Stocks enjoy Fed-induced bounce as dollar slips ahead of NFP

Fading rate hike fears lift markets

Investors appear to be positioning themselves to end the week on a high note after a tumultuous week for both equity and FX markets. Fed Chair Jerome Powell probably achieved what he set out to do, which is to beat the hawkish and dovish drums simultaneously. With markets going into the FOMC meeting expecting the worst, Powell’s refusal to steer policy anywhere near a rate hike came as huge relief, even as a cut this year is becoming more and more elusive.

Shares on Wall Street initially wavered on Wednesday, as investors priced in only a few additional basis points of rate cuts after Powell’s press conference. But mixed earnings had a hand to play in that and the rebound got into full swing on Thursday.

There’s still some ground to cover before the S&P 500 and Nasdaq erase all of their weekly losses but Apple’s earnings may just help them do that. The tech giant reported better-than-expected results after Thursday’s closing bell, even as revenue fell amid slumping iPhone sales. But the announcement of a $110 billion share buyback sent the stock around 6% higher in after-hours trading.

Will NFP report maintain the market optimism?

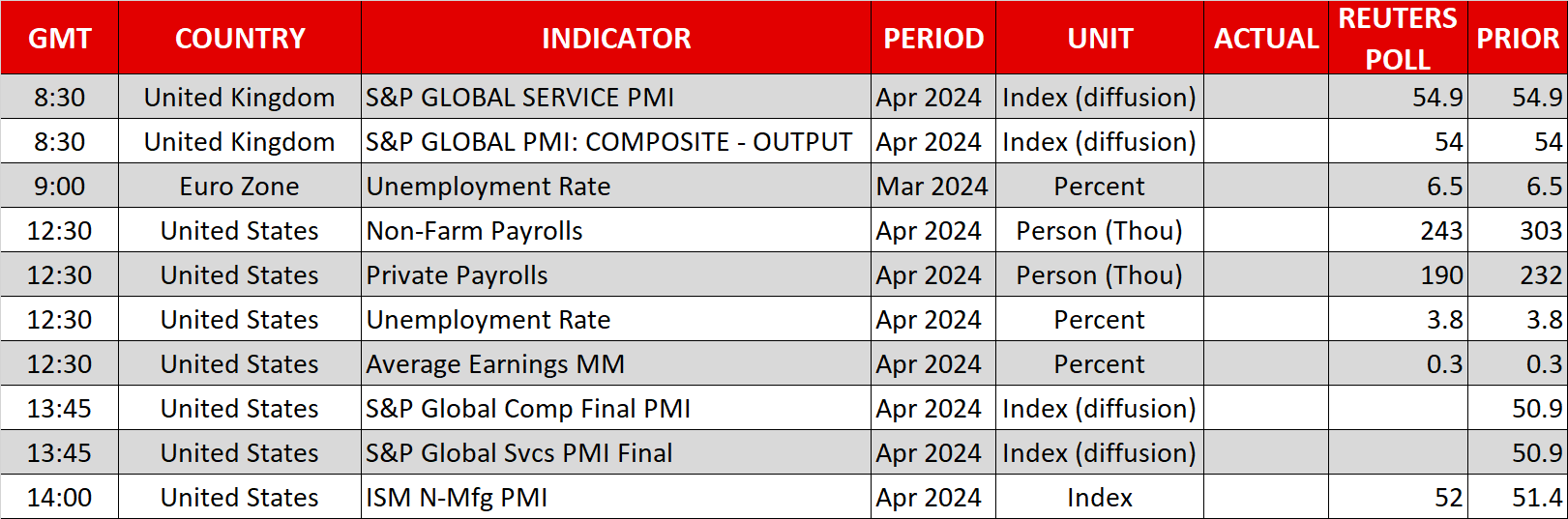

However, there’s still one more key event to go that could yet dampen the mood. The April jobs report due at 12:30 GMT will be crucial in underscoring the Fed’s dovish narrative. In particular, whether the labour market can continue to churn out new jobs at a staggering pace without fuelling a wage-price spiral is highly questionable.

Nonfarm payrolls are expected to have increased by 243k in April versus 303k the prior month, while average hourly earnings growth is forecast to have eased to 4.0% y/y. Any acceleration in the latter is likely to spur a bigger market reaction than a positive surprise in the payrolls print, especially after Powell’s apparent easing bias.

Investors will additionally be keeping an eye on the ISM services PMI, while Fed speakers in the coming days could also cast doubt on Powell’s reluctance to consider the possibility of further tightening.

Yen eyes weekly gains as dollar pulls back

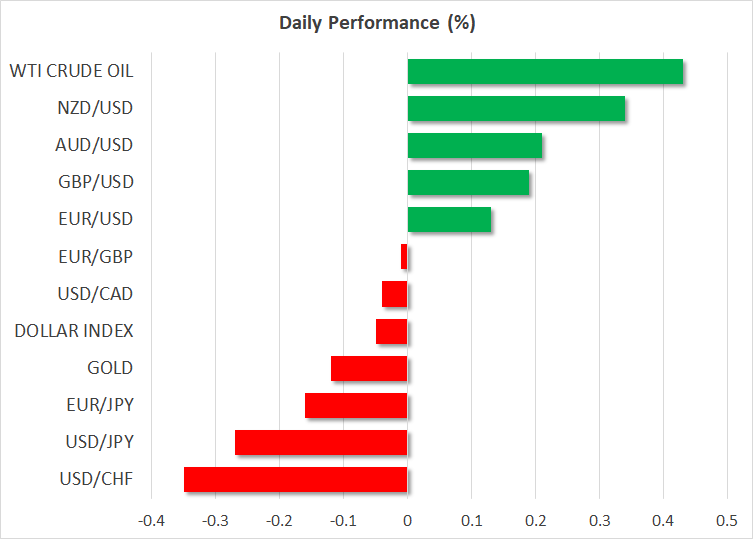

Ahead of all that, the US dollar is on the backfoot as the 10-year Treasury yield has pulled back from near-six month highs above 4.70% last week to a post-FOMC low of 4.57%. The greenback already suffered a wobble at the start of the week when Japanese authorities intervened on Monday to prop up the yen.

A second round of suspected intervention followed late on Wednesday, and combined with the not-so-hawkish Fed meeting, the yen is headed for weekly gains of more than 3.0%, with the dollar briefly dipping below 153 yen earlier in the day.

Japanese Finance Minister Suzuki and BoJ Governor Ueda are due to hold a press conference at 13:45 GMT, as the risk of further intervention remains high heading into the weekend amid bank holidays in Japan and the UK on Monday that will significantly impact liquidity in FX markets.