The funeral for Gold has been postponed

The Supreme Court, with its scepticism about the legality of tariffs, has allowed the shiny metal to find its footing. Steps to end the shutdown triggered the rebound from the recent low, and the US government shutdown made the Fed cautious. The central bank doubted the need to cut the federal funds rate at the end of the year. The resumption of US macroeconomic data publication will provide it with the necessary information and enable it to act.

The growing likelihood of tariffs being overturned in the Supreme Court is making Donald Trump nervous. The US president is resorting to extremes. He calls opponents of import duties fools and promises Americans $2,000 cheques at the expense of tariffs. This is reminiscent of the story of support measures during the COVID-19 pandemic. Receiving stimulus cheques laid the foundation for accelerating inflation from 2022 to 2023.

The growing likelihood of tariffs being overturned in the Supreme Court is making Donald Trump nervous. The US president is resorting to extremes. He calls opponents of import duties fools and promises Americans $2,000 cheques at the expense of tariffs. This is reminiscent of the story of support measures during the COVID-19 pandemic. Receiving stimulus cheques laid the foundation for accelerating inflation from 2022 to 2023.

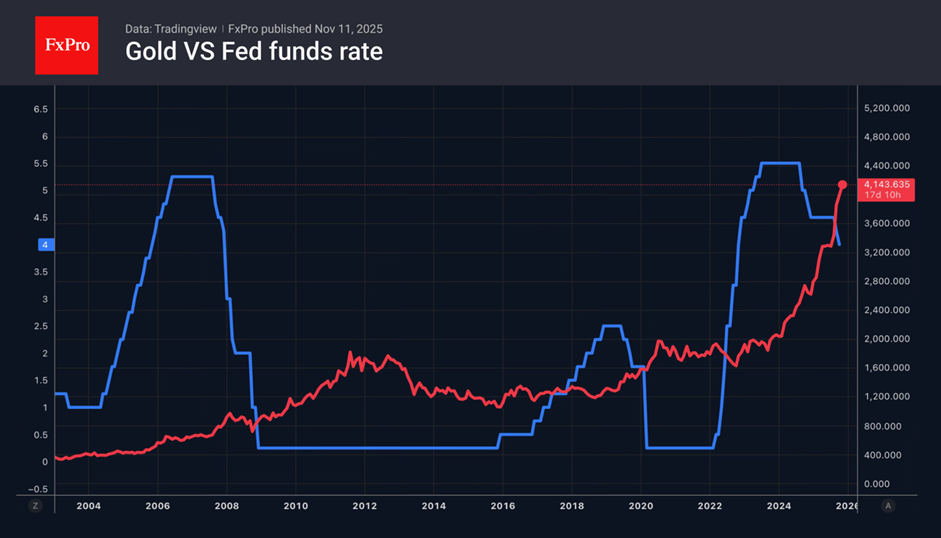

Back then, the Fed had to raise rates aggressively. But nowadays, the central bank is more concerned about job market issues. Maintaining borrowing costs at the current level or lowering them will lead to a decline in real yields on Treasury bonds, which will weaken the US dollar. Gold will be the primary beneficiary of these processes.

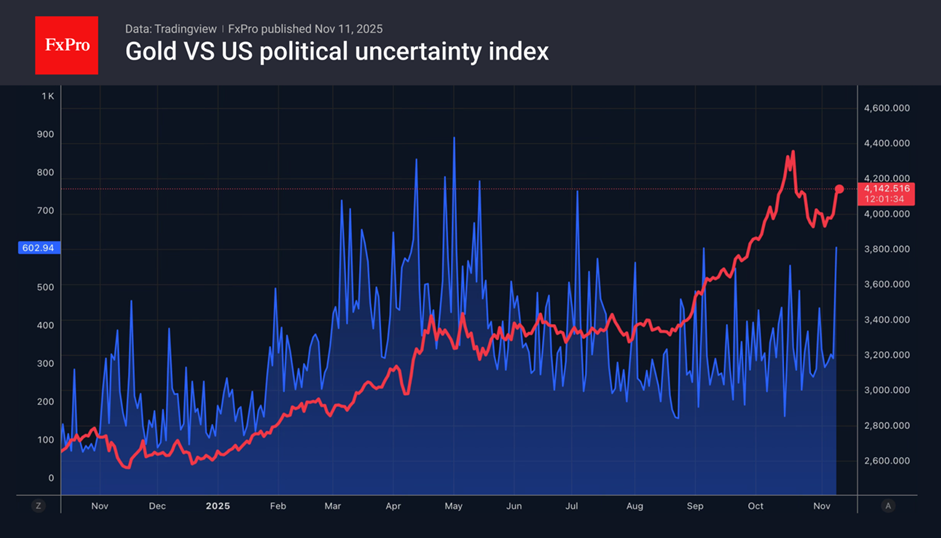

The outlook for the precious metal is no longer as bearish as it was a week ago. Growing political uncertainty, stemming from the potential repeal of tariffs by the Supreme Court and the Fed's dovish stance, is creating tailwinds for Gold. Goldman Sachs forecasts gold to rise to $4,900, while Morgan Stanley predicts $5,300 to $ 5,600 per ounce by the end of 2026. The main drivers of the rally will be high demand from central banks buying bullion and investors diversifying their portfolios.

The outlook for the precious metal is no longer as bearish as it was a week ago. Growing political uncertainty, stemming from the potential repeal of tariffs by the Supreme Court and the Fed's dovish stance, is creating tailwinds for Gold. Goldman Sachs forecasts gold to rise to $4,900, while Morgan Stanley predicts $5,300 to $ 5,600 per ounce by the end of 2026. The main drivers of the rally will be high demand from central banks buying bullion and investors diversifying their portfolios.

The October rout of Gold is no longer perceived as a burst bubble. Yes, speculators pushed gold too high, too fast. However, many of them joined the gold rally late. They began to offload their long positions as soon as they smelled trouble. As a result, we saw a correction. Whether it will continue or resume will be revealed by macroeconomic statistics from the United States and the Fed's verdicts.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)