Edit Your Comment

EUR/USD

May 01, 2015 at 17:12

Miembro desde Jun 07, 2011

posts 372

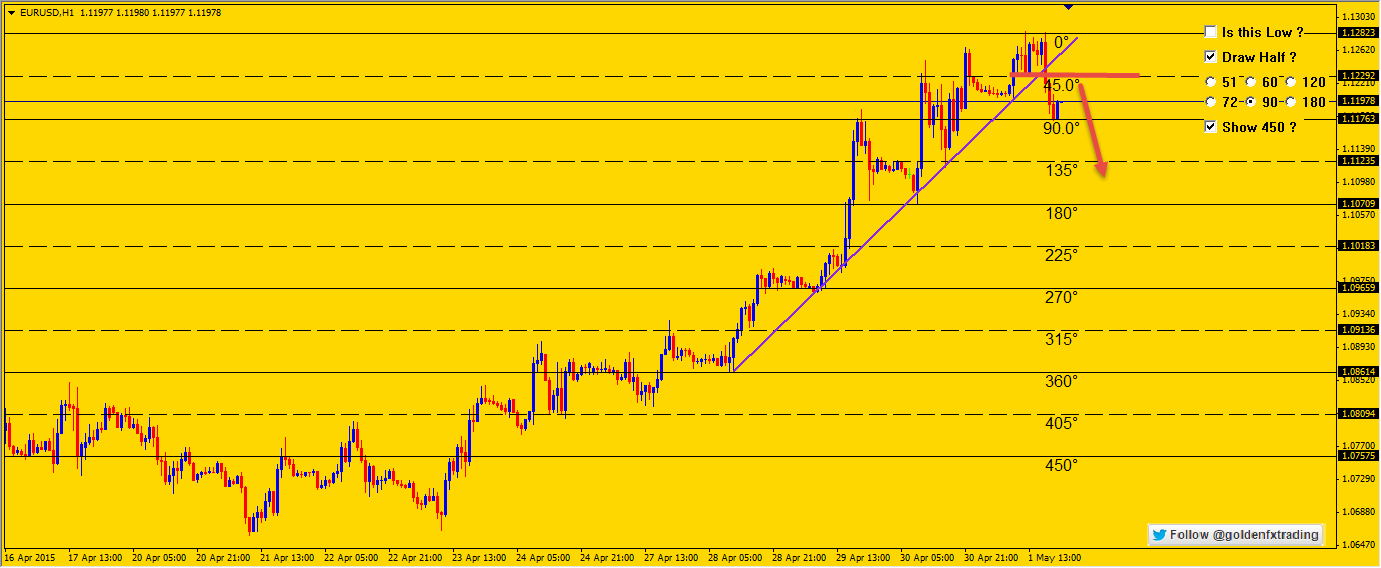

EUR / USD continued its ascent on Thursday and managed to reach the critical line of resistance 1.1260.

The short term trend remains positive.

In the momentum of studies, the RSI rose from its overbought zone and seems prepared to cross below 70.

MACD rose and could soon fall below the signal line.

On the daily chart, the break above 1.1045 marked the conclusion of a possible training 'double bottom' something that could represent bullish implications wider.

The short term trend remains positive.

In the momentum of studies, the RSI rose from its overbought zone and seems prepared to cross below 70.

MACD rose and could soon fall below the signal line.

On the daily chart, the break above 1.1045 marked the conclusion of a possible training 'double bottom' something that could represent bullish implications wider.

Miembro desde Apr 22, 2015

posts 11

May 02, 2015 at 09:20

Miembro desde Apr 22, 2015

posts 11

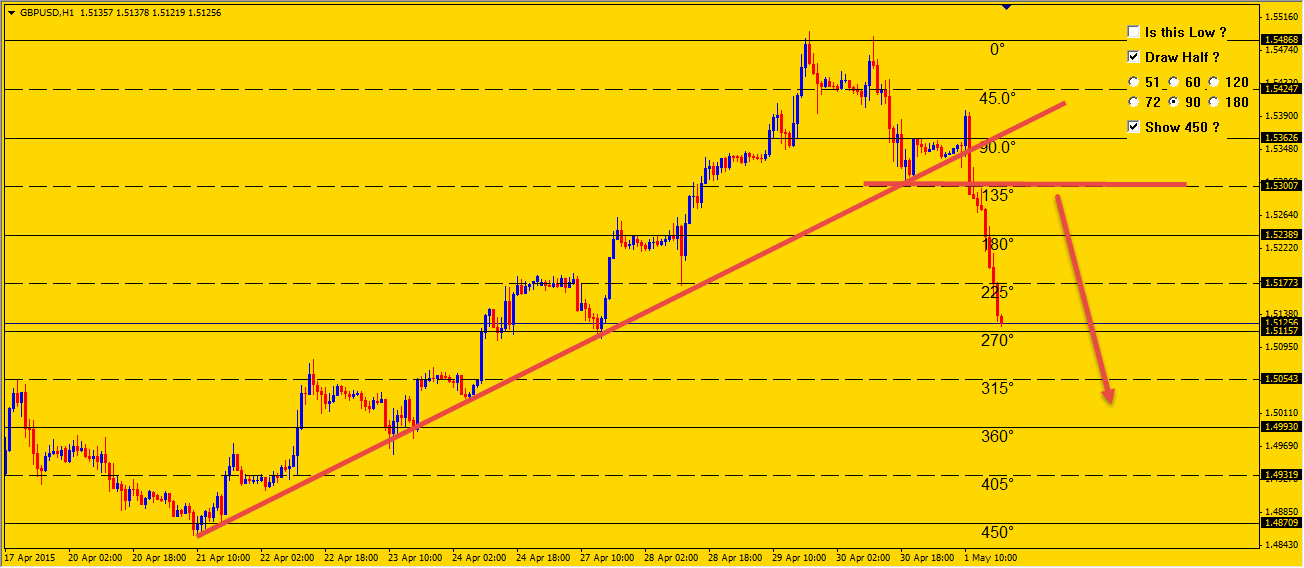

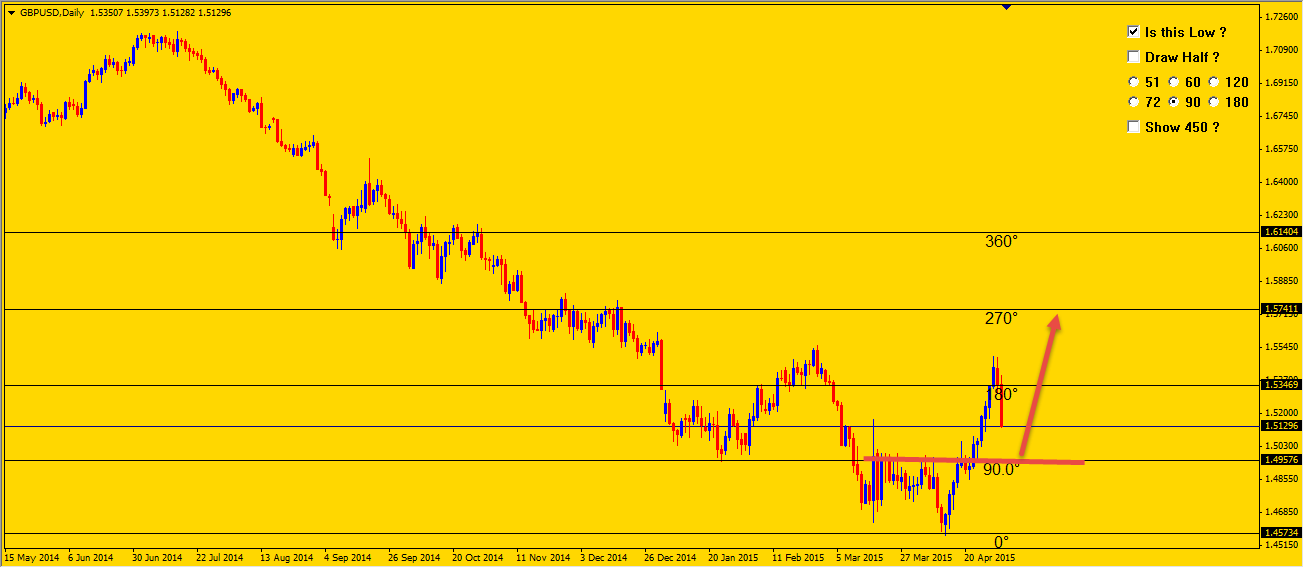

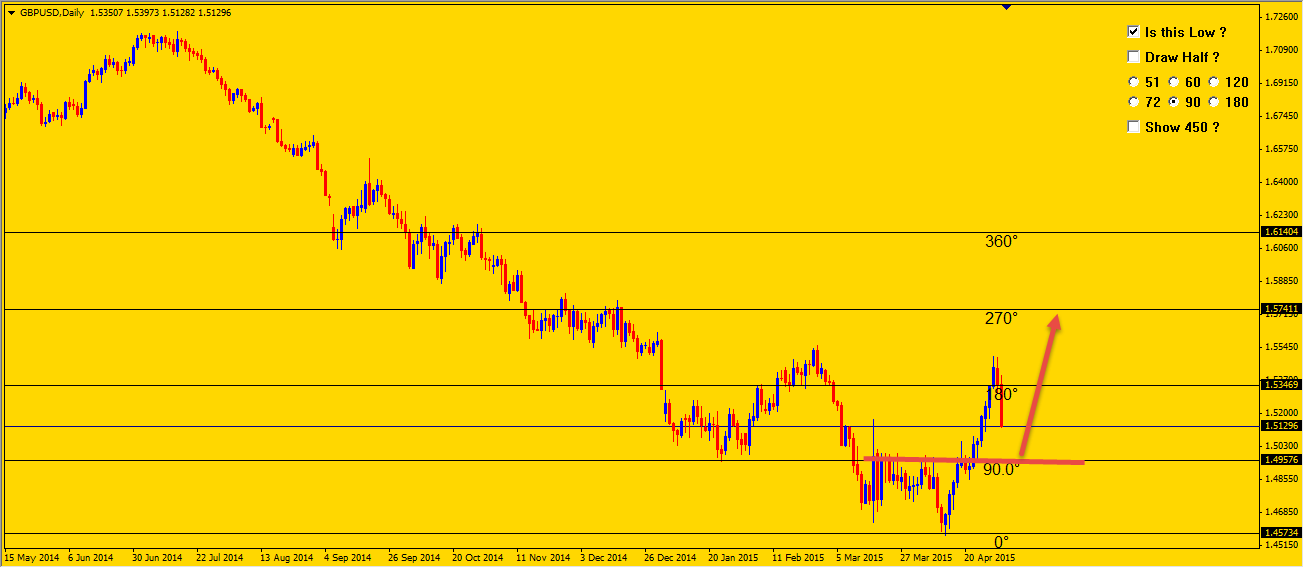

Nice call on short GBPUSD Crazy, long below 1.50 is very good setup for next or short again 1.53 if it goes there.

https://twitter.com/goldenfxtrading/status/594171082552180736/photo/1

https://twitter.com/goldenfxtrading/status/594171082552180736/photo/1

May 02, 2015 at 10:21

Miembro desde Apr 14, 2013

posts 1

Agreed and I am long EURUSD accordingly. My only concern is that we are the top of an ascending channel and I think between Mon and Wed we may see some dips, so watch your stops people it might be a bumpy ride. Of course the big event for next is the NFP data on Friday, that will determine the next few weeks of trading range for EURUSD.

I got stopped out many times this last month trying to get on a EURUSD north course and I could really use some payback. The anticipation of a June rate hike really seemed to mesmerize a lot of traders lately and now that June is kind of out of the cards we should see a lot of corrective movement for this pair, 1.15 seems pretty likely if Fridays NFP doesn't meet expectations.

I got stopped out many times this last month trying to get on a EURUSD north course and I could really use some payback. The anticipation of a June rate hike really seemed to mesmerize a lot of traders lately and now that June is kind of out of the cards we should see a lot of corrective movement for this pair, 1.15 seems pretty likely if Fridays NFP doesn't meet expectations.

Greed is death, it's all about risk management.

Miembro desde Nov 21, 2011

posts 1718

May 02, 2015 at 10:32

Miembro desde Nov 21, 2011

posts 1718

goldenfxtrading posted:

Nice call on short GBPUSD Crazy, long below 1.50 is very good setup for next or short again 1.53 if it goes there.

Thx.

Yes, I'm looking to buy on 1.50 area if it holds.

Miembro desde Jun 08, 2014

posts 454

May 03, 2015 at 20:01

Miembro desde Apr 09, 2014

posts 834

Gnudarve posted:

Agreed and I am long EURUSD accordingly. My only concern is that we are the top of an ascending channel and I think between Mon and Wed we may see some dips, so watch your stops people it might be a bumpy ride. Of course the big event for next is the NFP data on Friday, that will determine the next few weeks of trading range for EURUSD.

I got stopped out many times this last month trying to get on a EURUSD north course and I could really use some payback. The anticipation of a June rate hike really seemed to mesmerize a lot of traders lately and now that June is kind of out of the cards we should see a lot of corrective movement for this pair, 1.15 seems pretty likely if Fridays NFP doesn't meet expectations.

You are right, NFP will be the main focus next week.

Miembro desde Oct 11, 2013

posts 775

Miembro desde Apr 08, 2014

posts 1141

May 04, 2015 at 08:35

Miembro desde Apr 08, 2014

posts 1141

EURUSD initially rose but found enough resistance at 1.1237 to give all its early gains and closed in the red near the low of the day, suggesting a shooting star pattern. We may see a pullback off this recent bullish move to 1.1034 before another move upward.

"I trade to make money not to be right."

May 04, 2015 at 14:14

Miembro desde Jun 07, 2011

posts 372

EUR / USD retreated after meeting resistance slightly above the main resistance 1.1260 line.

The short-term outlook is positive but needs a clear close above this zone to give confidence on the rise.

Studies of momentum, recommend caution.

The RSI left the overbought territory and the MACD rose and fell below its signal line.

There are also negative divergence between RSI and price action.

The short-term outlook is positive but needs a clear close above this zone to give confidence on the rise.

Studies of momentum, recommend caution.

The RSI left the overbought territory and the MACD rose and fell below its signal line.

There are also negative divergence between RSI and price action.

Miembro desde Jun 08, 2014

posts 454

Miembro desde Jul 10, 2014

posts 1117

May 04, 2015 at 18:35

Miembro desde Jul 10, 2014

posts 1117

Initially I thought that EUR/USD has broken above the resistance at 1.1260, but apparently that was not the case. The pair has formed a shooting star and a marubozu candlestick on the daily filter chart and will likely move to the downside again.

Miembro desde Apr 08, 2014

posts 1141

May 05, 2015 at 08:42

Miembro desde Apr 08, 2014

posts 1141

On yesterday session EURUSD initially tried to rally but found strong selling pressure at Friday’s open to turn around and close near the low of the day. The bearish correction is underway with the next stop at 1.1034 if it holds.

"I trade to make money not to be right."

Miembro desde Oct 08, 2011

posts 137

May 05, 2015 at 10:36

Miembro desde Oct 08, 2011

posts 137

EUR/USD daily chart

As I have mentioned last week, after a major entry formation, a trend confirmation hook is required (some call it continuation hook).

Monday's bar failed to trade to a higher high than Friday's bar and therefore made the high from Friday a hook entry.

Many institutional traders use this entry as their first trade.

Place a buy-stop order 1 pip above the high from Friday (ask price)

The high from yesterday can be traded in the same fashion as an early entry.

Should today's high stay below the high from yesterday, it can be used as an entry as well.

Since Friday's bar traded into the first cavity stop already, the next target should be near 1.1450 and later near 1.1530

Any hook creates price-consolidation and therefore cannot consist of more than 9 bars.

The 10th bar is the last to break.

Today's bar is nr. 4 in the consolidation.

As I have mentioned last week, after a major entry formation, a trend confirmation hook is required (some call it continuation hook).

Monday's bar failed to trade to a higher high than Friday's bar and therefore made the high from Friday a hook entry.

Many institutional traders use this entry as their first trade.

Place a buy-stop order 1 pip above the high from Friday (ask price)

The high from yesterday can be traded in the same fashion as an early entry.

Should today's high stay below the high from yesterday, it can be used as an entry as well.

Since Friday's bar traded into the first cavity stop already, the next target should be near 1.1450 and later near 1.1530

Any hook creates price-consolidation and therefore cannot consist of more than 9 bars.

The 10th bar is the last to break.

Today's bar is nr. 4 in the consolidation.

"a little bit of knowledge is a dangerous thing"

May 05, 2015 at 13:28

Miembro desde Jun 07, 2011

posts 372

Given the recent momentum of the EUR / USD, we can not rule out the typical 'throw back' to the new support zone (1.10300 to 1.10500).

It is time to put a stop gains!

We will continue to keep the bullish positions in the euro, with a stop (on closing prices) under $ 1.10. While the stop is not triggered, we can not rule out that return to the resistance zone which has the maximum February to $ 1.15340.

It is time to put a stop gains!

We will continue to keep the bullish positions in the euro, with a stop (on closing prices) under $ 1.10. While the stop is not triggered, we can not rule out that return to the resistance zone which has the maximum February to $ 1.15340.

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.