EURUSD’s euphoria wanes

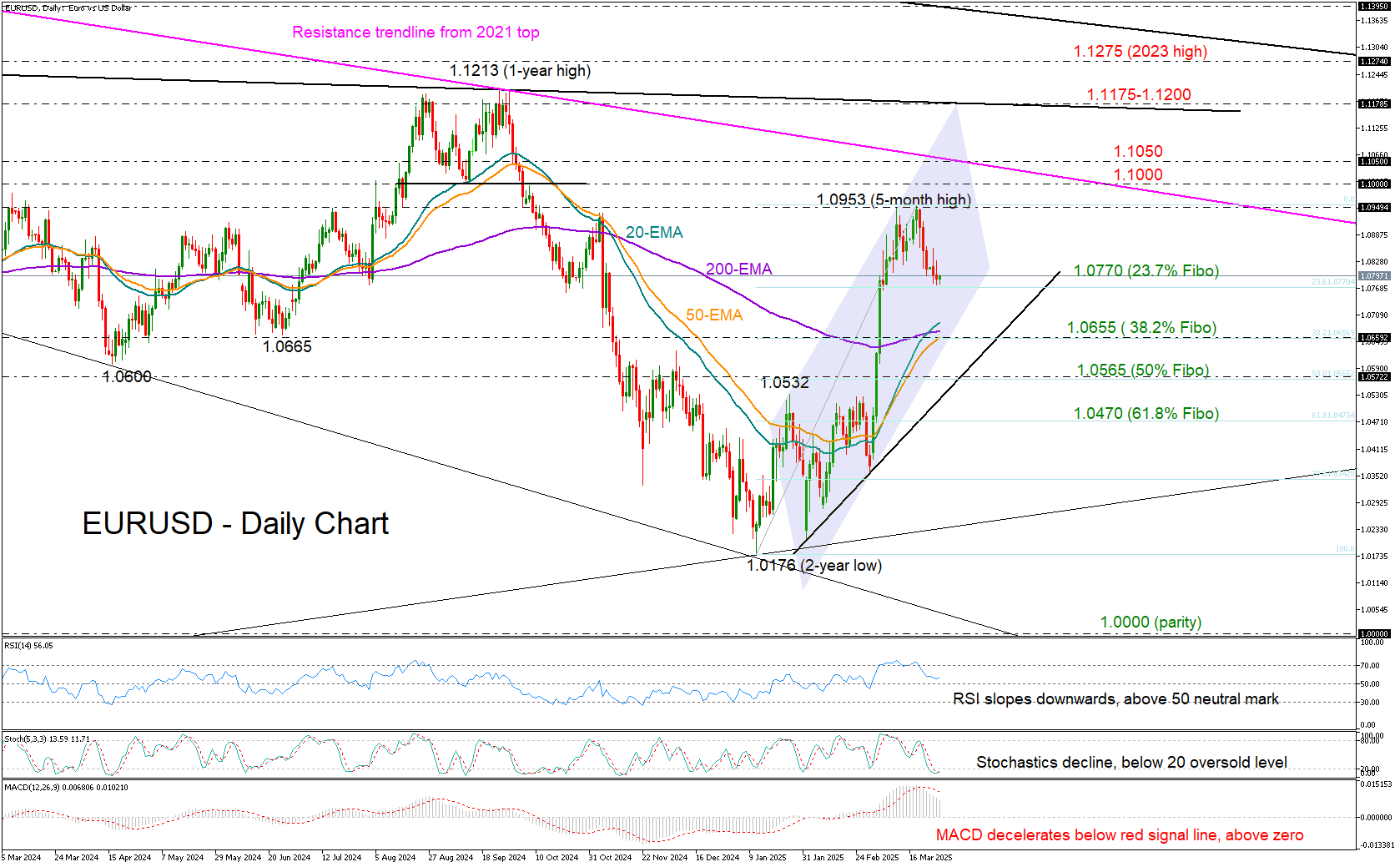

EURUSD has extended its retreat from the five-month high of 1.0953, trading lower for the second consecutive week, with the bears steering the price toward the key support near 1.0770.

The latest explosive vertical rally stalled below the 1.1000 threshold, and in the weekly chart, the bulls remain capped under the 200-period exponential moving average (EMA), raising concerns about further downside as investors reassess the impact of reciprocal tariffs, Germany’s defense spending and lower interest rates on economic growth.

On the daily chart, a bullish crossover between the 20- and longer-term EMAs offers a glimmer of hope that the upward trajectory could stay intact. However, a drop below these EMAs, near the 38.2% Fibonacci retracement of the recent upleg at 1.0655, could reinforce selling pressure toward the 50% Fibonacci level at 1.0565. A tentative support trendline from February’s lows adds extra significance to this area – failure to hold there could dampen prospects of a bullish reversal.

Despite the negative slope in the technical indicators, the stochastic oscillator is already within the oversold zone and the RSI has yet to cross below its 50 neutral mark, both suggesting that upside movements or some stability is still possible.

A sustained bullish outlook however could be a tough task. Buyers need to reclaim 1.0953 and break through the psychological 1.1000 barrier to test the crucial falling trendline at 1.1050 stemming from the 2021 peak. A breakout there could pave the way toward the next important barrier at 1.1175-1.1200.

Overall, EURUSD could remain under pressure in the coming sessions, with the 1.0770 area likely acting as support. A breakdown could expose the market to the 1.0600 territory.

.jpg)