Mood brightens ahead of key Eurozone and US data

OVERNIGHT

Shares on Wall Street rallied towards the close, erasing falls earlier in the week, following positive earnings results particularly in the tech sector. The upbeat mood continued into the Asian trading session, with indices up in most countries including Japan, China and Australia. The Bank of Japan under new Governor Ueda left its ultra-easy policy settings unchanged, including short-term interest rates at -0.1% and the target for 10-year government bond yields at 0% with a band of plus/minus 0.5% points. The BoJ dropped its guidance on interest rates (which stated they would stay at current or lower levels) and announced a review of policy although it will take up to 18 months.

THE DAY AHEAD

Business Barometer survey, released earlier, showed a rise in confidence to 33% in April, the highest for eleven months led by increased optimism for the economy. Hiring intentions and wage expectations also picked up, while firms’ own price expectations remained elevated.

The Eurozone focus will be on the first estimate of Q1 GDP and preliminary national CPI releases. The GDP figures are expected to reaffirm the economy skirted a recession early this year with a turnaround in industrial production and an improving external trade balance as the energy supply shock dissipates. Following a flat outturn in the final quarter of 2022, we forecast modest growth of 0.2%q/q in Q1 2023. France already released its estimate earlier this morning which showed growth of 0.2% after stagnating in Q4. Germany, Italy and Spain will release Q1 GDP ahead of the Eurozone estimate at 10:00am.

On CPI inflation, France released its figures earlier this morning showing a rise to 6.9%. (EU-harmonised measure). Germany and Spain will release their April CPI later, with the Eurozone flash CPI estimate due next week. Eurozone headline CPI fell sharply to 6.9% in March, but core inflation continued to rise to 5.7%. We look for signs of a temporary rise in April headline CPI due to energy price base effects.

The US focus will be on the Q1 employment cost index, a closely watched gauge of wage growth. We expect it to rise by 1.1%q/q which would result in a fall in the year-on-year comparison. The March reading for the PCE deflator, the Fed’s preferred inflation measure, is also due. Headline PCE inflation is likely to fall sharply in tandem with the already released CPI data due to the energy component. We forecast a fall to 4.1% from 5.0%, while the core measure excluding food and energy is seen staying unchanged at 4.6%.

MARKETS

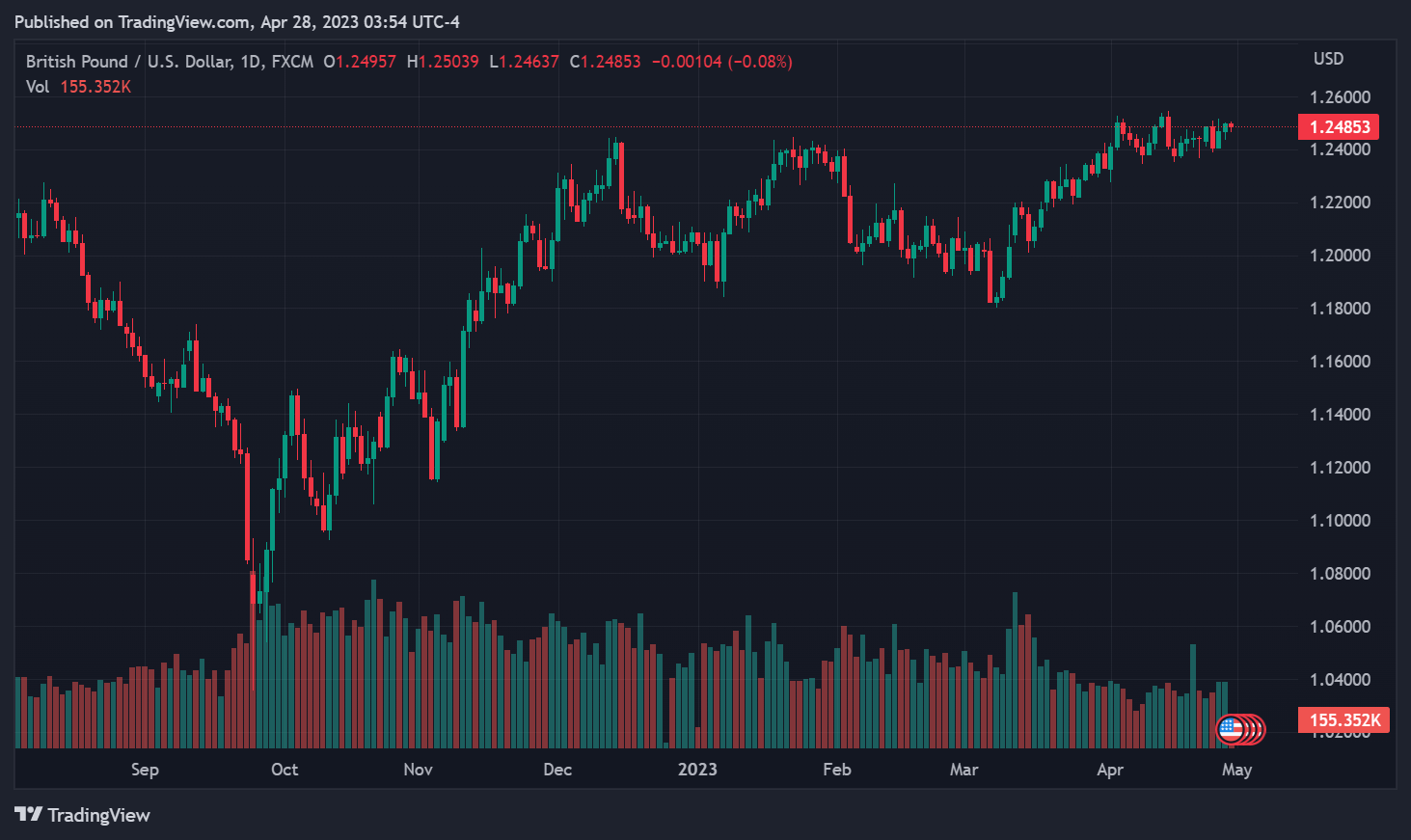

The yen weakened after the Bank of Japan’s decision to leave policy settings unchanged. The euro is broadly steady ahead of key GDP and CPI releases today as markets assess the size of next week’s ECB hike (likely 25bp but potentially another 50bp). Sterling remains just below $1.25.