- Home

- Community

- Trading Systems

- Flex EA - TrendSurfer - REAL

Advertisement

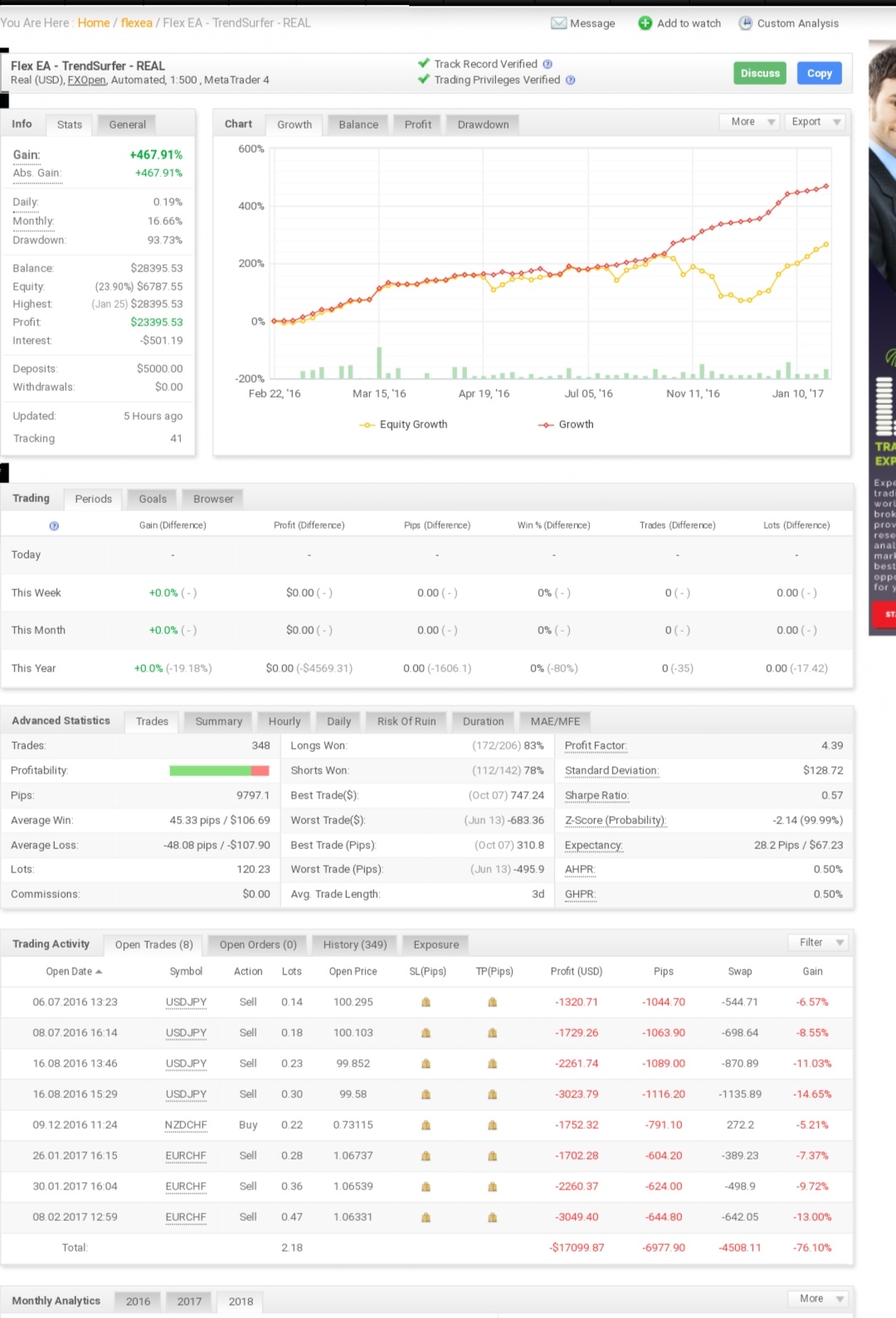

Flex EA - TrendSurfer - REAL (By flexea )

| Gain : | +125.27% |

| Drawdown | 74.48% |

| Pips: | 6336.3 |

| Trades | 434 |

| Won: |

|

| Lost: |

|

| Type: | Real |

| Leverage: | 1:500 |

| Trading: | Automated |

Edit Your Comment

Flex EA - TrendSurfer - REAL Discussion

Member Since Nov 18, 2015

241 posts

Nov 29, 2016 at 19:15

Member Since Nov 18, 2015

241 posts

I realized that for long term success "slow and steady" approach is the way to follow... Here low risk and small pips what we need..The idea should be getting rid of the open trades as soon as possible with profit..

So scalping must be paid attention..

Above the set file i custom tailored from default strategy aiming to scalp minimum 8-10-12 pips...It uses very tight EquityTrail settings but it sometimes scalps 20-30 pips after locking the amount i want at first place.

Risk is set to 0,1 and also uses 0.6x Hedge...

Seems safe but early to say profitable...(being tested for 1 day)

ideas will be appreciated.

So scalping must be paid attention..

Above the set file i custom tailored from default strategy aiming to scalp minimum 8-10-12 pips...It uses very tight EquityTrail settings but it sometimes scalps 20-30 pips after locking the amount i want at first place.

Risk is set to 0,1 and also uses 0.6x Hedge...

Seems safe but early to say profitable...(being tested for 1 day)

ideas will be appreciated.

Nov 30, 2016 at 07:54

Member Since May 09, 2016

14 posts

Also I'm trying to use hedging.

I am very favorable to its use, but I want to understand how to use it in the best way.

Your "scalper Set 2" seems to me to have too many settings than the settings that you have to manage in flex ea.

it's correct?

I am very favorable to its use, but I want to understand how to use it in the best way.

Your "scalper Set 2" seems to me to have too many settings than the settings that you have to manage in flex ea.

it's correct?

Member Since Nov 18, 2015

241 posts

Nov 30, 2016 at 08:16

Member Since Nov 18, 2015

241 posts

its correct yes you can test it on strategy tester...

I choose smaller hegde multiplier than 1 just because it reduces the drawdown but the price should retrace more pips..And the beauty of this you can manually interfere if the price doesnt retrace back..

I choose smaller hegde multiplier than 1 just because it reduces the drawdown but the price should retrace more pips..And the beauty of this you can manually interfere if the price doesnt retrace back..

Member Since Apr 06, 2018

242 posts

Aug 16, 2018 at 06:12

Member Since Apr 06, 2018

242 posts

May 30, 2020 at 16:28

Member Since Nov 08, 2019

20 posts

Any robotic system seems dangerous to me because you can't control it personally, so you can't control your money. Which I don't think is the best option. It's better to understand the market and trade yourself, it will be more productive.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.