EBC Markets Briefing | Bullion rally continues; Intel soared on Apple contract

Gold extended gains from the previous session, while silver hit another fresh record high. The RatingDog China General Manufacturing PMI unexpectedly contacted in November, missing analysts' expectations of 50.5.

Gold has been on a tear this year, and now a Goldman Sachs survey shows many investors think the precious metal will maintain its momentum and hit a new all-time high of $5,000 by the end of 2026.

More than 70% of institutional investors see gold rising next year. In contrast, just over 5% of those polled see prices pulling back to between $3,500 and $4,000 over the next 12 months.

They have turned to the commodity this year as a protection hedge against sticky inflation, geopolitical conflicts and a depreciating dollar, a move in line with global central banks.

Ukrainian negotiators have met US officials in Florida to thrash out details of the proposed framework to end Russia's war in Ukraine, as Kyiv faces pressure on military and political fronts.

Marco Rubio said the discussions were "productive", but there is "more work to be done." Russian president Putin said earlier Washington's draft could serve as a "basis for future agreements."

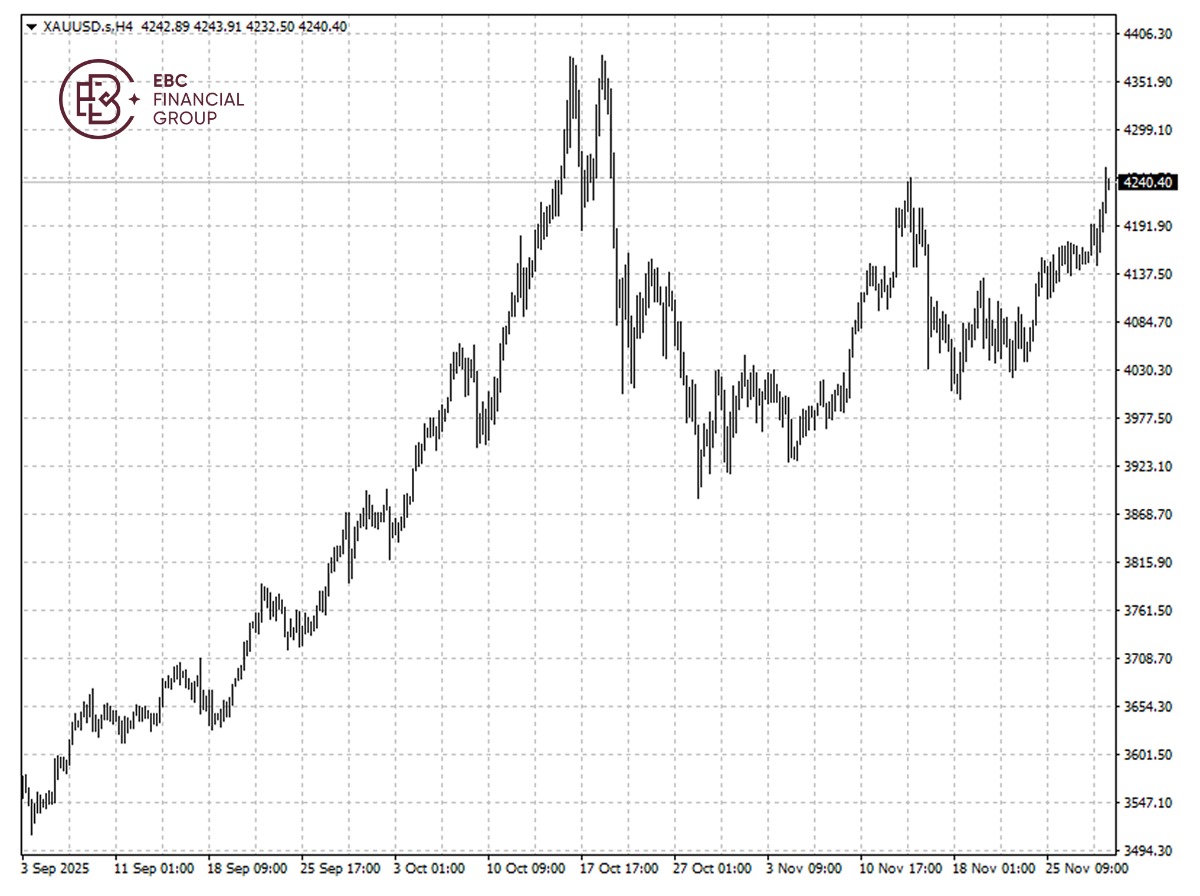

Bullion has breached the high around $4,245 it hit in 13 November, we expect the price to consolidate for a while before heading higher.

Asset recap

As of market close on 28 November, among EBC products, Intel shares led gains following a report that it may win a contract to produce chips for Apple devices.

Silver has reached record highs this year and still has further to run, according to experts. The boom in 2025 relied on a mix of low supply and high demand as well as industrial needs and tariffs.

A Silver Institute's survey estimates that mine production has been decreasing over the past 10 years, especially in Central and South America. The largest consumer – India – saw its demand double this year.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.