EUR/USD tests key support in bid for upside

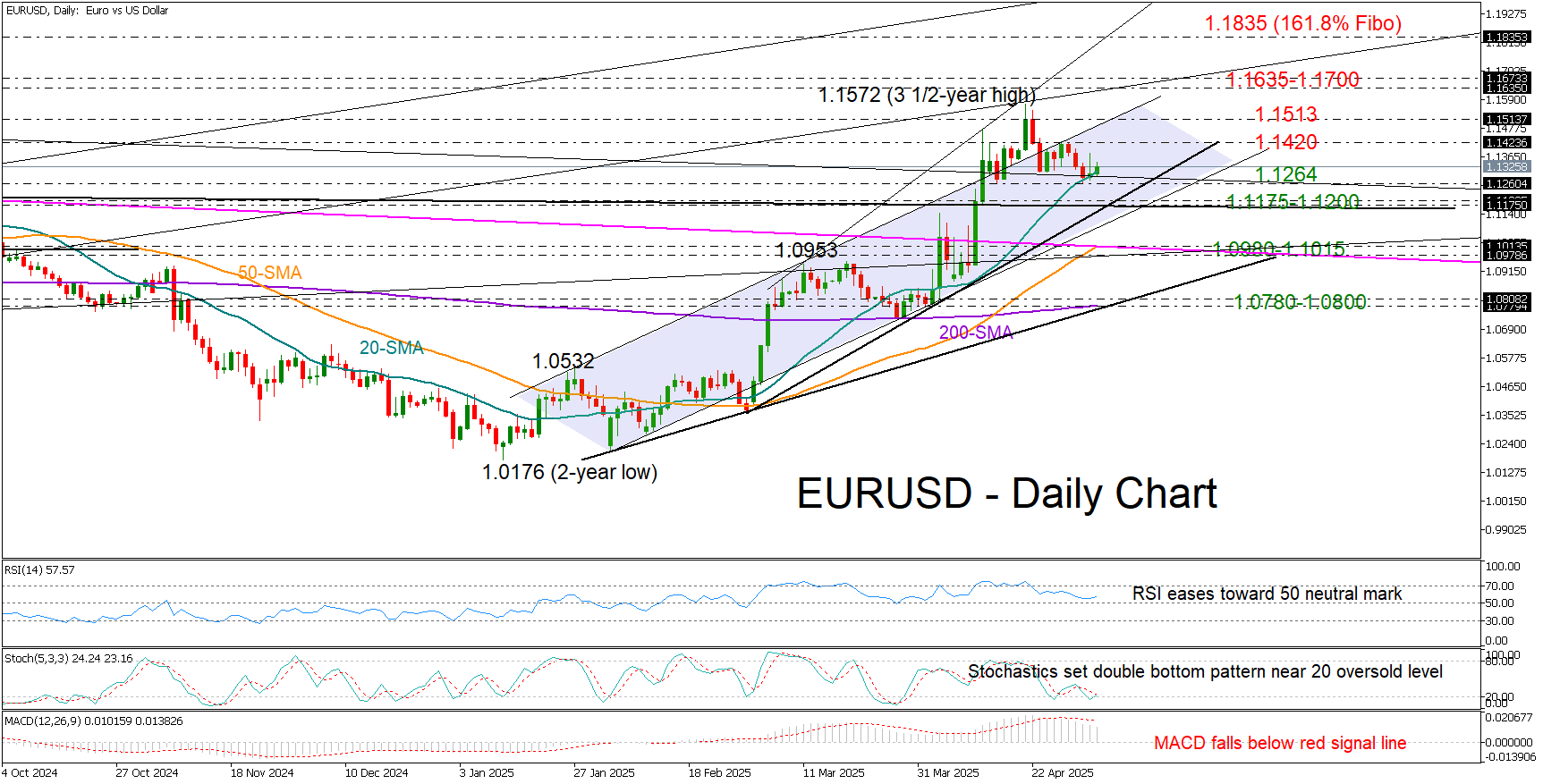

EUR/USD halted last week’s downside pressure near the 1.1265 support zone, which previously paved the way to the three-and-a-half-year high of 1.1572 reached on April 21.

The long-term descending trendline from the May 2014 peak, along with the 20-day simple moving average (SMA), are currently keeping the price above 1.1300. However, aside from the stochastic oscillator – currently forming a double bottom pattern near its oversold threshold of 20 – other declining technical indicators cast doubt on the potential for a sustained rebound.

Nevertheless, only a bearish extension below the 1.1175–1.1200 area and a break below the bullish channel would significantly weaken the short-term outlook. If that scenario materializes, the pair could correct sharply toward the 1.0980–1.1015 support zone and the 50-day SMA. A break below this area could lead to a deeper decline toward 1.0780-1.0800, where the 200-day SMA and a tentative support trendline from January intersect.

Should the bulls regain momentum near the 20-day SMA, the price could initially pause around the 1.1420 resistance level before challenging April’s resistance zone at 1.1513–1.1572. A decisive close above this region could establish a new higher high between 1.1635 and 1.1700. Further up, the bulls could head for the 161.8% Fibonacci extension of the September-January downtrend seen near 1.1835.

In brief, EUR/USD is trading near a key support zone, but technical indicators suggest that a clear confirmation is needed before buyers step in.