Recent Systems

| Name | Gain | Monthly | ||

|---|---|---|---|---|

|

|

IC Markets Demo

PropTraderEA

|

+35.20% | +35.20% | |

|

|

ProfitsKagawa(Human/AI)

JupiterCapitalz

|

+5213.49% | +5213.49% | |

|

|

Scalping eurusd xauusd

Kontant

|

+50.19% | +28.47% | |

|

|

HHP & Robo Scalper Combined 2265

renegadewealth

|

+10.85% | +7.09% | |

|

|

ExpertSniperX AR1719

eaforexglobal

|

+67.87% | +6.53% | |

|

|

Scalper X - EURUSD GBPUSD EURJPY AUDUSD

dpacuszka

|

+21.84% | +1.76% | |

|

|

Bot Trader

Jodvdw

|

+19.07% | +6.83% | |

|

|

KipkoechfxEAOnofferFor$100

EVANSFRE

|

+1484764.29% | +1484764.29% | |

|

|

AVAFX

LexTech

|

+26.35% | +26.35% | |

|

|

$BestSancle$

Sanclemente888

|

+11.34% | +11.34% |

Economic Calendar

|

Event

|

Prev.

|

Cons.

|

Act.

|

|||

|---|---|---|---|---|---|---|

|

8m

Low

|

SAR | SAR28.3B |

SAR33B

|

|||

|

8m

Low

|

SAR | SAR94.9B | ||||

|

8m

Low

|

SAR | SAR66.7B | ||||

|

8m

Low

|

SEK | 5.174M |

5.24M

|

|||

|

8m

Low

|

SEK | 8.5% |

7.9%

|

|||

|

38m

Low

|

HUF | 14.6% |

12.1%

|

|||

|

1h 8m

Low

|

PHP | -PHP164.7B | -PHP195.9B | |||

|

1h 8m

Low

|

CZK | 93 |

95

|

|||

|

1h 8m

Low

|

CZK | 99.9 |

99.5

|

|||

|

1h 8m

Med

|

TRY | 104.4 |

104.3

|

|||

|

1h 8m

Low

|

TRY | 76.2% |

76.2%

|

|||

|

1h 8m

Low

|

EUR | |||||

|

1h 28m

Low

|

IDR | 11.28% |

8.3%

|

|||

|

1h 38m

Low

|

IDR | 5.25% |

5.25%

|

|||

|

1h 38m

Low

|

IDR | 6.75% |

6.75%

|

|||

|

1h 38m

Med

|

IDR | 6% |

6%

|

|||

|

1h 38m

Low

|

VND | $4.6B |

$4.9B

|

|||

|

1h 43m

Low

|

EUR | |||||

|

2h 8m

Low

|

EUR | 88.1 |

88.7

|

|||

|

2h 8m

Low

|

EUR | 87.5 |

88.9

|

|||

|

2h 8m

High

|

EUR | 87.8 |

88.9

|

|||

|

2h 8m

Med

|

EUR | 96.5 |

96.9

|

|||

|

2h 8m

Med

|

EUR | 88.6 |

89.5

|

|||

|

2h 8m

Low

|

CHF | 11.5 |

9.9

|

|||

|

2h 8m

Med

|

PLN | 5.4% |

5.3%

|

|||

|

2h 23m

Low

|

EUR | |||||

|

2h 28m

Low

|

TWD | 5.59% | ||||

|

2h 38m

Low

|

EUR | -11 |

-10

|

|||

|

3h 8m

Low

|

ISK | -6.3% |

-1.3%

|

|||

|

3h 8m

Low

|

ISK | 0.4% |

0.3%

|

|||

|

3h 8m

Low

|

ISK | 3.5% |

4%

|

|||

|

3h 8m

Low

|

ISK | 6.8% |

6.7%

|

|||

|

3h 8m

Low

|

ISK | 0.8% |

0.5%

|

|||

|

3h 18m

Low

|

EUR | 3.765% | ||||

|

3h 18m

Low

|

EUR | |||||

|

3h 38m

Med

|

EUR | 2.38% | ||||

|

4h 8m

Med

|

GBP | -18 |

-16

|

|||

|

4h 8m

Med

|

GBP | -3 |

2

|

|||

|

5h 8m

Low

|

BRL | 91.3 |

91

|

|||

|

5h 8m

Low

|

USD | 145.6 | ||||

|

5h 8m

Low

|

USD | 3.3% | ||||

|

5h 8m

Low

|

USD | 202.1 | ||||

|

5h 8m

Low

|

USD | 7.13% | ||||

|

5h 8m

Low

|

USD | 500.7 | ||||

|

6h 8m

Low

|

BHD | -0.2% | ||||

|

6h 8m

Low

|

BHD | 0.9% | ||||

|

6h 8m

Low

|

MXN | 0.33% |

0.16%

|

|||

|

6h 8m

Low

|

MXN | 4.48% |

4.48%

|

|||

|

6h 8m

Low

|

MXN | 0.27% |

-0.03%

|

|||

|

6h 8m

Low

|

MXN | 4.69% |

4.39%

|

|||

|

6h 38m

High

|

CAD | 0.5% |

0%

|

|||

|

6h 38m

High

|

CAD | 0.9% |

1.1%

|

|||

|

6h 38m

High

|

CAD | -0.3% |

0.1%

|

|||

|

6h 38m

Low

|

USD | 0.7% |

0.2%

|

|||

|

6h 38m

High

|

USD | 1.3% |

2.5%

|

|||

|

6h 38m

High

|

USD | 2.2% |

1.2%

|

|||

|

6h 38m

High

|

USD | 0.5% |

0.3%

|

|||

|

6h 38m

Low

|

CAD | 0.7% |

0.1%

|

|||

|

7h 8m

Low

|

EUR | -10.4 |

-9.6

|

|||

|

7h 8m

Low

|

CLP | 6.4% |

3.1%

|

|||

|

7h 23m

Low

|

EUR | |||||

|

8h 8m

Low

|

EUR | |||||

|

8h 38m

Low

|

USD | -0.714M | ||||

|

8h 38m

Low

|

USD | 0.131M | ||||

|

8h 38m

Med

|

USD | 2.735M |

1.6M

|

|||

|

8h 38m

Med

|

USD | -1.154M |

-1.4M

|

|||

|

8h 38m

Low

|

USD | -1.991M | ||||

|

8h 38m

Low

|

USD | 0.033M | ||||

|

8h 38m

Low

|

USD | -0.038M | ||||

|

8h 38m

Low

|

USD | -2.76M |

-0.9M

|

|||

|

8h 38m

Low

|

USD | -0.025M | ||||

|

8h 38m

Low

|

USD |

55

|

||||

|

9h 38m

Low

|

USD | 5.24% | ||||

|

9h 38m

Low

|

USD | 0.19% | ||||

|

10h 8m

Low

|

RUB | 8.5% |

4.2%

|

|||

|

10h 8m

Low

|

RUB | RUB23.8T |

RUB7T

|

|||

|

11h 8m

Low

|

USD | 4.235% | ||||

|

11h 8m

Low

|

PYG | -3.06% |

-2.8%

|

|||

|

11h 38m

Med

|

CAD | |||||

|

13h 8m

Low

|

ARS | 165.3% |

160%

|

|||

|

15h 8m

Low

|

USD | -$770.7M |

-$672M

|

|||

|

15h 8m

Med

|

KRW | 71 |

71

|

|||

|

17h 8m

Med

|

KRW | 0.6% |

0.6%

|

|||

|

17h 8m

Med

|

KRW | 2.2% |

2.4%

|

|||

|

17h 9m

Low

|

GBP | 14.6% |

12%

|

|||

|

17h 9m

Low

|

EUR | 69.5 |

71.5

|

|||

|

17h 58m

Low

|

JPY | ¥1740B | ||||

|

17h 58m

Low

|

JPY | -¥1005.9B | ||||

|

18h 8m

None

|

AUD |

ANZAC Day

|

||||

|

18h 8m

None

|

EGP |

Sinai Liberation Day

|

||||

|

18h 8m

None

|

ISK |

First Day of Summer

|

||||

|

18h 8m

None

|

EUR |

Liberation Day

|

||||

|

18h 8m

None

|

NZD |

ANZAC Day

|

||||

|

18h 8m

None

|

EUR |

Liberty Day

|

||||

|

18h 8m

None

|

SZL |

National Flag Day

|

||||

|

21h 8m

Low

|

IDR | 5.3% |

8.901%

|

|||

|

22h 8m

Med

|

MYR | 1.8% |

2%

|

|||

|

22h 8m

Low

|

MYR | 0.5% |

0.4%

|

|||

|

22h 8m

Low

|

MYR | 1.6% |

0.9%

|

|||

|

22h 8m

Low

|

MYR | 0.2% |

0.2%

|

|||

|

22h 38m

Low

|

THB | -26.15% | ||||

|

23h 8m

Low

|

SGD | 3.75% | ||||

|

23h 8m

Low

|

JPY | 112.1 |

110.9

|

|||

|

23h 8m

Low

|

JPY | 109.5 |

111.8

|

|||

|

1d

High

|

EUR | -27.4 |

-25.9

|

|||

|

1d

Low

|

NOK | 3.6% |

3.7%

|

|||

|

1d

Low

|

SEK | 0% |

0.2%

|

|||

|

1d

Low

|

SEK | -1.3% |

-1%

|

|||

|

1d

Med

|

EUR | 102 |

102

|

|||

|

1d

Low

|

EUR | 100 |

100

|

|||

|

1d

Low

|

EUR | -8.2% |

-7%

|

|||

|

1d

Low

|

SEK | 87.5 |

88

|

|||

|

1d

Low

|

SEK | 94.4 |

95.1

|

|||

|

1d

Low

|

SEK | 6.4% |

6%

|

|||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

AMD | 28.3% |

20%

|

|||

|

1d

Low

|

AMD | $102.3M |

-$170M

|

|||

|

1d

Low

|

AMD | 36.4% |

18%

|

|||

|

1d

Low

|

AMD | -0.6% |

1.2%

|

|||

|

1d

Low

|

AMD | 11.7% |

8%

|

|||

|

1d

Low

|

AMD | 16.3% |

11%

|

|||

|

1d

Low

|

UZS | 14% |

14%

|

|||

|

1d

Low

|

ZMW | 1.2% |

1.5%

|

|||

|

1d

Low

|

ZMW | 13.7% |

13.9%

|

|||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

HKD | -H$41.7B |

-H$22B

|

|||

|

1d

Low

|

HKD | -0.8% | ||||

|

1d

Low

|

HKD | -1.8% | ||||

|

1d

Low

|

EUR | 7% |

12%

|

|||

|

1d

Low

|

BAM | 0.7% |

0.9%

|

|||

|

1d

Low

|

BAM |

1.5

|

||||

|

1d

Low

|

BAM | 2.1% |

3%

|

|||

|

1d

Low

|

BAM | 2.1% |

2.3%

|

|||

|

1d

Low

|

BAM | 0.5% |

0.6%

|

|||

|

1d

Low

|

BAM |

2.5

|

||||

|

1d

Low

|

ZAR | 4.5% |

4.3%

|

|||

|

1d

Low

|

ZAR | 0.5% |

0.3%

|

|||

|

1d

Low

|

EUR | 2811.9K |

2801.9K

|

|||

|

1d

Low

|

EUR | -€0.64B |

-€0.6B

|

|||

|

1d

Med

|

EUR | -15.8K |

-10K

|

|||

|

1d

Med

|

GBP | 2 |

5

|

|||

|

1d

Low

|

TRY | 50% |

50%

|

|||

|

1d

Low

|

TRY | 48.5% |

48.5%

|

|||

|

1d

Low

|

TRY | 51.5% |

51.5%

|

|||

|

1d

Low

|

UAH | 14.5% |

14.5%

|

|||

|

1d

Low

|

CAD | 3.9% |

3.8%

|

|||

|

1d

Low

|

USD | 3.3% |

2.8%

|

|||

|

1d

Low

|

USD | 2% |

3.4%

|

|||

|

1d

Low

|

USD | 3.9% |

3.1%

|

|||

|

1d

Low

|

USD | 1.8% |

2.9%

|

|||

|

1d

Med

|

USD | 1.7% |

3%

|

|||

|

1d

High

|

USD | 3.4% |

2.5%

|

|||

|

1d

Med

|

USD | 0.5% |

0.2%

|

|||

|

1d

Med

|

USD | 0.4% |

0.3%

|

|||

|

1d

High

|

USD | -$91.84B |

-$91.2B

|

|||

|

1d

High

|

USD | 214.5K |

215K

|

|||

|

1d

High

|

USD | 212K |

215K

|

|||

|

1d

High

|

USD | 1812K |

1810K

|

|||

|

1d

Low

|

BRL | BRL186.5B |

BRL205.4B

|

|||

|

1d

Low

|

ARS | 36.68 |

37

|

|||

|

1d

Med

|

USD | 1.6% |

0.9%

|

|||

|

1d

Med

|

USD | -7% |

-4%

|

|||

|

1d

Low

|

USD | 50B | ||||

|

1d

Low

|

COP | -0.3 |

-1

|

|||

|

1d

Low

|

USD | -7 |

-5

|

|||

|

1d

Low

|

USD | -9 |

-7

|

|||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

USD | 5.28% | ||||

|

1d

Low

|

USD | 5.275% | ||||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

USD | 6.39% | ||||

|

1d

Low

|

USD | 7.1% | ||||

|

1d

Low

|

CAD | 3.246% | ||||

|

1d

Low

|

USD | 4.185% | ||||

|

1d

Low

|

NZD | 86.4 |

89

|

|||

|

1d

Med

|

GBP | -21 |

-20

|

|||

|

1d

Low

|

JPY | 2.9% |

2.7%

|

|||

|

1d

Low

|

JPY | 2.4% |

2.2%

|

|||

|

1d

Low

|

JPY | 2.6% |

2.6%

|

News

European Economic News Preview: Germany Ifo Business Confidence Data Due

Business sentiment survey data from Germany is the major report due on Wednesday, headlining a light day for the European economic news. At 4.00 am ET, the ifo Institute is scheduled to issue Germany's business confidence survey results. The business sentiment index is expected to climb to 88.9 in April from 87.8 in March.

RTTNews

|

4h 5min ago

European Shares Seen Opening Up As Tesla Promises Affordable Cars

European stocks are likely to open on a positive note Wednesday after electric-vehicle giant Tesla struck an upbeat tone despite reporting a big drop in quarterly profits.

The company said it would accelerate the production of more affordable models, beginning in the second half of next year "if not late this year."

Several technology heavyweights such as Microsoft, Alphabet, Meta Platforms and other big names including Boeing, Intel, American Airlines, Chevron and Exxon Mobil are scheduled to announce their quarterly earnings this week.

The dollar slipped as traders await more economic data this week, including the release of first-quarter U.S. GDP data as well as the core personal-consumption expenditures (PCE) price index, which is the Fed's preferred measure of inflation.

Several ECB officials are scheduled to speak later today, with investors looking for additional clues on the future trajectory of interest rates in the euro area.

Asian markets were broadly higher, with Japanese and Hong Kong stocks leading regional gains.

The yen was pinned near 34-year lows ahead of a Bank of Japan policy meeting due later in the week.

Gold edged up slightly after having hit its lowest since April 5 in the previous session.

Oil prices were little changed after rallying sharply in the previous session as industry data showed shrinking U.S. crude stockpiles.

U.S. stocks rose for a second straight session overnight as investors digested a batch of strong corporate earnings, weak manufacturing data and mixed readings on the housing sector.

Treasury yields pulled back after a survey showed U.S. business activity cooled in April to a four-month low.

The Dow rose 0.7 percent, the S&P 500 climbed 1.2 percent and the tech-heavy Nasdaq Composite jumped 1.6 percent.

European stocks also gained for a second straight session on Tuesday and logged their best day in six weeks amid speculation over the timing of ECB and BOE rate cuts.

The pan European STOXX 600 rallied 1.1 percent. The German DAX surged 1.6 percent and France's CAC 40 gained 0.8 percent while the U.K.'s FTSE 100 edged up 0.3 percent to a fresh record closing high.

RTTNews

|

4h 23min ago

Sensex, Nifty Cling To Modest Gains In Early Trade

Indian shares opened on a positive note Wednesday as weak U.S. business activity data revived rate cut hopes and electric-vehicle giant Tesla struck an upbeat tone despite a sales miss.

RTTNews

|

5h 31min ago

Asian Markets A Sea Of Green

Asian stock markets are a sea of green on Wednesday, following the broadly positive cues from global markets overnight, as data showing a slowdown in U.S. manufacturing activity in the month of April raised hopes the US Fed will start thinking of cutting interest rates soon. Traders also continue to pick up stocks at relatively reduced levels after the recent sell-off.

RTTNews

|

6h 29min ago

Sensex, Nifty Seen Higher At Open

Indian shares look set to open a tad higher on Wednesday as weak U.S. business activity data revived investor hopes for U.S. rate cuts this year.

RTTNews

|

7h 18min ago

Analysis

Australian dollar rises on strong economic indicators

The AUD/USD pair is experiencing upward momentum for the second consecutive day, reaching a one-week high near 0.6453 on Tuesday. This positive movement comes after a period of rapid decline and is supported by encouraging economic data from Australia.

RoboForex

|

17h 45min ago

Daily Global Market Update

Gold-dollar down 2.4%, MACD negative. Euro-dollar flat, ROC negative. Pound-dollar dips 0.2%, oversold. Bitcoin-dollar jumps 2.3%, stochastic positive. Wall Street rebounds, eyes on earnings. Bitcoin demand slows post-halving. Tesla expects profit margin decline. Major events: US Redbook Index, New Home Sales, 2-Year Note Auction; Japan's PMI; UK's Net Borrowing.

Moneta Markets

|

18h 57min ago

Is gold ready for bearish correction?

Gold dives towards 2,300; MACD and RSI decline from overbought regions; Price post bearish correction

XM Group

|

20h 9min ago

Dollar pulls back, but yen hits new 34-year low

Dollar loses ground against risk-linked currencies - But yen continues to slide to new 34-year low - Stocks rebound, gold falls on easing geopolitical concerns

XM Group

|

20h 41min ago

U.S. Stock Markets Rebound on Profit Optimism

The market spotlight shifts to the U.S. equity market, particularly with the impending release of earnings reports from tech giants .

PU Prime

|

1 day ago

Interest Rates

Market Hours

Recent Topics

325

1 Hour ago

72

3 hours ago

2476

3 hours ago

83

4 hours ago

0

5 hours ago

85

7 hours ago

23

7 hours ago

101

9 hours ago

0

11 hours ago

3236

12 hours ago

Live Forex Spreads

| Brokers | EUR/USD | EUR/GBP |

|---|---|---|

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Forex Sentiment

Charts Activity

-

GBPUSD,M30 by princesajir Apr 18 at 07:52

-

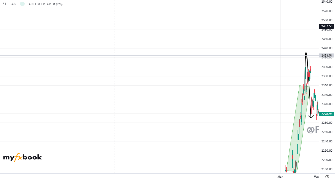

XAUUSD,M30 by princesajir Apr 18 at 05:38

-

XAUUSD,H1 by MagicTraderqatar Apr 18 at 01:58

-

EURUSD,M30 by princesajir Apr 17 at 08:33

-

XAUUSD,M30 by princesajir Apr 17 at 06:58