Trade talks progress calms markets after hawkish Powell

Trade progress offers some relief ahead of Easter break

Market spirits improved on Thursday ahead of the long Easter holiday weekend after US President Trump said “big progress” was made in talks with the Japanese trade delegation. Japan has been able to get a head start on trade negotiations with the United States, indicating that reaching a deal is a priority with the Trump administration.

Hence, investors are watching the talks very carefully, with the outcome likely to be seen as a bellwether for how easy it will be for all the other countries lining up to sign new trade pacts with Washington in a bid to avoid steeper tariffs.

Chip rout weighs on equity markets

Today’s turnaround in sentiment follows another dreadful session on Wall Street on Wednesday when the combination of fresh restrictions on chip exports to China and less than market sympathetic remarks by Fed chief Jay Powell roiled markets, pushing the S&P 500 2.2% lower.

Nvidia shares plunged by 6.9% after the company said that the US government’s tighter curbs on exports of its H20 AI chip to China will cost it $5.5 billion, while Dutch chipmaker ASML saw its stock fall by more than 5% after it reported disappointing orders for Q1.

There was better news from Taiwan’s TSMC today, as it beat its Q1 profit estimates, but the stock is nevertheless trading lower amid the ongoing uncertainty about Trump’s tariff policies. Netflix could also be a bright spot when it announces its Q1 earnings after Wall Street’s closing bell, although US traders won’t be able to respond until Monday.

No dovish tilt from Powell

Not helping matters is the reluctance of the Federal Reserve to step in and put a stop to the bleeding. Investors seem to think that the Fed will unequivocally prioritize growth over inflation and slash interest rates should the US economy slip into recession.

But that wasn’t the message from Powell yesterday when he stressed the importance of keeping longer-term inflation expectations well anchored. Powell is saying that you can’t have maximum employment without price stability and until it’s clear that the inflation shock from higher tariffs will be temporary, the Fed would rather stay on hold.

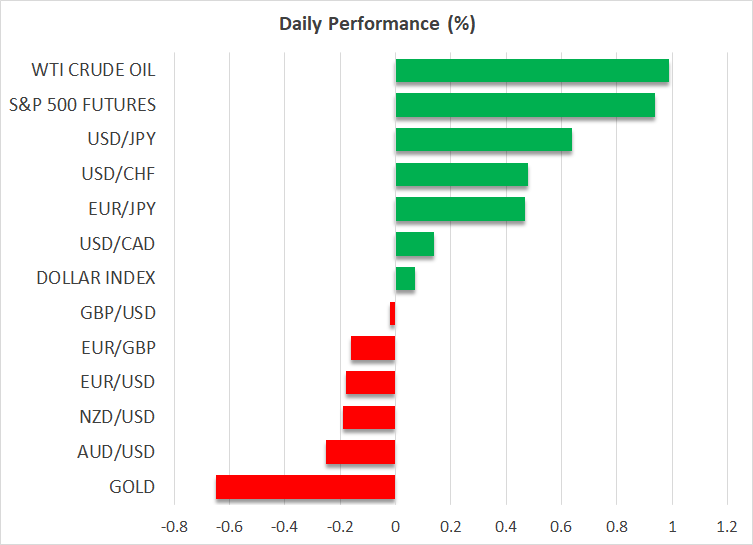

Dollar selloff eases, yen slips

Still, US futures are climbing today on the back of the encouraging developments on the trade front, although European markets appear not as convinced and stocks are in the red.

The US dollar is enjoying a respite from the selloff, which is likely to be temporary, but it’s at least able to claw back some losses against its safe-haven counterparts, the yen and Swiss franc. Fed rate cut expectations haven’t budged much even after yesterday’s upbeat retail sales data and Powell’s hawkish stance.

The yen has come under some pressure on the reports that Japan’s FX policy will likely be discussed in separate talks with the Trump administration to those about tariffs, easing concerns about accusations of currency manipulation.

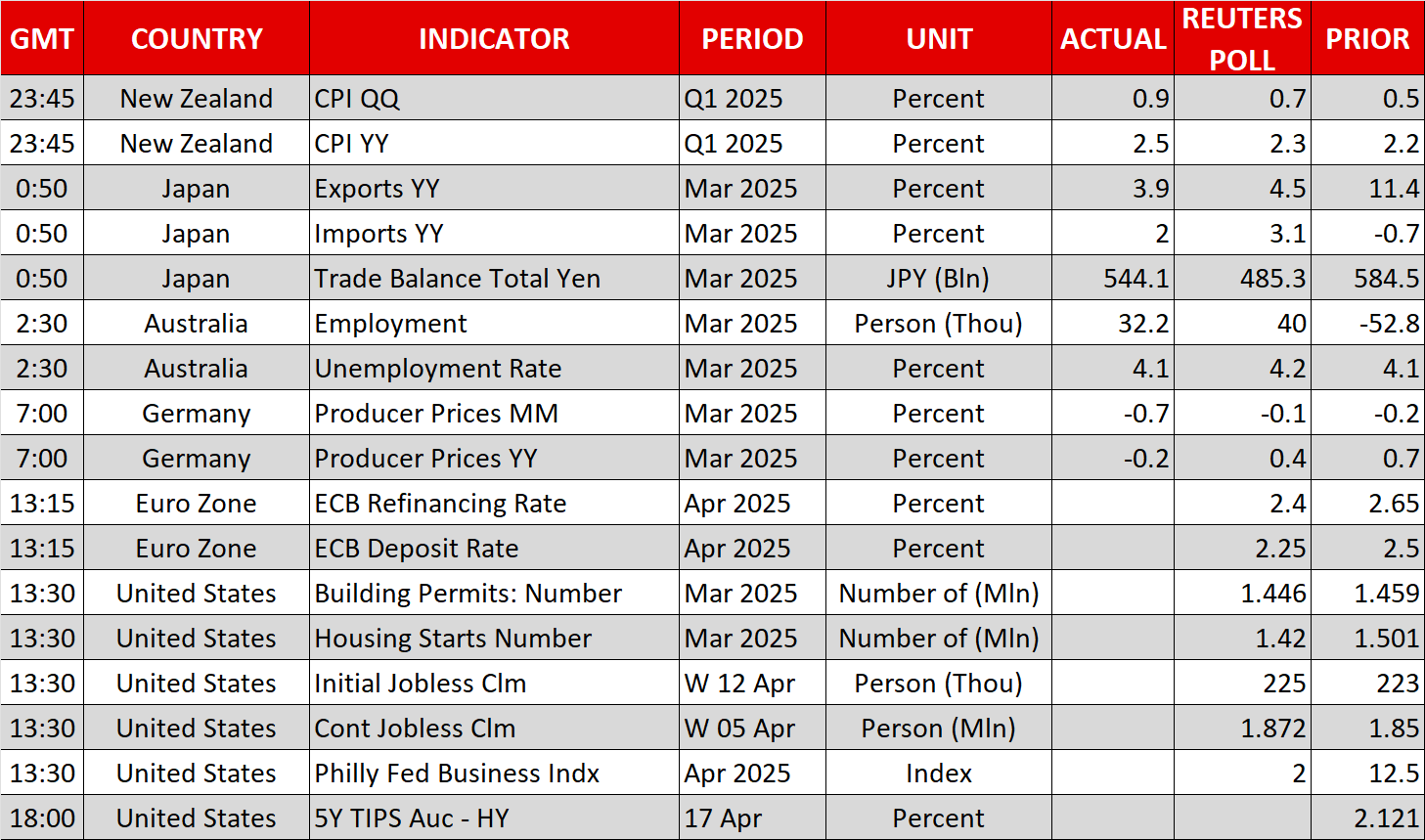

Euro softer ahead of ECB, BoC turns less dovish

The euro is also on the backfoot, trading slightly below $1.14, as investors await the European Central Bank’s interest rate decision. The ECB is almost certain to cut rates by another 25 bps today as the trade war clouds the outlook for Eurozone growth. But unless there’s a significant dovish or hawkish surprise by President Christine Lagarde, the euro is unlikely to react much to the decision.

The Bank of Canada, meanwhile, ended its streak of back-to-back rate cuts by keeping them unchanged on Wednesday. Like the Fed, the BoC is turning more cautious about the inflation outlook and may not cut as readily in the future.

The loonie rose following the decision, but is somewhat weaker today, along with the Australian and New Zealand dollars. The aussie and kiwi seem to have brushed off stronger-than-expected jobless rate and CPI data out of Australia and New Zealand, respectively, earlier today.

Gold rally pauses for breath

Amid the mixed picture from equity and currency markets, the improved mood was more evident in gold prices, which have reversed lower after earlier hitting a new all-time high of $3,357.40. It follows a surge of 3.6% yesterday and gains of over 6% in the month to date.

.jpg)