Edit Your Comment

EUR/USD

Mar 07, 2019 at 15:44

Miembro desde Nov 03, 2018

posts 60

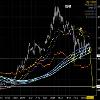

have the 4 h chart bearish patern is almost there en a new bullish patern on weekly chart so probaly going back up .

i trade to make money not to be right

Miembro desde Oct 11, 2013

posts 775

Miembro desde Nov 09, 2018

posts 212

Mar 08, 2019 at 11:39

Miembro desde Nov 09, 2018

posts 212

Miembro desde Oct 11, 2013

posts 775

Mar 11, 2019 at 21:20

Miembro desde Oct 11, 2013

posts 775

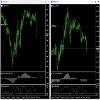

The EURUSD bounce to the upside, from the 1.1200 level, but it is a normal price behavior after the strong drop. The pullback may end and the pair may try to break below the 1.1200 level to continue lower. On the other hand, if the price keeps pulling back, the 1.1300 zone may act as resistance.

Miembro desde Jan 15, 2011

posts 87

Jul 01, 2019 at 19:13

(editado Jul 01, 2019 at 19:15)

Miembro desde Jan 15, 2011

posts 87

Problem with traders is not the analyses it's the management. Buying dips is easier said than done. How far the dip and swing on your trade is the problem. There's a way to analyze this. I would like to see more micromanaged technical analyses and no objective buy and Sell theories that when the market goes in that favor all of a sudden all the prospects post come out saying see I was right. Yes I guess you were.

The Turtle always wins the race!

Jul 04, 2019 at 13:40

Miembro desde Jul 04, 2019

posts 10

The Australian Dollar has outperformed for a second day, presently near high.AUD-USD posted a 57-day at 0.7047, extending gains seen from yesterday’s at 0.6956, seen in the immediate wake of the RBA’s rate cut. Markets had mostly priced-in the move, with Aussie money markets having factored in 85% odds for it. Given this, along with some cautiously upbeat remarks on the outlook in RBA Governor Lowe’s statement, and the thawing in US-China tensions, the scene was set for a rally in the Australian Dollar. AUDUSD has support at 0.7017-20.Next target will be 0.7072 if breakup over 0.7047 line.

Miembro desde Nov 09, 2018

posts 212

Jul 28, 2019 at 20:10

Miembro desde Nov 09, 2018

posts 212

The EUR/USD current position is 1.1130. I'd consider the support 1.1110 as a short signal point in case of its breaching. Target for bears is 1.0900.

The resistance 1.1150(MA25) will be the first significant level for bulls. The next one is 1.1190(MA55).

The resistance 1.1150(MA25) will be the first significant level for bulls. The next one is 1.1190(MA55).

#AnthonyWins

Miembro desde Sep 03, 2019

posts 32

Miembro desde Nov 09, 2018

posts 212

Oct 23, 2019 at 11:28

Miembro desde Nov 09, 2018

posts 212

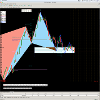

EUR/USD overview.

The pair started correction after MA150(1D) testing in 0.5Fib area(1.1150). The bullish strong trend direction is forming.

RSI (1D) shows 56 as a sign of market uncertainty.

The news background for USD today is Oil news.

EUR/USD analysis:

1D: The pair touched MA150 level and fell to the current 1.1115 as a correction after impulse from 1.0880. The support level is 0.382Fib at 1.1085.

The resistance level at 0.5Fib (1.1150) can be tested again as the current bullish trend continuation attempt.

EUR/USD signal points:

H4: MA25 and MA55 crossed both MA150 and MA250 as a signal to buy, but the price will probably test the MA55(1.1080) level firstly, because of MA25 level breaching.

1D: MA150 level will be a signal point for bulls in case of it's breaching.

There's also a probability of 0.382 (1.1080) level testing as a correction completion. And this level will be a signal point for bears.

The pair started correction after MA150(1D) testing in 0.5Fib area(1.1150). The bullish strong trend direction is forming.

RSI (1D) shows 56 as a sign of market uncertainty.

The news background for USD today is Oil news.

EUR/USD analysis:

1D: The pair touched MA150 level and fell to the current 1.1115 as a correction after impulse from 1.0880. The support level is 0.382Fib at 1.1085.

The resistance level at 0.5Fib (1.1150) can be tested again as the current bullish trend continuation attempt.

EUR/USD signal points:

H4: MA25 and MA55 crossed both MA150 and MA250 as a signal to buy, but the price will probably test the MA55(1.1080) level firstly, because of MA25 level breaching.

1D: MA150 level will be a signal point for bulls in case of it's breaching.

There's also a probability of 0.382 (1.1080) level testing as a correction completion. And this level will be a signal point for bears.

#AnthonyWins

Miembro desde Oct 11, 2013

posts 775

Feb 07, 2020 at 04:34

Miembro desde Oct 11, 2013

posts 775

The EURUSD completes five consecutive days falling and breaks below the 1.1000 level. The pair may continue falling, but a pullback to the 1.1000 level is possible. To the downside, its next support could be the 1.0900 level. Above the 1.1000 level, the 55 day EMA may act again as resistance as it did on the last pullback.

Miembro desde Oct 11, 2013

posts 775

Feb 28, 2020 at 16:10

Miembro desde Oct 11, 2013

posts 775

The EURUSD has been very volatile, leaving behind long shadows on the daily candle in both directions and keeping a small real body around the 1.1000 zone. From the current levels, the EURUSD may head in any direction, with the 1.1100 acting as resistance and the 1.0900 as support.

Apr 01, 2020 at 03:38

(editado Apr 01, 2020 at 03:40)

Miembro desde Aug 01, 2017

posts 1

Miembro desde Mar 10, 2015

posts 29

Apr 01, 2020 at 15:46

Miembro desde Mar 10, 2015

posts 29

Perhaps, to continue the downward trend in EURUSD and GBPUSD pairs, all that was missing was the appearance of a new monthly candle on the chart. After the recent impressive movement of the dollar to strengthen, finally, there was an equally impressive correction. And if we want to enter the current trend, we are waiting for the best levels to enter. What is the best level to enter the current trend?..? The one that was formed as a result of the rollback. And here it is, this very rollback has occurred, or is currently happening. And for the change of the trend (trend), the reasons are not yet visible.

Why do bulls buy EURUSD and GBPUSD?

Just because prices are low enough? But the trend is more likely to continue than change (one of the postulates of trading on the stock exchange). Yes, prices are low. But if you look at the overall global situation, it seems that the path of least resistance in the main pairs is the South (strengthening of the dollar).

Why?

Let's remember the end of the 2008 crisis. During the long recovery of the world economy, and in particular the economy of the European Union, Italy was in the most deplorable state. However, the crisis subsided, and the country that had just been at the top of the list of the next bankrupts suddenly continued to exist as if nothing had happened.

But now it's time for the next major crisis, and in Europe, the first country to crack the seams is Italy, and Spain is next. The prospects are not rosy for the EU.

In addition, at the height of the pandemic, the once United Europe suddenly distanced itself from its member countries. Without showing any solidarity or signs of unity, each country began to take care only of itself, forgetting all obligations.

When the crisis subsides and countries begin to recover, there will be difficult times for the EU. It is time to test its strength, which, as you can see, is very fragile. You will immediately remember the lack of assistance to each other, there will be reproaches against the participating countries and Brussels, in particular. As an example, they will start to cite the experience of the UK, which, although painful, still leaves the European Union. By the way, it is worth saying that, after leaving Europe, the Bank of England will get its hands on the levers of managing its economy. London's dependence on Brussels will disappear. Other countries in a United Europe may want to follow the example of great Britain. Against the background of the events that have occurred, this is quite likely, and the most realistic scenario.

Why do bears sell EURUSD and GBPUSD?

First, for the reasons described above.

And second, why should the dollar weaken?

Just because the fed is pouring trillions of liquidity into the economy? But the EU does it, and so does Britain...

In addition, the crisis has not been canceled, and the improving situation in China is not yet a reason for risk-taking. We should not forget that the pandemic is still spreading. Countries close not only themselves, but also cities within countries. Emergency measures are being introduced in cities. The consequences for all the world's economies will be astoundingly large.

Buying risky assets (and the Euro and British pound are risky assets in relation to the us dollar) is not a rational decision today.

Well, if you sell, then sell on growth.

And so, this growth (correction\rollback) inside the downward trend was formed.

And that means it's time to sell.

Why do bulls buy EURUSD and GBPUSD?

Just because prices are low enough? But the trend is more likely to continue than change (one of the postulates of trading on the stock exchange). Yes, prices are low. But if you look at the overall global situation, it seems that the path of least resistance in the main pairs is the South (strengthening of the dollar).

Why?

Let's remember the end of the 2008 crisis. During the long recovery of the world economy, and in particular the economy of the European Union, Italy was in the most deplorable state. However, the crisis subsided, and the country that had just been at the top of the list of the next bankrupts suddenly continued to exist as if nothing had happened.

But now it's time for the next major crisis, and in Europe, the first country to crack the seams is Italy, and Spain is next. The prospects are not rosy for the EU.

In addition, at the height of the pandemic, the once United Europe suddenly distanced itself from its member countries. Without showing any solidarity or signs of unity, each country began to take care only of itself, forgetting all obligations.

When the crisis subsides and countries begin to recover, there will be difficult times for the EU. It is time to test its strength, which, as you can see, is very fragile. You will immediately remember the lack of assistance to each other, there will be reproaches against the participating countries and Brussels, in particular. As an example, they will start to cite the experience of the UK, which, although painful, still leaves the European Union. By the way, it is worth saying that, after leaving Europe, the Bank of England will get its hands on the levers of managing its economy. London's dependence on Brussels will disappear. Other countries in a United Europe may want to follow the example of great Britain. Against the background of the events that have occurred, this is quite likely, and the most realistic scenario.

Why do bears sell EURUSD and GBPUSD?

First, for the reasons described above.

And second, why should the dollar weaken?

Just because the fed is pouring trillions of liquidity into the economy? But the EU does it, and so does Britain...

In addition, the crisis has not been canceled, and the improving situation in China is not yet a reason for risk-taking. We should not forget that the pandemic is still spreading. Countries close not only themselves, but also cities within countries. Emergency measures are being introduced in cities. The consequences for all the world's economies will be astoundingly large.

Buying risky assets (and the Euro and British pound are risky assets in relation to the us dollar) is not a rational decision today.

Well, if you sell, then sell on growth.

And so, this growth (correction\rollback) inside the downward trend was formed.

And that means it's time to sell.

Miembro desde Mar 10, 2015

posts 29

Apr 04, 2020 at 14:52

Miembro desde Mar 10, 2015

posts 29

Markets are in a state of panic and confusion. Until recently, well-functioning models and interpretations have stopped moving traders. Bidders make decisions emotionally, without paying any attention to the statistics that come out. The market is now at the mercy of fears about the coronavirus. On Friday, prices were hovering in one place, until it became known that Spain and Italy, a couple, surpassed America in the number of infected. And the Germans have overtaken the middle Kingdom in this respect. As a result, the EURUSD pair went down. Especially striking was the single decline of the Euro against the dollar. The British Pound, for example, steadfastly held positions.

The markets are a mess

The markets are a mess

At the same time, in the United States itself, a new record was set for the spread of the epidemic, and the number of confirmed cases of coronavirus infection increased by 30.1 thousand. The European market and the US market are the largest on our planet. And it is also very obvious that Europe and the United States are two of the world's largest financial centers. Only Europe and North America have enormous liquidity. This means that the main global investments are controlled by American and European investors. Therefore, as soon as a crisis occurs and anti-risk sentiment dominates the markets, these huge masses of money move to conditions where they can be placed and wait out the best of times. In cases where the shocks do not cease, European investors and owners of capital moved money overseas. Then back again. And so on.

Today, coronavirus is the main trigger. Market participants do not pay any attention to the emerging macrostatistics. And data from the UK on prices came out a week late, so traders did not pay any attention to them. In addition, statistics from Britain were distorted, due to the lack of demand for housing. At the same time, it showed a March acceleration in price growth. Citizens in quarantine remain in self-isolation and try not to leave the shelter. And suddenly, for no reason at all, the price of housing began to rise. Why is this happening? This can only happen at times of demand. But what exactly can serve as a catalyst for demand, especially for expensive purchases? In General, the British statistics were not accurate and doubtful. A week's delay doubles the distrust of it. This could have caused markets to ignore it.

Macroeconomic data from Europe came out in a perceived negative light. Again, the Market did not react in any way. The Euro quickly became cheaper after the publication of economic indicators from overseas. However, the rate of decline in producer prices increased from minus 0.7 percent to minus 1.3 percent. This has been happening for 7 months. This means that the potential for an increase in inflationary pressure does not yet exist. It is most likely that inflation will continue to show a tendency to weaken. In such conditions, the Central Bank of Europe is quite capable of lowering the rate to minus levels. The decline of the labor market in the United States may be a similar scenario for the European region. Already in Spain, the number of citizens who lost their jobs has approached three hundred thousand. At the same time, the indicator was expected to grow to forty-five thousand. This compares with the three million who lost their jobs in the States, if you take into account the different number of citizens living in Spain, with citizens living overseas. In General, these are huge values. Unemployment figures during the dot-com crisis of the noughties are not yet ahead, but this is little reassuring. And in Spain, unemployment was already high. In this crisis, which is the largest in history, the unemployment situation threatens to last for a more indefinite period. And the number of citizens who lost their jobs will grow steadily.

But this is not as bad as in the case of the United States, which the markets also did not pay attention to. It is difficult to imagine shock and concern when the unemployment data contains figures such as over 3,000,000 unemployed people. This has never happened before. In the entire history of statistics, such high rates and values have not been observed. It is difficult to realize that these unemployment figures are real. It is not clear what to do in such a situation, in which safe havens to hide. The idea of going back to the great depression comes to mind. In General, an agitated state that does not allow you to objectively look at the situation. And so a week passed, and the figure rose to 6,648,000 people who applied for unemployment benefits. This is already quite an exorbitant state, which is difficult to describe in words. It was expected that the figure will be around 3 680 000. This is a record figure, exceeding the data for the previous week. The situation itself in the current crisis has created such an amazing scale that it is really difficult to figure out what to do in such circumstances. But what really became a terrible fact is that for half a month, about ten million US citizens lost their jobs.

The markets are a mess

The markets are a mess

At the same time, in the United States itself, a new record was set for the spread of the epidemic, and the number of confirmed cases of coronavirus infection increased by 30.1 thousand. The European market and the US market are the largest on our planet. And it is also very obvious that Europe and the United States are two of the world's largest financial centers. Only Europe and North America have enormous liquidity. This means that the main global investments are controlled by American and European investors. Therefore, as soon as a crisis occurs and anti-risk sentiment dominates the markets, these huge masses of money move to conditions where they can be placed and wait out the best of times. In cases where the shocks do not cease, European investors and owners of capital moved money overseas. Then back again. And so on.

Today, coronavirus is the main trigger. Market participants do not pay any attention to the emerging macrostatistics. And data from the UK on prices came out a week late, so traders did not pay any attention to them. In addition, statistics from Britain were distorted, due to the lack of demand for housing. At the same time, it showed a March acceleration in price growth. Citizens in quarantine remain in self-isolation and try not to leave the shelter. And suddenly, for no reason at all, the price of housing began to rise. Why is this happening? This can only happen at times of demand. But what exactly can serve as a catalyst for demand, especially for expensive purchases? In General, the British statistics were not accurate and doubtful. A week's delay doubles the distrust of it. This could have caused markets to ignore it.

Macroeconomic data from Europe came out in a perceived negative light. Again, the Market did not react in any way. The Euro quickly became cheaper after the publication of economic indicators from overseas. However, the rate of decline in producer prices increased from minus 0.7 percent to minus 1.3 percent. This has been happening for 7 months. This means that the potential for an increase in inflationary pressure does not yet exist. It is most likely that inflation will continue to show a tendency to weaken. In such conditions, the Central Bank of Europe is quite capable of lowering the rate to minus levels. The decline of the labor market in the United States may be a similar scenario for the European region. Already in Spain, the number of citizens who lost their jobs has approached three hundred thousand. At the same time, the indicator was expected to grow to forty-five thousand. This compares with the three million who lost their jobs in the States, if you take into account the different number of citizens living in Spain, with citizens living overseas. In General, these are huge values. Unemployment figures during the dot-com crisis of the noughties are not yet ahead, but this is little reassuring. And in Spain, unemployment was already high. In this crisis, which is the largest in history, the unemployment situation threatens to last for a more indefinite period. And the number of citizens who lost their jobs will grow steadily.

But this is not as bad as in the case of the United States, which the markets also did not pay attention to. It is difficult to imagine shock and concern when the unemployment data contains figures such as over 3,000,000 unemployed people. This has never happened before. In the entire history of statistics, such high rates and values have not been observed. It is difficult to realize that these unemployment figures are real. It is not clear what to do in such a situation, in which safe havens to hide. The idea of going back to the great depression comes to mind. In General, an agitated state that does not allow you to objectively look at the situation. And so a week passed, and the figure rose to 6,648,000 people who applied for unemployment benefits. This is already quite an exorbitant state, which is difficult to describe in words. It was expected that the figure will be around 3 680 000. This is a record figure, exceeding the data for the previous week. The situation itself in the current crisis has created such an amazing scale that it is really difficult to figure out what to do in such circumstances. But what really became a terrible fact is that for half a month, about ten million US citizens lost their jobs.

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.

.png)