2025 Guide to Finding a Truly Regulated Broker

New names have been appearing on regulators' warning lists almost everyday in 2025. In the twelve months to March 2025, the UK FCA alone flagged 2,240 unauthorised firms and individuals. In mid-August 2025, CySEC added 17 websites in a single update, and IOSCO's global feed continues to publish new alerts.

A broker's licence means client money is protected by the rules. It brings ongoing supervision and the ability for authorities to intervene when issues arise. It also provides recognised paths for complaints and compensation. Regulated firms must meet conduct, disclosure, and capital requirements that unregulated entities do not.

Unregulated or misrepresented brokers can vanish brokers, block withdrawals, or hide behind fabricated credentials. Clone operations may reuse genuine licence numbers to appear legitimate. In 2025, EU regulators cautioned that some firms were misusing regulated status in marketing, blurring lines between protected and unprotected products. If it sounds too good to be true, it probably is.

You can verify a broker in minutes. The steps below show how to confirm a licence, check permissions on an official register, and spot red flags before you fund an account.

Step 1: Confirm the Licence Details

Look for precise legal text rather than badges. Most regulators restrict the use of their logos to avoid implying endorsement. The most credible signal on a broker's site is a plain-text disclosure showing the full legal entity name and a licence or reference number, typically in the footer or legal pages. The FCA explicitly prohibits firms from using the FCA logo in ways that suggest approval.

Step 2: Consult the Official Registry

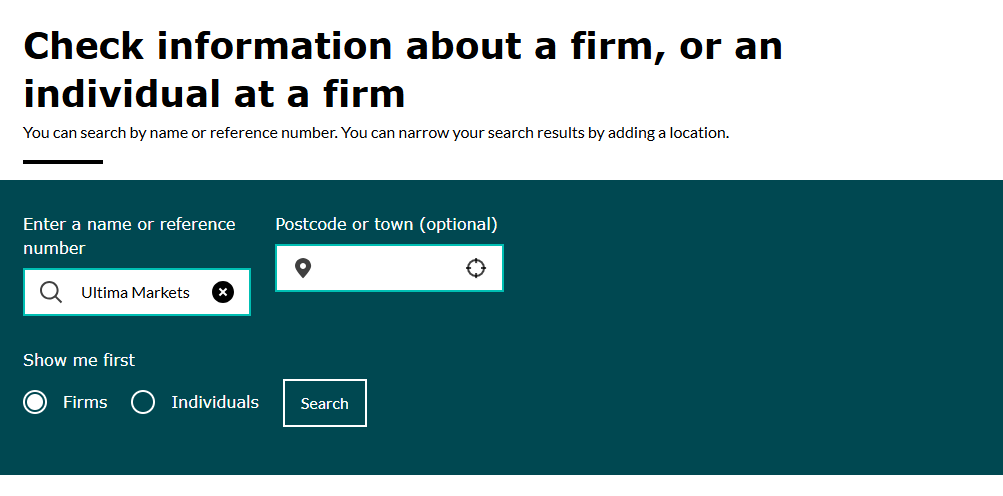

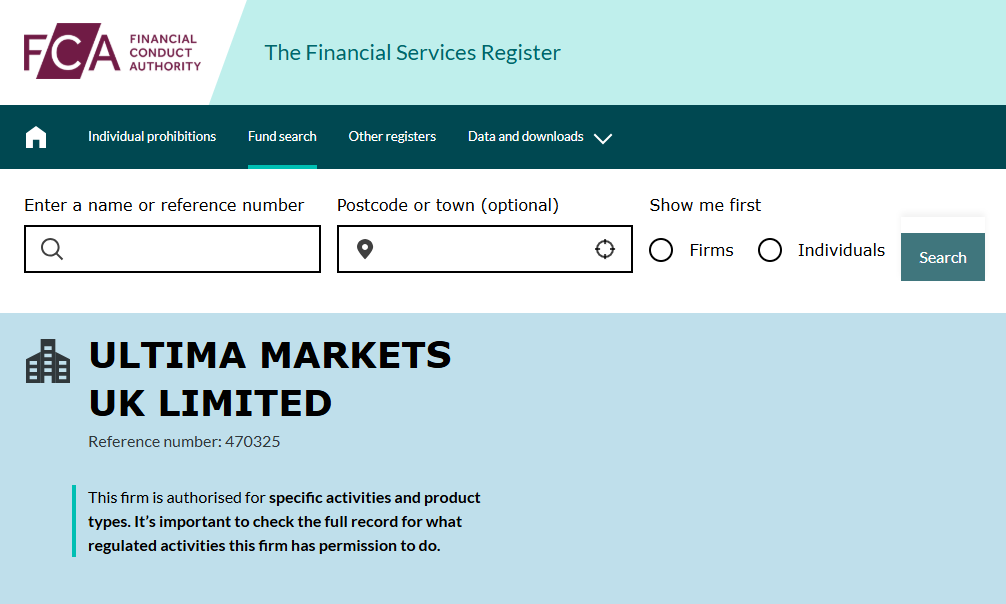

Once you have the claimed licence, confirm it on the regulator’s register. Verify the legal name, reference number, and the permissions granted. Make sure the firm is authorised for the services it advertises, such as CFDs or forex. Any mismatch or ambiguity is a warning sign.

Where to search:

- FCA (UK): Use the FCA Financial Services Register to look up the firm by name or reference number.

- FSCA (South Africa): Check the FSCA register for licensed financial services providers.

- FSC (Mauritius): Use the FSC Mauritius register to verify licence status.

Watch for clone firms that copy legitimate numbers yet operate without supervision. Always cross-check details on the official register before proceeding.

Step 3: Assess the Broker's Business Practices

A licence is necessary but not sufficient. Assess day-to-day practices. Check whether the firm participates in a recognised dispute resolution framework, such as the Financial Commission, which can offer independent arbitration when disputes arise.

Consider whether client funds benefit from additional protections like insurance. Some regulated brokers offer insurance on deposits up to a stated amount. At Ultima Markets, for example, company materials note alignment with global standards, FCA regulation, access to dispute resolution bodies, and insurance coverage up to US$1 million through a partnership with Willis Towers Watson. This coverage is described as automatic for clients at no extra cost.

These operational checks help confirm that the broker applies robust safeguards in practice, not only on paper.

The Takeaway

In 2025, verification relies less on marketing claims and more on careful due diligence. A regulatory licence is the starting point, not the finish line. Look beyond the surface to understand how a broker handles client money, manages conflicts, and provides recourse.

Remember, verify first and trade later. A few minutes of checking can help you avoid significant risks.

Ultima Markets UK Ltd meets these criteria in practice. As a firm regulated by the Financial Conduct Authority, Ultima Markets UK Ltd’s status and licence can be verified on the FCA Financial Services Register.

Ultima Markets is developing a dedicated website for UK clients and expects to begin onboarding under FCA rules in 2026.

Disclaimer

This content is provided for informational purposes only and does not constitute, and should not be construed as, financial, investment, or other professional advice. No statement or opinion contained here in should be considered a recommendation by Ultima Markets or the author regarding any specific investment product, strategy, or transaction. Readers are advised not to rely solely on this material when making investment decisions and should seek independent advice where appropriate.