Recent Systems

| Name | Gain | Monthly | ||

|---|---|---|---|---|

|

|

Breakouts sys Xau stp

Jim5995

|

+26.79% | +26.79% | |

|

|

DM dm

kevi

|

+68.38% | +16.02% | |

|

|

HD 20K

AlgoPartners

|

+46.37% | +6.77% | |

|

|

IC Markets Demo

PropTraderEA

|

+35.20% | +35.20% | |

|

|

ProfitsKagawa(Human/AI)

JupiterCapitalz

|

+5213.49% | +5213.49% | |

|

|

Scalping eurusd xauusd

Kontant

|

+50.19% | +28.47% | |

|

|

HHP & Robo Scalper Combined 2265

renegadewealth

|

+10.85% | +7.09% | |

|

|

ExpertSniperX AR1719

eaforexglobal

|

+67.87% | +6.53% | |

|

|

Scalper X - EURUSD GBPUSD EURJPY AUDUSD

dpacuszka

|

+21.84% | +1.76% | |

|

|

Bot Trader

Jodvdw

|

+19.07% | +6.83% |

Economic Calendar

|

Event

|

Prev.

|

Cons.

|

Act.

|

|||

|---|---|---|---|---|---|---|

|

10m

Low

|

CZK | 93 |

95

|

|||

|

10m

Low

|

CZK | 99.9 |

99.5

|

|||

|

10m

Med

|

TRY | 104.4 |

104.3

|

|||

|

10m

Low

|

TRY | 76.2% |

76.2%

|

|||

|

10m

Low

|

EUR | |||||

|

30m

Low

|

IDR | 11.28% |

8.3%

|

|||

|

40m

Low

|

IDR | 5.25% |

5.25%

|

|||

|

40m

Low

|

IDR | 6.75% |

6.75%

|

|||

|

40m

Med

|

IDR | 6% |

6%

|

|||

|

40m

Low

|

VND | $4.6B |

$4.9B

|

|||

|

45m

Low

|

EUR | |||||

|

1h 10m

Low

|

EUR | 88.1 |

88.7

|

|||

|

1h 10m

Low

|

EUR | 87.5 |

88.9

|

|||

|

1h 10m

High

|

EUR | 87.8 |

88.9

|

|||

|

1h 10m

Med

|

EUR | 96.5 |

96.9

|

|||

|

1h 10m

Med

|

EUR | 88.6 |

89.5

|

|||

|

1h 10m

Low

|

CHF | 11.5 |

9.9

|

|||

|

1h 10m

Med

|

PLN | 5.4% |

5.3%

|

|||

|

1h 25m

Low

|

EUR | |||||

|

1h 30m

Low

|

TWD | 5.59% | ||||

|

1h 40m

Low

|

EUR | -11 |

-10

|

|||

|

2h 10m

Low

|

ISK | -6.3% |

-1.3%

|

|||

|

2h 10m

Low

|

ISK | 0.4% |

0.3%

|

|||

|

2h 10m

Low

|

ISK | 3.5% |

4%

|

|||

|

2h 10m

Low

|

ISK | 6.8% |

6.7%

|

|||

|

2h 10m

Low

|

ISK | 0.8% |

0.5%

|

|||

|

2h 20m

Low

|

EUR | 3.765% | ||||

|

2h 20m

Low

|

EUR | |||||

|

2h 40m

Med

|

EUR | 2.38% | ||||

|

3h 10m

Med

|

GBP | -18 |

-16

|

|||

|

3h 10m

Med

|

GBP | -3 |

2

|

|||

|

4h 10m

Low

|

BRL | 91.3 |

91

|

|||

|

4h 10m

Low

|

USD | 145.6 | ||||

|

4h 10m

Low

|

USD | 3.3% | ||||

|

4h 10m

Low

|

USD | 202.1 | ||||

|

4h 10m

Low

|

USD | 7.13% | ||||

|

4h 10m

Low

|

USD | 500.7 | ||||

|

5h 10m

Low

|

BHD | -0.2% | ||||

|

5h 10m

Low

|

BHD | 0.9% | ||||

|

5h 10m

Low

|

MXN | 0.33% |

0.16%

|

|||

|

5h 10m

Low

|

MXN | 4.48% |

4.48%

|

|||

|

5h 10m

Low

|

MXN | 0.27% |

-0.03%

|

|||

|

5h 10m

Low

|

MXN | 4.69% |

4.39%

|

|||

|

5h 40m

High

|

CAD | 0.5% |

0%

|

|||

|

5h 40m

High

|

CAD | 0.9% |

1.1%

|

|||

|

5h 40m

High

|

CAD | -0.3% |

0.1%

|

|||

|

5h 40m

Low

|

USD | 0.7% |

0.2%

|

|||

|

5h 40m

High

|

USD | 1.3% |

2.5%

|

|||

|

5h 40m

High

|

USD | 2.2% |

1.2%

|

|||

|

5h 40m

High

|

USD | 0.5% |

0.3%

|

|||

|

5h 40m

Low

|

CAD | 0.7% |

0.1%

|

|||

|

6h 10m

Low

|

EUR | -10.4 |

-9.6

|

|||

|

6h 10m

Low

|

CLP | 6.4% |

3.1%

|

|||

|

6h 25m

Low

|

EUR | |||||

|

7h 10m

Low

|

EUR | |||||

|

7h 40m

Low

|

USD | -0.714M | ||||

|

7h 40m

Low

|

USD | 0.131M | ||||

|

7h 40m

Med

|

USD | 2.735M |

1.6M

|

|||

|

7h 40m

Med

|

USD | -1.154M |

-1.4M

|

|||

|

7h 40m

Low

|

USD | -1.991M | ||||

|

7h 40m

Low

|

USD | 0.033M | ||||

|

7h 40m

Low

|

USD | -0.038M | ||||

|

7h 40m

Low

|

USD | -2.76M |

-0.9M

|

|||

|

7h 40m

Low

|

USD | -0.025M | ||||

|

7h 40m

Low

|

USD |

55

|

||||

|

8h 40m

Low

|

USD | 5.24% | ||||

|

8h 40m

Low

|

USD | 0.19% | ||||

|

9h 10m

Low

|

RUB | 8.5% |

4.2%

|

|||

|

9h 10m

Low

|

RUB | RUB23.8T |

RUB7T

|

|||

|

10h 10m

Low

|

USD | 4.235% | ||||

|

10h 10m

Low

|

PYG | -3.06% |

-2.8%

|

|||

|

10h 40m

Med

|

CAD | |||||

|

12h 10m

Low

|

ARS | 165.3% |

160%

|

|||

|

14h 10m

Low

|

USD | -$770.7M |

-$672M

|

|||

|

14h 10m

Med

|

KRW | 71 |

71

|

|||

|

16h 10m

Med

|

KRW | 0.6% |

0.6%

|

|||

|

16h 10m

Med

|

KRW | 2.2% |

2.4%

|

|||

|

16h 11m

Low

|

GBP | 14.6% |

12%

|

|||

|

16h 11m

Low

|

EUR | 69.5 |

71.5

|

|||

|

17h 0m

Low

|

JPY | ¥1740B | ||||

|

17h 0m

Low

|

JPY | -¥1005.9B | ||||

|

17h 10m

None

|

AUD |

ANZAC Day

|

||||

|

17h 10m

None

|

EGP |

Sinai Liberation Day

|

||||

|

17h 10m

None

|

ISK |

First Day of Summer

|

||||

|

17h 10m

None

|

EUR |

Liberation Day

|

||||

|

17h 10m

None

|

NZD |

ANZAC Day

|

||||

|

17h 10m

None

|

EUR |

Liberty Day

|

||||

|

17h 10m

None

|

SZL |

National Flag Day

|

||||

|

20h 10m

Low

|

IDR | 5.3% |

8.901%

|

|||

|

21h 10m

Med

|

MYR | 1.8% |

2%

|

|||

|

21h 10m

Low

|

MYR | 0.5% |

0.4%

|

|||

|

21h 10m

Low

|

MYR | 1.6% |

0.9%

|

|||

|

21h 10m

Low

|

MYR | 0.2% |

0.2%

|

|||

|

21h 40m

Low

|

THB | -26.15% | ||||

|

22h 10m

Low

|

SGD | 3.75% | ||||

|

22h 10m

Low

|

JPY | 112.1 |

110.9

|

|||

|

22h 10m

Low

|

JPY | 109.5 |

111.8

|

|||

|

23h 10m

High

|

EUR | -27.4 |

-25.9

|

|||

|

23h 10m

Low

|

NOK | 3.6% |

3.7%

|

|||

|

23h 10m

Low

|

SEK | 0% |

0.2%

|

|||

|

23h 10m

Low

|

SEK | -1.3% |

-1%

|

|||

|

23h 55m

Med

|

EUR | 102 |

102

|

|||

|

23h 55m

Low

|

EUR | 100 |

100

|

|||

|

1d

Low

|

EUR | -8.2% |

-7%

|

|||

|

1d

Low

|

SEK | 87.5 |

88

|

|||

|

1d

Low

|

SEK | 94.4 |

95.1

|

|||

|

1d

Low

|

SEK | 6.4% |

6%

|

|||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

AMD | 28.3% |

20%

|

|||

|

1d

Low

|

AMD | $102.3M |

-$170M

|

|||

|

1d

Low

|

AMD | 36.4% |

18%

|

|||

|

1d

Low

|

AMD | -0.6% |

1.2%

|

|||

|

1d

Low

|

AMD | 11.7% |

8%

|

|||

|

1d

Low

|

AMD | 16.3% |

11%

|

|||

|

1d

Low

|

UZS | 14% |

14%

|

|||

|

1d

Low

|

ZMW | 1.2% |

1.5%

|

|||

|

1d

Low

|

ZMW | 13.7% |

13.9%

|

|||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

HKD | -H$41.7B |

-H$22B

|

|||

|

1d

Low

|

HKD | -0.8% | ||||

|

1d

Low

|

HKD | -1.8% | ||||

|

1d

Low

|

EUR | 7% |

12%

|

|||

|

1d

Low

|

BAM | 0.7% |

0.9%

|

|||

|

1d

Low

|

BAM |

1.5

|

||||

|

1d

Low

|

BAM | 2.1% |

3%

|

|||

|

1d

Low

|

BAM | 2.1% |

2.3%

|

|||

|

1d

Low

|

BAM | 0.5% |

0.6%

|

|||

|

1d

Low

|

BAM |

2.5

|

||||

|

1d

Low

|

ZAR | 4.5% |

4.3%

|

|||

|

1d

Low

|

ZAR | 0.5% |

0.3%

|

|||

|

1d

Low

|

EUR | 2811.9K |

2801.9K

|

|||

|

1d

Low

|

EUR | -€0.64B |

-€0.6B

|

|||

|

1d

Med

|

EUR | -15.8K |

-10K

|

|||

|

1d

Med

|

GBP | 2 |

5

|

|||

|

1d

Low

|

TRY | 50% |

50%

|

|||

|

1d

Low

|

TRY | 48.5% |

48.5%

|

|||

|

1d

Low

|

TRY | 51.5% |

51.5%

|

|||

|

1d

Low

|

UAH | 14.5% |

14.5%

|

|||

|

1d

Low

|

CAD | 3.9% |

3.8%

|

|||

|

1d

Low

|

USD | 3.3% |

2.8%

|

|||

|

1d

Low

|

USD | 2% |

3.4%

|

|||

|

1d

Low

|

USD | 3.9% |

3.1%

|

|||

|

1d

Low

|

USD | 1.8% |

2.9%

|

|||

|

1d

Med

|

USD | 1.7% |

3%

|

|||

|

1d

High

|

USD | 3.4% |

2.5%

|

|||

|

1d

Med

|

USD | 0.5% |

0.2%

|

|||

|

1d

Med

|

USD | 0.4% |

0.3%

|

|||

|

1d

High

|

USD | -$91.84B |

-$91.2B

|

|||

|

1d

High

|

USD | 214.5K |

215K

|

|||

|

1d

High

|

USD | 212K |

215K

|

|||

|

1d

High

|

USD | 1812K |

1810K

|

|||

|

1d

Low

|

BRL | BRL186.5B |

BRL205.4B

|

|||

|

1d

Low

|

ARS | 36.68 |

37

|

|||

|

1d

Med

|

USD | 1.6% |

0.9%

|

|||

|

1d

Med

|

USD | -7% |

-4%

|

|||

|

1d

Low

|

USD | 50B | ||||

|

1d

Low

|

COP | -0.3 |

-1

|

|||

|

1d

Low

|

USD | -7 |

-5

|

|||

|

1d

Low

|

USD | -9 |

-7

|

|||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

USD | 5.28% | ||||

|

1d

Low

|

USD | 5.275% | ||||

|

1d

Low

|

EUR | |||||

|

1d

Low

|

USD | 6.39% | ||||

|

1d

Low

|

USD | 7.1% | ||||

|

1d

Low

|

CAD | 3.246% | ||||

|

1d

Low

|

USD | 4.185% | ||||

|

1d

Low

|

NZD | 86.4 |

89

|

|||

|

1d

Med

|

GBP | -21 |

-20

|

|||

|

1d

Low

|

JPY | 2.9% |

2.7%

|

|||

|

1d

Low

|

JPY | 2.4% |

2.2%

|

|||

|

1d

Low

|

JPY | 2.6% |

2.6%

|

News

Yen Slides Against Majors

The Japanese yen weakened against other major currencies in the Asian session on Wednesday.

RTTNews

|

4h 7min ago

NZ Dollar Advances Against Most Majors

The New Zealand dollar strengthened against most major currencies in the Asian session on Wednesday.

RTTNews

|

4h 18min ago

Australian Dollar Rises Against Majors

The Australian dollar strengthened against other major currencies in the Asian session on Wednesday.

RTTNews

|

4h 24min ago

European Economic News Preview: Germany Ifo Business Confidence Data Due

Business sentiment survey data from Germany is the major report due on Wednesday, headlining a light day for the European economic news. At 4.00 am ET, the ifo Institute is scheduled to issue Germany's business confidence survey results. The business sentiment index is expected to climb to 88.9 in April from 87.8 in March.

RTTNews

|

5h 2min ago

European Shares Seen Opening Up As Tesla Promises Affordable Cars

European stocks are likely to open on a positive note Wednesday after electric-vehicle giant Tesla struck an upbeat tone despite reporting a big drop in quarterly profits.

The company said it would accelerate the production of more affordable models, beginning in the second half of next year "if not late this year."

Several technology heavyweights such as Microsoft, Alphabet, Meta Platforms and other big names including Boeing, Intel, American Airlines, Chevron and Exxon Mobil are scheduled to announce their quarterly earnings this week.

The dollar slipped as traders await more economic data this week, including the release of first-quarter U.S. GDP data as well as the core personal-consumption expenditures (PCE) price index, which is the Fed's preferred measure of inflation.

Several ECB officials are scheduled to speak later today, with investors looking for additional clues on the future trajectory of interest rates in the euro area.

Asian markets were broadly higher, with Japanese and Hong Kong stocks leading regional gains.

The yen was pinned near 34-year lows ahead of a Bank of Japan policy meeting due later in the week.

Gold edged up slightly after having hit its lowest since April 5 in the previous session.

Oil prices were little changed after rallying sharply in the previous session as industry data showed shrinking U.S. crude stockpiles.

U.S. stocks rose for a second straight session overnight as investors digested a batch of strong corporate earnings, weak manufacturing data and mixed readings on the housing sector.

Treasury yields pulled back after a survey showed U.S. business activity cooled in April to a four-month low.

The Dow rose 0.7 percent, the S&P 500 climbed 1.2 percent and the tech-heavy Nasdaq Composite jumped 1.6 percent.

European stocks also gained for a second straight session on Tuesday and logged their best day in six weeks amid speculation over the timing of ECB and BOE rate cuts.

The pan European STOXX 600 rallied 1.1 percent. The German DAX surged 1.6 percent and France's CAC 40 gained 0.8 percent while the U.K.'s FTSE 100 edged up 0.3 percent to a fresh record closing high.

RTTNews

|

5h 20min ago

Analysis

Wall Street Closes Higher on Profit Optimism

U.S. markets experienced significant gains, with both the Nasdaq and S&P 500 closing up over 1% on impending earnings reports from tech giants.

PU Prime

|

52 minutes ago

Australian dollar rises on strong economic indicators

The AUD/USD pair is experiencing upward momentum for the second consecutive day, reaching a one-week high near 0.6453 on Tuesday. This positive movement comes after a period of rapid decline and is supported by encouraging economic data from Australia.

RoboForex

|

18h 42min ago

Daily Global Market Update

Gold-dollar down 2.4%, MACD negative. Euro-dollar flat, ROC negative. Pound-dollar dips 0.2%, oversold. Bitcoin-dollar jumps 2.3%, stochastic positive. Wall Street rebounds, eyes on earnings. Bitcoin demand slows post-halving. Tesla expects profit margin decline. Major events: US Redbook Index, New Home Sales, 2-Year Note Auction; Japan's PMI; UK's Net Borrowing.

Moneta Markets

|

19h 55min ago

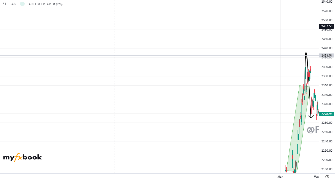

Is gold ready for bearish correction?

Gold dives towards 2,300; MACD and RSI decline from overbought regions; Price post bearish correction

XM Group

|

21h 6min ago

Dollar pulls back, but yen hits new 34-year low

Dollar loses ground against risk-linked currencies - But yen continues to slide to new 34-year low - Stocks rebound, gold falls on easing geopolitical concerns

XM Group

|

21h 38min ago

Interest Rates

Market Hours

Recent Topics

0

32 minutes ago

16

50 minutes ago

330

1 Hour ago

72

4 hours ago

2476

4 hours ago

85

5 hours ago

86

8 hours ago

24

8 hours ago

101

10 hours ago

0

12 hours ago

Live Forex Spreads

| Brokers | EUR/USD | EUR/GBP |

|---|---|---|

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Forex Sentiment

Charts Activity

-

GBPUSD,M30 by princesajir Apr 18 at 07:52

-

XAUUSD,M30 by princesajir Apr 18 at 05:38

-

XAUUSD,H1 by MagicTraderqatar Apr 18 at 01:58

-

EURUSD,M30 by princesajir Apr 17 at 08:33

-

XAUUSD,M30 by princesajir Apr 17 at 06:58