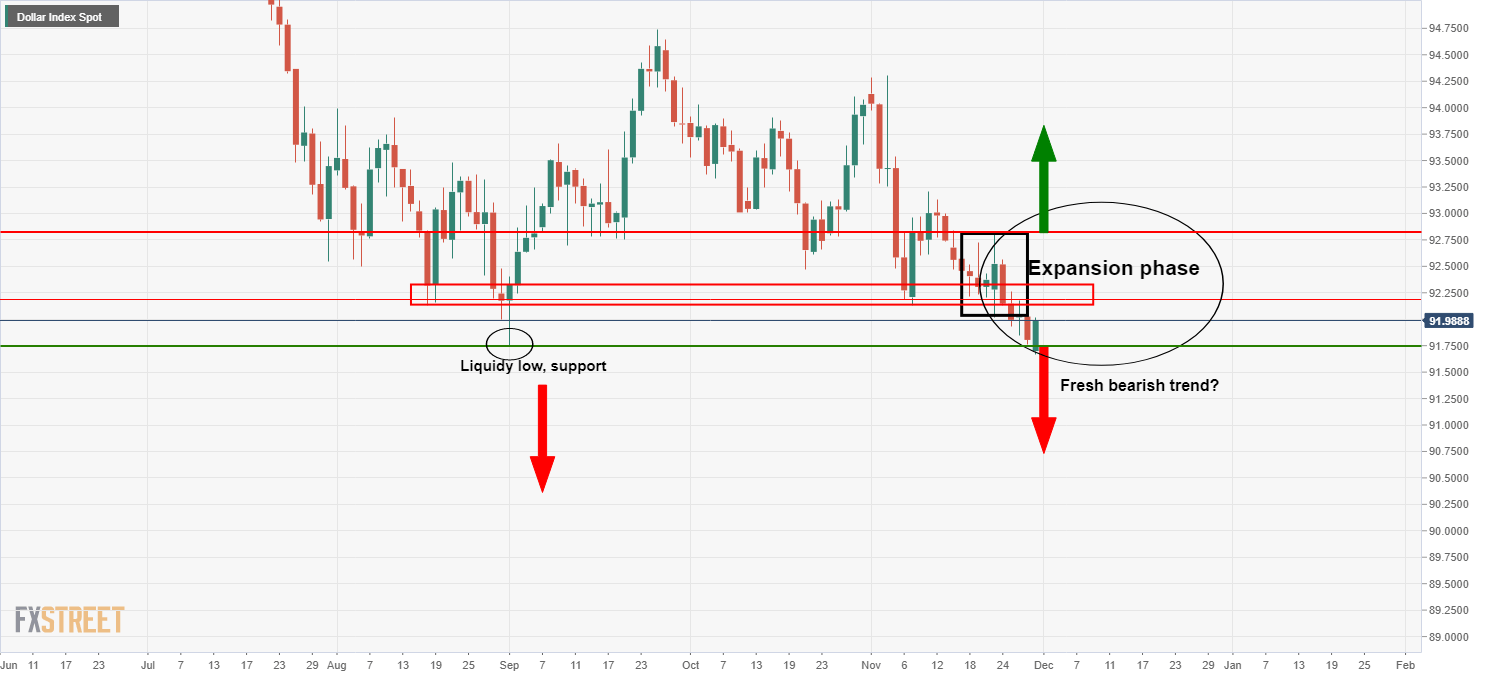

- Bulls not catching a break here as the US dollar crumbles.

- TRY and emerging FX to benefit from a weaker dollar environment.

- Technically, the conditions are, however, somewhat closer to a favourable bullish setup.

In a follow-up to the prior session's analysis, USD/TRY, remains on track for the following setup.

This is despite the weakness in the DXY, a basket of currencies weighted heavily to the euro and a number of other G7-FX currencies.

The price is moving dangerously against the bullish outlook for USD/TRY, for is the US does indeed tend lower, then the emerging market forex will eventually benefit, especially high yielders such as TRY.

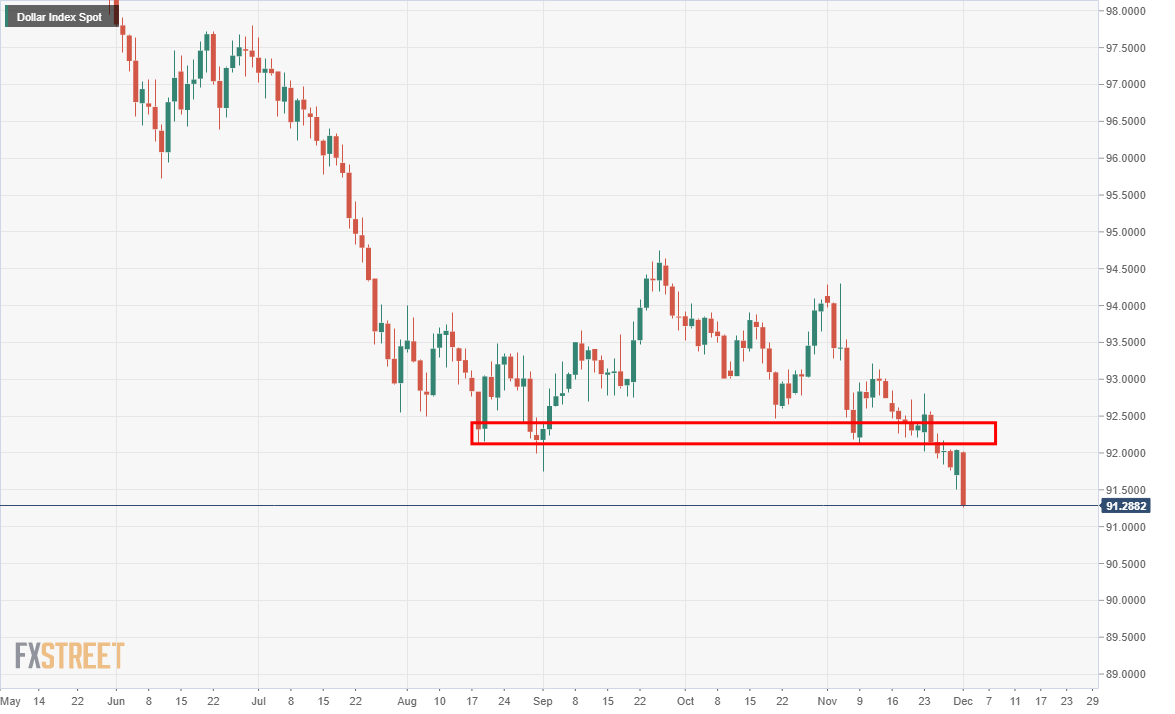

The following is the prior day's analysis of DXY t illustrate where this trade set up could all fall down:

Meanwhile, for a recap of the set-up, here were yesterday's analysis:

Weekly chart

At the start of the week, the price was opening bullish and seeking to fill in the wick which gave rise to a potential trading opportunity on the daily chart, as follows:

The upside potential and setup is being monitored on the 4-hour chart, as illustrated in yesterday's analysis as follows:

There was still some work left to do from the bulls for price needs to get above the 21-moving average and MADC needs to be above the zero-line to confirm a bullish price action environment.

We are inching closer to the setup criteria on Tuesday as follows:

We want to see a clean break to the upside and above the 21-moving average and MACD more positive than this.

Let's see if the price can form some bullish structure in a more favourable environment for where a buy limit order and entry protected by structure and a stop loss can be placed in coming sessions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0800 after US data

EUR/USD clings to daily recovery gains above 1.0800 in the American session. The downward revision to US Q1 GDP growth and bigger-than-expected Jobless Claims data weigh on the US Dollar and help the pair stretch higher.

GBP/USD hovers above 1.2700 after weak US data

GBP/USD stays in positive territory above 1.2700 in the second half of the day on Thursday. The US dollar struggles to preserve its strength and allows the pair to hold its ground after the Bureau of Economic Analysis announced a downward revision to Q1 GDP growth.

Gold recovers above $2,340 as US yields turn south

Gold gained traction and recovered above $2,340 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is down nearly 1% on the day following the downward revision to US GDP data, supporting XAU/USD's rebound.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Facing correction after ETFs led rally

Bitcoin (BTC) price continues to consolidate in a range that offers a buying opportunity, while other major cryptocurrencies, such as Ethereum (ETH) and Ripple (XRP), look set for a potential price correction.

How could the UK election influence BoE policy?

Polls show the Labour party is likely to win the July 4 UK general election. The election outcome could have consequences for the UK economy, the Bank of England policy and the Pound Sterling valuation.

-637423549979996854.png)

-637423554196922205.png)

-637423565801178605.png)

-637424524630348891.png)