Will Silver Explode Past $54 or Snap into a Reversal?

Get a focused breakdown of silver from the Ultima Markets team for November 28, 2025.

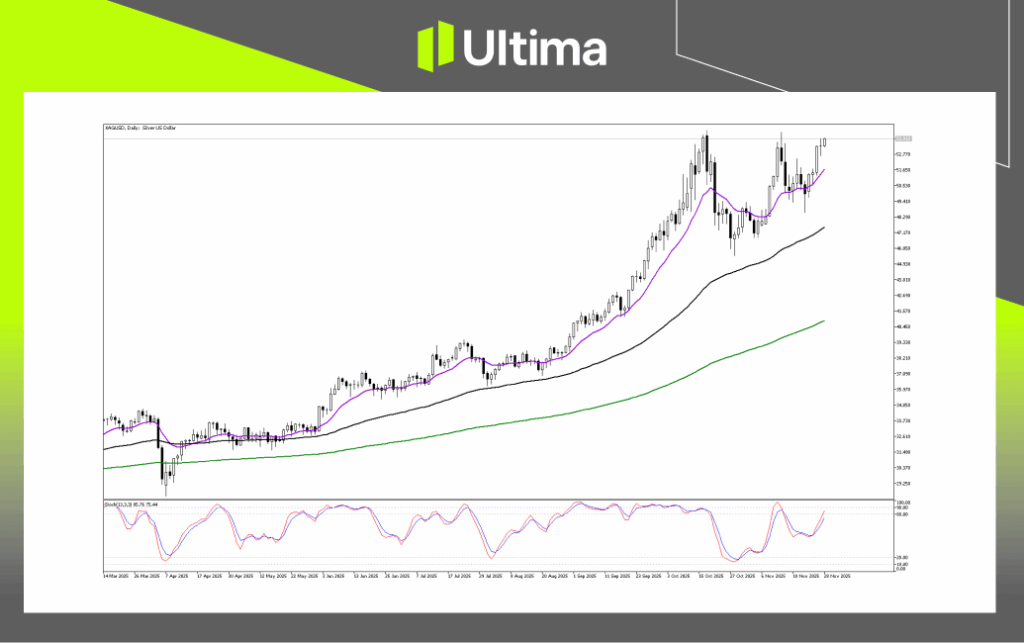

Silver Approaches a Make-or-Break Test at $54

The daily chart shows a firmly bullish structure. The early November pullback flushed out weaker positions, paving the way for a momentum-backed climb. Price is now pressing against the $53.91 breakout barrier. While buyers hold the advantage, it remains wide to wait for a clean daily close above $54 to avoid getting caught in a potential Double Top reversal.

Key Levels

The primary resistance zone lies between $53.91 and $54.10, aligning with the mid-October wick. A decisive daily close above this range would confirm a breakout. If price pushes through $54, the next upside objectives fall near the psychological $55 to $56 region, supported by Fibonacci extension targets as silver moves into price discovery.

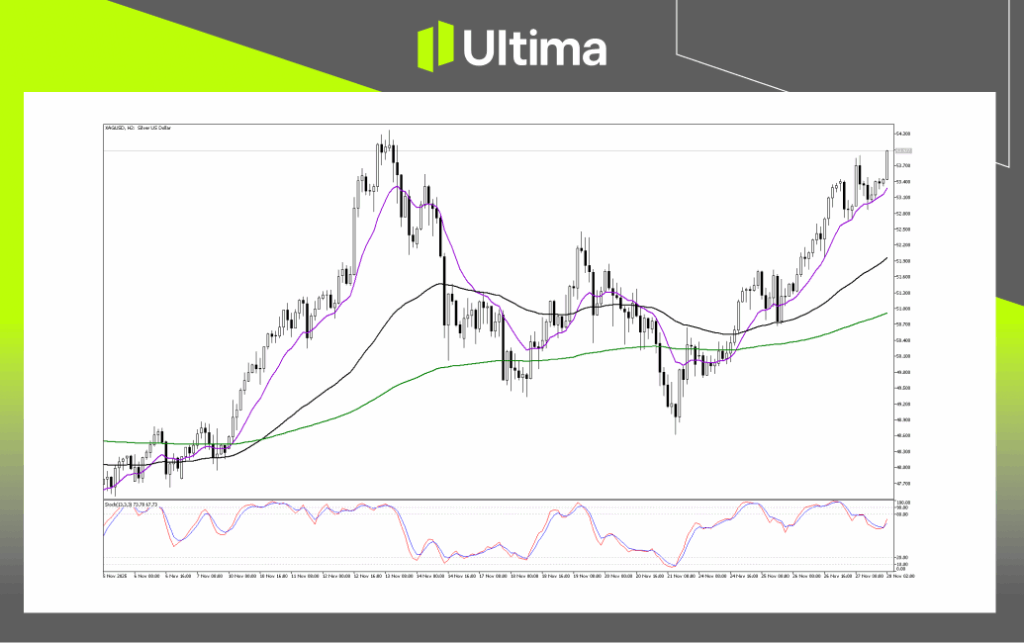

Short-term Buyers Return as Silver Resets for Another Push

The moving averages confirm strong upward momentum. The purple fast line has crossed above the black medium line, and both continue to trade above the green slow line. Price is riding the purple average as dynamic support, showing firm and active buying. The Stochastic sits around 73 and is climbing after bouncing off the 50 mid-line without dipping into oversold levels. This "bullish shuffle" reset signals buyers stepping back in before momentum fades.

Breakout Scenarios

A bullish breakout forms if price pushes through the $54 ceiling, with confirmation coming from an H2 close above $54.10, continued support from the purple moving average, and Stochastics holding above 80. This setup targets $55 first, with room for extension if volume strengthens. A bearish pullback activates if price rejects $54 and closes below the purple average near $53, alongside Stochastics turning down from 80 toward 50. In this case, price would likely revisit the black moving average around $51.9 as a mean reversion target unless that level fails.

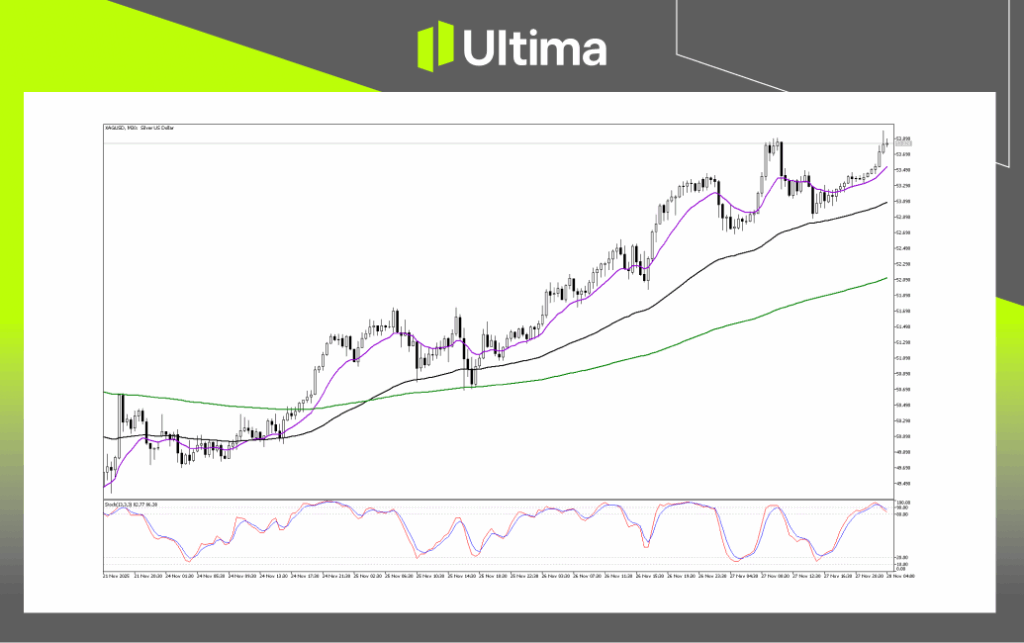

Silver's Next Pivot Move

The M30 chart continues to show a solid uptrend as price retests the highs. Although the overbought oscillator signals caution against buying the very top, the moving average structure indicates that pullbacks toward $53.4 should attract support, keeping the broader bias pointed upward.

Bullish Continuation

For continued upside momentum, price is pressing against the $53.9 zone. A confirmed M30 close above this level acts as the breakout trigger. Stochastics holding flat in the 90-100 range would reinforce strong trend continuation. This move would likely draw momentum buyers, with initial targets at $54.25 and then $54.5.

“Buy the Dip” Retracement

Given the stretched Stochastics, the market may briefly ease lower to gather liquidity. A drift toward the purple moving average around $53.4 forms the setup, with confirmation coming from long-tailed rejection wicks showing buyers defending the level. This typically offers a high-probability trend-following entry, aiming for a return to the $53.9 highs.

Short-Term Reversal

A reversal takes shape if price breaks below the purple moving average and fails to reclaim it. The trigger is a strong bearish M30 close below $52.90 at the black moving average. This would indicate intraday momentum has flipped, opening the door to a deeper connection toward the green moving average near $52.10.

Navigating the Forex Market with Ultima Markets

Whether you're new to trading or already have some experience, navigating the world of forex, commodities, indices, and shares can feel overwhelming. That's why staying informed and making data-driven decisions is key to performing well in the financial markets. Ultima Markets is committed to delivering clear and timely insights that support your trading journey. If you need guidance tailored to your financial situation, our team is here to assist.

Join Ultima Markets and explore a trading ecosystem designed to help you grow with confidence. More expert updates and market analyses are on the way from the Ultima Markets team.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.