30-Trade Test PA (By quicksilver)

| Прибыль : | -99.9% |

| Просадка | 99.92% |

| Пипс: | -13399.4 |

| Сделки | 103 |

| Выигрыш: |

|

| Потери: |

|

| Тип: | Демо |

| Кредитное плечо: | 1:500 |

| Трейдинг: | Вручную |

Edit Your Comment

30-Trade Test PA Обсуждение

Участник с Jan 09, 2013

40 комментариев

May 18, 2015 at 08:20

Участник с Jan 09, 2013

40 комментариев

Journal to discuss my 30 trade test, using price action analysis.

Участник с Jan 09, 2013

40 комментариев

May 18, 2015 at 08:25

(отредактировано May 18, 2015 at 08:30)

Участник с Jan 09, 2013

40 комментариев

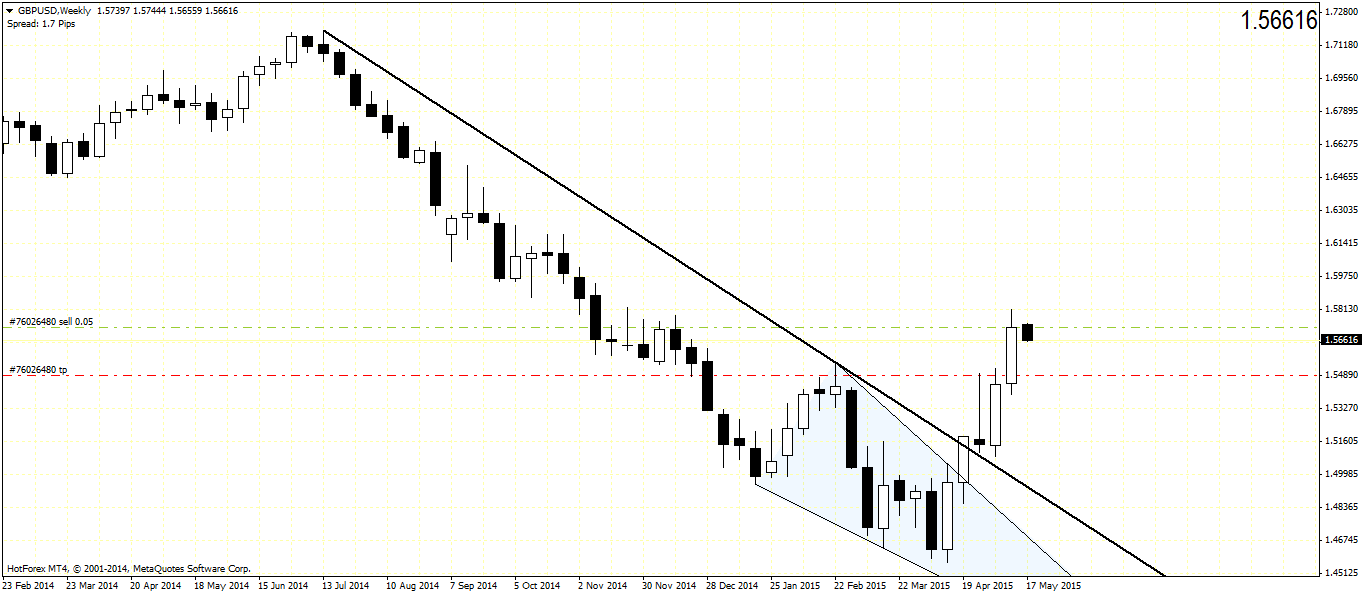

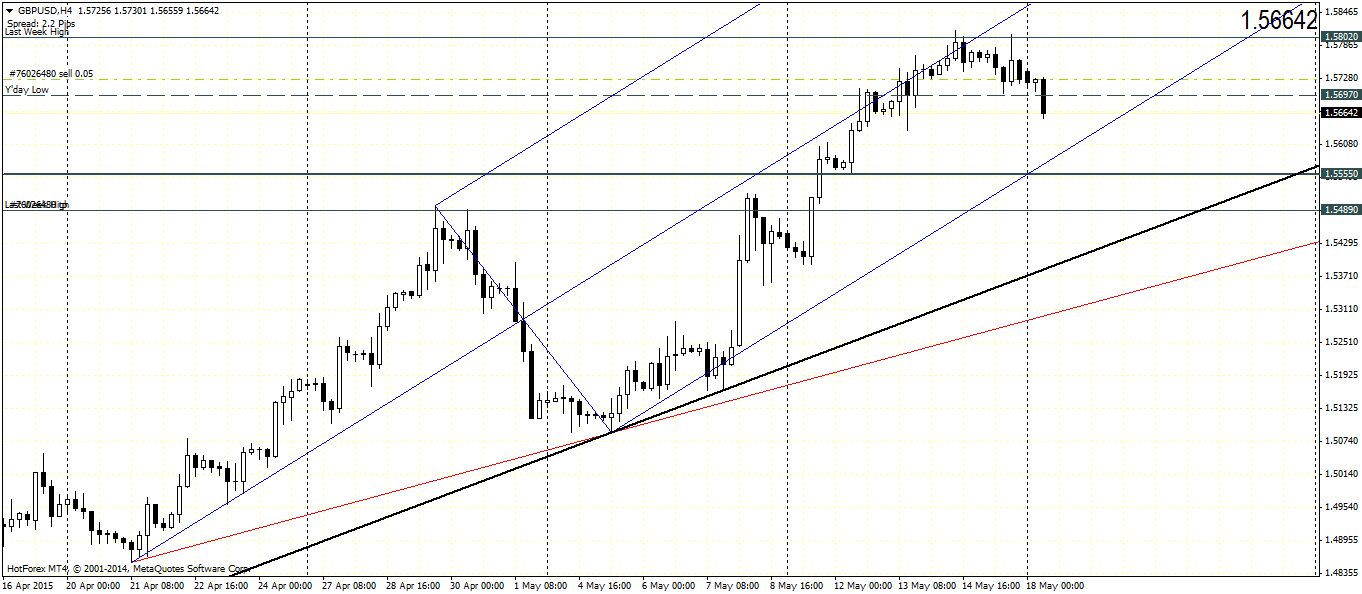

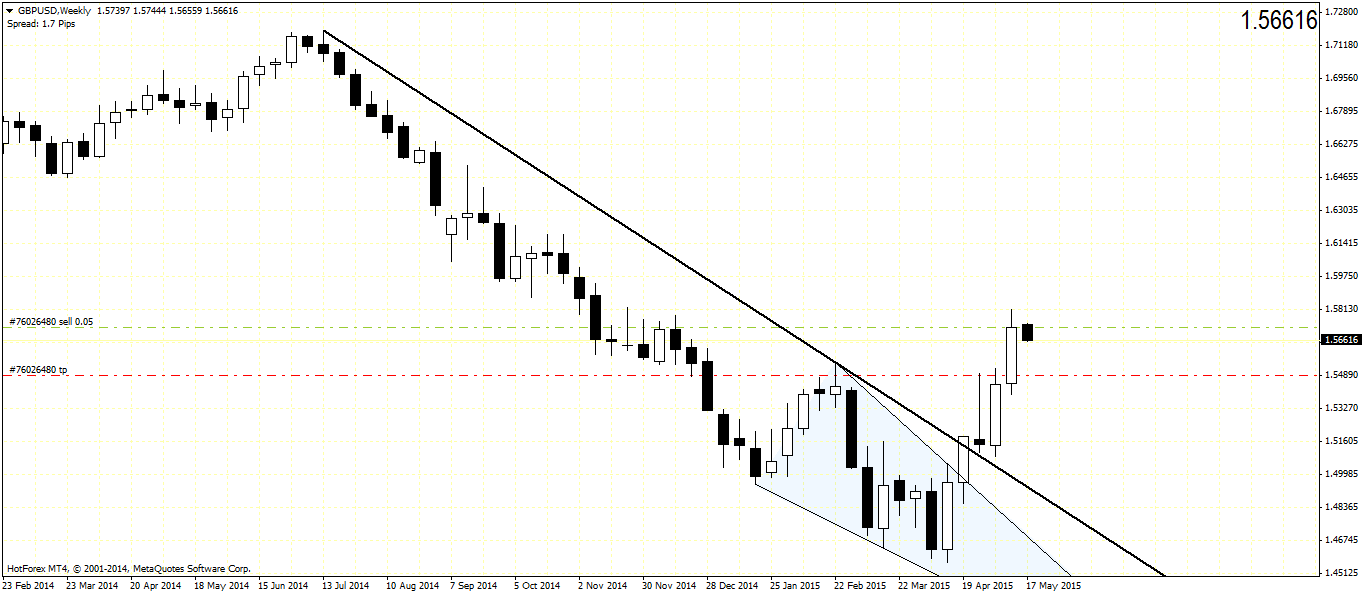

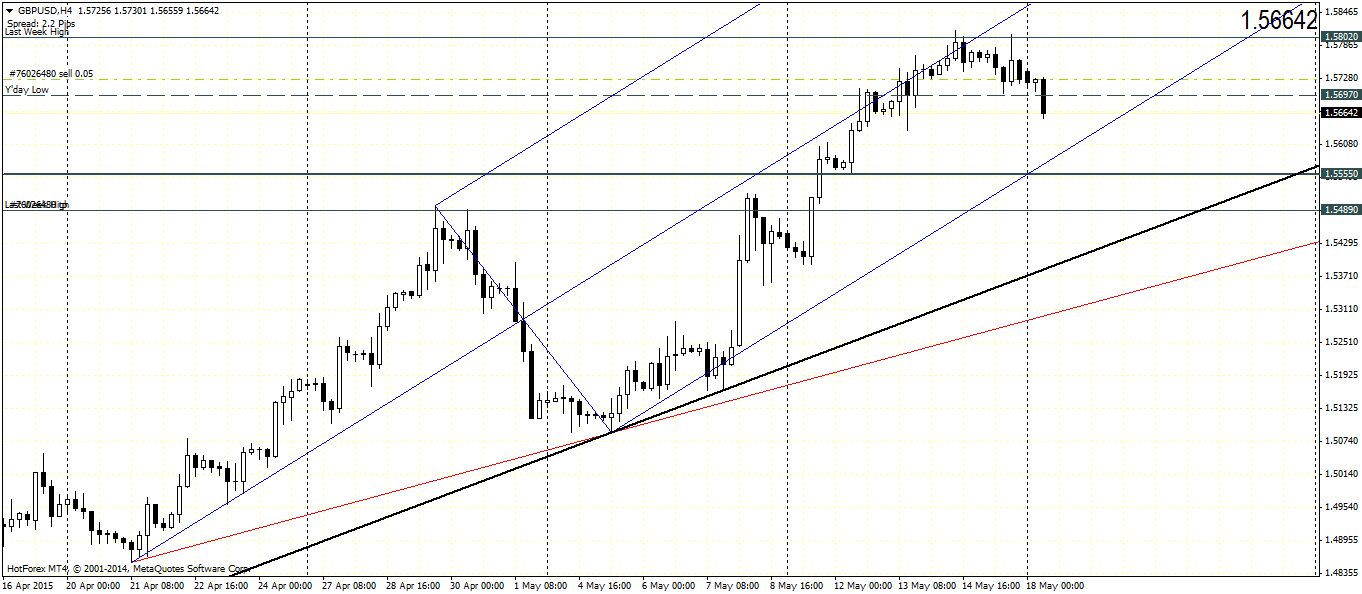

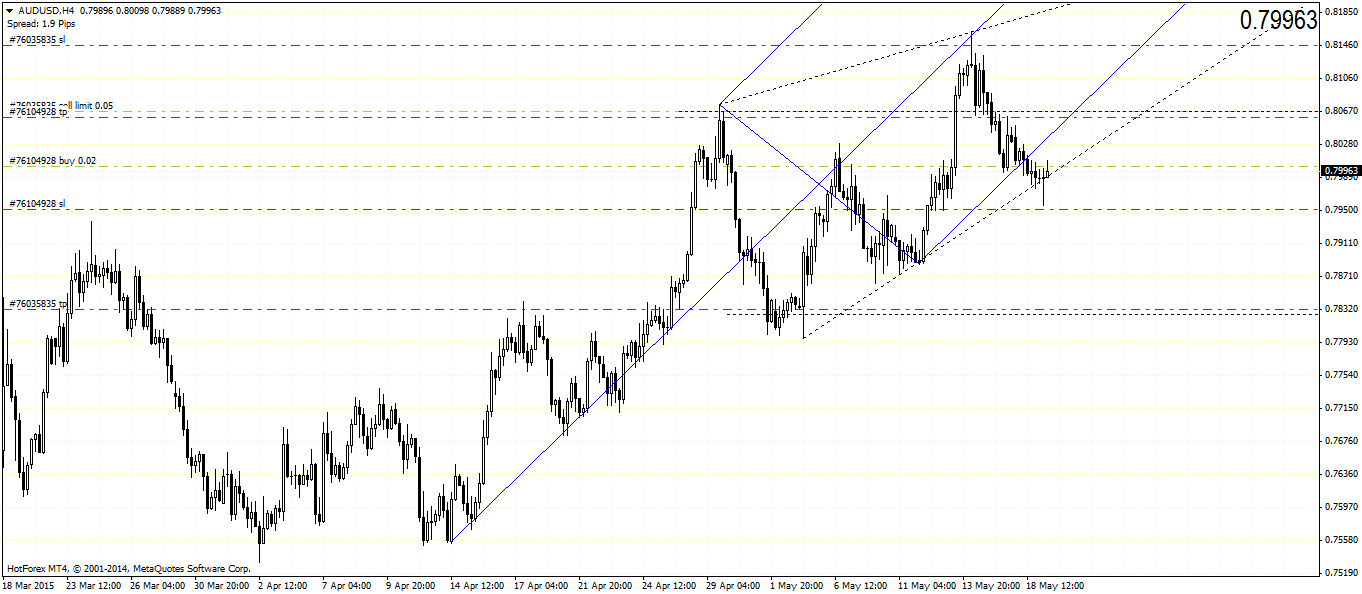

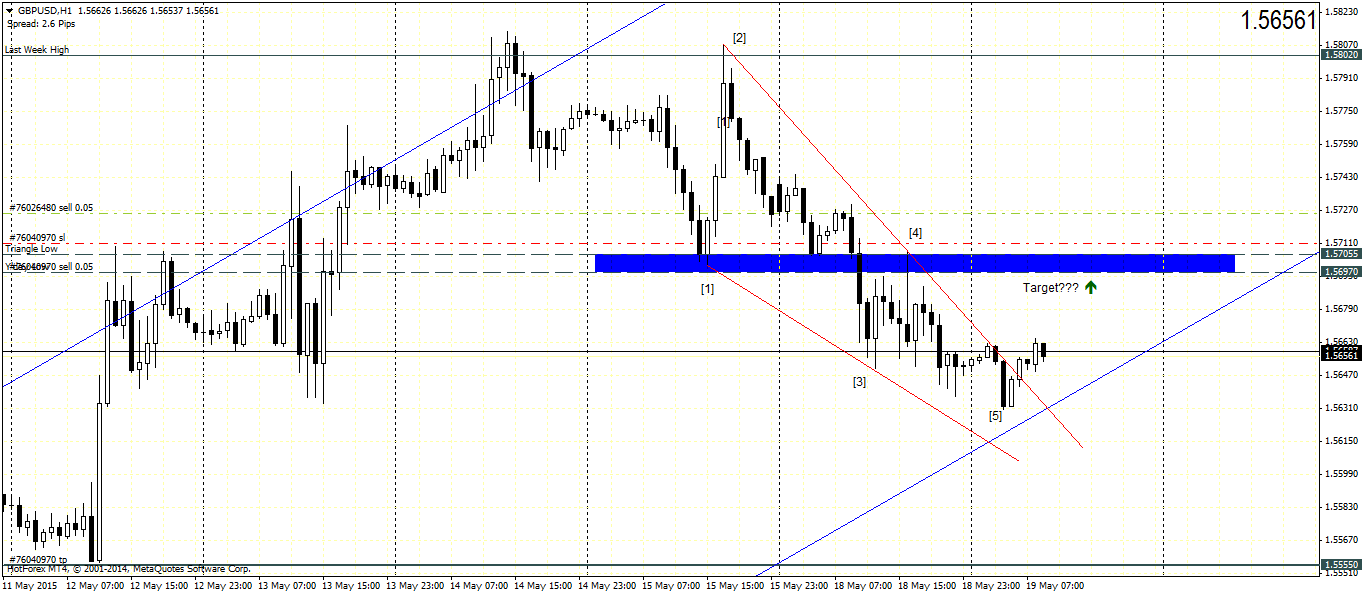

GBPUSD, 15/05 - Trade #1

-------------------------------------------------

Weekly chart has a break out from the falling wedge and the trend line broken as well.

Last week's PA rallied to 1.5813 zone but closed lower from the high. Expecting a test back to the falling wedge's resistance level to be tested for support @ 1.5489

Daily chart formed a bearish engulfing and indicative of a move downside.

On h4, plotting median lines, price has broken below Friday's low at 1.56697. So went short at 1.5728 and targeting 1.5489. Possible risk of test only to 1.5555 though, so i'll be watching GU trade.

So far, no SL placed. But on this H4 close below 1.5697, will move SL to BE.

Looking for small bounces to add to shorts to target the more realistic 1.5555

-------------------------------------------------

Weekly chart has a break out from the falling wedge and the trend line broken as well.

Last week's PA rallied to 1.5813 zone but closed lower from the high. Expecting a test back to the falling wedge's resistance level to be tested for support @ 1.5489

Daily chart formed a bearish engulfing and indicative of a move downside.

On h4, plotting median lines, price has broken below Friday's low at 1.56697. So went short at 1.5728 and targeting 1.5489. Possible risk of test only to 1.5555 though, so i'll be watching GU trade.

So far, no SL placed. But on this H4 close below 1.5697, will move SL to BE.

Looking for small bounces to add to shorts to target the more realistic 1.5555

Участник с Jan 09, 2013

40 комментариев

May 18, 2015 at 08:30

Участник с Jan 09, 2013

40 комментариев

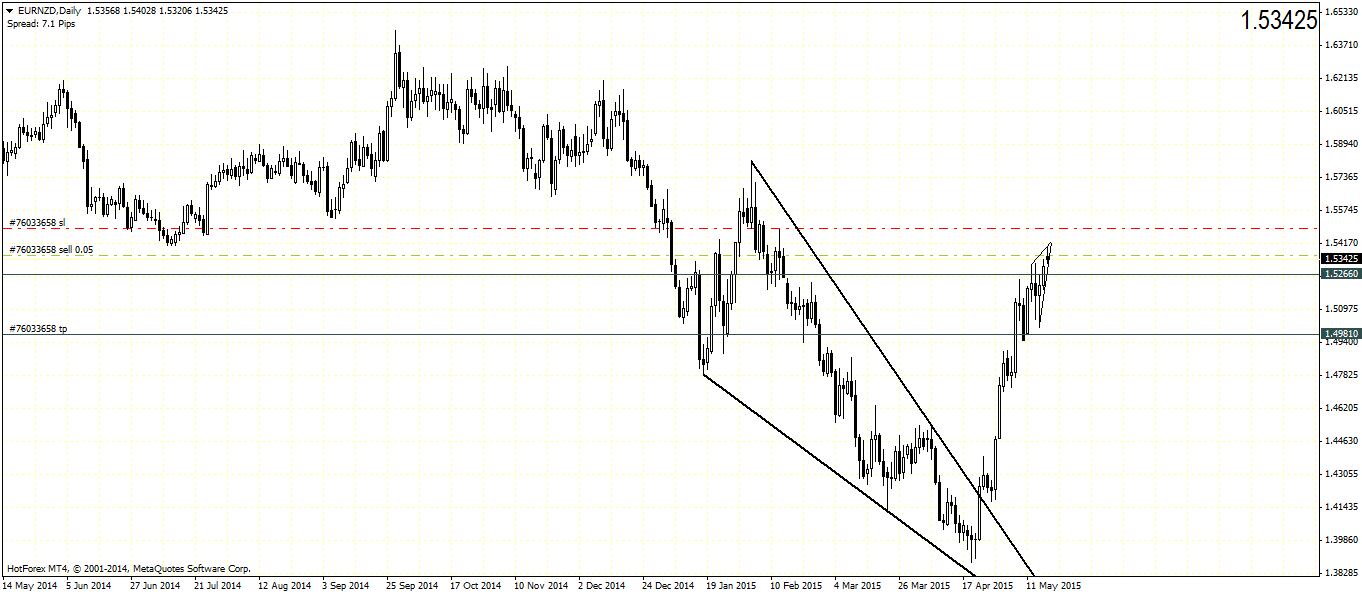

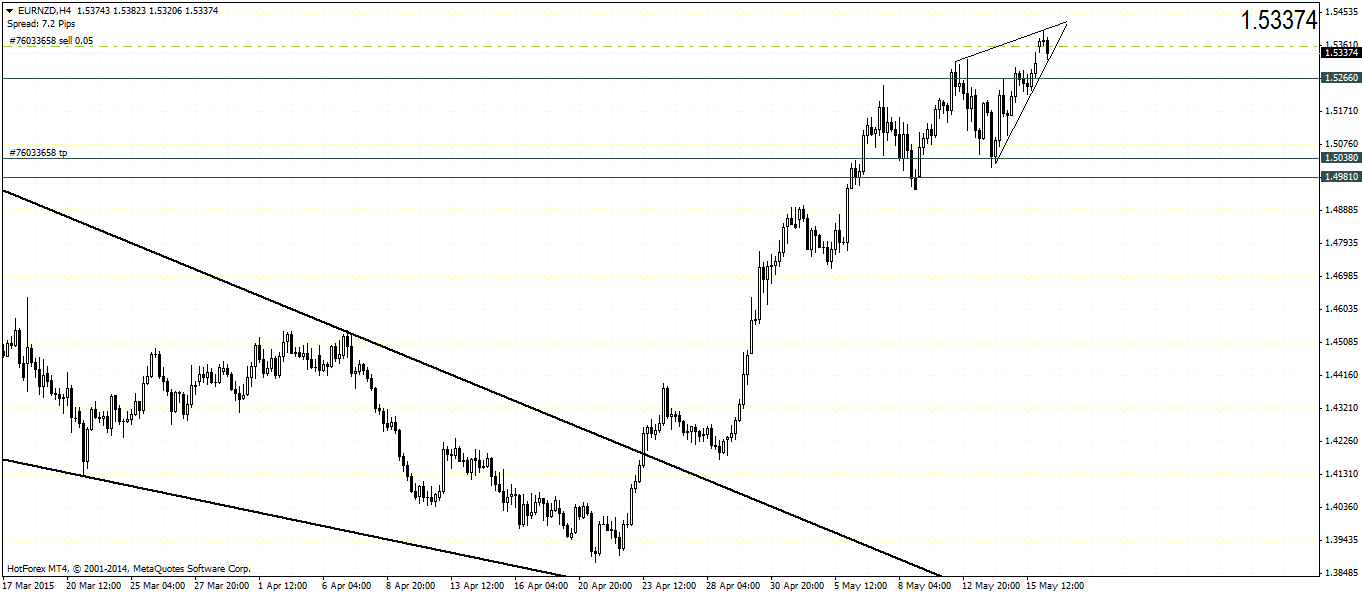

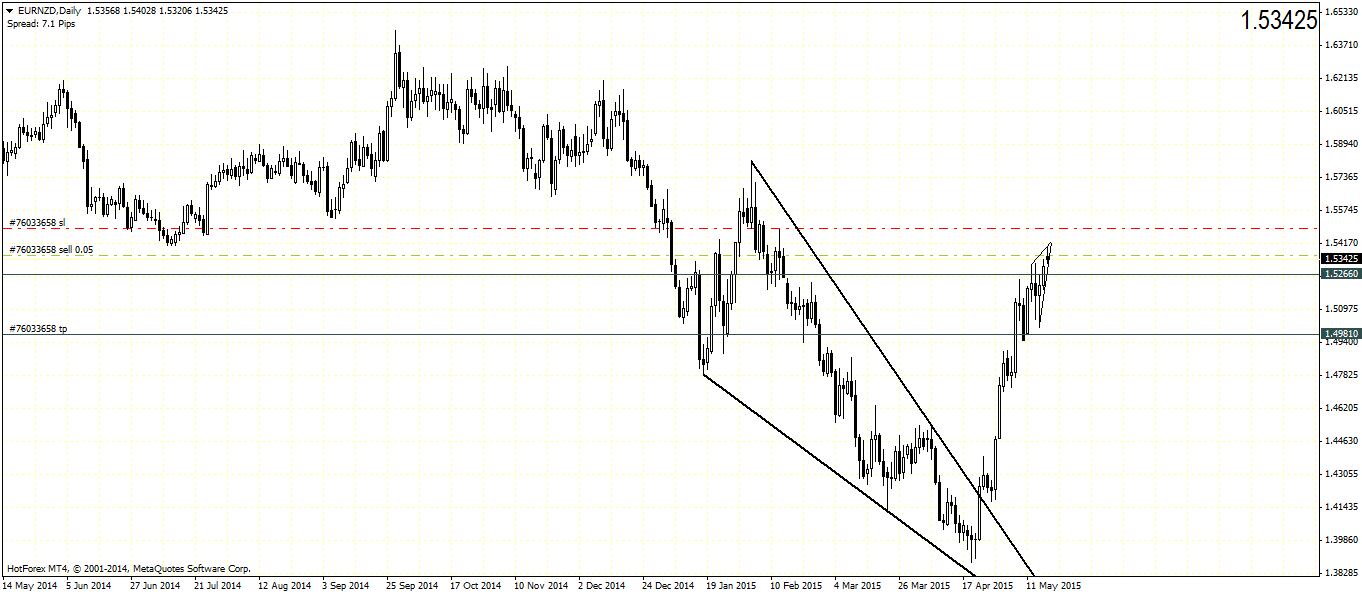

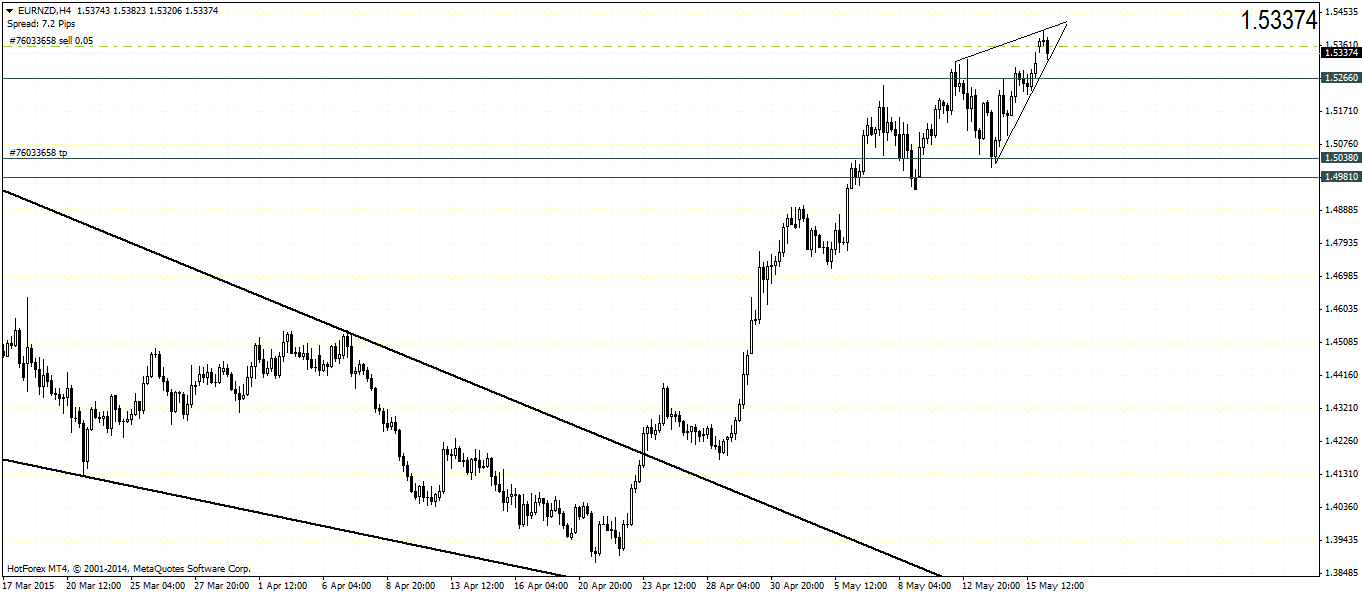

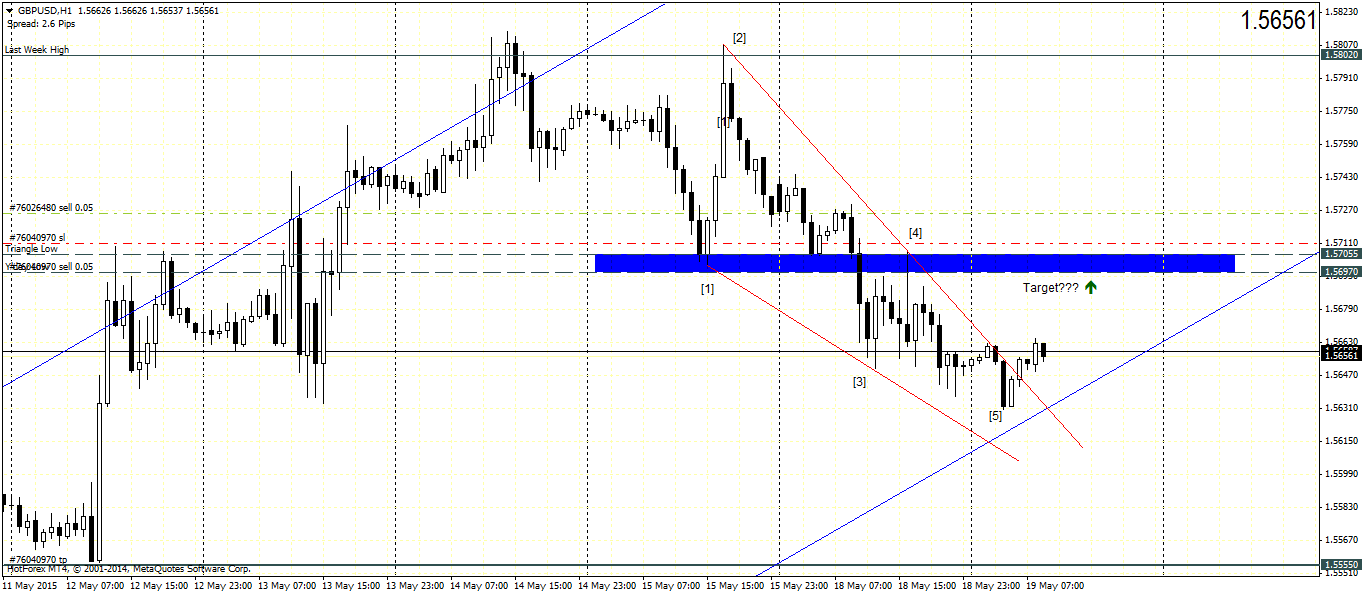

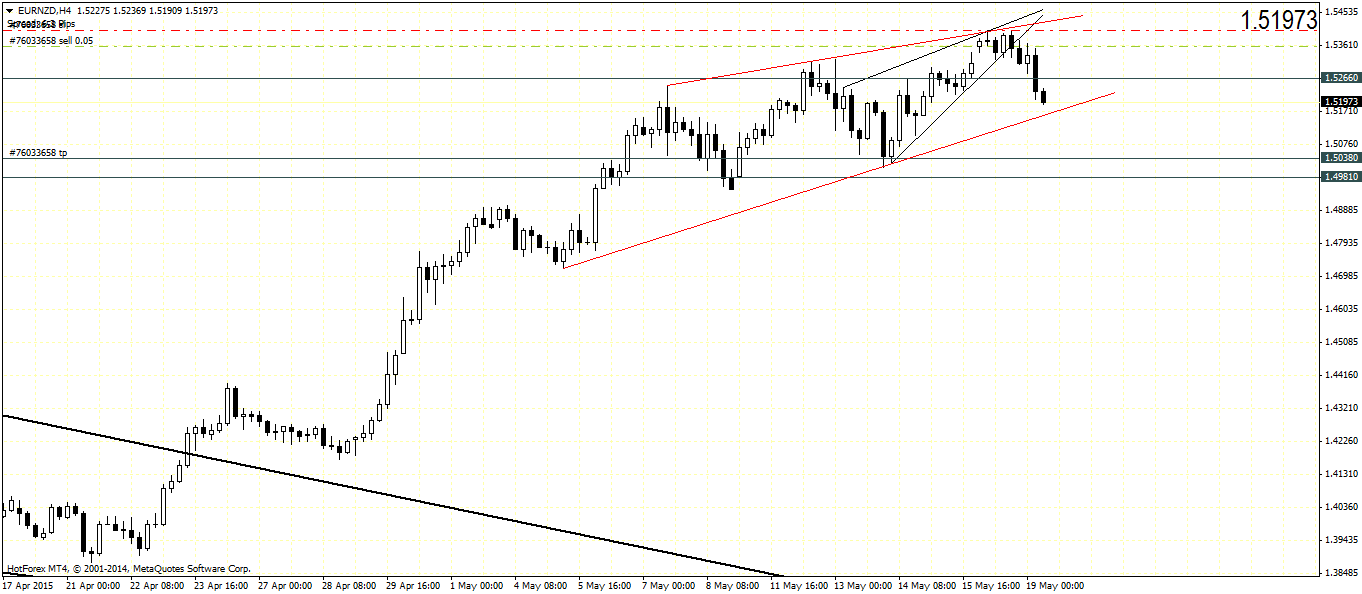

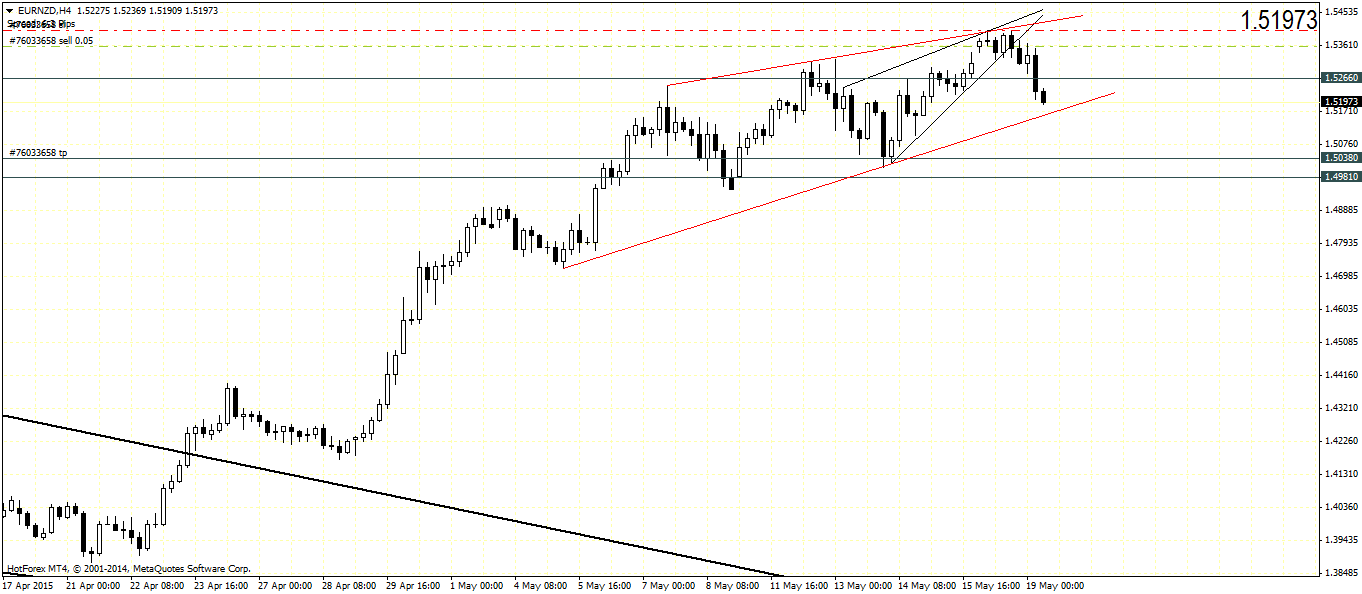

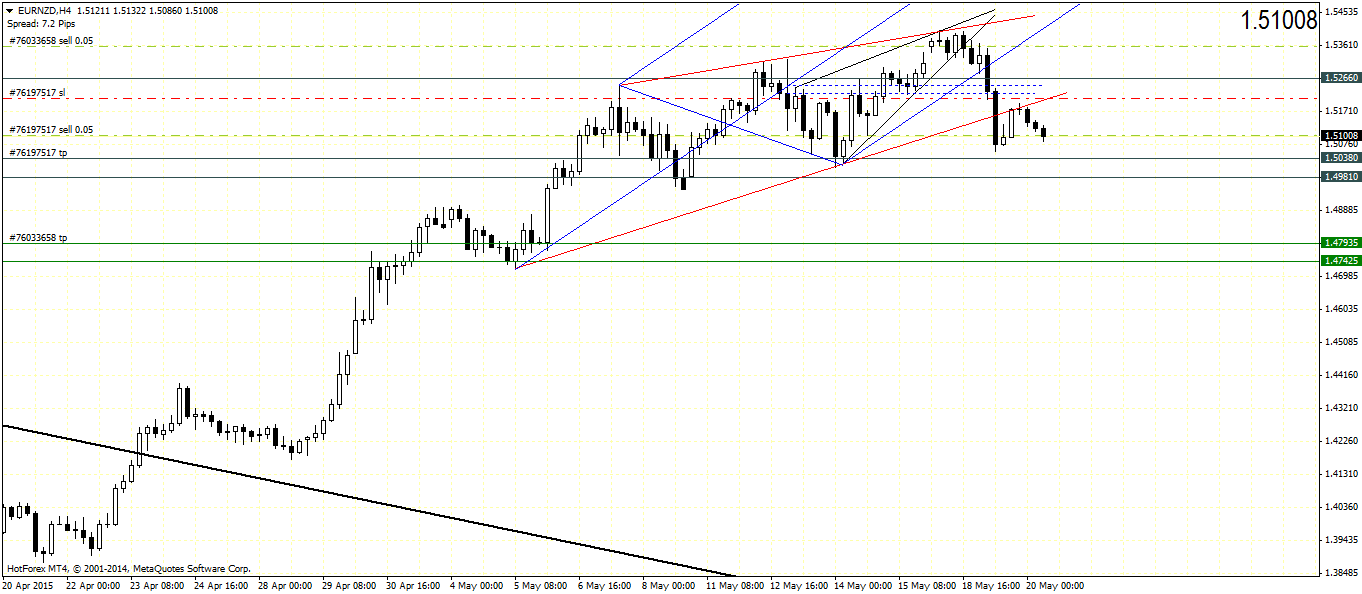

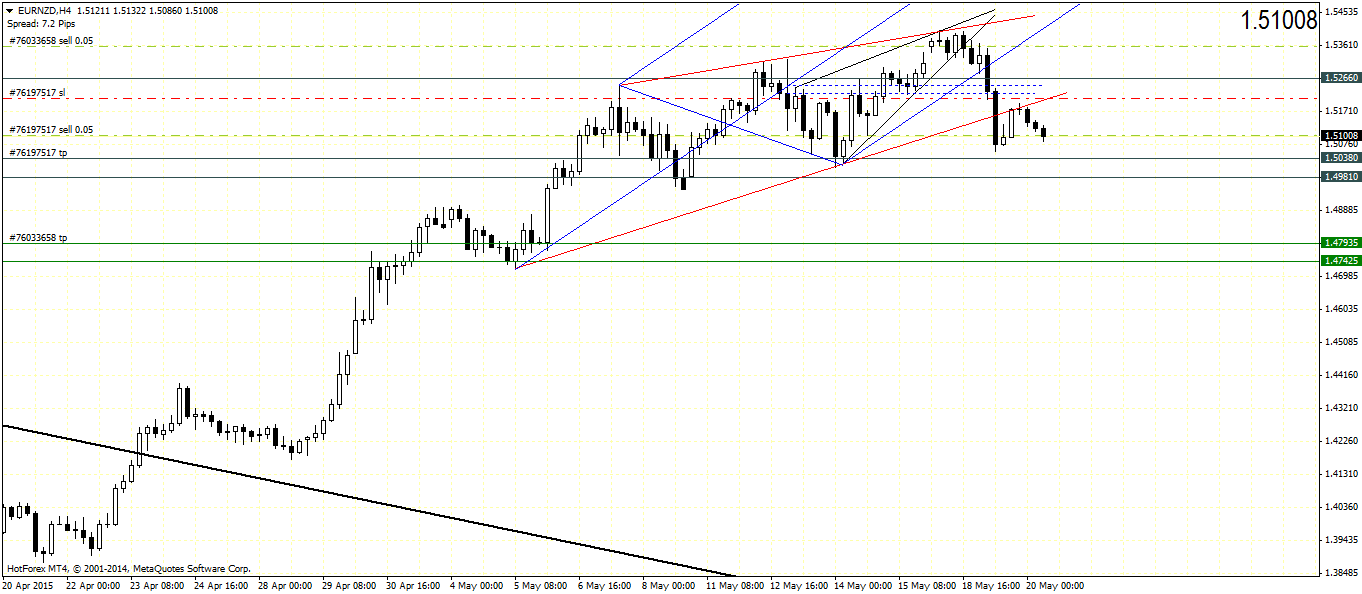

EURNZD, 15/05 - Trade #2

-------------------------------------------------

EURNZD on weekly has rallied after break out from falling wedge. Price looks to be stalling near 1.5417, although current high is at 1.54028.

On daily, if we see a lower close today, it could be quite bearish. Moving to H4, price is forming a rising wedge/triangle pattern. So far we got 3 contact points.

I have entered this trade a bit early as the H4 is shaping out to be a reversal with the doji on the previous H4 candle.

There could be a bounce from point 4 however but could be doubtful.

Looking to move trade to BE on close below 1.5266 (which will be another level to watch to add to shorts.

Targeting 1.5038, the low of the triangle.

-------------------------------------------------

EURNZD on weekly has rallied after break out from falling wedge. Price looks to be stalling near 1.5417, although current high is at 1.54028.

On daily, if we see a lower close today, it could be quite bearish. Moving to H4, price is forming a rising wedge/triangle pattern. So far we got 3 contact points.

I have entered this trade a bit early as the H4 is shaping out to be a reversal with the doji on the previous H4 candle.

There could be a bounce from point 4 however but could be doubtful.

Looking to move trade to BE on close below 1.5266 (which will be another level to watch to add to shorts.

Targeting 1.5038, the low of the triangle.

Участник с Jan 09, 2013

40 комментариев

May 18, 2015 at 09:57

Участник с Jan 09, 2013

40 комментариев

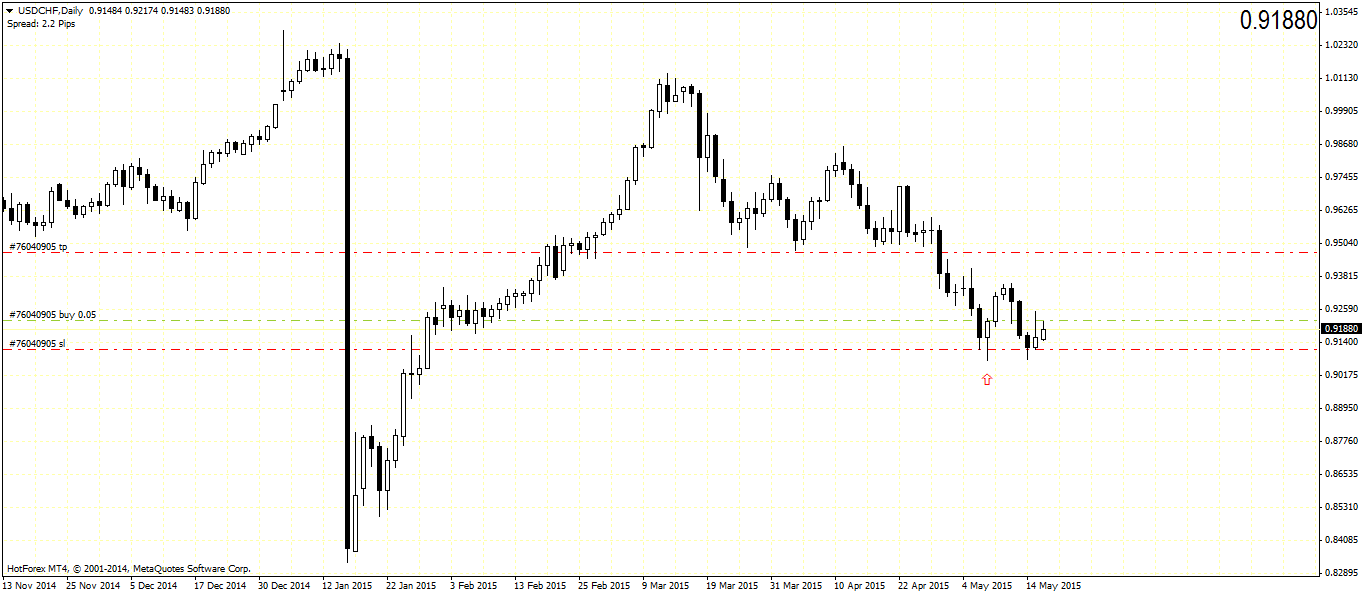

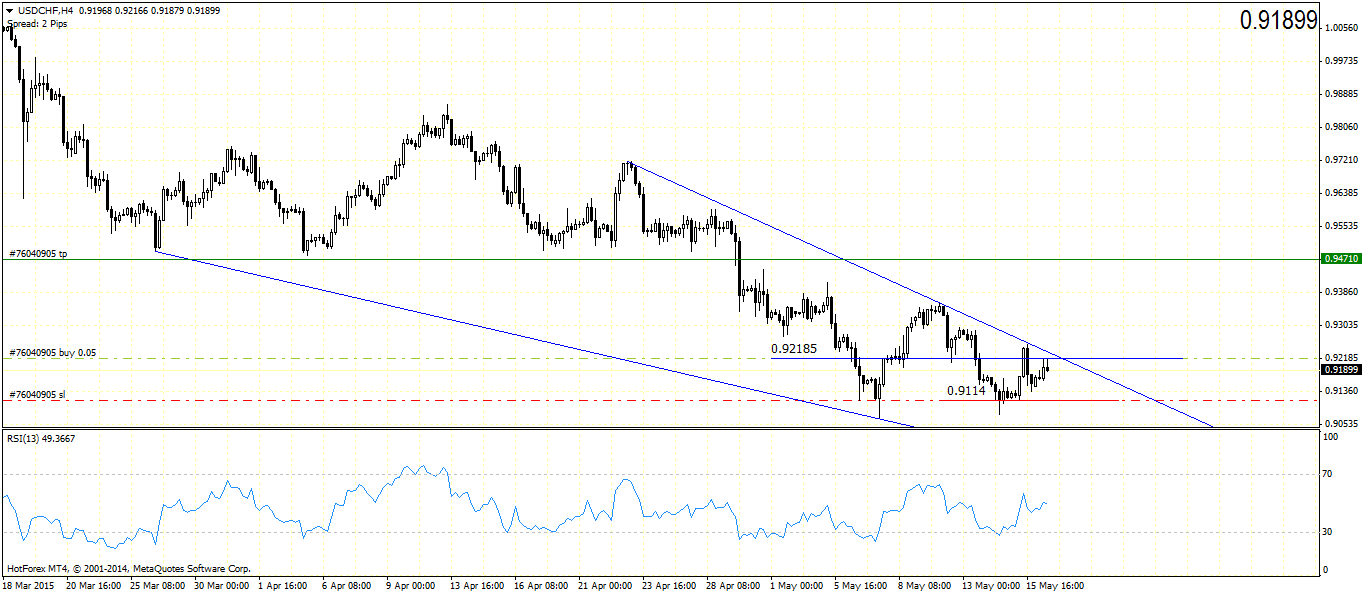

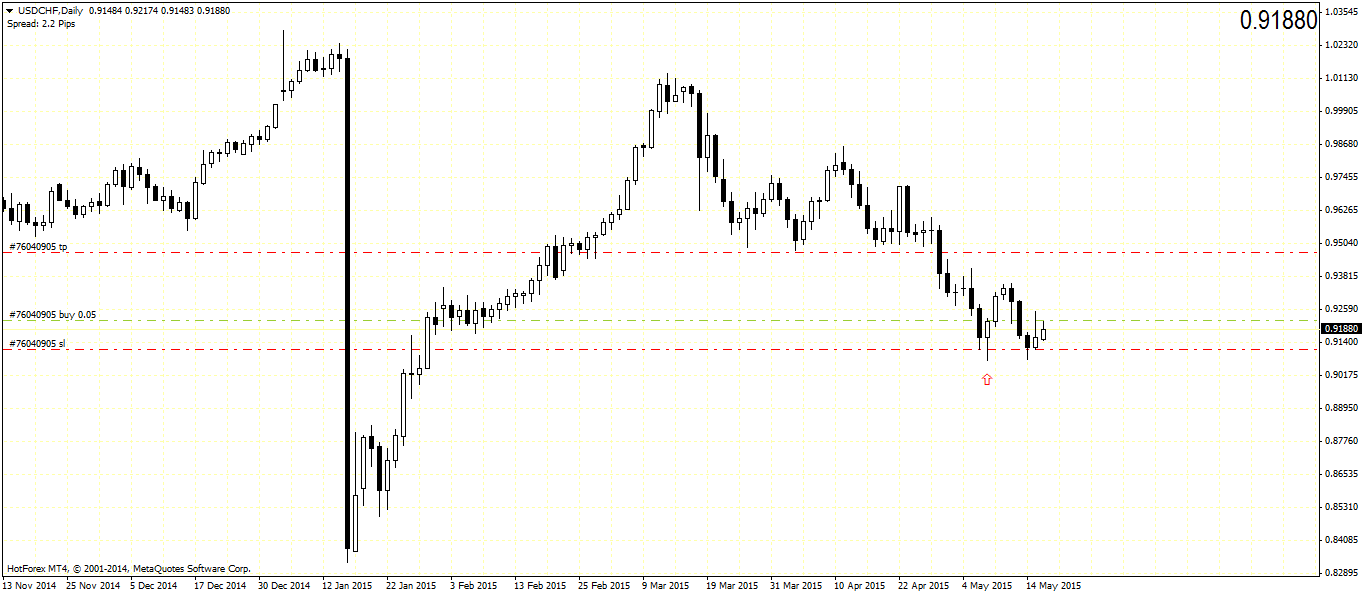

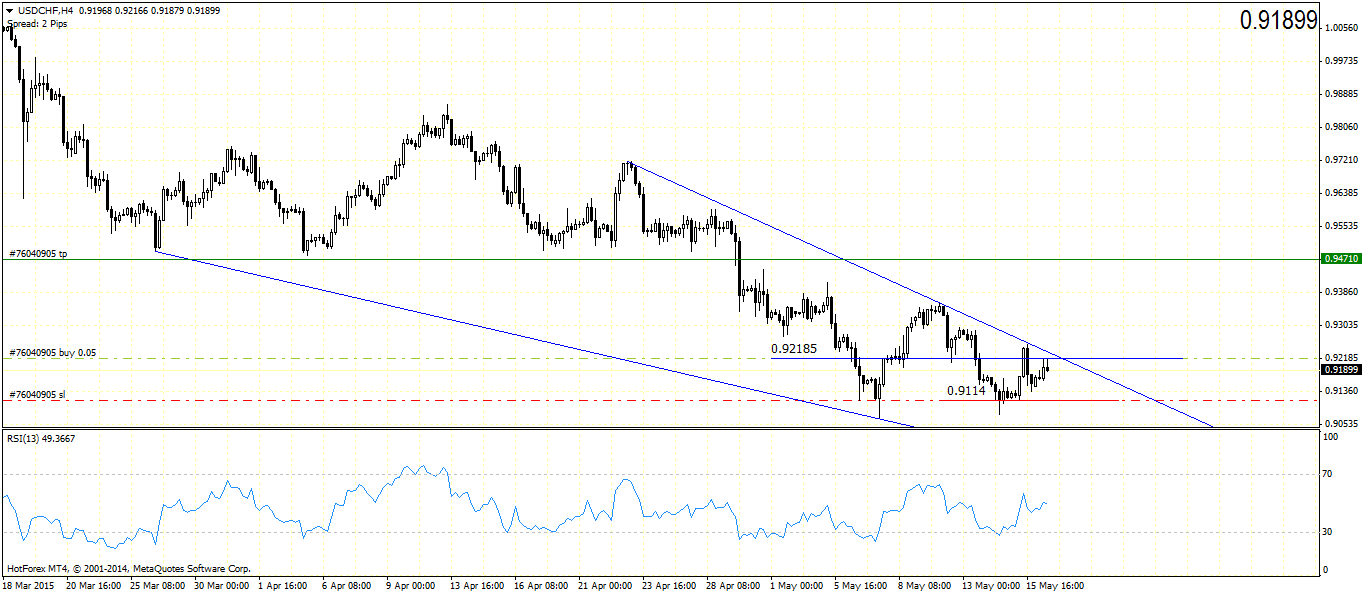

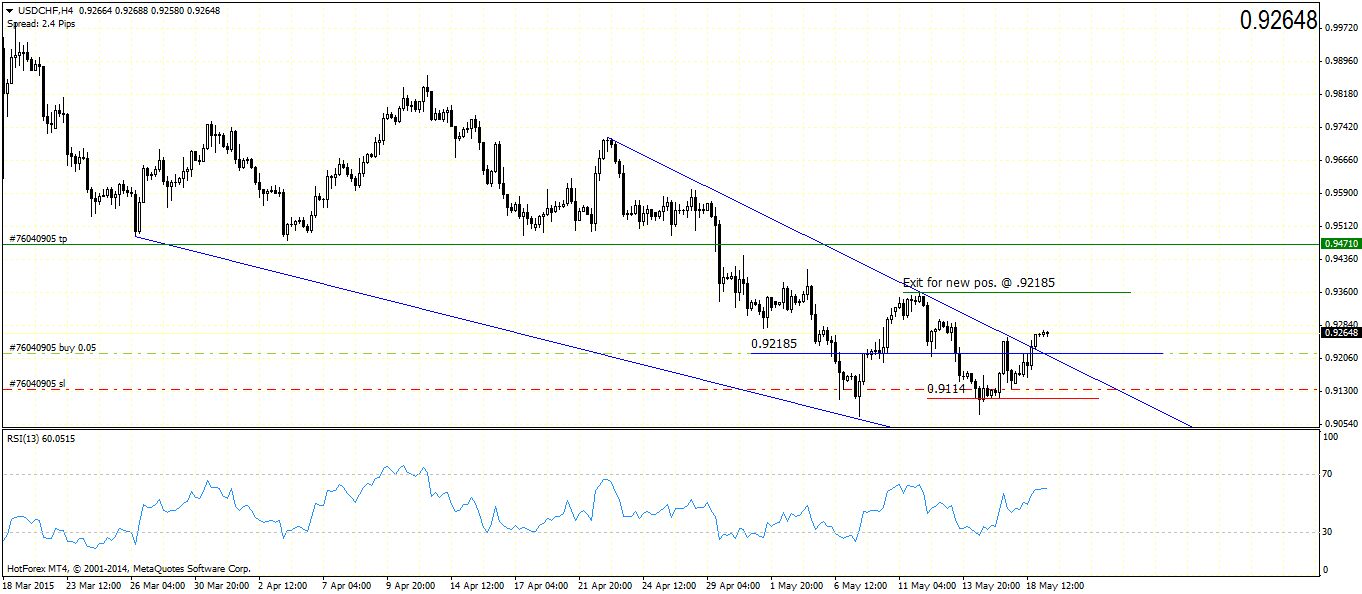

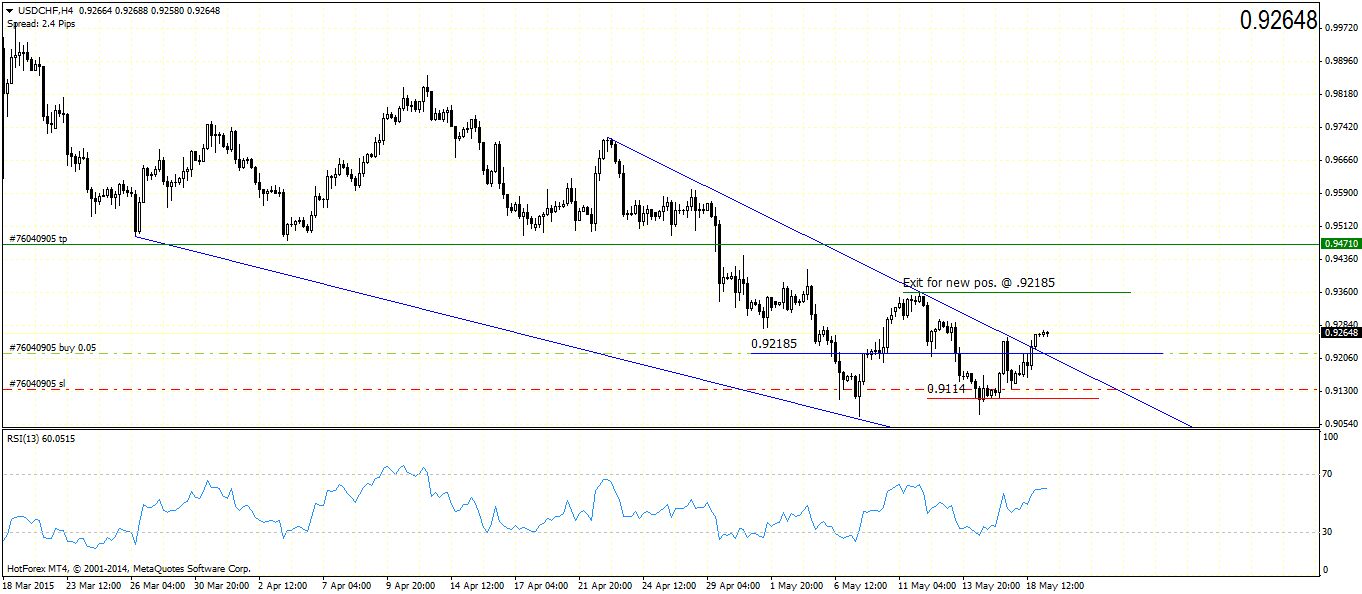

USDCHF, 15/05 - Trade #3

-------------------------------------------------

On the daily charts, price action formed a bullish piercing candlestick pattern few days ago. Price rallied following this candlestick and then fell but the low of the piercing line wasn't breached.

On the H4 TF there is a near double bottom formed and this is validated by a small bullish divergence on the RSI. There is also a falling wedge pattern being formed on the chart.

I think I got in a bit early at 0.92185, but will see how this goes. Expecting a break above 0.92185, which will see a test to 0.9471, a conservative target to the double bottom and the falling wedge.

-------------------------------------------------

On the daily charts, price action formed a bullish piercing candlestick pattern few days ago. Price rallied following this candlestick and then fell but the low of the piercing line wasn't breached.

On the H4 TF there is a near double bottom formed and this is validated by a small bullish divergence on the RSI. There is also a falling wedge pattern being formed on the chart.

I think I got in a bit early at 0.92185, but will see how this goes. Expecting a break above 0.92185, which will see a test to 0.9471, a conservative target to the double bottom and the falling wedge.

Участник с Jan 09, 2013

40 комментариев

May 19, 2015 at 06:06

Участник с Jan 09, 2013

40 комментариев

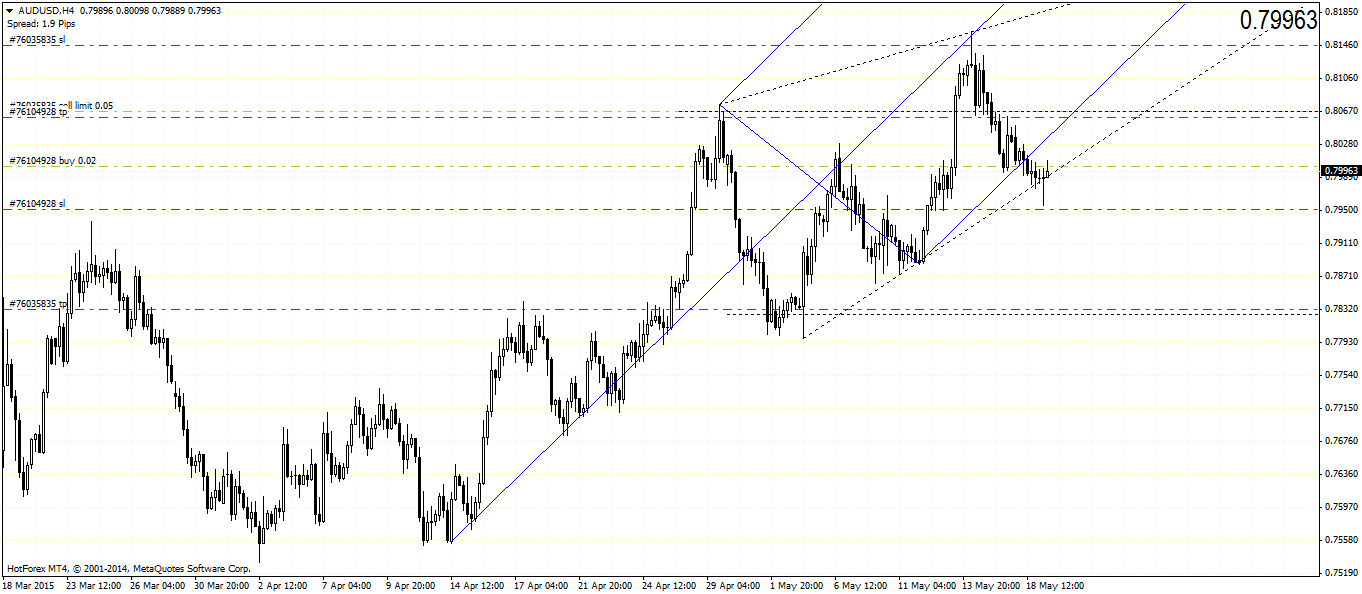

AUDUSD, 19/05 - Trade #4

-------------------------------------------------

I've been watching AUDUSD on the potential triangle consolidation pattern forming on H4. Price broke the Lower median line and also touched the lower trend line of the rising triangle/wedge pattern.

Lack of retest to 0.806 and the strong doji rejection near the trend line of the triangle led me to take a counter trend set up with a smaller position of 0.02. RR is close to 1:1, so there's nothing great about this set up and i'm not expecting too much from this trade either.

I do have a pending sell order near 0.8067 price zone.

-------------------------------------------------

I've been watching AUDUSD on the potential triangle consolidation pattern forming on H4. Price broke the Lower median line and also touched the lower trend line of the rising triangle/wedge pattern.

Lack of retest to 0.806 and the strong doji rejection near the trend line of the triangle led me to take a counter trend set up with a smaller position of 0.02. RR is close to 1:1, so there's nothing great about this set up and i'm not expecting too much from this trade either.

I do have a pending sell order near 0.8067 price zone.

Участник с Jan 09, 2013

40 комментариев

May 19, 2015 at 06:16

Участник с Jan 09, 2013

40 комментариев

Trade Summary:

Trade#1 GBPUSD

Both the trades triggered as expected

Stops moved a bit more close to the entries with a close to 0-loss on the cards

On H1, noticed a falling wedge, but not too sure if this will work. Regardless, expecting a retest to 1.5697 (on CPI data maybe?)

Any move higher will likely see the trades stopped out.

In this event, will look to enter again near 1.57 - 1.569

Trade#2 EURNZD

The early entry did work as price dropped out of the rising wedge and closed below 1.5266. Will move stops to BE towards EOD

Tempted to add to positions if there is a bounce on the larger wedge (red), although I expect a straight run through for this set up to work, else the position might be at risk. Will most likely leave this trade alone with the current set up and focus on moving Stops to BE by EOD.

Trade#3 USDCHF

While the trade triggered prematurely, price managed to break out of the falling wedge

Now I expect a retest to 0.92185 and tempted to add more positions here, targeting .936 for new trades

Will see how PA shapes up into US session.

Trade#1 GBPUSD

Both the trades triggered as expected

Stops moved a bit more close to the entries with a close to 0-loss on the cards

On H1, noticed a falling wedge, but not too sure if this will work. Regardless, expecting a retest to 1.5697 (on CPI data maybe?)

Any move higher will likely see the trades stopped out.

In this event, will look to enter again near 1.57 - 1.569

Trade#2 EURNZD

The early entry did work as price dropped out of the rising wedge and closed below 1.5266. Will move stops to BE towards EOD

Tempted to add to positions if there is a bounce on the larger wedge (red), although I expect a straight run through for this set up to work, else the position might be at risk. Will most likely leave this trade alone with the current set up and focus on moving Stops to BE by EOD.

Trade#3 USDCHF

While the trade triggered prematurely, price managed to break out of the falling wedge

Now I expect a retest to 0.92185 and tempted to add more positions here, targeting .936 for new trades

Will see how PA shapes up into US session.

Участник с Jan 09, 2013

40 комментариев

May 19, 2015 at 06:59

Участник с Jan 09, 2013

40 комментариев

Update:

Closed out GBPUSD second entry for $13.8 profit

Closed out USDCHF for $16.97 profit

EURNZD moved stops to BE, locking in $10 in profit

Added new positions on GBPUSD at previous trade entry

Placed new entry on USDCHF as this is the trade I was looking for.

So far P/L is $30.46, which should limit any potential losses on GU

Closed out GBPUSD second entry for $13.8 profit

Closed out USDCHF for $16.97 profit

EURNZD moved stops to BE, locking in $10 in profit

Added new positions on GBPUSD at previous trade entry

Placed new entry on USDCHF as this is the trade I was looking for.

So far P/L is $30.46, which should limit any potential losses on GU

Участник с Jan 09, 2013

40 комментариев

May 19, 2015 at 10:17

Участник с Jan 09, 2013

40 комментариев

Trade#1 - Profitable (GBPUSD)

I moved the Take profit to 1.55275 due to spreads. And have now gotten a new pending buy order near 1.5489, with two orders, one targeting 1.57 and 1.60 respectively.

Mistakes: Previous short was exited prematurely on expectations that there would be a rally to 1.57, which didn't happen.

I moved the Take profit to 1.55275 due to spreads. And have now gotten a new pending buy order near 1.5489, with two orders, one targeting 1.57 and 1.60 respectively.

Mistakes: Previous short was exited prematurely on expectations that there would be a rally to 1.57, which didn't happen.

Участник с Jan 09, 2013

40 комментариев

May 19, 2015 at 13:18

Участник с Jan 09, 2013

40 комментариев

Trade# 2 - Profitable on early close (USDCHF)

Missed quite a few pips on the table as I expected price to retest the break out. Failure to do so has led me to close out on the pending long positions.

Trade# 3.1 - AUDUSD, loss on SL

Price hit SL, but this was more of a feeler trade with 0.02 lots in position.

Running trades:

Trade#3 - EURNZD, moved SL to lock $33 in profits. Added pending shorts.

Missed quite a few pips on the table as I expected price to retest the break out. Failure to do so has led me to close out on the pending long positions.

Trade# 3.1 - AUDUSD, loss on SL

Price hit SL, but this was more of a feeler trade with 0.02 lots in position.

Running trades:

Trade#3 - EURNZD, moved SL to lock $33 in profits. Added pending shorts.

Участник с Jan 09, 2013

40 комментариев

May 19, 2015 at 13:20

Участник с Jan 09, 2013

40 комментариев

Trade# 4 - GBPUSD Long

Trade triggered with 2 positions at 1.5455 and a pending stop order at 1.55275. Targeting 1.57, 1.6 and 1.625 for the long term.

Trade triggered with 2 positions at 1.5455 and a pending stop order at 1.55275. Targeting 1.57, 1.6 and 1.625 for the long term.

Участник с Jan 09, 2013

40 комментариев

May 20, 2015 at 06:03

Участник с Jan 09, 2013

40 комментариев

Trade# 3 EURNZD

----------------------------------

Added new position at market

Reason: I was watching the level at 1.5246 - 1.52215 on the H4 chart. Price formed a doji close to this level and followed through with two (currently third) bearish candlestick.

So added to the position with stops at around -$38 in risk while moving previous short entry to the same stop level for a +$50 profit locked in. In the event price invalidates my bias, I will still exit with a profit.

Target for the new EURNZD short is at 1.5038.

----------------------------------

Added new position at market

Reason: I was watching the level at 1.5246 - 1.52215 on the H4 chart. Price formed a doji close to this level and followed through with two (currently third) bearish candlestick.

So added to the position with stops at around -$38 in risk while moving previous short entry to the same stop level for a +$50 profit locked in. In the event price invalidates my bias, I will still exit with a profit.

Target for the new EURNZD short is at 1.5038.

Участник с Jan 09, 2013

40 комментариев

May 20, 2015 at 06:08

Участник с Jan 09, 2013

40 комментариев

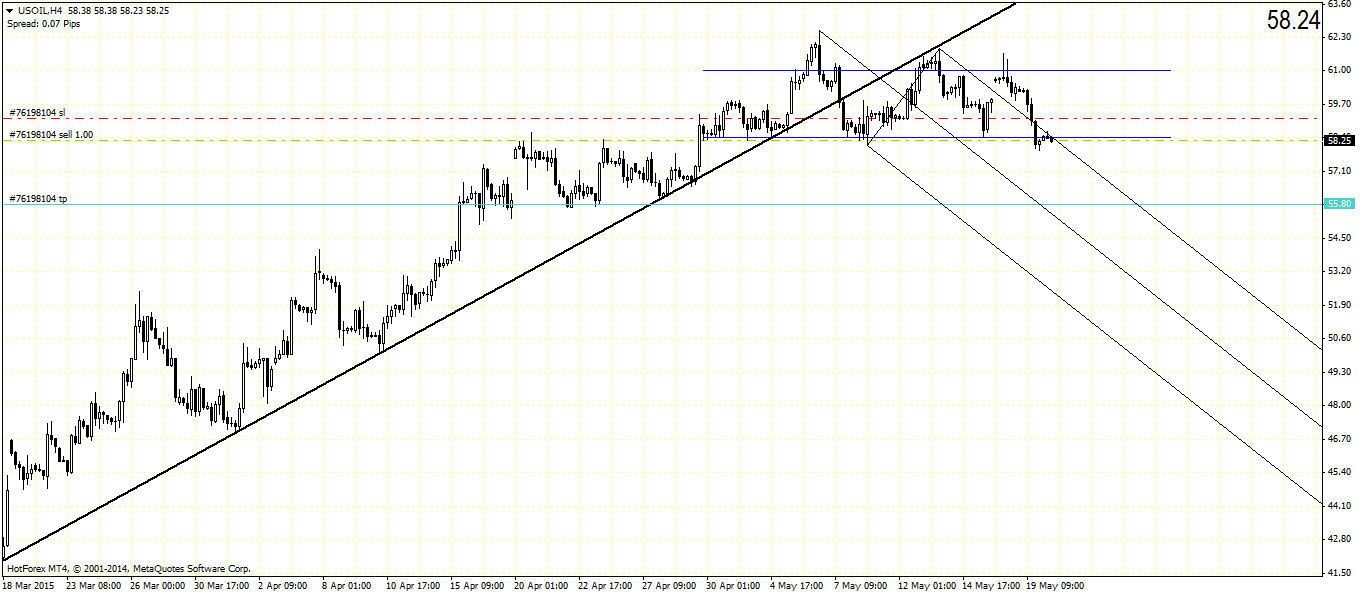

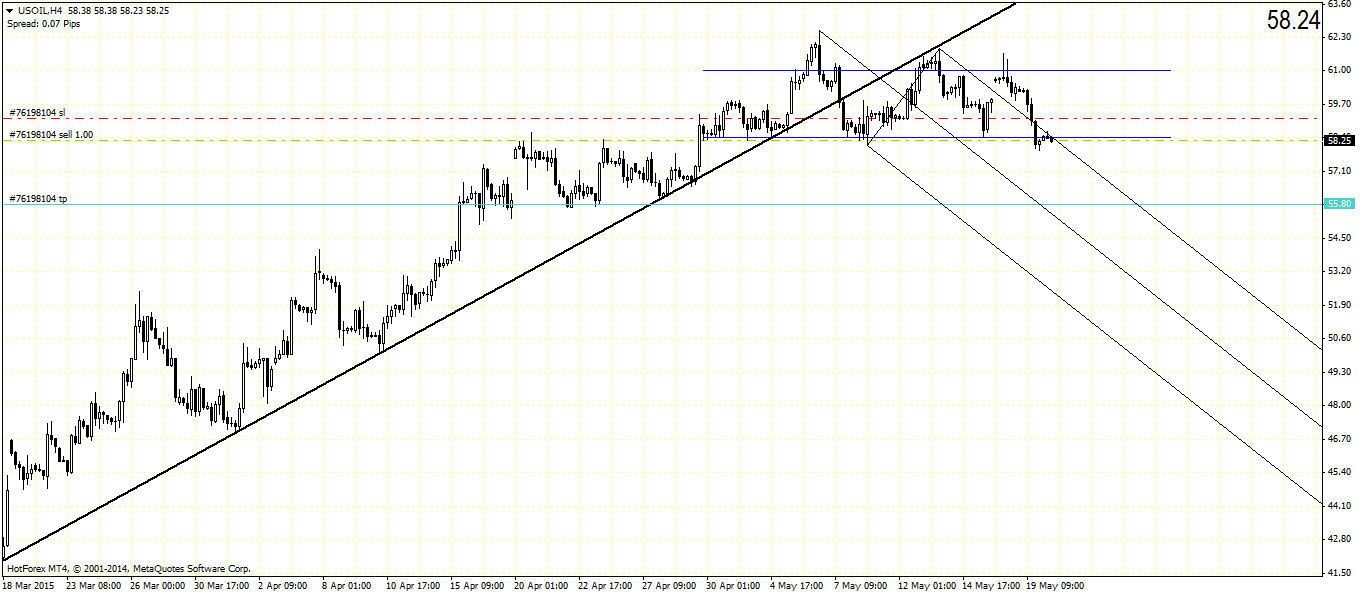

Trade #5 - WTI Crude Oil - 20/05

---------------------------------------------------

Took a short at market after price formed a DCC type of candlestick on H4 near the lower range at 58.40

Support comes in at 55.8, which is where the target is. For the stops, I used the nearest previous resistance/support level at 59.15

The bias for the trade comes as the longer term trend line was broken and prices failed to make new highs and instead ranged sideways. Adding the pitchfork, I see price attempted to rally to previous resistance which held and promptly declined lower. Lot of room between the UML where price is now and the ML where the target of 55.8 comes in.

---------------------------------------------------

Took a short at market after price formed a DCC type of candlestick on H4 near the lower range at 58.40

Support comes in at 55.8, which is where the target is. For the stops, I used the nearest previous resistance/support level at 59.15

The bias for the trade comes as the longer term trend line was broken and prices failed to make new highs and instead ranged sideways. Adding the pitchfork, I see price attempted to rally to previous resistance which held and promptly declined lower. Lot of room between the UML where price is now and the ML where the target of 55.8 comes in.

Участник с Jan 09, 2013

40 комментариев

May 20, 2015 at 08:37

Участник с Jan 09, 2013

40 комментариев

quicksilver posted:Exited Trade 4 as unsure on the market reaction to FOMC & BoE.

Trade# 4 - GBPUSD Long

Trade triggered with 2 positions at 1.5455 and a pending stop order at 1.55275. Targeting 1.57, 1.6 and 1.625 for the long term.

Partly successful trade.

Участник с Jan 09, 2013

40 комментариев

May 26, 2015 at 08:08

Участник с Jan 09, 2013

40 комментариев

Trade #5 - EURUSD Short (TP reached)

EURUSD just hit take profit. I'm now looking to go long

Trade #6 - USDJPY Long (TP reached)

USDJPY hit take profit and will stay on the sidelines for possible short opportunities.

Running trades:

Crude Oil trades are still running

Entered AUDUSD short and USDCAD longs on a scalp basis and looking to exit if either of these trades look to be threatened.

EURUSD just hit take profit. I'm now looking to go long

Trade #6 - USDJPY Long (TP reached)

USDJPY hit take profit and will stay on the sidelines for possible short opportunities.

Running trades:

Crude Oil trades are still running

Entered AUDUSD short and USDCAD longs on a scalp basis and looking to exit if either of these trades look to be threatened.

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.