BIZGROUP trader's profile

Info

| Name | BIZGROUP |

Bio:

Prossesional CFD and Forex trader. Individual fund management. MAM accounts.

Bonus programs for freelancers.

To join and copy the trades please send email to [email protected]

Skype: bizgroup.info

web: bizgoup.info

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month.

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to one of the MAM accounts.

- Give the link to your clients.

- Gain up to 25% from your clients profit every month.

mail to: [email protected]

skype: bizgroup.info

web: bizgroup.info

Bonus programs for freelancers.

To join and copy the trades please send email to [email protected]

Skype: bizgroup.info

web: bizgoup.info

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month.

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to one of the MAM accounts.

- Give the link to your clients.

- Gain up to 25% from your clients profit every month.

mail to: [email protected]

skype: bizgroup.info

web: bizgroup.info

Trading style:

Not specified

Motto:

No bad trade happens. Sometimes a little cocaine *

| Experience | More than 5 years |

| Location |

| Vouchers | 0 |

| Registered | Jun 27, 2016 at 04:39 |

| Blocked users | 0 |

in BIZGROUP feed

Apr 27, 2017 at 06:45

in BIZGROUP feed

Apr 11, 2017 at 07:19

in BIZGROUP feed

Mar 30, 2017 at 14:36

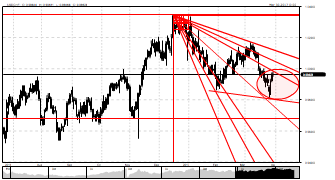

in BIZGROUP chart

Mar 30, 2017 at 13:59

in BIZGROUP chart

Mar 30, 2017 at 13:56

Chart

Systems by BIZGROUP

| Name | Gain | Drawdown | Pips | Trading | Leverage | Type |

|---|---|---|---|---|---|---|

| Golden Ticket | 1732.29% | 36.74% | 9771.4 | Manual | 1:100 | Real |

| DAXFF MAM | 91.26% | 46.10% | 1544135.4 | Mixed | 1:200 | Real |

| Bronze Ticket | 820.44% | 62.84% | 5608.2 | Manual | 1:200 | Real |

| Silver Ticket | 90.65% | 3.97% | 1544135.4 | Mixed | 1:200 | Real |

| Blue Bird | 69.28% | 4.40% | 1543353.5 | Mixed | 1:200 | Real |

| Red Bird | 80.09% | 3.56% | 1542636.4 | Mixed | 1:200 | Real |

| San Paulo | 58.72% | 44.01% | 1480.4 | - | 1:200 | Real |

in Forex Contest Vantage FX

Jun 29, 2016 at 08:50

in LION FX TRADER

Jun 27, 2016 at 12:48

BIZGROUP

Apr 27, 2017 at 06:45

France: Elections. What investors must know.

After the first tour of elections in France Macron and Le Pen are the leaders for the final battle on the 7th May. The result of the French presidential elections may determine the fate of the Europian Union.

After the preliminary election results and expectations about Macrons victory, the EUR reached the top positions after 5 months. Now the difference between bond yield of Germany and France, which was constantly growing during last time, decreased to 0,75%. Foreign investors started to look closely to European stocks on the background of weak foresights of American stock market. And the prospect of Macron’s victory may strengthen this interest.

Bulls are sure that Macron will win. The research shows that on the second tour Macron is leading by far. It is expected the Macron will get all the votes of those who did not vote for her in the first tour.

After the surprising Brexit in UK and Trump’s presidency, we cannot preclude the possibility of the unexpected result. There is an opinion, that after the terrorist attack last week in Paris may give more votes to Le Pen.

Investors are already greeting Macron as a new president of France. The current situation looks like the economic mainstream again will win. Both main French parties of republicans and socialists lost the elections. But we have to remember, that Macron is not a classical candidate with his political party “En Marche!”, which has no strong regional body, neither has Le Pen. And after the parliament elections in June the president will have to work with the classic parties concerning lawmaking and that may bring France to the political gridlock.

After the first tour of elections in France Macron and Le Pen are the leaders for the final battle on the 7th May. The result of the French presidential elections may determine the fate of the Europian Union.

After the preliminary election results and expectations about Macrons victory, the EUR reached the top positions after 5 months. Now the difference between bond yield of Germany and France, which was constantly growing during last time, decreased to 0,75%. Foreign investors started to look closely to European stocks on the background of weak foresights of American stock market. And the prospect of Macron’s victory may strengthen this interest.

Bulls are sure that Macron will win. The research shows that on the second tour Macron is leading by far. It is expected the Macron will get all the votes of those who did not vote for her in the first tour.

After the surprising Brexit in UK and Trump’s presidency, we cannot preclude the possibility of the unexpected result. There is an opinion, that after the terrorist attack last week in Paris may give more votes to Le Pen.

Investors are already greeting Macron as a new president of France. The current situation looks like the economic mainstream again will win. Both main French parties of republicans and socialists lost the elections. But we have to remember, that Macron is not a classical candidate with his political party “En Marche!”, which has no strong regional body, neither has Le Pen. And after the parliament elections in June the president will have to work with the classic parties concerning lawmaking and that may bring France to the political gridlock.

BIZGROUP

Apr 11, 2017 at 07:19

Forecast for the new week.

The U.S. dollar traded higher against most of the major currencies this past week. Unfortunately the strength was driven by risk aversion and not healthier data.

This can be confirmed by the fact that the Australian dollar was the worst performer and the Japanese yen the best performer. High beta currencies tend to perform poorly when investors are nervous whereas the yen is generally bid up under these same conditions.

USD/JPY

• Support 110.00

• Resistance 112.50

Geopolitical risks are front and center for forex traders this month with terrorist attacks in Russia and Sweden and the U.S.’ airstrikes in Syria putting investors on edge. U.S. data took a backseat to these developments, resulting in a messy to end to a busy trading week. The Chinese – U.S. Summit ended the best way possible – with no shots fired from either side. Instead, President Trump said “tremendous progress” was been made and declaredthe U.S.’ relationship with China as “outstanding.” Without going into details he also said “I believe lots of very potentially bad problems will be going away.” In a statement released by China, President Xi told Trump, "We have a thousand reasons to get China-US relations right, and not one reason to spoil the China-US relationship." While Chinese President Xi won’t be happy with the U.S.’ attacks on Syria (as their views are more closely aligned with Russia), this was the best ending that the markets could have hoped for from one of this week’s most dangerous event risks. Meanwhile we believe that the weakness in March non-farm payrolls will come back to haunt the dollar as the market looks forward to the latest U.S. consumer spending and inflation reports. Geopolitical risks and softer U.S. data could keep investors risk averse, leading to weakness in USD/JPY and other high beta currencies like the euro. The U.S.’ decision to take direct military action in Syria is shifting U.S.-Russian relations and that could be bad news for the markets. Fox News reported that a Russian warship has entered the eastern Mediterranean heading toward 2 US Navy destroyers that launched airstrikes last night. Yet many investors may be confused by the quick recovery in the U.S. dollar post payrolls but the move was driven by a combination of short covering, positive outcome to the U.S. / Chinese Summit and a flight to safety into U.S. dollars.

GBP/USD

• Support 1.2250

• Resistance 1.2550

Finally sterling ended the week lower against most of the major currencies. Data has been mostly weaker and likely to worsen as the U.K. moves towards leaving the European Union. Although service sector activity accelerated, manufacturing and construction activity slowed in the month of March. Friday’s Halifax house price report, industrial production and the trade balance also missed expectations. Next week, we’ll get more insight into whether the hawkish dissent from BoE member Forbes at the last monetary policy meeting is justified. This past week’s data and the cautious comments from BoE member Vlieghe certainly puts her views into question. Vlieghe believes the BoE should be cautious as the U.K. consumer slowdown could intensify. The U.K.’s inflation and employment reports are scheduled for release next week. Inflation is an exceptionally important input into the central bank’s policy.

Key Levels - EUR/USD

• Support 1.0550

• Resistance 1.0700

After trading in an exceptionally tight range for most of the week, the euro finally broke down on Friday, falling to its lowest level versus the U.S. dollar in 3 weeks. The move had nothing to do with data as German industrial production and trade activity improved in the month of February. Instead, ongoing terrorist attacks in Europe are making investors nervous about Marine Le Pen’s chances of becoming the next President of France. She is running on a campaign of anti-immigration, anti-terrorism and the latest polls show her virtually neck to neck with Emmanuel Macron going into the first round of voting on April 23rd. The latest terror attacks probably won’t make it into this week’s ZEW survey but we continue to expect the euro to trade with a heavy bias despite improving domestic conditions. At the same time, ECB officials are still worried about inflation – central bank President Draghi said this past week that it is clearly too soon to declare success on inflation and they need more inflation confidence to change their stance. As such, he sees no need to deviate from the wording of forward guidance even as the balance of growth risks seem to be shifting upwards. ECB member Constancio agrees that it is too soon to declare success on inflation and Praet believes rates should stay at present or lower level well past QE.

The U.S. dollar traded higher against most of the major currencies this past week. Unfortunately the strength was driven by risk aversion and not healthier data.

This can be confirmed by the fact that the Australian dollar was the worst performer and the Japanese yen the best performer. High beta currencies tend to perform poorly when investors are nervous whereas the yen is generally bid up under these same conditions.

USD/JPY

• Support 110.00

• Resistance 112.50

Geopolitical risks are front and center for forex traders this month with terrorist attacks in Russia and Sweden and the U.S.’ airstrikes in Syria putting investors on edge. U.S. data took a backseat to these developments, resulting in a messy to end to a busy trading week. The Chinese – U.S. Summit ended the best way possible – with no shots fired from either side. Instead, President Trump said “tremendous progress” was been made and declaredthe U.S.’ relationship with China as “outstanding.” Without going into details he also said “I believe lots of very potentially bad problems will be going away.” In a statement released by China, President Xi told Trump, "We have a thousand reasons to get China-US relations right, and not one reason to spoil the China-US relationship." While Chinese President Xi won’t be happy with the U.S.’ attacks on Syria (as their views are more closely aligned with Russia), this was the best ending that the markets could have hoped for from one of this week’s most dangerous event risks. Meanwhile we believe that the weakness in March non-farm payrolls will come back to haunt the dollar as the market looks forward to the latest U.S. consumer spending and inflation reports. Geopolitical risks and softer U.S. data could keep investors risk averse, leading to weakness in USD/JPY and other high beta currencies like the euro. The U.S.’ decision to take direct military action in Syria is shifting U.S.-Russian relations and that could be bad news for the markets. Fox News reported that a Russian warship has entered the eastern Mediterranean heading toward 2 US Navy destroyers that launched airstrikes last night. Yet many investors may be confused by the quick recovery in the U.S. dollar post payrolls but the move was driven by a combination of short covering, positive outcome to the U.S. / Chinese Summit and a flight to safety into U.S. dollars.

GBP/USD

• Support 1.2250

• Resistance 1.2550

Finally sterling ended the week lower against most of the major currencies. Data has been mostly weaker and likely to worsen as the U.K. moves towards leaving the European Union. Although service sector activity accelerated, manufacturing and construction activity slowed in the month of March. Friday’s Halifax house price report, industrial production and the trade balance also missed expectations. Next week, we’ll get more insight into whether the hawkish dissent from BoE member Forbes at the last monetary policy meeting is justified. This past week’s data and the cautious comments from BoE member Vlieghe certainly puts her views into question. Vlieghe believes the BoE should be cautious as the U.K. consumer slowdown could intensify. The U.K.’s inflation and employment reports are scheduled for release next week. Inflation is an exceptionally important input into the central bank’s policy.

Key Levels - EUR/USD

• Support 1.0550

• Resistance 1.0700

After trading in an exceptionally tight range for most of the week, the euro finally broke down on Friday, falling to its lowest level versus the U.S. dollar in 3 weeks. The move had nothing to do with data as German industrial production and trade activity improved in the month of February. Instead, ongoing terrorist attacks in Europe are making investors nervous about Marine Le Pen’s chances of becoming the next President of France. She is running on a campaign of anti-immigration, anti-terrorism and the latest polls show her virtually neck to neck with Emmanuel Macron going into the first round of voting on April 23rd. The latest terror attacks probably won’t make it into this week’s ZEW survey but we continue to expect the euro to trade with a heavy bias despite improving domestic conditions. At the same time, ECB officials are still worried about inflation – central bank President Draghi said this past week that it is clearly too soon to declare success on inflation and they need more inflation confidence to change their stance. As such, he sees no need to deviate from the wording of forward guidance even as the balance of growth risks seem to be shifting upwards. ECB member Constancio agrees that it is too soon to declare success on inflation and Praet believes rates should stay at present or lower level well past QE.

BIZGROUP

Mar 30, 2017 at 14:36

UK and USA

UK Prime-minister Theresa May signed the papers about British exit from European Union. It was sent to the head of EU Donald Tusk. GBP/USD reacted with a fall because of Article 50. Support was found at 1.2380. Now it is very hard to predict the future of the pair. EUR is going down on the background of financial flows, which are common for the end of month, Article 50 and situation in Greece. Commodity currencies grow against USD. FTSE gained 0,3% which was caused by the GBP fall and price growth for materials. As was expected, competition authorities of EU blocked the business combination of Deutsche Doerse (XETRA: Deutsche Doerse [DB1]) and LSE (LSE: London Stock Exchange Group [LSE]).

This Thursday USA president Donald Trump will discuss the tax reform with the top economic adviser Gary Cohn. The presiden will be informed about the plans of republicans including the frontier tax. Recently Donald trump said that the bill about healthcare reform will soon be submitted to the parliament. WTI (NYMEX: Futures On Light Sweet Crude Oil (WTI) May 2017 [CL]) and Brent (ICE Europe: Fututres On Brent Crude Oil May 2017 [B]) are growing after lower than expected increase of the oil stocks in USA according to API. Today Ministry of Energy in USA will release the report, what may cause some volatility.

UK Prime-minister Theresa May signed the papers about British exit from European Union. It was sent to the head of EU Donald Tusk. GBP/USD reacted with a fall because of Article 50. Support was found at 1.2380. Now it is very hard to predict the future of the pair. EUR is going down on the background of financial flows, which are common for the end of month, Article 50 and situation in Greece. Commodity currencies grow against USD. FTSE gained 0,3% which was caused by the GBP fall and price growth for materials. As was expected, competition authorities of EU blocked the business combination of Deutsche Doerse (XETRA: Deutsche Doerse [DB1]) and LSE (LSE: London Stock Exchange Group [LSE]).

This Thursday USA president Donald Trump will discuss the tax reform with the top economic adviser Gary Cohn. The presiden will be informed about the plans of republicans including the frontier tax. Recently Donald trump said that the bill about healthcare reform will soon be submitted to the parliament. WTI (NYMEX: Futures On Light Sweet Crude Oil (WTI) May 2017 [CL]) and Brent (ICE Europe: Fututres On Brent Crude Oil May 2017 [B]) are growing after lower than expected increase of the oil stocks in USA according to API. Today Ministry of Energy in USA will release the report, what may cause some volatility.

BIZGROUP

Mar 30, 2017 at 06:31

3 Graphics to watch this week.

Last week was the worse for American stock market in 2017: Dow Jones Industrial Average (INDEX: Dow Jones Industrial Average [DJI]), and S&P 500 (INDEX: S&P 500 INDEX [SPX]) fell more than 1%. Nevertheless since the beginning of the year both indexes gained more than 4%.

In the next few days quarterly statements are expected, which may bring rise and falls of selected stocks. Especially the traders expect the reports from Carnival, McCorrmick and Cal-Maine.

Cal-Maine (NASDAQ: Cal-Maine Foods [CALM]), must report the results of the III fiscal quarter on Monday. Last quarter the average sales price lost 51% and total sales lost 54%. At that time Cal-Maine losses were 23 million USD (0,48$ per stock). In the same quarter in previous year the profit was 109 million USD (2,26% per stock). This quarter the results must be better. Wall-Street is expecting the sales losses to 28%.

Carnival (NYSE: Carnival Corporation [CCL]) will report the I fiscal quarter on Tuesday and the expectations are on top record levels. The investors have a lot of reasons for optimism. In 2016 the price per ship cabin increased by 3,5%. CEO of Carnival Arnold Donald and Management of the Company anticipate in this quarter the growth of profit by 2% (0,31$-0,35$ per stock).

McCormick (NYSE: McCormick & Company [MKC]) will report the fiscal quarter statement on Tuesday. The growth of sales in the last quarter was pretty small, only 4%, but the company was able to increase the profit rate, what increased the operational profit by 6%. Also last year the company was able to decrease the expenses by 100 million USD. Specialists anticipate the growth in 2017 by 5-7% and more.

Last week was the worse for American stock market in 2017: Dow Jones Industrial Average (INDEX: Dow Jones Industrial Average [DJI]), and S&P 500 (INDEX: S&P 500 INDEX [SPX]) fell more than 1%. Nevertheless since the beginning of the year both indexes gained more than 4%.

In the next few days quarterly statements are expected, which may bring rise and falls of selected stocks. Especially the traders expect the reports from Carnival, McCorrmick and Cal-Maine.

Cal-Maine (NASDAQ: Cal-Maine Foods [CALM]), must report the results of the III fiscal quarter on Monday. Last quarter the average sales price lost 51% and total sales lost 54%. At that time Cal-Maine losses were 23 million USD (0,48$ per stock). In the same quarter in previous year the profit was 109 million USD (2,26% per stock). This quarter the results must be better. Wall-Street is expecting the sales losses to 28%.

Carnival (NYSE: Carnival Corporation [CCL]) will report the I fiscal quarter on Tuesday and the expectations are on top record levels. The investors have a lot of reasons for optimism. In 2016 the price per ship cabin increased by 3,5%. CEO of Carnival Arnold Donald and Management of the Company anticipate in this quarter the growth of profit by 2% (0,31$-0,35$ per stock).

McCormick (NYSE: McCormick & Company [MKC]) will report the fiscal quarter statement on Tuesday. The growth of sales in the last quarter was pretty small, only 4%, but the company was able to increase the profit rate, what increased the operational profit by 6%. Also last year the company was able to decrease the expenses by 100 million USD. Specialists anticipate the growth in 2017 by 5-7% and more.

BIZGROUP

Mar 28, 2017 at 12:05

EURO or FRANC? Elections in France.

Elections in France is an opposition of two absolutely different economic perspectives with great consequences. Marine Le Pen and Emmanuel Macron are the leading candidates for presidency have submitted their programs.

Marine Le Pen is the leader of National Front favours the freedom from Euro and job protection. On the other hand Emmanuel Macron, ex-minister of economic affairs and banker, favours open boarders and deep European integration.

Marine Le Pen wants to start the referendum about the membership of France in European Union. She proposes the freedom from euro and cut over to a new currency “new French franc” with lower value to boost the marketability of the French export. National debt will be converted to the new currency - what means default by commitments. During debates she was blamed by opponents in creating motivations for economical crisis. Her position is to give more attention to French companies when distributing government contracts and it is necessary to protect the work spaces in France. In her opinion the products produced by French companies outside of France will be charged by special import taxes. Marine Le Pen is against free trade agreement (FTA) and stands for “rational protection” policy. In her opinion the taxes for most poor segment and make a new tax for companies who hire immigrants. Marine Le Pen is sure that independence of France and currency devaluation will give a great boost to the country. She promises to perform a “reindustrialisation” to support French business and increase the level of cooperation with the country.

Emmanuel Macron favours the free-current trading and Canada-European Union Comprehensive Economic and Trade Agreement (CETA). Also he thinks that it is important to keep the high European standards of security, social life and environment. Macron is against borderlines in European Union and wishes more integration in trading bloc. He wants to cut the profit taxes of corporate organisations from 33% to 25%. Also he wants to cut the local property taxes for most of the citizens and reform the wealth tax. He promises to cut down the state expenses by 60 billion euro a year and decrease the amount of state officials by 120 thousand people. He also thinks about changing the 35-hour working week. Macron is ready to spend 50 billion euro during 5 years for education, energetics, environment, transportation, healthcare and agriculture.

Elections in France is an opposition of two absolutely different economic perspectives with great consequences. Marine Le Pen and Emmanuel Macron are the leading candidates for presidency have submitted their programs.

Marine Le Pen is the leader of National Front favours the freedom from Euro and job protection. On the other hand Emmanuel Macron, ex-minister of economic affairs and banker, favours open boarders and deep European integration.

Marine Le Pen wants to start the referendum about the membership of France in European Union. She proposes the freedom from euro and cut over to a new currency “new French franc” with lower value to boost the marketability of the French export. National debt will be converted to the new currency - what means default by commitments. During debates she was blamed by opponents in creating motivations for economical crisis. Her position is to give more attention to French companies when distributing government contracts and it is necessary to protect the work spaces in France. In her opinion the products produced by French companies outside of France will be charged by special import taxes. Marine Le Pen is against free trade agreement (FTA) and stands for “rational protection” policy. In her opinion the taxes for most poor segment and make a new tax for companies who hire immigrants. Marine Le Pen is sure that independence of France and currency devaluation will give a great boost to the country. She promises to perform a “reindustrialisation” to support French business and increase the level of cooperation with the country.

Emmanuel Macron favours the free-current trading and Canada-European Union Comprehensive Economic and Trade Agreement (CETA). Also he thinks that it is important to keep the high European standards of security, social life and environment. Macron is against borderlines in European Union and wishes more integration in trading bloc. He wants to cut the profit taxes of corporate organisations from 33% to 25%. Also he wants to cut the local property taxes for most of the citizens and reform the wealth tax. He promises to cut down the state expenses by 60 billion euro a year and decrease the amount of state officials by 120 thousand people. He also thinks about changing the 35-hour working week. Macron is ready to spend 50 billion euro during 5 years for education, energetics, environment, transportation, healthcare and agriculture.

BIZGROUP

Mar 26, 2017 at 07:23

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month.

Become our PARTNER. Only three simple steps:

Contact us and ask for a referal link to one of the MAM accounts.

Give the link to your clients.

Gain up to 25% from your clients profit every month.

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month.

Become our PARTNER. Only three simple steps:

Contact us and ask for a referal link to one of the MAM accounts.

Give the link to your clients.

Gain up to 25% from your clients profit every month.

BIZGROUP

Mar 26, 2017 at 07:23

EURO or FRANC? Elections in France

Elections in France is an opposition of two absolutely different economic perspectives with great consequences. Marine Le Pen and Emmanuel Macron are the leading candidates for presidency have submitted their programs.

Marine Le Pen is the leader of National Front favours the freedom from Euro and job protection. On the other hand Emmanuel Macron, ex-minister of economic affairs and banker, favours open boarders and deep European integration.

Marine Le Pen wants to start the referendum about the membership of France in European Union. She proposes the freedom from euro and cut over to a new currency “new French franc” with lower value to boost the marketability of the French export. National debt will be converted to the new currency - what means default by commitments. During debates she was blamed by opponents in creating motivations for economical crisis. Her position is to give more attention to French companies when distributing government contracts and it is necessary to protect the work spaces in France. In her opinion the products produced by French companies outside of France will be charged by special import taxes. Marine Le Pen is against free trade agreement (FTA) and stands for “rational protection” policy. In her opinion the taxes for most poor segment and make a new tax for companies who hire immigrants. Marine Le Pen is sure that independence of France and currency devaluation will give a great boost to the country. She promises to perform a “reindustrialisation” to support French business and increase the level of cooperation with the country.

Emmanuel Macron favours the free-current trading and Canada-European Union Comprehensive Economic and Trade Agreement (CETA). Also he thinks that it is important to keep the high European standards of security, social life and environment. Macron is against borderlines in European Union and wishes more integration in trading bloc. He wants to cut the profit taxes of corporate organisations from 33% to 25%. Also he wants to cut the local property taxes for most of the citizens and reform the wealth tax. He promises to cut down the state expenses by 60 billion euro a year and decrease the amount of state officials by 120 thousand people. He also thinks about changing the 35-hour working week. Macron is ready to spend 50 billion euro during 5 years for education, energetics, environment, transportation, healthcare and agriculture.

BIZGROUP

Mar 26, 2017 at 07:23

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month.

Become our PARTNER. Only three simple steps:

Contact us and ask for a referal link to one of the MAM accounts.

Give the link to your clients.

Gain up to 25% from your clients profit every month.

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month.

Become our PARTNER. Only three simple steps:

Contact us and ask for a referal link to one of the MAM accounts.

Give the link to your clients.

Gain up to 25% from your clients profit every month.

BIZGROUP

Mar 24, 2017 at 07:01

Individual VIP account Golden Ticket and the Brazilian system.

BIZGROUP

Mar 24, 2017 at 07:00

BIZGROUP.INFO can rescue your account

You have problems with your trading account and you start panic? We can help you! Our experienced team will rescue your account and find the exit point. We have a big portfolio of saved accounts from margin call. Please contact us for more information.

You have problems with your trading account and you start panic? We can help you! Our experienced team will rescue your account and find the exit point. We have a big portfolio of saved accounts from margin call. Please contact us for more information.