What next: political deadlocks in France, Japan, and the US

The main question for the coming week is when the shutdown will end. The White House is nervous. Donald Trump first announces negotiations with Democrats on healthcare issues, then he says that this is only possible after the government resumes work. On Polymarket, participants are betting that the shutdown will last until the end of the month. Republicans are asking the president not to carry out mass layoffs of civil servants. This would lower his political ratings and undermine confidence.

The government shutdown casts doubt on the release of important reports on the US labour market and inflation. Investors are trying to focus on alternative data, while the Fed is moving in the dark. Some media reports, the BLS will bring in staff so that the Fed will have employment and inflation data for its next meeting on October 26.

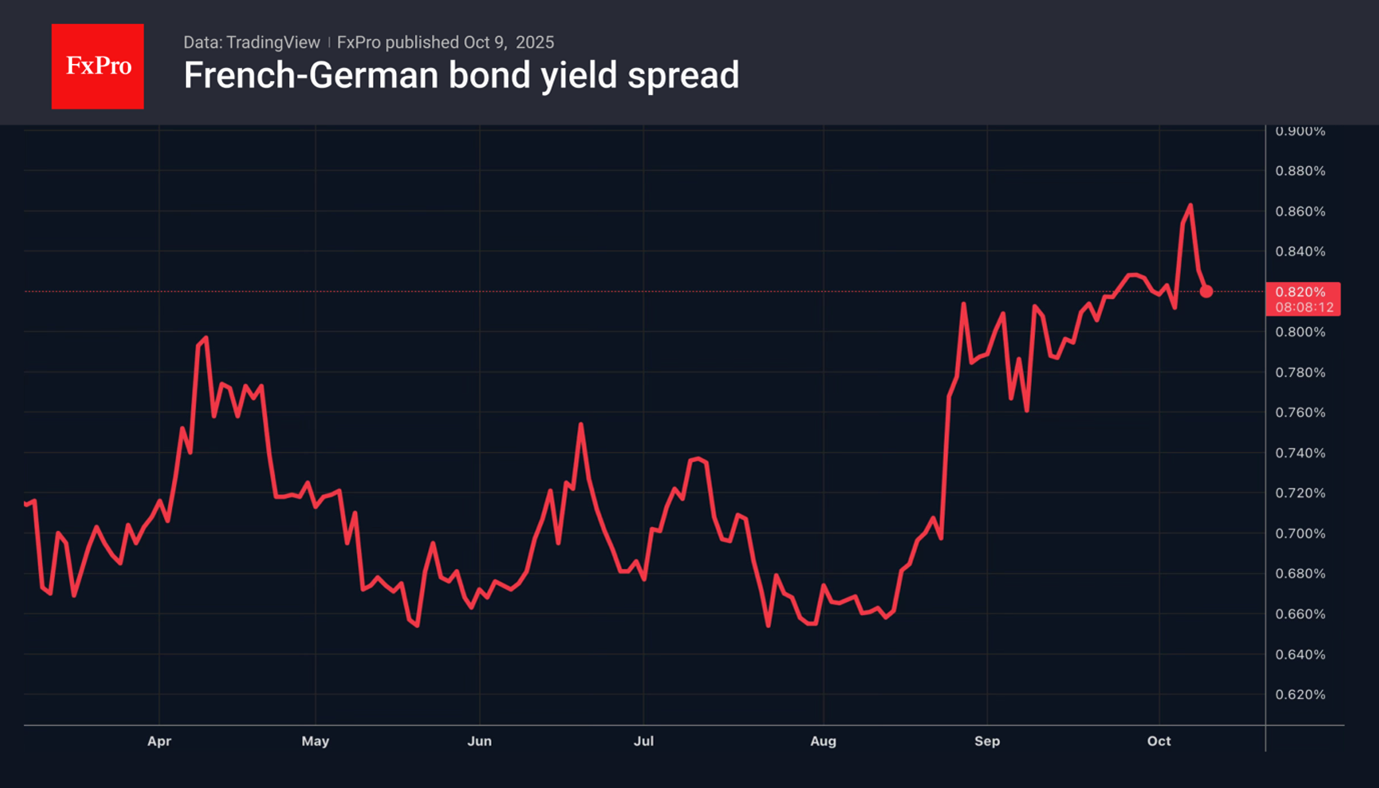

In Europe, the markets will be focused on the political crisis in France. Will Paris get a fifth prime minister, or will it go down the path of parliamentary elections? The key question in Asia is how the new leader of the Liberal Democratic Party, Sanae Takaichi, will behave. She is a supporter of Shinzo Abe's Three Arrows policies. However, Japan is not currently fighting deflation.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)