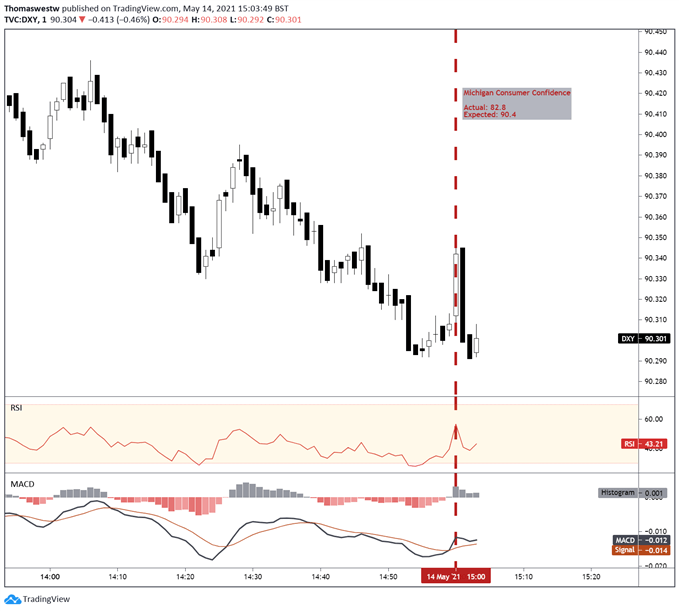

Consumer Confidence, US Dollar, Inflation Expectations – Talking Points

- US Dollar largely unfazed on weaker Michigan headline figure

- Consumers’ inflation expectations tick higher, 5-year at 3.1%

- Next week’s FOMC Minutes may provide next shift for Greenback

The May Surveys of Consumers report from the University of Michigan crossed the wires at 82.8 versus an expected 90.4 consensus forecast and up from the prior month read of 88.3. The US Dollar appeared largely unfazed following the release, keeping attention on the weaker than expected retail sales figure. The downbeat data shows a still-fragile economy despite massive monetary and fiscal stimulus.

US Dollar 1-Minute Chart

Chart created with TradingView

US Dollar upside from the hot consumer price inflation (CPI) print earlier this week has now been nearly wiped out. The Greenback rocketed higher earlier this week as rate traders pushed their expectations for the Federal Reserve to tighten policy sooner than previously thought. The Federal Reserve, however, is standing firm on the view that the uptick in inflation will be a temporary phenomenon and that inflation will cool as pent-up demand in the economy is exhausted.

The University of Michigan survey has its own component on inflation expectations, which helps gauge the outlook consumers have on forward price pressures in the economy. The 1-year expected change in inflation crossed the wires at 4.6%, while the farther out 5-year expected change came in at 3.1%. Investors now have a close eye on inflation – given the implications toward Fed policy – and next week’s FOMC Minutes may help gauge the Fed’s outlook further.

US DOLLAR TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

- Subscribe to the DailyFX Newsletter for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter