US producer prices confirm disinflationary trends

US producer prices confirm disinflationary trends

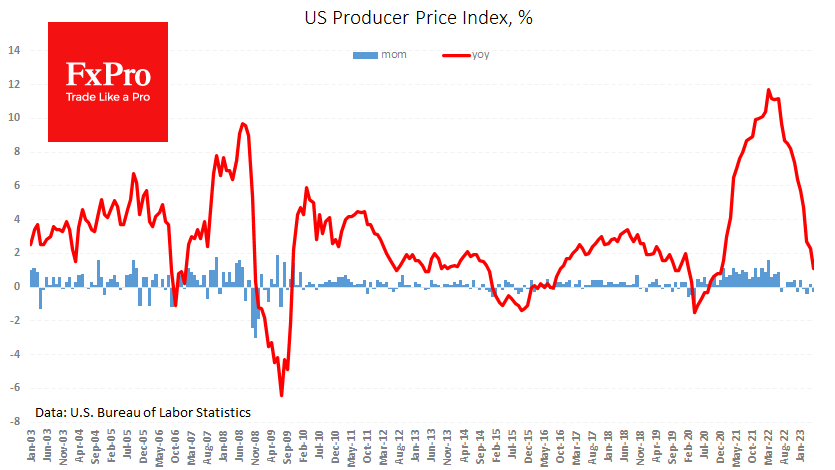

US producer prices fell stronger than expected, potentially reinforcing the dovish argument at the Fed. For May, PPI declined by 0.3% m/m, more than the expected 0.1%, and the index gained a modest 1.1% y/y after 2.3% a month earlier.

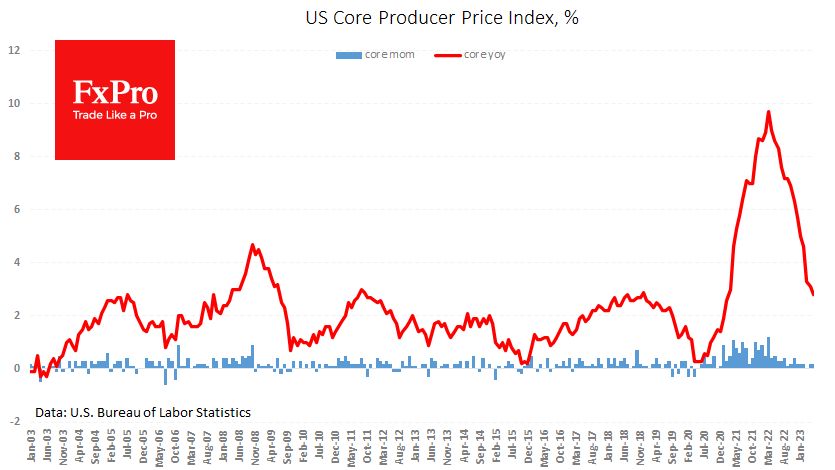

The core PPI, which excludes food and energy, added 0.2% m/m and 2.8% y/y. The annual rate was lower than 3.2% a month earlier and the expected 2.9%.

In contrast to the core CPI, the PPI shows a return to desired inflation numbers, with the monthly price growth rate well within the Central Bank target.

Were it not for a strong labour market and the resulting robust consumer demand, the producer price development should have been regarded as a leading indicator for the CPI. However, in a full employment environment, retailers can use the situation to support their margins by justifying it with increased interest expenses.

The balance between divergent forces could result in a continued downward trajectory of inflation but a longer path towards the 2% target from the Fed.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)