EBC Markets Briefing | FTSE 100 breaks record; bullion hits 2-week high

UK's FTSE 100 touched a record closing high on Monday following a week during which a selloff in high-flying US tech stocks rippled through global markets and the BOE held interest rates as expected.

But the Times reported that Finance Minister Rachel Reeves has told the country's budget watchdog that a rise in personal taxation is among the "major measures" she is preparing to announce in her November 26 budget.

Shares of the big banks have particularly enjoyed a strong run this year, as higher interest rates have improved margins and profits picked up. Tax hikes could weigh down their key growth driver- lending.

Other cyclical stocks also benefited from improving global growth outlook as the US reached trade deals in turn with its major trade partners. Britain enjoys the lowest baseline tariffs among them.

Investors pulled £203m out of global equity funds last month, marking the fourth consecutive month of net selling, according to Calastone, with UK-focused funds shedding £691 million.

The UK services PMI was revised up to 52.3 in October, according to a closely watched survey, indicating that demand is proving resilient. The labour market also shows signs of stabilising.

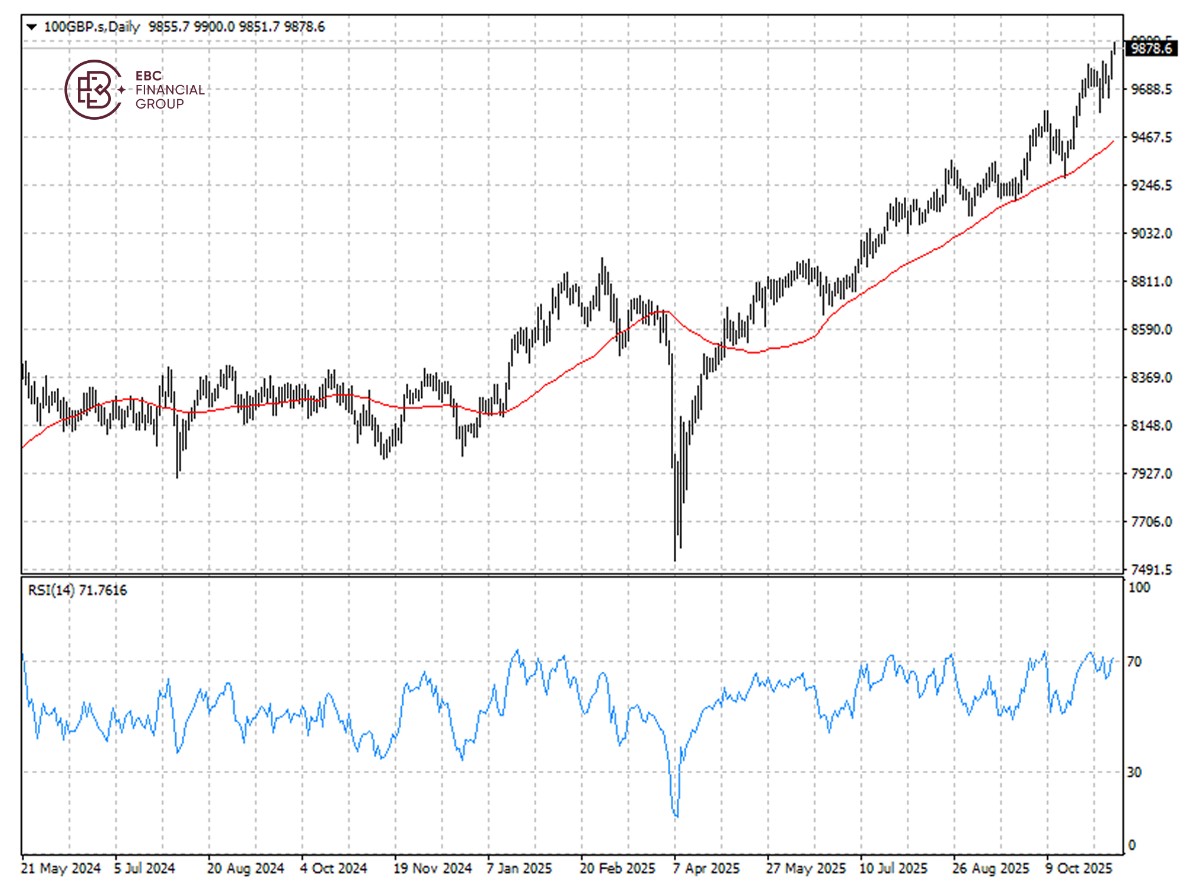

While the FTSE 100 has headed higher above 50 SMA, the RSI suggests a pullback below 9,800 might be seen later this week. Even so, the long-term uptrend remains intact.

Asset recap

As of market close on 10 November, among EBC products, ProShares UltraPro QQQ ETF led gains as the end of the longest government shutdown in US history boosted risk sentiment.

Nvidia got another confidence boost from Wall Street. Ahead of its upcoming earnings report, Citi Research raised its price target on the AI chip leader to $720 from $650, citing still-hot demand.

Gold and silver prices jumped as expectations of another Fed rate cut grew following last week's release of soft economic data. Fed Governor Stephen Miran on Monday advocated for further loosening.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.