Nasdaq100 set for further gains, confounding early sceptics

Nasdaq100 set for further gains, confounding early sceptics

US indices turned sharply higher at the start of last week and are still on the offensive, with the Nasdaq100 leading the rally. The pace of growth has slowed considerably, but it would be foolhardy to bet on a corrective pullback now.

The Nasdaq100 is up more than 9% from its 26 October low. The leaders in the early stages of a market rally often continue to lead the market for an extended period, albeit at a slower pace.

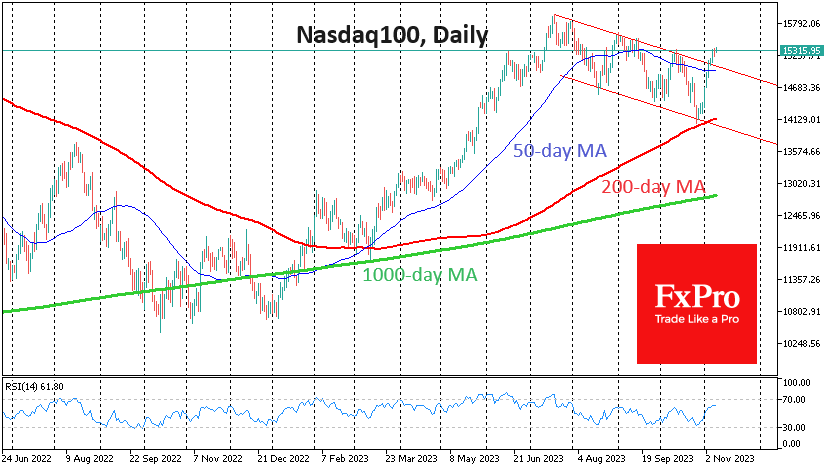

At the end of last month, buyers stepped in just in time to prevent the index from falling below its 200-day moving average.

Reaching this curve coincided with the touching and attempted breaking of the downtrend support line within which the Nasdaq100 had been trading since the second half of July.

The rally was strong enough to break through the upper boundary of this corridor. The index rewrote the local highs, confirming the break of the downtrend.

The third factor was the accumulated bullish divergence between the RSI on the daily timeframe and the price when the sequence of new local lows did not find confirmation in the form of new index lows.

The fourth factor is the accumulated substantial short position in equities, justified by expectations of weakness in economic indicators and corporate financial performance. The bears failed to wait for a meaningful deterioration in economic indicators and moved to close shorts, which poured more fuel for growth.

The Nasdaq100 quickly returned to its previous local highs, and the subsequent local target for its growth looks to be the 15500 area, followed by 16000.

With interest rates kept high and the central banks committed to the mantra of "higher for longer" (than the market expects), one should be cautious about the prospects of making new highs and breaking through 16500. Nevertheless, it may be too dangerous for short-term traders to build up short positions or close out long positions too early.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)