90 pips and our worst trade is sitting at -9.7 pips.

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful” - Warren Buffet

forex_trader_139412

Medlem sedan Jul 16, 2013

385 inlägg

Aug 30, 2015 at 19:46

Medlem sedan Jul 16, 2013

385 inlägg

theHand posted:

@RoboExpert

Ya, when those 'correcations' go we're doomed....!

LMAO!!

forex_trader_165856

Medlem sedan Dec 03, 2013

631 inlägg

Aug 31, 2015 at 07:34

Medlem sedan Dec 03, 2013

631 inlägg

theHand posted:

And here's my mean return, between these two I can pinpoint the change closely, 21-22 Aug the market started trending.

It will recover in due course when the markets return to ranges. Then the trending one will flatline again. And so it goes. Just keep making sure you have systems running for both markets and that way you won't have to do threads like these.

Regardless of the loss here, I'm up 30% net in 2 weeks. Position building systems don't build positions in mean return markets, but they are frustrating as hell to watch. So this way I always have something that's working.

The idea is to hedge systems. Not trades or positions.

Interesting concept. Thank you for sharing. Wouldn't your net profits be minimal with hedged systems until means reversion on the range bound strategy happens? If the market continued to trend farther you'd have 1 winning account and a massively floating loss in the other account.

Medlem sedan Sep 20, 2014

365 inlägg

Aug 31, 2015 at 09:07

(redigerad Aug 31, 2015 at 09:28)

Medlem sedan Sep 20, 2014

365 inlägg

The trending system is by far out banking the losing mean return. My net there was 30%. These accounts are relatively new though, so they're still running without half the thing implemented.

What I really need is to kick out the mean return at what looks like -4%, maybe -5%, then have a cooling off period or at the very least wait for the return on the trend following system to diminish. Fairly easy to track. Just gain / time. Low figure means restart Mean Return.

But of course I won't know that unless I run it like this first. Have to guess the parameters first and then zone in on specifics once I have more data.

Point is really it's no mystery why some systems started failing and when they did. One of the main problems we face as developers as the we develop a system for the market conditions we see and/or optimise for those conditions and then they change.

It's nearly impossible to develop one system that works all the time. A better approach, in my opinion, is to acknowledge there are different market conditions, they do require different systems and find a way of identifying when to switch.

Nav is as good an indicator as any as to what is working and what not.

At the very least I can run those and live while my search for the answer to the question of the universe continues.

What I really need is to kick out the mean return at what looks like -4%, maybe -5%, then have a cooling off period or at the very least wait for the return on the trend following system to diminish. Fairly easy to track. Just gain / time. Low figure means restart Mean Return.

But of course I won't know that unless I run it like this first. Have to guess the parameters first and then zone in on specifics once I have more data.

Point is really it's no mystery why some systems started failing and when they did. One of the main problems we face as developers as the we develop a system for the market conditions we see and/or optimise for those conditions and then they change.

It's nearly impossible to develop one system that works all the time. A better approach, in my opinion, is to acknowledge there are different market conditions, they do require different systems and find a way of identifying when to switch.

Nav is as good an indicator as any as to what is working and what not.

At the very least I can run those and live while my search for the answer to the question of the universe continues.

*Kommersiell användning och skräppost tolereras inte och kan leda till att kontot avslutas.

Tips: Om du lägger upp en bild/youtube-adress bäddas den automatiskt in i ditt inlägg!

Tips: Skriv @-tecknet för att automatiskt komplettera ett användarnamn som deltar i den här diskussionen.