US dollar weakens as markets await restart of US data releases

US government shutdown ends, focus shifts to data releases

The longest federal government shutdown in United States history is over. President Trump signed the bill funding the federal government until January 30, 2026, giving both Republicans and Democrats more than two months to find a permanent solution and avoid another shutdown. The crucial votes on extending health insurance programmes will be held in December, with investors gauging the appetite on both sides to find a compromise.

The focus now shifts to the Bureau of Labor Statistics (BLS) and other federal agencies responsible for publishing economic data. An amended calendar is eagerly awaited by the market, particularly the release dates of the nonfarm payrolls reports. The BLS has two options: (1) compile a brand new calendar, potentially with two NFP and two CPI reports in the same months, or (2) try to meet the current calendar with some necessary changes, publishing two reports together, i.e. on December 5 we could get both the October and November nonfarm payrolls figures.

Notably, White House Press Secretary Leavitt stated yesterday that the October CPI and jobs data may never be released, a rather odd statement considering that these are quantitative measures and data exists. Additionally, a soft set of data would play right into the hands of Trump, supporting calls for a stronger Fed rate cut in December, in line with Fed Miran’s remarks.

Data during shutdown will most likely be soft

That said, putting aside the immediate market reaction upon the release of these delayed data, it is obvious that these figures will not be representative of the real economic situation. Particularly, labour statistics will be plagued by the federal government layoffs, distorting the picture. In a nutshell, we probably have to wait for January to get cleaner data and the fog to dissipate.

The US government, though, is acknowledging the economic damage done in the past 43 days. Leavitt commented that the shutdown could lower Q4 growth by up to 2%, while National Economic Council Director Hassett talked about a 1.5% hit. Trump hopes that Fed members are listening to these statements and preparing for another rate cut in December.

However, it is evident that most FOMC officials are not happy with the current setup. Boston Fed President Collins was the last one to call for a pause in December, highlighting inflation risks. Regional Fed Presidents Daly, Kashkari, Musalem and Hammack will be on the wires today, with a strong probability of fresh hawkish remarks being delivered.

Dollar weakens, yen fails to benefit; equities and gold rally

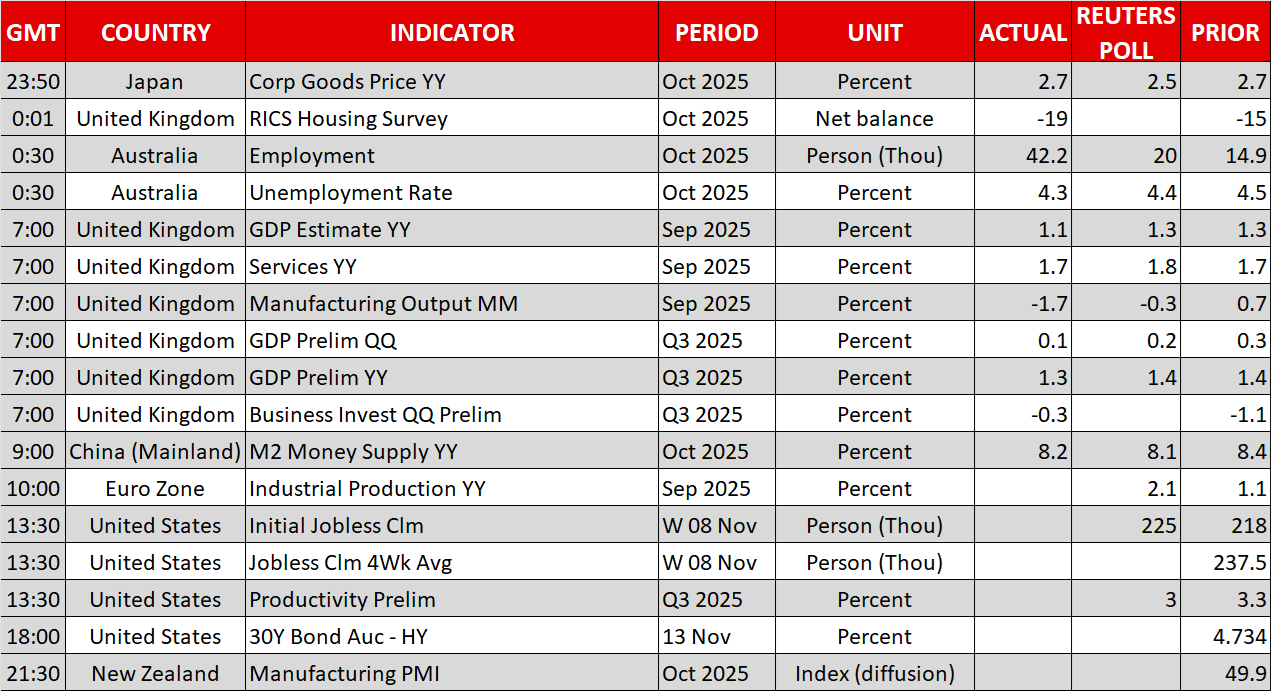

Following a period of solid gains against the euro, the greenback is on the back foot once again. Euro/dollar has climbed above the 1.1600 level, recovering from the early-November trough of 1.1469. This dollar underperformance is also evident versus the Australian dollar, with the latter being boosted by today’s stronger labour market data wiping out the chances of an RBA rate cut in the foreseeable future.

More importantly, both the pound and yen are trying to benefit from the dollar’s troubles. The pound/dollar pair is in the green today, but momentum remains extremely negative as the UK’s Q3 GDP report showed a below-expectations 0.1% QoQ growth. Should next week’s CPI report show another inflation deceleration, the December BoE rate cut would become the central scenario, particularly if the late-November budget is tax-heavy and the current Labour government crisis worsens.

Interestingly, the prevailing dollar/yen rally appears to have paused today, just above the 154.50 area. Verbal interventions continue, but comments like Finance Minister Katayama’s remark that it is “hard to foresee Japan defaulting on its debt” are not helping the yen. Markets are testing the new administration, as Prime Minister Takaichi continues to talk about additional spending without tax hikes.

Finally, after a brief period, the one-month S&P 500 - gold correlation has turned positive, as both asset classes are benefiting from the end of the US shutdown, uncertainty about the US economic growth outlook, and the possibility of further Fed rate cuts. US equities are led by the Dow Jones index, which posted a new all-time high. This probably means that the market’s concerns about AI are not yet over, with the next key test being the upcoming Nvidia earnings release. Similarly, gold has jumped above the $4,200 area, quickly surpassing resistance in the $4,150 area.

.jpg)