Rate cut optimism buoys equities, gold jumps on geopolitical risks

Stocks extend post-CPI gains

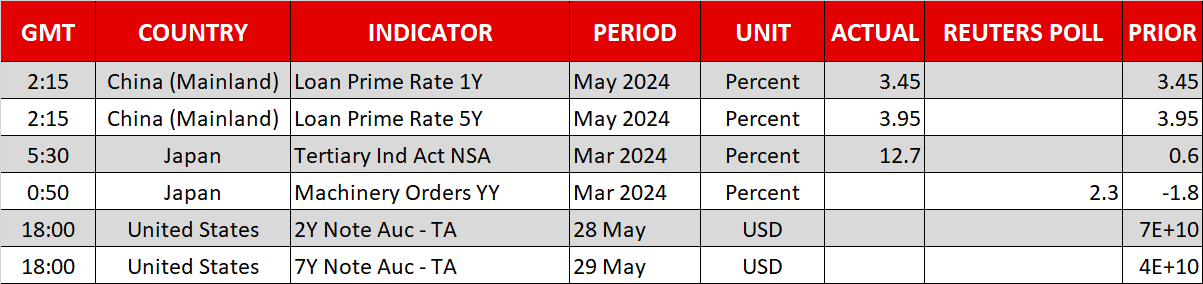

Equity markets remained buoyant at the start of the new trading week following last week’s somewhat cooler-than-expected inflation report out of the United States, as the data further extinguished any lingering fears about a possible Fed rate hike. Yet, the latest CPI readings don’t seem to have made much of an impression on Fed policymakers.

Several FOMC members have taken to the podium since the CPI report, all reinforcing the ‘higher for longer’ message, with Kashkari and Bowman even leaving the door open to rate hikes. Year-end rate cut bets have subsequently receded again to around 40 basis points from just over 50 bps in the immediate aftermath.

There will be a plethora of Fed speakers this week as well, with Governor Waller’s remarks likely to be particularly watched today. The busy roster looks set to take the shine off Wednesday’s FOMC minutes.

In the meantime, Wall Street futures point to more gains today after the Dow Jones closed at a fresh record high on Friday.

Copper rallies on China stimulus

Major indices in Europe and Asia also headed higher on Monday, as investors remained hopeful that the Fed’s next move will be a cut, while in Europe, both the European Central Bank and Bank of England are edging closer to easing policy in the summer. There’s been some good news out of Asia too, as Chinese authorities appear to be stepping up their efforts to boost the country’s troubled property market.

Although it’s unclear if China’s stimulus plan is large enough to end the property slump, markets are encouraged that the latest measures are more significant than previous policies and this is boosting certain metals such as copper.

Combined with China’s increasing grip on copper supply chains, the commodity has surged in recent days, with COMEX futures hitting a new all-time high of $5.1985 per pound on Monday.

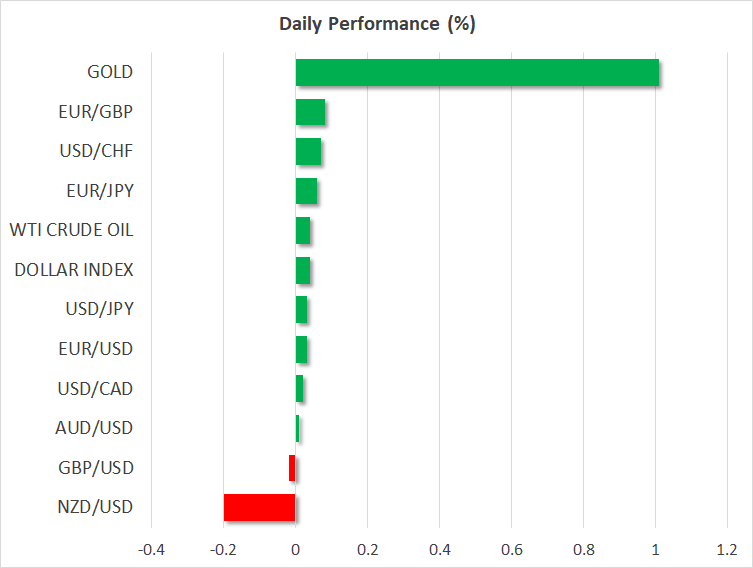

Precious metals such as silver and gold have also been rallying lately, though for different reasons.

Oil and gold up on ME risks

Heightened geopolitical tensions and strong central bank demand have catapulted gold to above the $2,400/oz level. Gold prices are gaining further traction today on some worrying developments in the Middle East over the weekend.

Iran’s president has reportedly been killed in a helicopter crash along the border with Azerbaijan, while Saudi Arabia’s crown prince has been forced to cancel a trip to Japan due to the poor health of King Salman.

Oil futures are inching higher amid the uncertainties about the leadership in two major oil producing nations. But overall, despite some speculation that Israel might be involved with the downing of the helicopter carrying Iran’s president, there’s no sign of panic.

Yen continues to underperform

In FX markets, major pairs are consolidating their gains following the US dollar’s sharp pullback. The flash PMIs for May, due Thursday, will be the euro’s focus this week as a strengthening economic rebound could dash expectations for aggressive rate cuts by the ECB this year. For the pound, Wednesday’s CPI data could pave the way for a BoE rate cut in June.

Surprisingly, the yen has been unable to capitalize on the dollar’s retreat, holding steady in the 155 region, even as Japan’s 10-year yield approaches 1% for the first time since 2013.