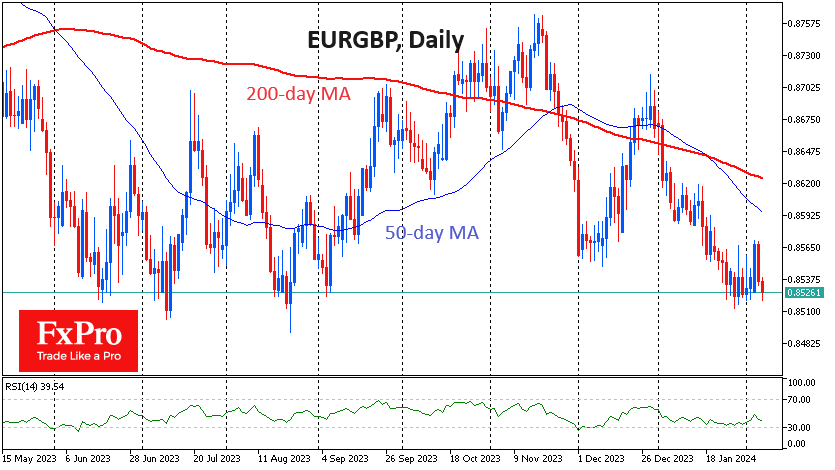

Euro/pound One Step Away from a Descending Stair

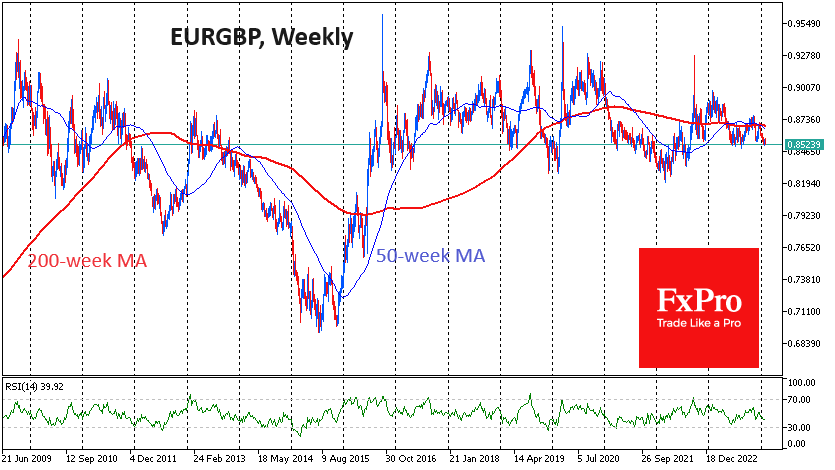

The euro is back at 0.8520 against the pound. The pair bounced off this level in June and August last year. Reaching the same level in late January triggered a shake-out, but active declines resumed on Tuesday and Wednesday, and the pair is testing multi-month lows with renewed vigour.

Technically, a break of support at 0.8500 would allow a move towards 0.8250-0.8300 to be considered as a working scenario. A decline of 2.0-2.5% looks like a significant move. However, we may be seeing the beginning of a new global trend.

EURGBP has tried to break above 0.9200 several times since 2016, mainly triggered by the weakness of the pound. We may now be entering a period of euro weakness, like what we saw in 2013-2015. Back then, a wave of pressure on the euro pushed EURGBP towards 0.7000.

The reason for this global reshuffle in a rather dull pair could be the increasing divergence in economic dynamics. With interest rate changes on the agenda, interest is being drawn to the more buoyant economies where the UK has an advantage due to domestic demand.

The level of interest rates and interest rate expectations will also be critical in the coming quarters. The Bank of England's base rate is now 5.25%, compared with 4.5% for the ECB. However, markets expect the Bank of England to cut four times to 4.25% by 2024. The ECB is expected to start its rate-cutting cycle a little earlier and bigger.

While one should be prepared for the EURGBP to return to a lower floor, confirmation in the form of a break of 0.8500 is still needed and is not yet a done deal. There is still a relatively high chance of renewed gains from current levels, as the current multi-month lows may attract buyers into the EUR.

By the FxPro Analyst Team