Gold regains its shine; Is it ready for the next leg up?

Gold prices are rebounding slightly after Tuesday’s sharp 5.3% drop, finding solid support around the 4,000 mark. The decline was driven by profit-taking following the recent record highs, while a boost in risk appetite, spurred by optimism over easing US–China trade tensions, reduced demand for the metal’s safe-haven qualities.

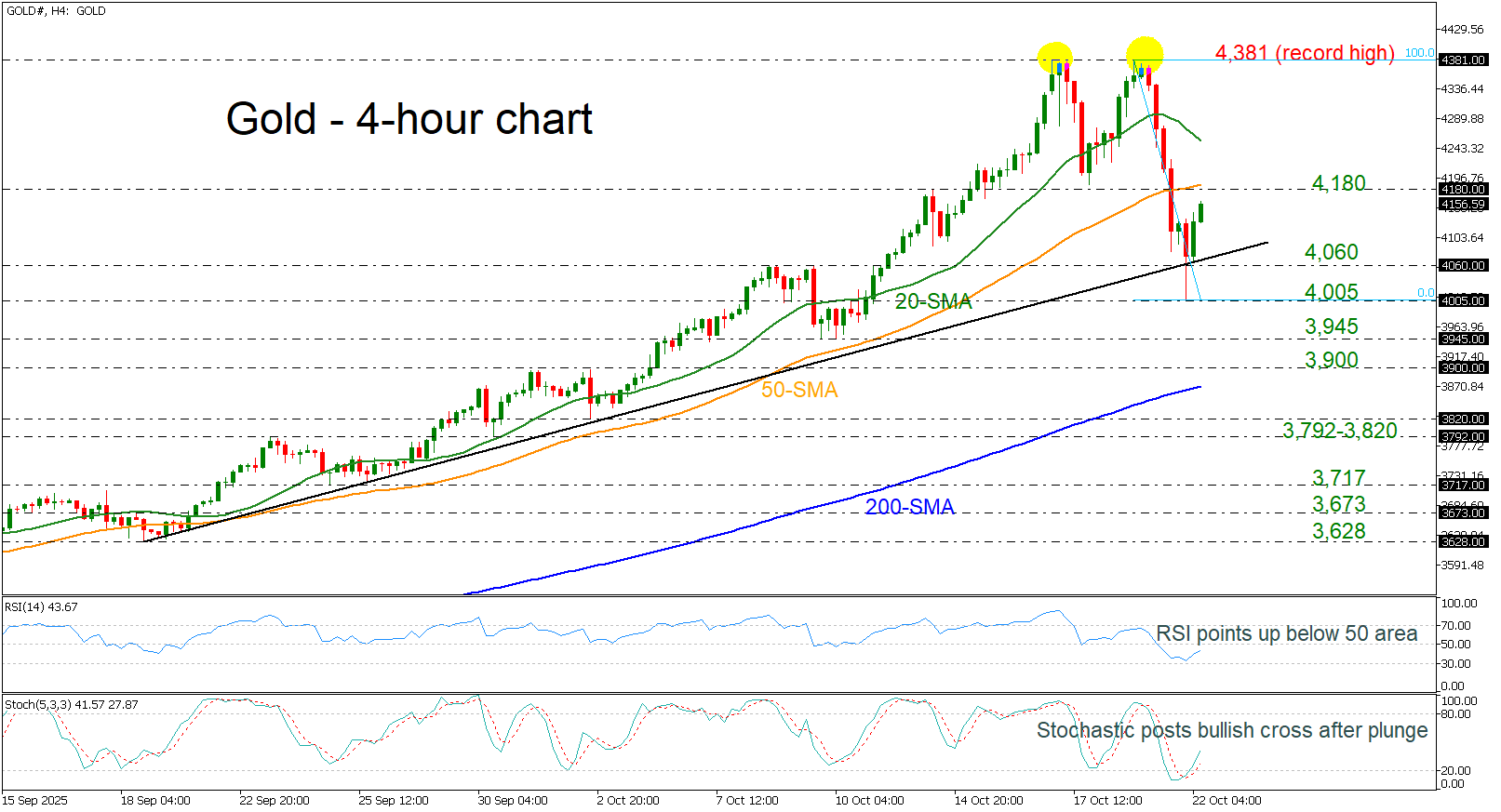

The double top pattern, a signal of trend reversal, has completed, and the price now appears poised for another bullish wave toward the first immediate resistance at 4,180, which coincides with the 50-period simple moving average (SMA) in the 4-hour chart. Beyond that, the 20-period SMA at 4,252 and the record high of 4,381 may act as the next resistance levels. If the rally continues, the next potential target could be the uncharted 4,610 level, which represents the 161.8% Fibonacci extension of the recent down leg from 4,381 to 4,005.

However, a drop below the short-term uptrend line and the 4,060–4,005 support zone could extend the downside correction toward 3,945 and 3,900.

Technical indicators are reflecting the market’s upward momentum, with the RSI turning higher after rebounding from the 30 level, and the stochastic oscillator showing a bullish crossover between the %K and %D lines in oversold territory.

In summary, the technical outlook suggests a potential continuation of the bullish trend, provided that key support levels hold. A break above immediate resistance levels could open the way for fresh highs.

.jpg)