US100 index under pressure as slowing economy fears mount

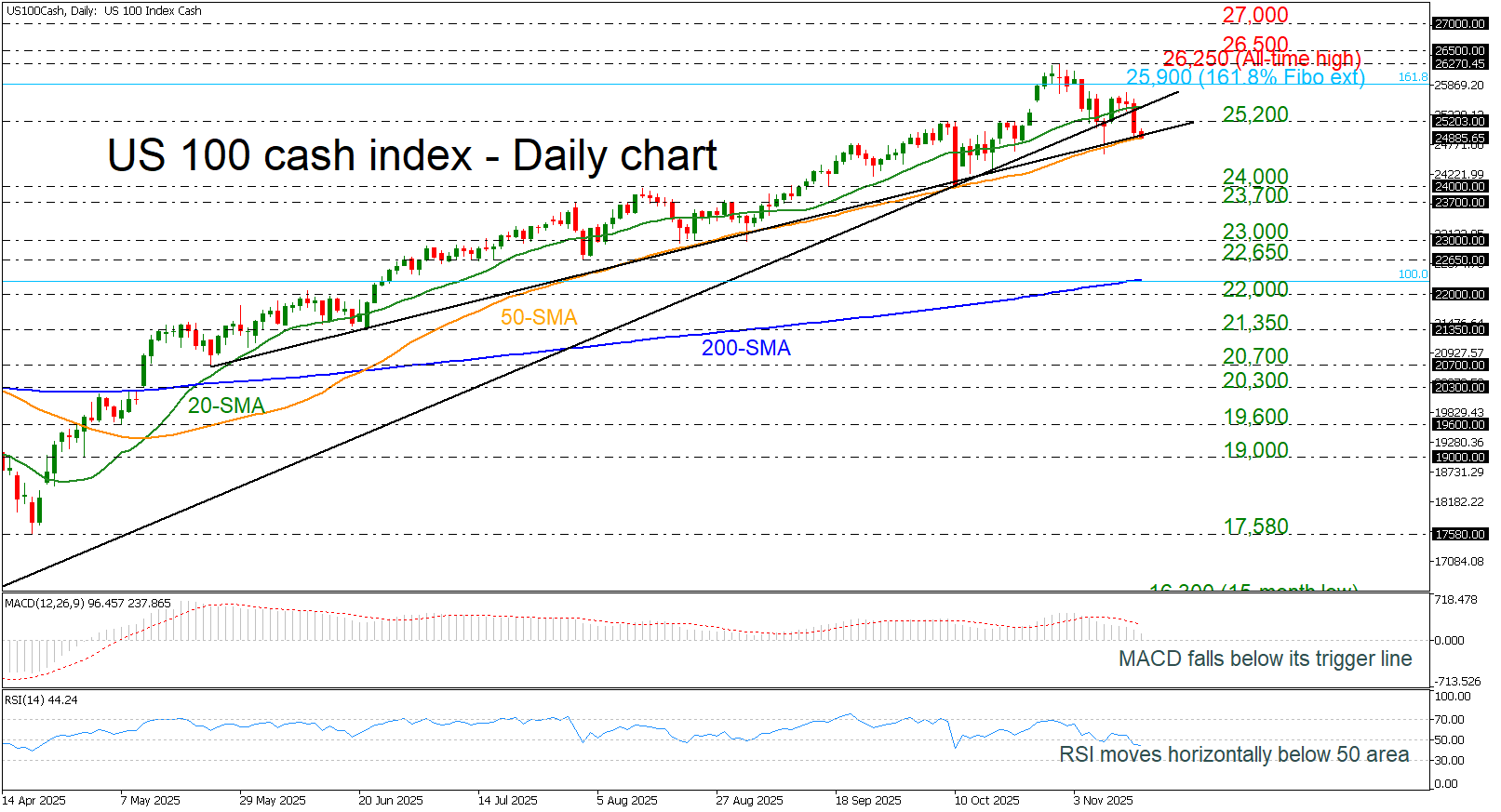

The US100 index plunged due to investor concerns that a backlog of economic data following the government reopening might reveal signs of a slowing economy. The price is currently flirting with the medium-term ascending trend line and the 50-day simple moving average (SMA), which may act as a significant turning point for the market.

A rebound from this level would maintain the bullish tendency, testing the 25,200 resistance ahead of the 20-day SMA at 25,500 and the 161.8% Fibonacci extension level of the down leg from February highs to April lows at 25,900. Rising further, the all-time peak at 26,250 and the 26,500 handle could come into focus.

In the negative scenario, a daily close below the 50-day SMA could increase the likelihood of steeper declines toward the 24,000 support level and the 23,700 barrier, shifting the outlook to neutral.

From a technical standpoint, the MACD is losing ground below its trigger line, while the RSI is flattening below the neutral threshold of 50, both confirming the recent downward wave in the market.

Overall, the US100 index is at a critical juncture. Holding above the 50-day SMA could revive bullish momentum and open the door to higher resistance levels, while a break below this key support would likely trigger a deeper correction and neutralize the current outlook.

.jpg)