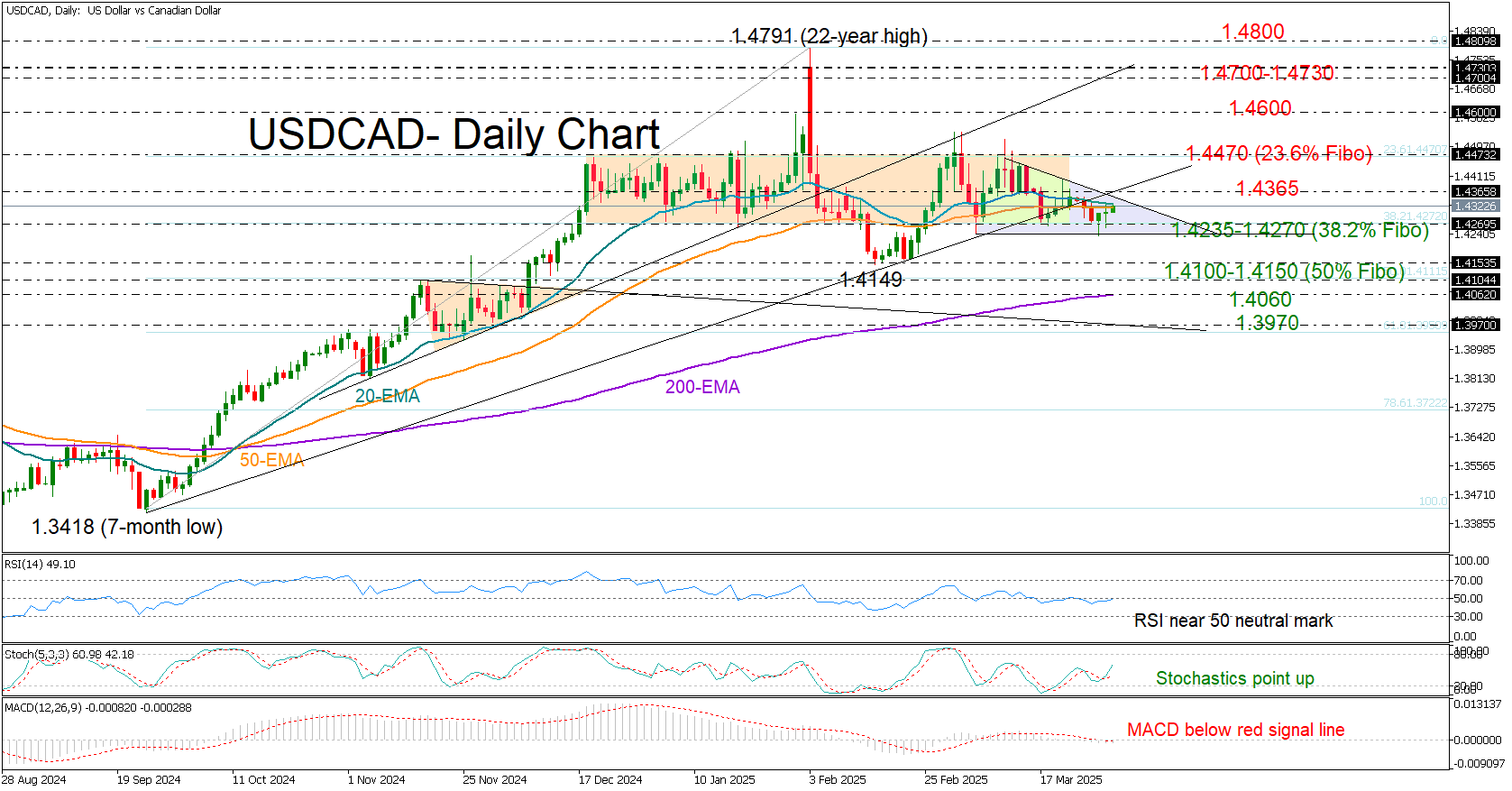

USDCAD indecisive within neutral zone

USDCAD extended its four-month sideways trajectory above the 1.4270 base for another week as the US tariffs deadline approached on April 2 and the Fed chairman reaffirmed economic stability.

Trend signals remain fragile. The pair slipped below the support trendline from September 2024 and remains capped below the 20- and 50-day exponential moving averages (EMAs) at 1.4330. Additionally, recent price action seems to be forming a descending triangle, which is usually a sign of a bearish breakout.

However, Wednesday’s green hammer candlestick and the rising stochastic oscillator suggest upside potential hasn’t vanished. The 20-day EMA is also holding resilient above the 50-day EMA for the fifth consecutive month. Still, bulls must reclaim 1.4365 and then break successfully above 1.4470 to exit the neutral zone.

A climb above 1.4470 could initially pause near 1.4600. If the bulls sustain power, a tougher obstacle could emerge within the 1.4700-1.4730 territory before the 1.4800 mark comes into play.

Conversely, a close below 1.4235-1.4270 may activate fresh selling orders toward 1.4100-1.4150. A drop past the 200-day EMA at 1.4065 could push prices toward 1.3970, aligning with the 61.8% Fibonacci retracement of the September-February rally.

Overall, USDCAD remains in limbo. A break above 1.4365 or below 1.4235 could set the next direction.