Edit Your Comment

Opinions on ESMA & Financial Markets

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 20:05

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

….and no I'm not taking my meds

Well this explains why you aren't thinking clearly.

Seek immediate medical attention if needed.

Please get your medication straightened out.

NottsBlade posted:

and yes I am trying to get psychiatric help. I hope this answers your questions!!!

That's good. Perhaps professional therapy can help you with your emotions.

They are clearly in control of you, rather than you being in control of them.

It's a difficult skill that few people can truly master.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 20:39

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call 'Elliott waves', or simply 'waves'. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that 'because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 21:12

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Wrong.

Elliott Wave isn't manipulating the financial markets. You clearly DO NOT understand how investment markets work in general or how currency valuations are actually determined.

What YOU are doing when you analyze a chart, is looking to recognize the Elliott Wave pattern.

Pattern recognition is nothing more than the visualization of past events from the 'real world' being reflected in the markets, and given the statistical probability of repeated patterns of outcomes from those past events (markets are cyclical), then you can establish a setup of high probability for that specific instance.

However this is still nothing more than just a technical indicator showing a possible pattern, you are not considering the actual HOW AND WHY the events took place, or what the greater level of impact those events will have on the markets.

Successful trading is SO MUCH more than just throwing a technical indicator on a screen.

To be successful you have to understand how the markets really work, and you MUST absolutely leave your emotions out of trading.

Kill your losing trades, let your winning trades run, collect them in profit when you hit your target. Don't get greedy.

If you did your job correctly, then hitting your target and collecting the profits is exactly what you should be doing.

Do you feel pleasure when you close a winning trade?

Do you feel loss when you close a losing trade?

Do you hold losing trades because you hope they will come back up? Why hold them? That's stupid. Close them, then open them back up when the markets come back to this price.

Do you feel a slight rush of excitement when you place a trade?

Do you feel proud and joyful when you see a trade become profitable?

If you said yes to any of those, then you do NOT have your emotions under control.

If you did your proper homework and proper advanced research, then you should know already if your trade is going to be profitable.

But of course, even if you did your homework and all your research properly, that is still no guarantee that you will be profitable.

If the trade goes bad, then it goes bad, kill it, analyze the markets again, and make the next trade when appropriate.

If you can't do that without emotions, then you have no business trading. Emotions cause traders to do STUPID things, and STUPID things cause BLOWN ACCOUNTS.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 21:14

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

NottsBlade posted:NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call 'Elliott waves', or simply 'waves'. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that 'because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 21:15

(แก้ไขแล้ว Jul 08, 2018 at 21:26)

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Multiple quote postings of your own messages? That's pointless.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 21:17

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

NottsBlade posted:NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call 'Elliott waves', or simply 'waves'. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that 'because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

Elliott Wave is emotion Elliott Wave is about peoples emotions and they're trying to replace that with Automated Systems - Artificial Intelligence. How can Elliott Wave be a true reflection of human behaviour when the majority of trades are HFT!!!

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 21:25

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), eing programmed to tell us what to do!!!

Repeated quote posting of yourself is pointless.

You are clearly showing that you are incorrect, and you do not understand at all how the markets really work, even in using this website you are proving that your emotions are in control of you, where it should be you being in control of your emotions.

My advice is simple, Seek assistance from either a Psychologist or Psychiatrist who specializes in dealing with Professional level traders who need to control their emotions to be effective when trading.

Without control of your emotions, and without truly understanding how the markets work, you will never become a successful trader over the long term of your trading career.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 21:27

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Wave Personality

The idea of wave personality is a substantial expansion of the Wave Principle. It has the advantage of bringing human behaviour more personally into the equation. The personality of each wave in the Elliott sequence is an integral part of the reflection of the MASS PSYCHOLOGY it embodies. The progression of mass emotions from pessimism to optimism.

Furthermore Winston Churchill suffered with mental health problems and 'NO' he didn't take his meds!!!

The idea of wave personality is a substantial expansion of the Wave Principle. It has the advantage of bringing human behaviour more personally into the equation. The personality of each wave in the Elliott sequence is an integral part of the reflection of the MASS PSYCHOLOGY it embodies. The progression of mass emotions from pessimism to optimism.

Furthermore Winston Churchill suffered with mental health problems and 'NO' he didn't take his meds!!!

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 21:31

(แก้ไขแล้ว Jul 08, 2018 at 21:32)

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

Wave Personality

The idea of wave personality is a substantial expansion of the Wave Principle. It has the advantage of bringing human behaviour more personally into the equation. The personality of each wave in the Elliott sequence is an integral part of the reflection of the MASS PSYCHOLOGY it embodies. The progression of mass emotions from pessimism to optimism.

Furthermore Winston Churchill suffered with mental health problems and 'NO' he didn't take his meds!!!

Another example of an EMOTIONAL response rather than a RATIONAL response.

You do not understand how the markets work.

Please get your emotions under control.

In order to be successful, you have to be disciplined in all aspects of ones self.

This goes for trading and all other aspects of ones life as well.

Without self control and discipline, how can you ever expect to become successful?

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 21:35

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

Furthermore Winston Churchill suffered with mental health problems and 'NO' he didn't take his meds!!!

1: You aren't Winston Churchill.

2: Mental health issues are a serious problem.

3: If you have mental health issues which are currently not under control, please seek Professional help immediately.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 21:41

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Professional4X Don't tell me I should control my emotions. Why don't you try telling the millions of England Fans who watched England get through to the Semi - finals of the World Cup to control their emotions. Try telling the players when they score a goal to control their emotions, try telling the players when a penalty is awarded against them. Try telling any person who is passionate about what they do to control their emotions. Try telling the Members of Parliament at Prime Ministers Question Time to control their emotions!!!

People are blessed with emotions for a reason, we are not poxy robots!!!

People are blessed with emotions for a reason, we are not poxy robots!!!

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 21:50

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

NottsBlade posted:

Financial Markets - Elliott Wave Theory

The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call 'Elliott waves', or simply 'waves'. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature's Laws: The Secret of the Universe in 1946. Elliott stated that 'because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable.

Since when did humans become psychologists in the behaviour of Artificial Intelligence? I thought they were being programmed to tell us what to do!!!

The Elliott Wave Principle posits that collective investor psychology, or crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of trend or time scale. Algorithms do not have emotions, neither does Artificial Intelligence!!!

If algorithms are trading the financial markets how can the markets be showing collective investor psychology with all its emotions.

I'm not having a go at Elliott Wave, I'm not having a go at Robert Prechter but if the financial markets are a representation of mans productivity where does Artificial Intelligence come into it.

Furthermore how can we trust volume? If HFT are making millions of transactions a day how can that be classed as investor (people) transactions.

As for market manipulation: 'Manipulation is possible in the day to day movement of the averages, and the secondary reactions are subject to such an influence to a more limited degree, but the primary trend can never be manipulated'. The Dow Theory, by Robert Rhea (Rhea, p.12) and (2)

Refutation of the first idea in pages 379 -384 of Pioneering Studies in Socionomics (2003) and a challenge to the idea of any consequential manipulation of the averages in pages 365 - 370 of the The Wave Principle of Human Social Behaviour (1999)

My personal opinion is that Elliott Wave is used to some degree to manipulate the financial markets. This is my personal opinion, but if you're counting waves and you label them a, b, c and the market spikes making 4 & 5. I'm not saying Elliott Wave does not exist because I believe under perfect conditions is probably does.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 21:53

(แก้ไขแล้ว Jul 08, 2018 at 21:53)

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

Professional4X Don't tell me I should control my emotions.

I'm tell you that your are in control of you when it comes to trading.

If you wish to become successful in trading, then it needs to be the other way around.

Emotions have no place when it comes to placing a trade.

NottsBlade posted:

Why don't you try telling the millions of England Fans who watched England get through to the Semi - finals of the World Cup to control their emotions.

The millions of fans for the World Cup is a good example of emotions out of control.

That lack of control on a mass scale, is a psychological data point which also needs to be taking into consideration for effective analysis of the markets.

The fact that you do not understand that is yet another example which clearly shows you do not understand how markets actually work.

NottsBlade posted:

Try telling the players when they score a goal to control their emotions, try telling the players when a penalty is awarded against them. Try telling any person who is passionate about what they do to control their emotions. Try telling the Members of Parliament at Prime Ministers Question Time to control their emotions!!!

When emotions control people, they make decisions often contrary to what is the best decision to actually make.

NottsBlade posted:

People are blessed with emotions for a reason, we are not poxy robots!!!

No one said 'we' were poxy robots.

I am saying that 'YOU' lack self control and discipline, and furthermore your emotions are in control of you.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 22:19

(แก้ไขแล้ว Jul 08, 2018 at 22:21)

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

Professional4X Stop getting all emotional and focus on your own trading!!!

My emotions are under control.

This is a public discussion forum, and as such I am participating in the discussion in a rational and calm manner.

The ideas and opinions that I have expressed to you and expressed in general, is such that I believe you and others would benefit from Professional assistance.

Professional assistance can help bad traders become good traders, and it can help good traders become great traders.

The difference between a successful trader and an unsuccessful trader comes down to a few very basic but equally vital things.

Successful traders have discipline and control of their emotions.

Successful traders do their homework and understand how the markets really work.

Successful traders understand that even after doing all their research, there is still no guarantee that their trades will be profitable.

Successful traders kill their bad trades as soon as they confirm they are bad.

Successful traders close their good trades when they hit their profit targets. That's why it's call a profit target. When you get to that specific profit, then you've reached your target so you should close the tickets and collect the profits from the trades.

Successful traders know that even very small accounts can become very large profitable accounts in a reasonable amount of time.

Unsuccessful traders lack discipline and do not understand how the financial markets work.

Unsuccessful traders will often ignore beneficial and practical advice from Successful traders.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 22:43

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

Professional4X Don't tell me I should control my emotions.

Professional4X posted:

I'm tell you that your are in control of you when it comes to trading.

If you wish to become successful in trading, then it needs to be the other way around.

Emotions have no place when it comes to placing a trade.

To clarify what I was intending to say.

I am telling you that your emotions are in control of you currently when it comes to your trading and discipline in regard to the financial markets and it is my opinion that your investing is unsuccessful to a large extent because of it.

Without firm discipline and control over ones emotions when it comes to trading and investing in general, it will be hard for anyone to become a successful trader over the long term of their investing.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 22:48

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Professional4X I really do appreciate those words of advice so Thank You.....and yes I agree that I need to get control of my emotions and be more disciplined in my trading, but I'm not perfect!!! I've maintained throughout that I'm still learning, I'm learning all the time and I am improving all the time.

I've had massive breakthroughs in my trading and if I appear to be too emotional on here it is because of these new leverage restrictions being imposed by ESMA, which I feel will hinder me from making a living trading the financial markets. All I'm looking for is consistency and consistent profits.

I'm not rich I don't have £500,000 sitting idly by doing nothing and I have very little income and that is why I am trying to trade with such a small amount. NOW, I have seen that £100 quadrupled in minutes to a few hours and I've also turned that £100 into £1000 in just a few days. I admit its rare to have made a 1000, but I've done it on 3 - 4 occasions in recent weeks. I trade with 500:1 leverage which improves the chances of me being able to make a living. Lower this leverage to 30:1 and I have no chance. I might as well take out a savings account because I'll be lucky if I make 10% a year.

So you see I am very much aware of areas that I need to improve on, BUT should these new restrictions be imposed then the likelihood is there will be no point in continuing to trade!!!

I've had massive breakthroughs in my trading and if I appear to be too emotional on here it is because of these new leverage restrictions being imposed by ESMA, which I feel will hinder me from making a living trading the financial markets. All I'm looking for is consistency and consistent profits.

I'm not rich I don't have £500,000 sitting idly by doing nothing and I have very little income and that is why I am trying to trade with such a small amount. NOW, I have seen that £100 quadrupled in minutes to a few hours and I've also turned that £100 into £1000 in just a few days. I admit its rare to have made a 1000, but I've done it on 3 - 4 occasions in recent weeks. I trade with 500:1 leverage which improves the chances of me being able to make a living. Lower this leverage to 30:1 and I have no chance. I might as well take out a savings account because I'll be lucky if I make 10% a year.

So you see I am very much aware of areas that I need to improve on, BUT should these new restrictions be imposed then the likelihood is there will be no point in continuing to trade!!!

forex_trader_524352

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

Jul 08, 2018 at 23:07

เป็นสมาชิกตั้งแต่ May 25, 2018

75 โพสต์

I've traded 3 times in forex and each time I've lost money. First time I was trading when SNB unpegged the Franc and the broker I was trading with Alpari went bust. I wasn't even trading CHF that day and I was actually in profit.

Second time was October 2016 during the Sterling Flash Crash I'd opened an account with £100 and was trading with 2p a pip and I still lost my money.

The third time was the second biggest daily fall in GBPUSD since the flash crash and I was long Sterling.

The last time I invested in shares I invested in Bradford & Bingley just after the 2008 crash and they went bankrupt. When I bought into them they were just penny shares. All the other banks, building societies were thrown a lifeline....

Call it bad luck, call it what you want but that's my experience of investing and trading, but I'm determined not to give up and that's why I'm biding my time, trying to build consistency and hopefully I'll be able to return another day.

Losing money is not the issue, I know the risks but losing my hopes and dreams that is an issue, a MASSIVE issue!!!

…..and I've worked damned hard at my trading and technical analysis 24/7 and I'm still learning!!!

Second time was October 2016 during the Sterling Flash Crash I'd opened an account with £100 and was trading with 2p a pip and I still lost my money.

The third time was the second biggest daily fall in GBPUSD since the flash crash and I was long Sterling.

The last time I invested in shares I invested in Bradford & Bingley just after the 2008 crash and they went bankrupt. When I bought into them they were just penny shares. All the other banks, building societies were thrown a lifeline....

Call it bad luck, call it what you want but that's my experience of investing and trading, but I'm determined not to give up and that's why I'm biding my time, trying to build consistency and hopefully I'll be able to return another day.

Losing money is not the issue, I know the risks but losing my hopes and dreams that is an issue, a MASSIVE issue!!!

…..and I've worked damned hard at my trading and technical analysis 24/7 and I'm still learning!!!

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 23:12

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

I trade with 500:1 leverage which improves the chances of me being able to make a living. Lower this leverage to 30:1 and I have no chance. I might as well take out a savings account because I'll be lucky if I make 10% a year.

High leverage investing is a 'get rich quick' component that some people use to make money in the short term, but it's just as equal to call it a 'lose money quick' investing strategy.

As a United States base investor at a retail level, I would be limited to 1:50 leverage, and at the retail level I am required to abide by the FIFO rule (first in, first out).

And yet I am able to generate a reasonable return on my investment capital because I don't take massive risks and I leave my emotions out of trading.

And while YES I would agree that changing maximum leverage available from 1:500 down to 1:30 might seem extreme at first, however you need to take into consideration who that leverage change is really impacting.

It impacts HIGH LEVERAGE traders.

If you avoid trying to double your account every trade with high leverage trading, and you use smart money management, then you should be able to make a reasonable income from investing.

There is a huge difference with someone trading 1.0 lots on a $100.00 account, and someone trading 1.0 lots on a $100,000.00 account.

With 1.0 lots against a $100.00 account using high leverage, and the trade suddenly goes really bad, your account is going to be at risk for margin call, stop out, loss of funds, and this will happen very quickly. When that happens the investment capital will be gone. Boom. MONEY GONE.

With 1.0 lots against a $100,000.00 account, you would be able to absorb the loss without much risk to the account.

Big deal. No fancy dinner on Friday. BOOM. Pocket change gone.

Losing $100.00 in trading on a $100.00 account is a total loss of investment capital.

Losing $100.00 in trading on a $100,000.00 account is nothing other than just a bad trade that was closed out at a loss of $100.00

Do you see what I am saying here?

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

Jul 08, 2018 at 23:52

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1189 โพสต์

NottsBlade posted:

I'd opened an account with £100 and was trading with 2p a pip and I still lost my money.

You lost it because you are not using low risk trading, but instead you are trading with high leverage with the hope of getting rich quick.

You cannot do that, if you wish to make money over a sustained period of time.

If you had of invested that $100.00 and used a low risk trading strategy, and properly evaluated the markets, you could have made a substantial income from it.

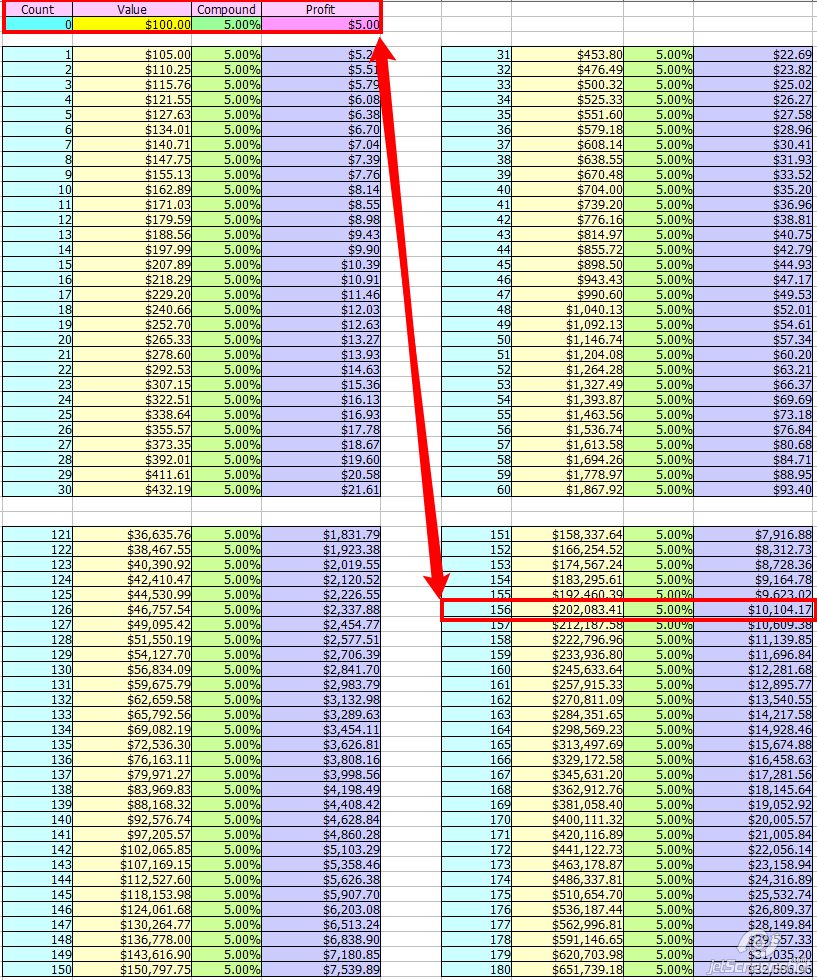

$100.00 invested with 5% ROI per week compounded over the period of 3 years.

Trading successfully does not require massive initial capital risks.

It does however required discipline and absolute emotional control, as well as an intimate understanding of how the markets really work.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

*การใช้งานเชิงพาณิชย์และสแปมจะไม่ได้รับการยอมรับ และอาจส่งผลให้บัญชีถูกยกเลิก

เคล็ดลับ: การโพสต์รูปภาพ/youtube url จะฝังลงในโพสต์ของคุณโดยอัตโนมัติ!

เคล็ดลับ: พิมพ์เครื่องหมาย @ เพื่อป้อนชื่อผู้ใช้ที่เข้าร่วมการสนทนานี้โดยอัตโนมัติ