Edit Your Comment

Do you think you can turn $200 into $400 in six weeks?

Miembro desde Apr 14, 2013

posts 402

Jun 17, 2014 at 23:58

Miembro desde Apr 14, 2013

posts 402

CodeMonkey posted:

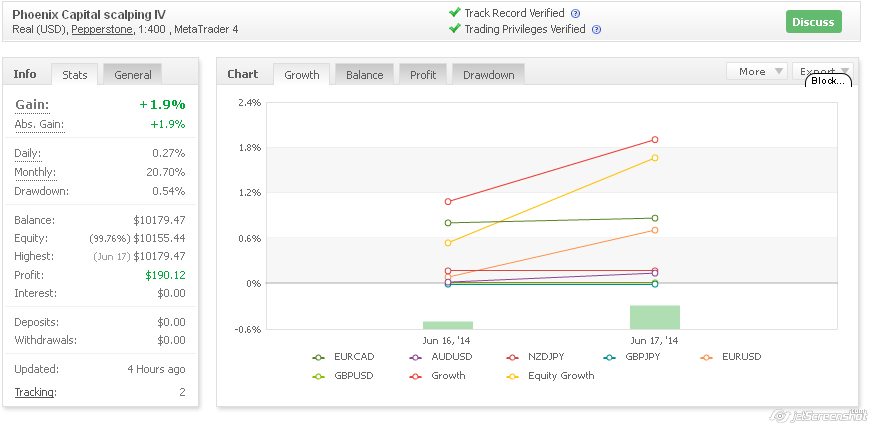

YOUR growth from monday session until now.

MY growth from monday session from now.

I've refrained from arguing with you because it is pointless, and we're suppose to be trading.

So please do so, and just stop arguing.

No one is arguing. I'm simply looking at your trades, and leaving my comments on it. That's all. As for claiming I don't understand it. It is as simple as opening a chart. I can see EVERYTHING you've done, and your silly block orders proves that you are trading using support and resistance.

Focus on pip-drawdown

Miembro desde Aug 19, 2013

posts 182

Miembro desde Aug 19, 2013

posts 182

Miembro desde Apr 14, 2013

posts 402

Jun 18, 2014 at 00:00

Miembro desde Apr 14, 2013

posts 402

CodeMonkey posted:

Yes ok. One trade. Sure. You could easily open one big trade and put me out.

As I said, you have twice the account I have.

If you can put me out. Do it then.

Less LIP more PIP.

Not to worry, it will come soon enough, and stop b!tching about who has more capital then the other. Please it is getting rather dry. Since the market is dull right now, this is the perfect time to look at your trades.

Focus on pip-drawdown

Miembro desde Aug 19, 2013

posts 182

Jun 18, 2014 at 00:03

Miembro desde Aug 19, 2013

posts 182

Ok the markets are dead right now so then please by all means...

Give me a detailed breakdown of my trading strategy.....

I'm listening.... Tell me exactly how and why I am trading this way.

(NO ONE ELSE PLEASE. Thank you.)

Give me a detailed breakdown of my trading strategy.....

I'm listening.... Tell me exactly how and why I am trading this way.

(NO ONE ELSE PLEASE. Thank you.)

Viva La Puerto Rico!

Miembro desde Apr 14, 2013

posts 402

Jun 18, 2014 at 00:06

Miembro desde Apr 14, 2013

posts 402

Have a look at this everyone. He has almost 100 usd in floating loss, and a total of over - 1000 pips in the last 2 trading days in floating loss. Doesn't appear as thought your support and resistance is doing to well. Oh by the way guys, this is how people manipulate the ' net pip' stat. So instead of placing .05 lots for EUR/NZD he then places 5 .01 orders. So say EUR/NZD losses 20 pips since he entered, it will show as a 100 pip loss since he has 5 separate orders, compared to just placing 1 .05 order in which it would simply be a 20 pip loss if it dropped against him 20 pips................ Those are little things noobs due to make their stats look better then what it is. I can't wait to see if this noob cake stops trading, or keeps adding to his big time floating loss.

Focus on pip-drawdown

Miembro desde Apr 14, 2013

posts 402

Jun 18, 2014 at 00:07

Miembro desde Apr 14, 2013

posts 402

CodeMonkey posted:

Ok the markets are dead right now so then please by all means...

Give me a detailed breakdown of my trading strategy.....

I'm listening.... Tell me exactly how and why I am trading this way.

(NO ONE ELSE PLEASE. Thank you.)

You may want to scroll up noob cake. I already mentioned WHAT AND HOW you are doing it.

Focus on pip-drawdown

Miembro desde Apr 14, 2013

posts 402

Jun 18, 2014 at 00:18

Miembro desde Apr 14, 2013

posts 402

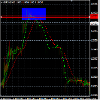

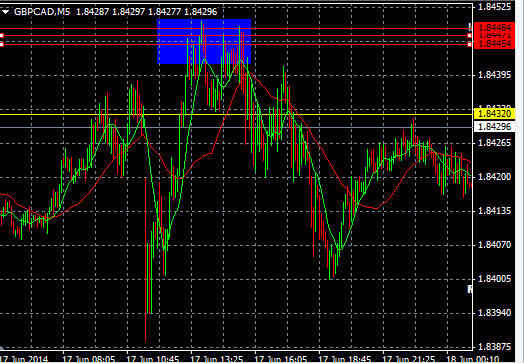

Here is one last example.

Have a look at code monkies OPEN TRADES. Do you see his gbp/CAD order, and how many trades he has placed? Well look at this chart, this is where he placed the orders to BUY. Of course he was wagering that the price would rocket past the'last resistance', only for it to have failed......

Have a look at code monkies OPEN TRADES. Do you see his gbp/CAD order, and how many trades he has placed? Well look at this chart, this is where he placed the orders to BUY. Of course he was wagering that the price would rocket past the'last resistance', only for it to have failed......

Focus on pip-drawdown

Miembro desde Apr 14, 2013

posts 402

Jun 18, 2014 at 00:20

Miembro desde Apr 14, 2013

posts 402

Here is the second to last time the same currency was at the same level....

You can clearly see his orders from today were based on the accumulation + resistance which GBP/CAD had at the price displayed. So now noobmonkey you're going to tell me you aren't wagering onsupport and resistance?

You can clearly see his orders from today were based on the accumulation + resistance which GBP/CAD had at the price displayed. So now noobmonkey you're going to tell me you aren't wagering onsupport and resistance?

Focus on pip-drawdown

Miembro desde Aug 19, 2013

posts 182

Jun 18, 2014 at 00:22

(editado Jun 18, 2014 at 00:23)

Miembro desde Aug 19, 2013

posts 182

Master_Kiwa posted:

Have a look at this everyone. He has almost 100 usd in floating loss, and a total of over - 1000 pips in the last 2 trading days in floating loss.

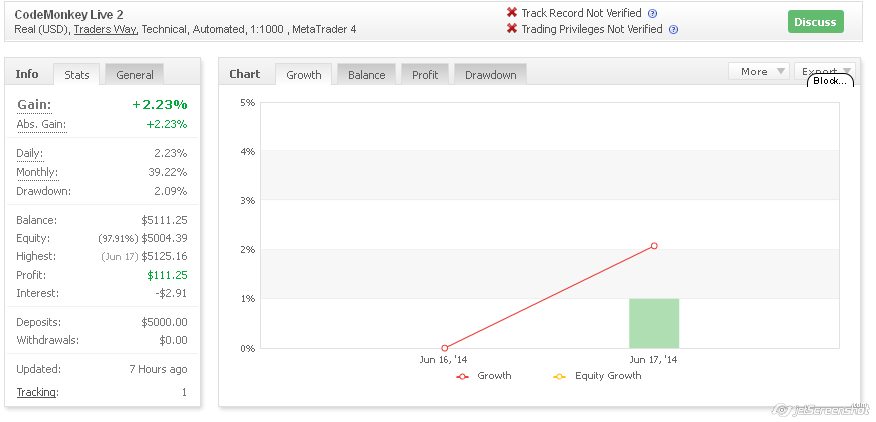

My stats are.

Gain: +2.23%

Abs. Gain: +2.23%

Daily: 1.11%

Monthly: 38.86%

Drawdown: 2.09%

Balance: $5111.25

Equity: (97.91%) $5004.39

Highest: (Jun 17) $5125.16

Profit: $111.25

Your stats are.

Abs. Gain: +1.9%

Daily: 0.24%

Monthly: 15.12%

Drawdown: 0.54%

Balance: $10179.47

Equity:(99.76%) $10155.44

Highest: (Jun 17) $10179.47

Profit: $190.12

My daily percentage gains are almost 5 times yours.

My monthly percentage gains are over twice yours.

The point is about percentage gains.

Master_Kiwa posted:

Doesn't appear as thought your support and resistance is doing to well. Oh by the way guys, this is how people manipulate the ' net pip' stat.

I am not manipulating anything. I am properly protecting my account using a method you don't understand.

Master_Kiwa posted:

So instead of placing .05 lots for EUR/NZD he then places 5 .01 orders. So say EUR/NZD losses 20 pips since he entered, it will show as a 100 pip loss since he has 5 separate orders, compared to just placing 1 .05 order in which it would simply be a 20 pip loss if it dropped against him 20 pips................

That has exactly 0.00% of accuracy as to why I am doing my trades this way.

keep trying....

Master_Kiwa posted:

Those are little things noobs due to make their stats look better then what it is. I can't wait to see if this noob cake stops trading, or keeps adding to his big time floating loss.

Keep talking. It's irrelevant to me if you think me a noob.

You don't understand what is being done, and you're making it clear you don't.

So yeah. Just keep talking. Fine with me.

Viva La Puerto Rico!

Miembro desde Apr 14, 2013

posts 402

Jun 18, 2014 at 00:26

Miembro desde Apr 14, 2013

posts 402

CodeMonkey posted:Master_Kiwa posted:

Have a look at this everyone. He has almost 100 usd in floating loss, and a total of over - 1000 pips in the last 2 trading days in floating loss.

My stats are.

Gain: +2.23%

Abs. Gain: +2.23%

Daily: 1.11%

Monthly: 38.86%

Drawdown: 2.09%

Balance: $5111.25

Equity: (97.91%) $5004.39

Highest: (Jun 17) $5125.16

Profit: $111.25

Your stats are.

Abs. Gain: +1.9%

Daily: 0.24%

Monthly: 15.12%

Drawdown: 0.54%

Balance: $10179.47

Equity:(99.76%) $10155.44

Highest: (Jun 17) $10179.47

Profit: $190.12

My daily percentage gains are almost 5 times yours.

My monthly percentage gains are over twice yours.

The point is about percentage gains.Master_Kiwa posted:

Doesn't appear as thought your support and resistance is doing to well. Oh by the way guys, this is how people manipulate the ' net pip' stat.

I am not manipulating anything. I am properly protecting my account using a method you don't understand.Master_Kiwa posted:

So instead of placing .05 lots for EUR/NZD he then places 5 .01 orders. So say EUR/NZD losses 20 pips since he entered, it will show as a 100 pip loss since he has 5 separate orders, compared to just placing 1 .05 order in which it would simply be a 20 pip loss if it dropped against him 20 pips................

That has exactly 0.00% of accuracy as to why I am doing my trades this way.

keep trying....Master_Kiwa posted:

Those are little things noobs due to make their stats look better then what it is. I can't wait to see if this noob cake stops trading, or keeps adding to his big time floating loss.

Keep talking. It's irrelevant to me if you think me a noob.

You don't understand what is being done, and you're making it clear you don't.

So yeah. Just keep talking. Fine with me.

Oh great so now you want to compare AVG's based on your 1 day worth of trading. Well let's see where it will stand up after tomorrows trading. :) As for you 'protecting your trades' I have no idea how you can be doing such a thing when you are trading with 0 sl and your not counter trading your float losses. Oh well...... time for me to take a nap. See you during London.

Focus on pip-drawdown

Miembro desde Aug 19, 2013

posts 182

Jun 18, 2014 at 00:31

Miembro desde Aug 19, 2013

posts 182

And all discussions aside, please set the start date properly on your contest stats page, so it shows the proper data.

You should have it showing from Monday session, because otherwise you are showing gains on your account which are outside of this challenge.

Thank you.

You should have it showing from Monday session, because otherwise you are showing gains on your account which are outside of this challenge.

Thank you.

Viva La Puerto Rico!

Miembro desde Apr 14, 2013

posts 402

Miembro desde Aug 19, 2013

posts 182

Jun 18, 2014 at 00:37

Miembro desde Aug 19, 2013

posts 182

Oh great so now you want to compare AVG's based on your 1 day worth of trading.

That's what the challenge is about. Percentage gains RIGHT? And NOOB this is the second day of trading already

Sun->Mon

Mon->Tue

Yep two days.

Well let's see where it will stand up after tomorrows trading. :)

Let's see where we are in two weeks. How about that?

As for you 'protecting your trades' I have no idea how you can be doing such a thing when you are trading with 0 sl and your not counter trading your float losses.

You're finally being truthful about one thing! You have no idea how I am trading.

THANK YOU.

That's what I've been saying all along.

Oh well...... time for me to take a nap. See you during London.

OH? Will it be another BIG night for you like last night? Pretty sure you said something about london last night too.

What happened? Oh thats right. NOTHING.

Keep talking. I'll just keep trading.

Viva La Puerto Rico!

Miembro desde Aug 19, 2013

posts 182

Jun 18, 2014 at 06:57

Miembro desde Jan 01, 2013

posts 126

@CrazyTrader I totally agree with your analysis... and I can back it up with EW counts.. it is only a matter of time for the EUR/USD to return @1.3680 (at least)... in other words it is a great buy now...

@Master_Kiwa Just because you feel more comfortable entering and exiting trades almost immediately, while you are uncomfortable of holding a losing trade, it doesn't mean that swing trading is bad! Believe me, being patient pays out in the end...

As long as you can identify the trend, you can ride it and get 100+ pips in a single trade, paying a lot less in commissions!!! In the meantime you can still scalp by buying weakness in uptrends and selling strength in downtrends...

There is nothing wrong being in red (as you call it) for 99% of the time, as long as there is a very specific and meaningful stop loss in place!

On the other hand.... I cannot really say that your trading style is scalping...

you currently hold 2 EURUSD losing positions, since 16.06.2014....

https://www.myfxbook.com/members/Master_Kiwa/phoenix-capital-scalping-iv/944495

what kind of scalper holds positions for days???

@Master_Kiwa Just because you feel more comfortable entering and exiting trades almost immediately, while you are uncomfortable of holding a losing trade, it doesn't mean that swing trading is bad! Believe me, being patient pays out in the end...

As long as you can identify the trend, you can ride it and get 100+ pips in a single trade, paying a lot less in commissions!!! In the meantime you can still scalp by buying weakness in uptrends and selling strength in downtrends...

There is nothing wrong being in red (as you call it) for 99% of the time, as long as there is a very specific and meaningful stop loss in place!

On the other hand.... I cannot really say that your trading style is scalping...

you currently hold 2 EURUSD losing positions, since 16.06.2014....

https://www.myfxbook.com/members/Master_Kiwa/phoenix-capital-scalping-iv/944495

what kind of scalper holds positions for days???

Miembro desde Nov 21, 2011

posts 1718

Jun 18, 2014 at 07:10

Miembro desde Nov 21, 2011

posts 1718

There are so many things that this guy can't get like 'shut up and trade', '2 weeks anticipation', 'Swing style'....

All he knows it's 'Noob cake', 'pip drawdown theory' since Myfxbook has created this tool! Lol...

=> What could have been his super therory before they developped it. Mouhahha

=> Imagine they take it off one day! he will explose like the Big bang theory.

All he knows it's 'Noob cake', 'pip drawdown theory' since Myfxbook has created this tool! Lol...

=> What could have been his super therory before they developped it. Mouhahha

=> Imagine they take it off one day! he will explose like the Big bang theory.

Miembro desde Apr 14, 2013

posts 402

Jun 18, 2014 at 12:18

Miembro desde Apr 14, 2013

posts 402

dchara01 posted:

@CrazyTrader I totally agree with your analysis... and I can back it up with EW counts.. it is only a matter of time for the EUR/USD to return @1.3680 (at least)... in other words it is a great buy now...

@Master_Kiwa Just because you feel more comfortable entering and exiting trades almost immediately, while you are uncomfortable of holding a losing trade, it doesn't mean that swing trading is bad! Believe me, being patient pays out in the end...

As long as you can identify the trend, you can ride it and get 100+ pips in a single trade, paying a lot less in commissions!!! In the meantime you can still scalp by buying weakness in uptrends and selling strength in downtrends...

There is nothing wrong being in red (as you call it) for 99% of the time, as long as there is a very specific and meaningful stop loss in place!

On the other hand.... I cannot really say that your trading style is scalping...

you currently hold 2 EURUSD losing positions, since 16.06.2014....

https://www.myfxbook.com/members/Master_Kiwa/phoenix-capital-scalping-iv/944495

what kind of scalper holds positions for days???

Well Mr. Swinger trader If you dont see accuracy as somethig which is important then I guess its not important then... Well to you that is. As for myself I can consider myself a scalper. My trades reveal that especially of my accuracy in over 70% of my trades. Patients is what kills in forex. It creates bias which is the leading cause of a decreasing account value.

You say its 'ok to be in' because the price 'will eventually come back'. Well ask the people who bought EU at 1.39** right before this massive drop. Will EUR go back up, only price action will tell. No indicator could ever tell yes or no. which would make Time a very important factor in determining if a position is a dud or not. Simply using small lots doesn't equate to good money management. It only reveals that you have a system which you don't trust.

P.S. Please stop talking about the commission a broker makes from you trading. The commission is a small % of wha you actually earn anyway.

Focus on pip-drawdown

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.