US job vacancies fall faster than expected

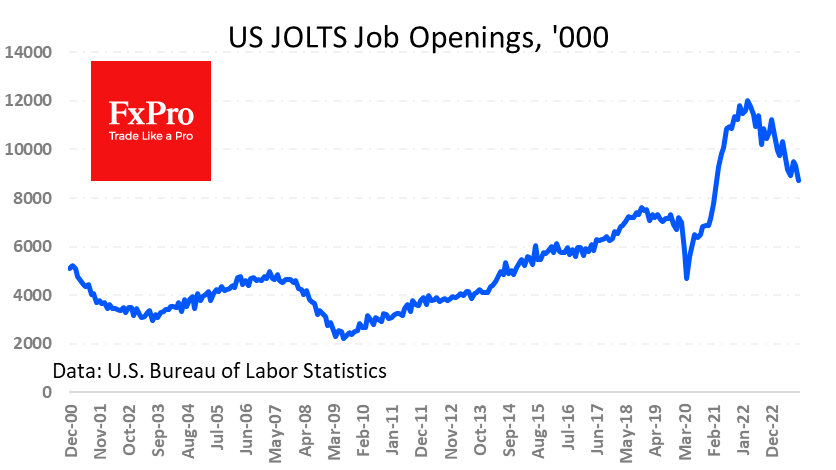

There were more signs of a cooling US labour market ahead of Friday's employment report. The number of open job vacancies in October fell to 8.733 million from 9.35 million a month earlier and 9.31 million expected.

With occasional bounces, the figure is down from 12 million since March last year. However, the job market is still hotter than it was at its peak in January 2019 at 7.5 million.

US markets remain in "bad is good" mode. This logic makes sense for inflation, suggesting the Fed is easing its stance or bringing the date for an interest rate cut closer.

But it is a very volatile game when we look at indicators of economic activity such as the labour market or consumption. A deterioration in these indicators may first prove to be the cause of market turbulence before a softening of the Central Bank's stance and a "natural recovery" of the market reverses the trend.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)