Dollar stabilizes on ISM mfg. PMI, yen resumes slide

Dollar stabilizes on mixed ISM mfg. PMI

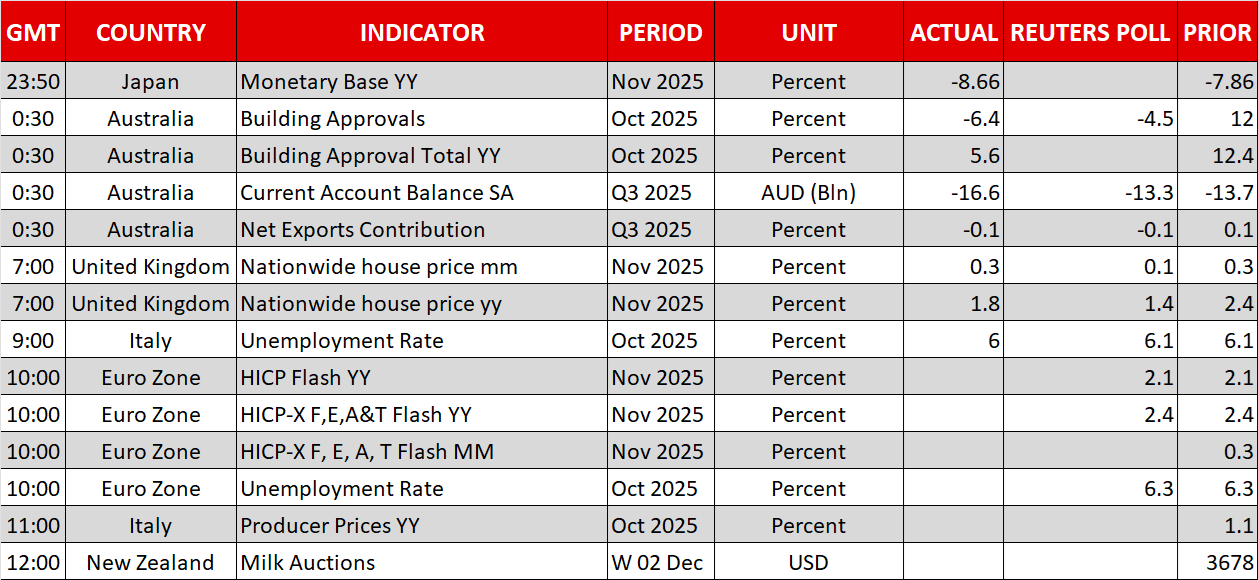

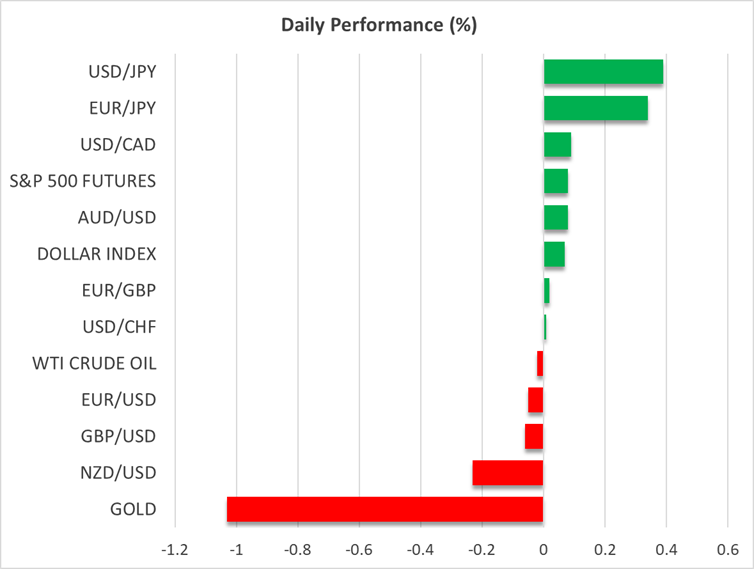

The US dollar traded mixed against its major counterparts on Monday losing the most ground against the yen due to hawkish remarks by Bank of Japan Governor Ueda. Today, the greenback is trading slightly higher against most of its peers.

Yesterday’s highlight was the ISM manufacturing PMI for November. The headline index dropped to 48.2 from 48.7, dragged down by deeper contractions in employment and new orders. That said, the prices subindex, although below its own forecast, rose to 58.5 from 58.0, suggesting that the drag may be stemming from persistent import tariffs.

Maybe that’s why the probability of a December rate cut went down somewhat, to around 85% from 95% ahead of the data. As for the number of basis points worth of rate cuts for 2026, it also dropped to 65 from 75. The slight trimming of rate cut bets is also supported by the rebound in Treasury yields.

ISM non-mfg. PMI and ADP report the next tests

The next focal points for dollar traders are the ISM non-manufacturing PMI and the ADP employment report, both for November and both due out on Wednesday. The ISM non-manufacturing PMI may attract more attention than yesterday’s manufacturing index, given that non-manufacturing activity accounts for around 90% of US GDP. The prices subindex has been suggesting inflation stickiness, with the October print rising to 70.

Therefore, signs of US inflation remaining hot could prompt investors to further scale back their rate cut bets, but they are unlikely to weigh on the December cut chance, especially if the ADP report confirms the weakness in the labor market suggested by its latest weekly prints. Sticky ISM prices could just weigh on 2026 rate cut expectations. This could keep the US dollar under pressure at least until next week’s Fed decision.

Yen resumes slide on strong JGB demand

The yen extended its recovery yesterday after BoJ Governor Ueda said that he and his colleagues will consider the “pros and cons” of pressing the hike button at the upcoming monetary policy gathering, with the probability of such action rising slightly to 35%. However, the yen is on the back foot today, perhaps driven by the pullback in Japanese Government Bond (JGB) yields after an auction attracted solid demand.

Having said that though, further declines in the yen could revive intervention warnings by Japanese authorities and perhaps ring the BoJ’s inflation alarm bells. Maybe the BoJ will eventually raise interest rates to prevent the slide in the yen from fueling inflation and thereby allow the Ministry of Finance to save its ammunition. Either way, the risks surrounding the yen may be tilted to the upside for now. In other words, dollar/yen could resume its retreat soon.

From the Eurozone, the preliminary CPI data for November was released today. The headline rate rose somewhat to 2.2% y/y from 2.1% and the core rate held steady at 2.4% y/y. With growth being surprisingly resilient to trade uncertainty, a headline inflation rate remaining relatively close to the ECB’s 2% objective may allow ECB officials to maintain their “we are in a good place” view and traders to continue holding bets of no further rate reductions by the central bank.

Stocks slide, gold pulls back after ISM mfg data

On Wall Street, the weakness revealed by the ISM manufacturing PMI and the rise in Treasury yields pushed all three of the main indices slightly lower, with the Dow Jones losing the most ground. However, following an upbeat earnings season, a rebound cannot be ruled out should Wednesday’s US data reveal more labor-related wounds and thereby seal the deal again for a December rate cut.

The same logic applies to gold, which is pulling back today after hitting resistance at around $4,270 yesterday. A rebound and a break above that level may encourage the bulls to put the record high of $4,381.46 back on their radars.