EBC Markets Briefing | Aussie dollar higher after ADP report; Merck beats on earnings

The Australian dollar edged up on Wednesday after private-sector US jobs data stoked worries about the health of the labour market. Traders are now pricing in around 68% chance of a Fed's rate cut next month.

Payroll processor ADP said that US firms were shedding more than 11,000 jobs a week through late October. The reopening of the federal government has helped ease concerns over economy.

A top Australian central banker said that there was increasing debate about whether the current cash rate of 3.6% is restrictive enough to keep inflation in check, adding that the question is critical for the policy outlook.

The economy grew 0.6% in Q2, the highest annual rate since September 2023. The central bank has warned earlier a lack of investment by business is holding back the growth, further delaying more rate cuts.

Iron ore, the major exports of the country, failed to get a lift from metal boom in2025. Its price hit multi-month lows this week on rising portside inventories and China's weak demand.

Meanwhile, the New Zealand dollar is on the verge of becoming the first major developed-market currency to wipe out its gains this year as aggressive monetary loosening.

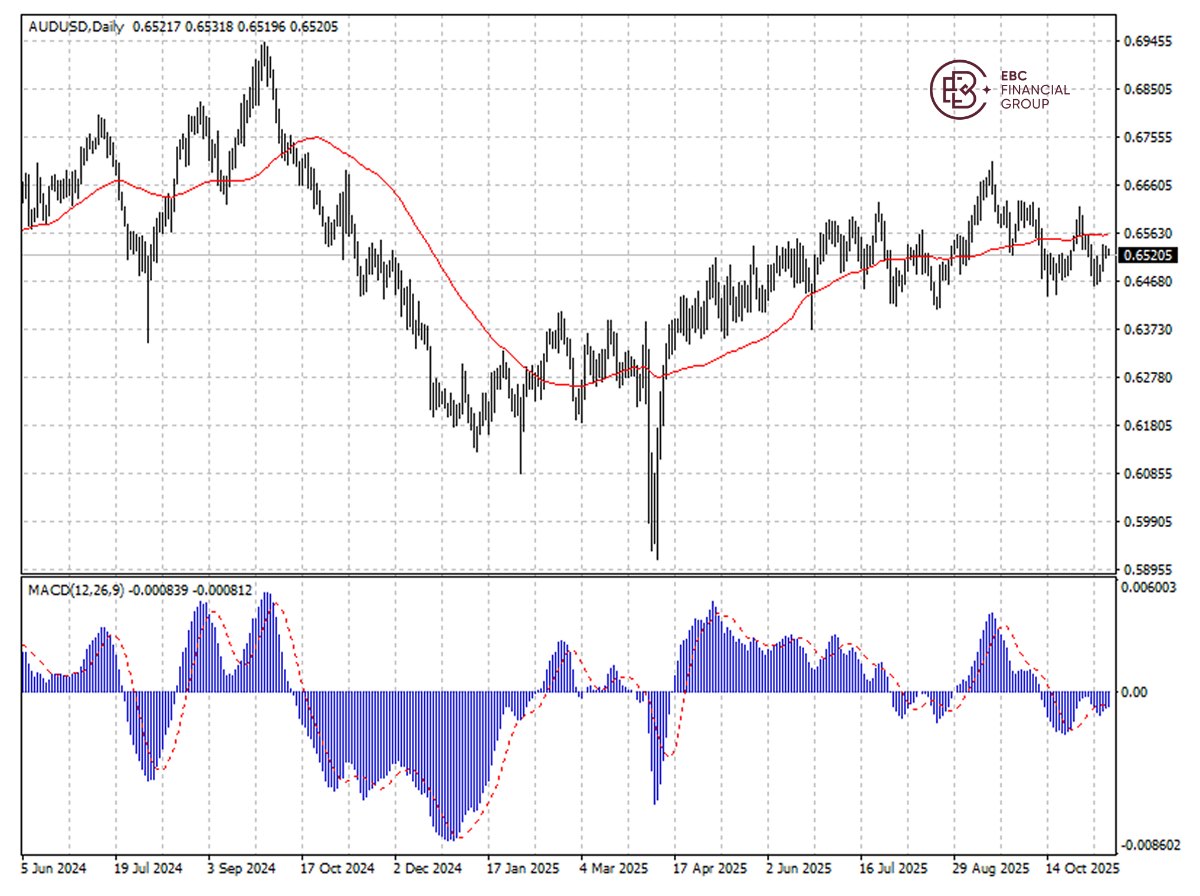

A bullish MACD divergence pointed to a potential rebound in the Aussie dollar, but 50 SMA around 0.6560 could act as the resistance level.

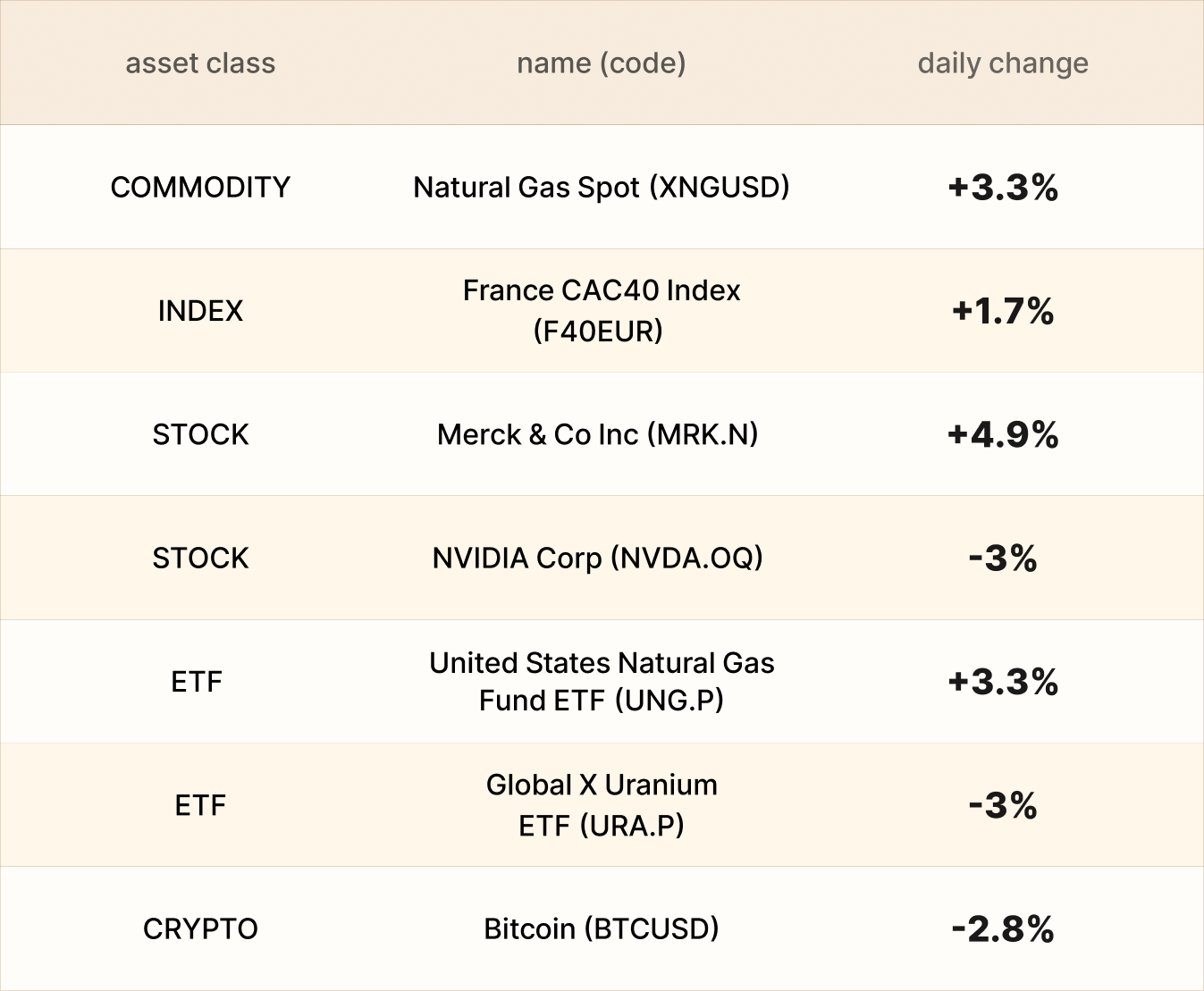

Asset recap

As of market close on 11 November, among EBC products, Merck & Co led gains with Q3 earnings outperforming Wall Street's predictions and a raised guidance for FY25.

SoftBank intensified the debate about valuations in AI on Tuesday by revealing it had sold its stake in the chipmaker Nvidia. The company explained it had to use its existing assets to finance new investments.

Carmaker stocks pushed France's market significantly higher. The country's central bank said the economy "will grow slightly in Q4" as high political uncertainty contributes to a slowing pace of expansion in November.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.