EBC Markets Briefing | Yen lower on weak data; market frowns at Musk's pay package

The yen lost ground in early Asian trading on Monday though a string of weak economic data revived global growth worries. Japan's manufacturing activity shrank in October at the fastest pace in 19 months.

Japan's GDP probably contracted an annualised 2.5% in Q3, the first time in six quarters, after being battered by Trump's tariff policies, a Reuters poll showed on Friday.

The US agreed to a 15% tariff rate on Japanese imports in a deal. Still the impact is seen as significant, especially for the car industry, because the duties are still much higher than their previous rate of 2.5%.

PM Takaichi faces an early challenge to her 'Abenomics' approach to economics as real wages fell for a ninth consecutive month in September. Any fiscal stimulus could complicate the ongoing inflation fight.

The country's debt-to-GDP ratio is already among the highest in the world, standing at almost 250% as of 2023. The 10-year government yield climbed to around 1.7%, the highest level in 17 years.

BOJ policymakers saw a growing case to raise interest rates in the near term, with some calling for the need to ensure companies' wage-hike momentum will be sustained, the October meeting minutes showed.

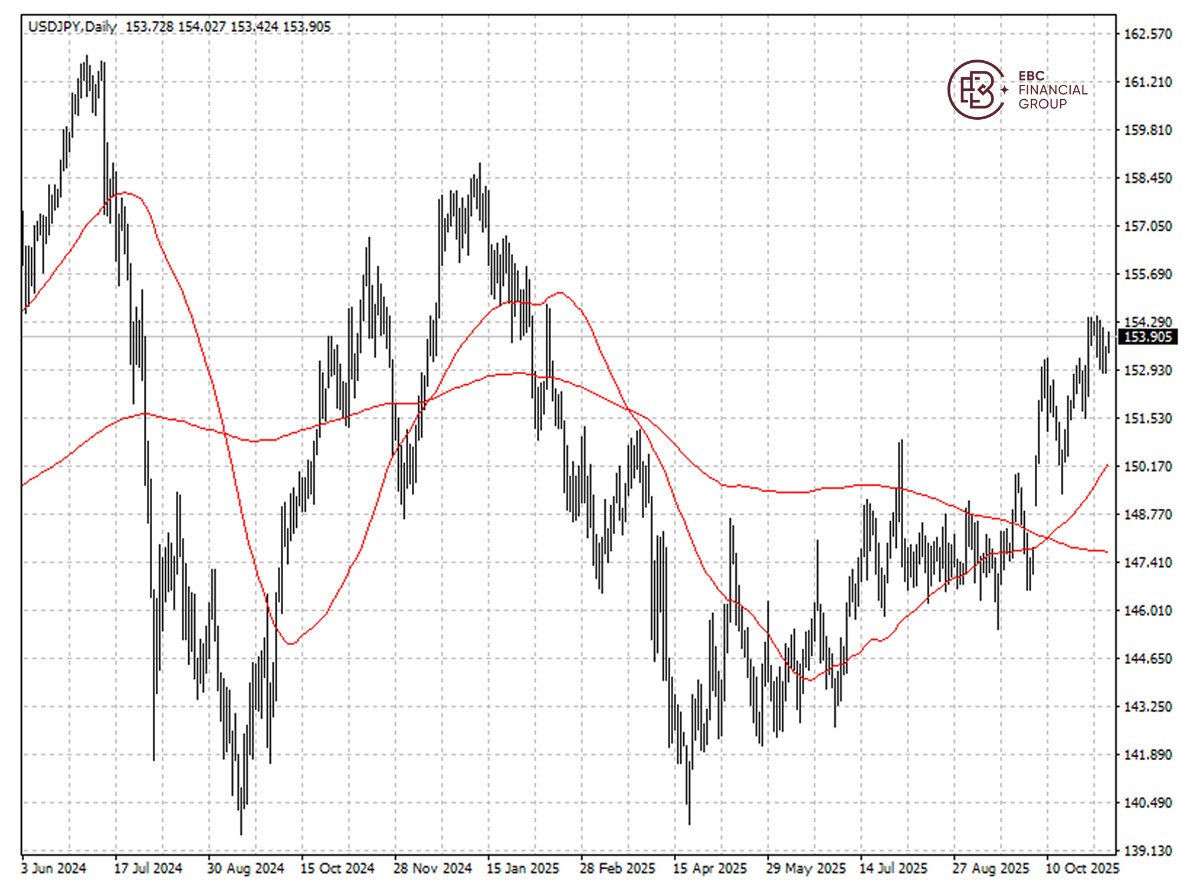

The yen has been trending lower for nearly a month since the formation of a death cross. A short-term rally seems likely, but a push above 150 per dollar could be needed to negate the bearish bias.

Asset recap

As of market close on 9 November, among EBC products, VanEck Junior Gold Miners ETF led gains as gold was attempting to reclaim the key psychological level at $4,000.

Elon Musk on Thursday said Tesla will have to build "a gigantic chip fab" to make AI chips and publicly mused partnership with Intel to power its autonomous ambitions.

Meanwhile, he has had a record-breaking pay package that could be worth nearly one trillion dollars approved by shareholders. The market responded negatively to the headline.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.