Edit Your Comment

Anyone Trading For A Living?

Miembro desde Jan 14, 2010

posts 2299

Dec 08, 2012 at 10:26

(editado Dec 08, 2012 at 10:26)

Miembro desde Jan 14, 2010

posts 2299

I am trying to get there now. But it is not what i am doing here for all to see. It is private. will let know when I succeed.

Dec 08, 2012 at 10:34

Miembro desde Jun 06, 2010

posts 69

James_Bond posted:

I'm wondering how many traders are actually trading for a living? Please do not spam you system here as that is not the point of this topic. What I'm looking to find out is the answers to the following questions, (if you are trading for a living):

- How did you make the move from part time trading to fulltime?

- What starting capital did you require to trade full time?

- Has your performance changed once you did the transition from part to fulltime?

- Are you happy with your decision?

- Do you trade only your own money? Either yes or no, why?

- Do you see yourself still trading fulltime in the long term?

If more questions come to mind, I will be sure to post them as well 😄

Hi Jame,

I am glad you had thos post out, and i am gonan do my best to try to give some advices. I hope they would help you out on the patch of trading Forex.

- How did you make the move from part time trading to fulltime?

when you are are able to make pips consistently.

when you figured out trading is a challenge to your inner self other than something you try to impress ppl around you.

when you figured the benfit of trading and decide to fully commit the next 2-5 years to trading and trading ONLY.

There would be more, but these would be the key points I can think of for now =)

- What starting capital did you require to trade full time?

1. It's the key to fully BACKTEST your system on a LIVE account to figure out what your monthly return rate is.

(Please remember it must be a live account because it give your a whole new emotional challenge than trading demo account. And you must get use to trading live account FIRST)

2. Figure out what your monthly expense

3. If you monthly expense is $2000, and your average return rate is 10% You would need $20,000 to start. I would suggest you to prepare 3 - 6 moths money on the side just incase you start with several losing months. This way you would still have food to eat and place to stay when your system does NOT perform well.

- Has your performance changed once you did the transition from part to fulltime?

Your performance will be badly affected when every lose trade cost one of your daily meals. So have enough money set aside to keep you in good shape during bad months.

- Are you happy with your decision?

YES if freedom is what you are looking for.

- Do you trade only your own money? Either yes or no, why?

I do both.

You would probably start with trading your own money. After you become good at it, your system will draw ppl and friends towards you.

To me, trading mine and someone else's money is feels the same. The only differences is when you trade someone's money and if you ask for the account management fee which is about 5-10% total account amount, you get paid right the way didn't matter you lose or win. Of course, if you lose for several months in a roll, you would probably lose your rights as well.

- Do you see yourself still trading fulltime in the long term?

I would put YES for this question.

excuse my typo, and hope this would give you some help.

Good luck and keep your eyes open. See you at the finish line.

Don't allow yesterday's success to lull you into today's complacency, for this is the great foundation of failure.

Dec 08, 2012 at 10:36

Miembro desde Jun 06, 2010

posts 69

Chikot posted:

I am trying to get there now. But it is not what i am doing here for all to see. It is private. will let know when I succeed.

=) we will wait.

Don't allow yesterday's success to lull you into today's complacency, for this is the great foundation of failure.

Miembro desde Jan 14, 2010

posts 2299

Dec 08, 2012 at 10:49

Miembro desde Jan 14, 2010

posts 2299

😀

Emo2010 posted:Chikot posted:

I am trying to get there now. But it is not what i am doing here for all to see. It is private. will let know when I succeed.

=) we will wait.

Miembro desde May 30, 2012

posts 134

Dec 08, 2012 at 20:41

Miembro desde May 30, 2012

posts 134

This topic remains to be verry interesting.

Trading for a living would be nice.

Anyone got a spare 10 k USD to put in a PAMM account to get me started? ^^

Check my best independant verified and still ongoing result at the atc 2012 championship:

https://championship.mql5.com/2012/en/users/Financialarts

Only reason I don't got the money myself is because I only recently graduated. :)

Everyone making their money trading for a living: Congrats to you guys, hope to become one of you in the short future.

Trading for a living would be nice.

Anyone got a spare 10 k USD to put in a PAMM account to get me started? ^^

Check my best independant verified and still ongoing result at the atc 2012 championship:

https://championship.mql5.com/2012/en/users/Financialarts

Only reason I don't got the money myself is because I only recently graduated. :)

Everyone making their money trading for a living: Congrats to you guys, hope to become one of you in the short future.

I am the change in the market that causes you to lose :p / Watch out before I negative pip you! ^^

forex_trader_96460

Miembro desde Oct 25, 2012

posts 20

Miembro desde Nov 09, 2012

posts 76

Dec 20, 2012 at 08:33

Miembro desde Nov 09, 2012

posts 76

@TPOTrader you trade really great! congrats to your change to the full time trading, you may have the real gift in this field)

If you want to end up with a nonaverage net worth, a “learn from someone else” attitude is paramount. Putting your ego aside and admitting that you don’t know it all isn’t easy, but it is the mindset of true winner ----Paul Tudor Jones.

forex_trader_96460

Miembro desde Oct 25, 2012

posts 20

Dec 21, 2012 at 03:54

(editado Dec 21, 2012 at 03:55)

Miembro desde Oct 25, 2012

posts 20

Thanks David.

Only time will tell if I'm a good trader or fail like the 95%.

If I am proven to be a good trader, I would love to leverage my skills. I've signed up with sites like fxstat, fxjunction, collective2, currensee that will allow me to indrectly manage OPM. Most of them are under the probationary mode-so i'm assuming sometime in Jan or Feb 2013, other people can start following me. Just search for 'TPOTrader'

Only time will tell if I'm a good trader or fail like the 95%.

If I am proven to be a good trader, I would love to leverage my skills. I've signed up with sites like fxstat, fxjunction, collective2, currensee that will allow me to indrectly manage OPM. Most of them are under the probationary mode-so i'm assuming sometime in Jan or Feb 2013, other people can start following me. Just search for 'TPOTrader'

Miembro desde Sep 24, 2012

posts 26

Dec 21, 2012 at 05:24

Miembro desde Sep 24, 2012

posts 26

TPOTrader posted:

Thanks David.

Only time will tell if I'm a good trader or fail like the 95%.

If I am proven to be a good trader, I would love to leverage my skills. I've signed up with sites like fxstat, fxjunction, collective2, currensee that will allow me to indrectly manage OPM. Most of them are under the probationary mode-so i'm assuming sometime in Jan or Feb 2013, other people can start following me. Just search for 'TPOTrader'

Is there any reason that make you guys always lock up your balance, equity, etc of you published accounts on my fxbook? seen that severally

Always Preserve Capital So To Trade Next Time

forex_trader_96460

Miembro desde Oct 25, 2012

posts 20

Dec 21, 2012 at 06:45

Miembro desde Oct 25, 2012

posts 20

universalfunds posted:TPOTrader posted:

Thanks David.

Only time will tell if I'm a good trader or fail like the 95%.

If I am proven to be a good trader, I would love to leverage my skills. I've signed up with sites like fxstat, fxjunction, collective2, currensee that will allow me to indrectly manage OPM. Most of them are under the probationary mode-so i'm assuming sometime in Jan or Feb 2013, other people can start following me. Just search for 'TPOTrader'

Is there any reason that make you guys always lock up your balance, equity, etc of you published accounts on my fxbook? seen that severally

For me personally, it's just tacky. I think this is the only profession where you go around asking people how much $ they have or how much they make. Although it's true our job is money it's still taboo to some. Having balance/and profit locked gives some dignity-at least to me.

I'm with you on this though-about being transparent. I don't understand why some would hide their trading history. Open trades? sure-maybe they don't want you to freely copy their trades. but hiding trading history doesn't make sense to me. And so is not having trading verified or trading privelege verified. I also see accounts of supposedly 'fund manager' trading DEMO money. What is that about?

Like i said, i'm a full time trader. I do share my trading history WITH trading size lots for each trade. IF you want really want to know what kind of money i deal with just look at my trading history and do simple math. I don't trade pennies. I make sure i make several times my mortgage payment every month.

Miembro desde Sep 24, 2012

posts 26

Dec 21, 2012 at 07:03

(editado Dec 21, 2012 at 07:04)

Miembro desde Sep 24, 2012

posts 26

TPOTrader posted:universalfunds posted:TPOTrader posted:

Thanks David.

Only time will tell if I'm a good trader or fail like the 95%.

If I am proven to be a good trader, I would love to leverage my skills. I've signed up with sites like fxstat, fxjunction, collective2, currensee that will allow me to indrectly manage OPM. Most of them are under the probationary mode-so i'm assuming sometime in Jan or Feb 2013, other people can start following me. Just search for 'TPOTrader'

Is there any reason that make you guys always lock up your balance, equity, etc of you published accounts on my fxbook? seen that severally

For me personally, it's just tacky. I think this is the only profession where you go around asking people how much $ they have or how much they make. Although it's true our job is money it's still taboo to some. Having balance/and profit locked gives some dignity-at least to me.

I'm with you on this though-about being transparent. I don't understand why some would hide their trading history. Open trades? sure-maybe they don't want you to freely copy their trades. but hiding trading history doesn't make sense to me. And so is not having trading verified or trading privelege verified. I also see accounts of supposedly 'fund manager' trading DEMO money. What is that about?

Like i said, i'm a full time trader. I do share my trading history WITH trading size lots for each trade. IF you want really want to know what kind of money i deal with just look at my trading history and do simple math. I don't trade pennies. I make sure i make several times my mortgage payment every month.

I checked your trading history and i can not find the lot sizes used, it does not make sense to me when one lock out all the published accounts infor, why not just make it private then? better.

Always Preserve Capital So To Trade Next Time

forex_trader_96460

Miembro desde Oct 25, 2012

posts 20

Dec 21, 2012 at 07:13

(editado Dec 21, 2012 at 07:15)

Miembro desde Oct 25, 2012

posts 20

universalfunds posted:

I checked your trading history and i can not find the lot sizes used, it does not make sense to me when one lock out all the published accounts infor, why not just make it private then? better.

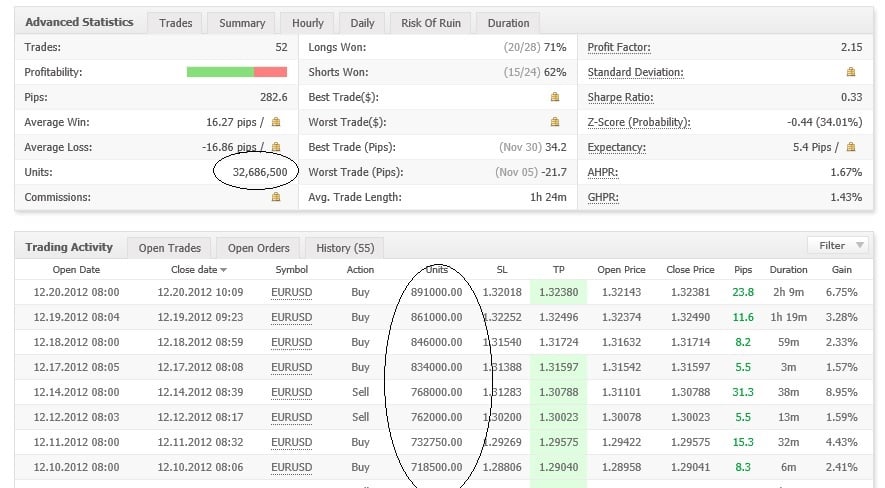

really? this is the view I get when i signed out. It's under 'UNITS' just in case you're a newbie.

my last trade for example

8910000 units ($89.10/pip) x 23.8 pips = $2120.58

My account is connected via third party access with oanda. Oanda deal in 'units'

but anyways. it's a choice to privatize. what really matters is the % return. As Paul Tudor jones said

'After a while, the size means nothing. It gets back to the question of whether you’re making a 100 percent rate-of-return on $10,000 or $100 million. It doesn’t make any difference. If you complete 78 percent of your passes, it’d be nice if you were in the NFL, but if you’re in college or high school or even elementary school, I’m sure the thrill is just as great.'

Miembro desde Jan 14, 2010

posts 2299

Dec 22, 2012 at 15:51

Miembro desde Jan 14, 2010

posts 2299

I agree with above said, just want to add one important consideration. Not only % is important but what risked was taken to achieve that % is even more important.

Dec 25, 2012 at 03:36

Miembro desde Apr 12, 2012

posts 155

TPOTrader posted:

my last trade for example

8910000 units ($89.10/pip) x 23.8 pips = $2120.58

My account is connected via third party access with oanda. Oanda deal in 'units'

'After a while, the size means nothing. It gets back to the question of whether you’re making a 100 percent rate-of-return on $10,000 or $100 million. It doesn’t make any difference. If you complete 78 percent of your passes, it’d be nice if you were in the NFL, but if you’re in college or high school or even elementary school, I’m sure the thrill is just as great.'

8910000 units ($89.10/pip) x 23.8 pips = $2120.58 (6,75%)

So your balance about 30t.

with that balance you have opened 20lot. order?

very very professionally!!!

----------------------

'It gets back to the question of whether you’re making a 100 percent rate-of-return on $10,000 or $100 million. It doesn’t make any difference.'

The difference is very big. the larger amount, the lower leverage...

Morgan Stanley: In a published report, Morgan Stanley announced in 2012 a profit of 5.72%, which is the best result since 2008.

my friend, they are losers!

show them how to work!😉😄😎

Dec 26, 2012 at 20:49

Miembro desde Sep 16, 2011

posts 13

Mars30 posted:TPOTrader posted:

my last trade for example

8910000 units ($89.10/pip) x 23.8 pips = $2120.58

My account is connected via third party access with oanda. Oanda deal in 'units'

'After a while, the size means nothing. It gets back to the question of whether you’re making a 100 percent rate-of-return on $10,000 or $100 million. It doesn’t make any difference. If you complete 78 percent of your passes, it’d be nice if you were in the NFL, but if you’re in college or high school or even elementary school, I’m sure the thrill is just as great.'

8910000 units ($89.10/pip) x 23.8 pips = $2120.58 (6,75%)

So your balance about 30t.

with that balance you have opened 20lot. order?

very very professionally!!!

----------------------

'It gets back to the question of whether you’re making a 100 percent rate-of-return on $10,000 or $100 million. It doesn’t make any difference.'

The difference is very big. the larger amount, the lower leverage...

Morgan Stanley: In a published report, Morgan Stanley announced in 2012 a profit of 5.72%, which is the best result since 2008.

my friend, they are losers!

show them how to work!😉😄😎

If I'm not mistaken he traded 8.91 Lot. But risk is still too high anyway.

forex_trader_96460

Miembro desde Oct 25, 2012

posts 20

Miembro desde Dec 20, 2012

posts 25

Dec 28, 2012 at 17:22

Miembro desde Dec 20, 2012

posts 25

I'v recently sold a company and plan to start trading for living. I've currently opened a demo account with 100k USD and will practice there for 3-4 months before going live. Hope to become a successful trader. 😎

https://www.myfxbook.com/members/Garbriel21/armada-markets-gabriel-21/445853

https://www.myfxbook.com/members/Garbriel21/armada-markets-gabriel-21/445853

When I win I win small, when I loose I loose it all!

Dec 28, 2012 at 23:21

Miembro desde Apr 12, 2012

posts 155

Garbriel21 posted:

I'v recently sold a company and plan to start trading for living. I've currently opened a demo account with 100k USD and will practice there for 3-4 months before going live. Hope to become a successful trader. 😎

https://www.myfxbook.com/members/Garbriel21/armada-markets-gabriel-21/445853

3 to 5 years, and you'll understand what is happening in the market!... 😉😄😎

even harder to find the trader to invest in..

Good Luck man! 😎

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.