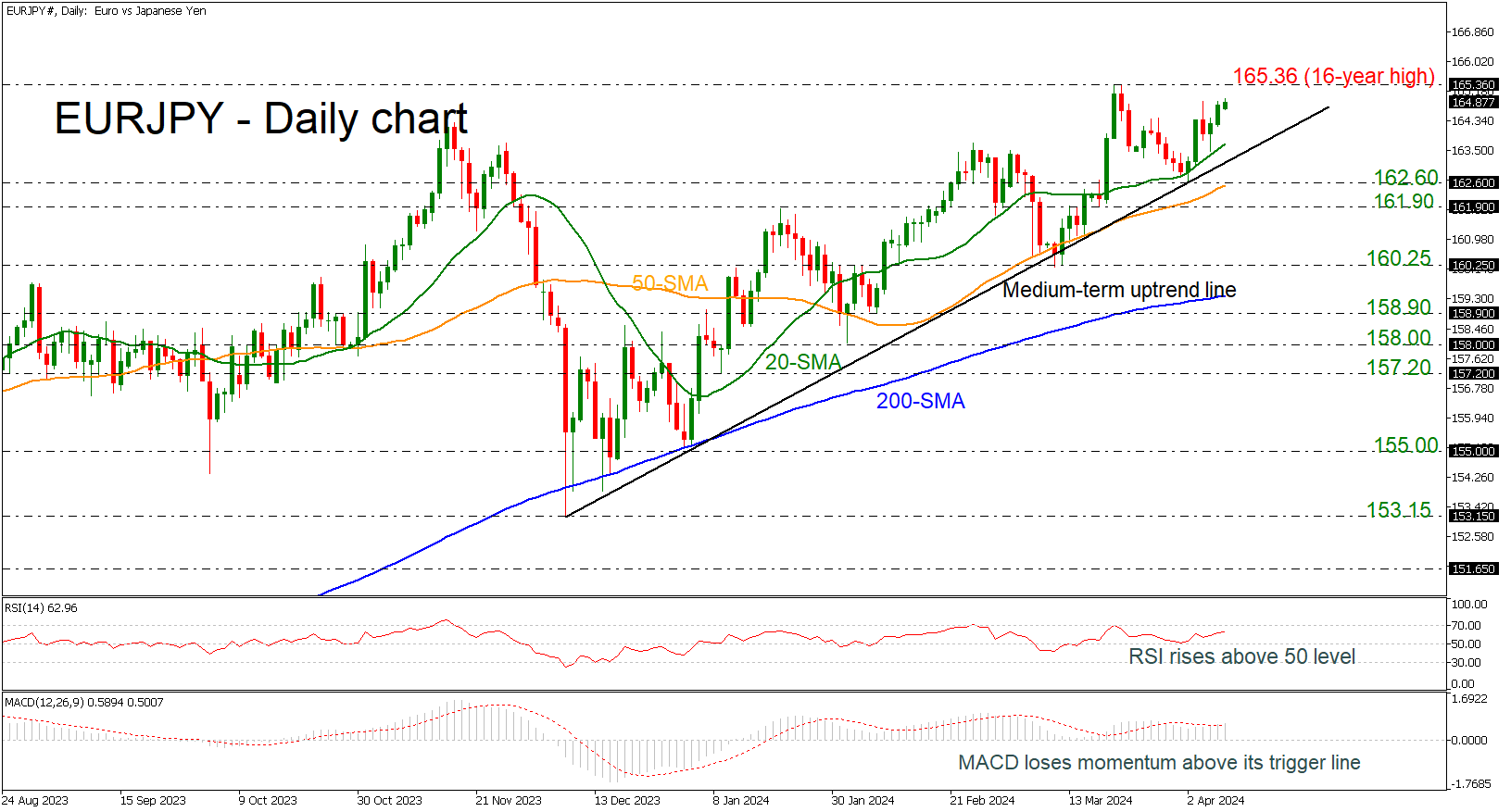

EUR/JPY rises towards 16-year high

EUR/JPY is climbing higher after the turning point near the medium-term ascending trend line and is moving towards the 16-year high of 165.36. The market has been developing within an uptrend since December 7 with the technical oscillators confirming an upside tendency. The RSI is moving higher above the neutral threshold of 50, while the MACD is crossing above its trigger line.

Should the pair manage to strengthen its positive momentum, the next resistance could come around 165.36. A break above it would shift the bias to a more bullish one and open the way towards the next psychological numbers of 166.00, 167.00 and 168.00 until the price meets the July 2007 peak of just under 169.00.

However, if prices are unable to break higher, the risk would shift to the downside, with the 20-day simple moving average (SMA) at 163.70 coming into focus, as well as the uptrend line at 163.20. A drop lower would signal a downside retracement until the 50-day SMA, which overlaps with the 162.60 support and the 161.90 barrier underneath.

In a nutshell, EUR/JPY is looking bullish in the short- and medium-term timeframes, but a decline beneath the 200-day SMA at 159.40 could switch the bias to bearish.