AUD/USD jumps on stronger CPI data

AUD/USD accelerated into the 0.6200 zone early on Wednesday on news that Australia’s monthly CPI inflation surged the fastest in a year to reach again the upper band of the RBA's range target of 3.0% in August from 2.8% previously.

The data suggest little urgency for the RBA to cut interest rates at its September 29–30 meeting, as the unemployment rate continues to hover near record lows. However, investors still believe the cautious rate-cut cycle could resume in November.

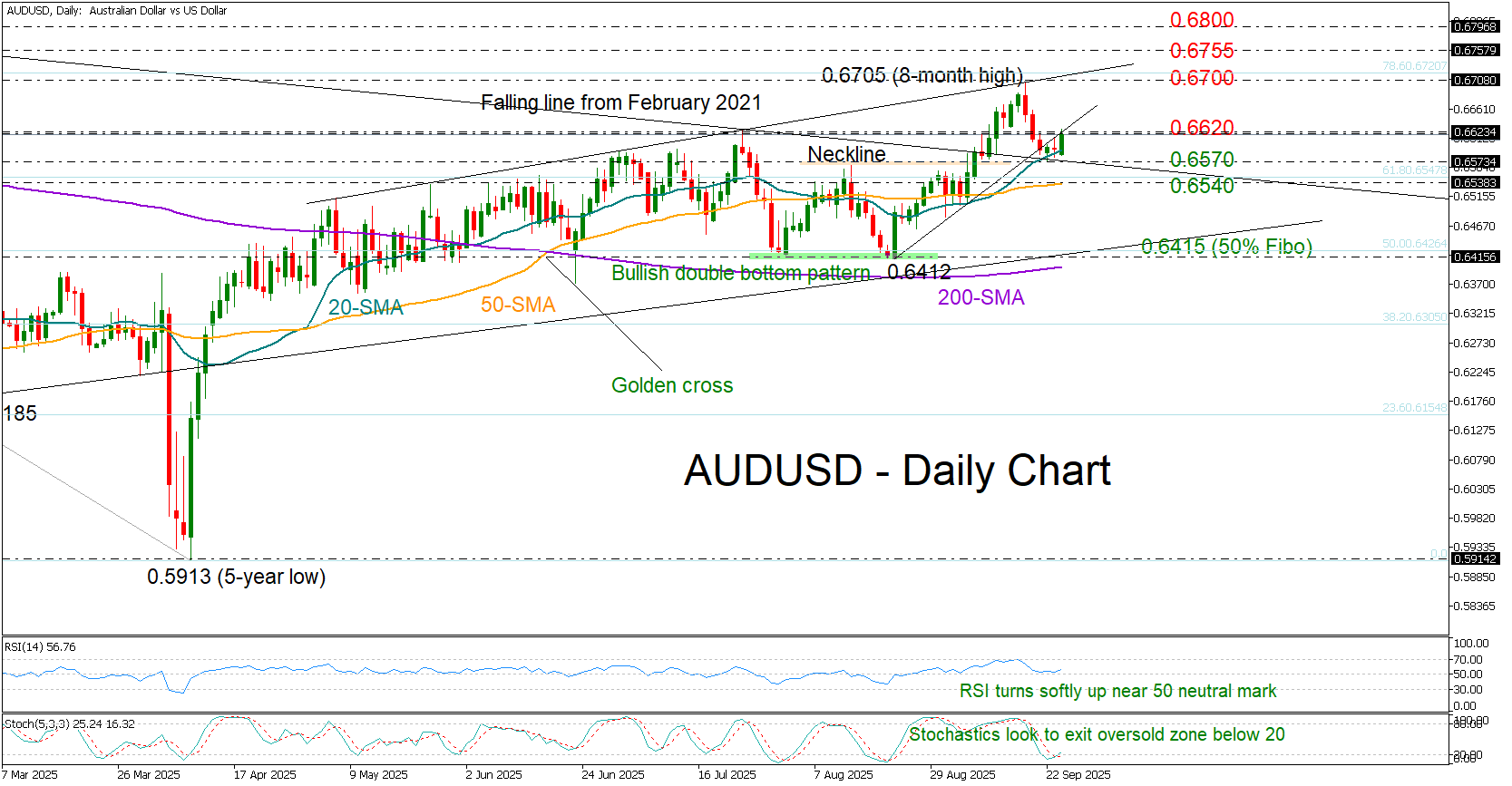

The technical picture is also favoring the bulls. The pair has decisively rebounded from its 20-day simple moving average (SMA), increasing the odds of another acceleration toward the 0.6700 level. Still, traders may stay patient until the price breaks above the nearby 0.6620 barrier – aligned with July’s peak and a broken support trendline – before targeting higher levels. Adding to the positive signals is the RSI which is looking ready to pivot near its 50 neutral mark, while the Stochastic oscillator appears to have bottomed in oversold territory, both endorsing the positive momentum.

A move beyond September’s near one-year high could initially test the 0.6755 zone before the 0.6800 psychological threshold.

On the downside, only a drop below the 50-day SMA at 0.6540 could trigger aggressive selling toward the double-bottom area at 0.6415, formed in July–August. Notably, the 50% Fibonacci retracement level of the previous long downtrend and the 200-day SMA are also in the neighborhood.

Overall, AUD/USD is setting the ground for its next bullish wave, though the bulls may need to recharge near 0.6620 before attempting a sustained continuation higher.

.jpg)