AI selloff sinks Nvidia ahead of tech earnings, dollar bounces back

DeepSeek triggers alarm about AI spending

Tech stocks heavily invested in artificial intelligence (AI) sunk on Monday after the emergence of China’s answer to ChatGPT led investors to question the sky-high valuations for Wall Street’s AI darlings that have driven much of the rally in equities over the past year.

DeepSeek, a Chinese startup that has developed its own AI model to rival US ones such as OpenAI, came into the spotlight after its app flew to the top of Apple’s and Google’s app stores, displacing ChatGPT. The sudden popularity of DeepSeek is a worry for US tech giants, which until recently have dominated the global AI landscape, not only because of the competition it poses, but probably even more so of the fact that it was developed at a fraction of the cost using cheaper and older-technology chips.

If a Chinese-based startup is able to build AI models that match the performance of the current industry leaders, that’s a major concern for the likes of Microsoft and Alphabet, which have poured billions to stay ahead in the AI race. But more importantly, it’s a blow for AI king Nvidia, whose advanced processors were until now seen to be indispensable for building sophisticated AI platforms.

AI valuations under scrutiny

Some may see this is as a much-needed reality check for investors who have emphatically pushed tech valuations to extortionate levels. However, it may also act as a wake-up call for Western developers as the intensifying competition could speed up the advances within the AI field and potentially lower costs.

Moreover, even if DeepSeek and other smaller rivals manage to keep the pressure on US tech behemoths, it will be difficult for Chinese companies to gain a complete advantage with all the restrictions on chip exports that Washington has in place right now. Hence, it remains to be seen whether yesterday’s panic that sparked the biggest selloff in chip stocks since March 2020 was an overdue correction or the start of a bigger downtrend.

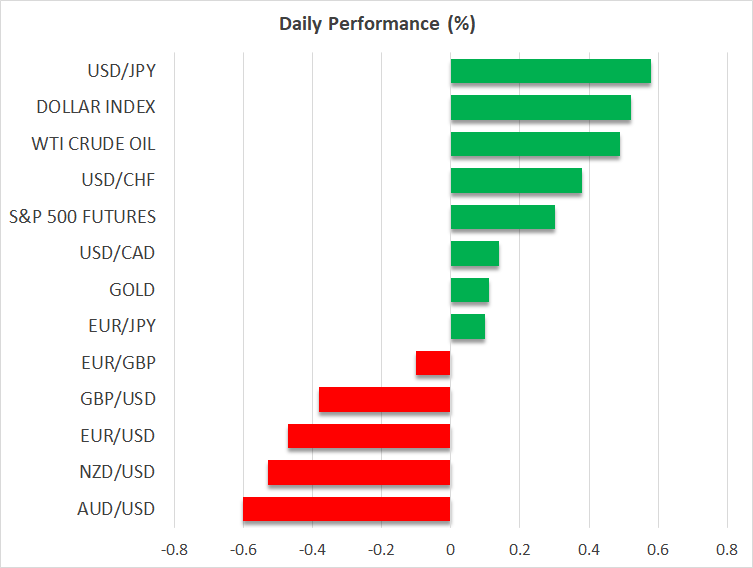

Nvidia’s stock plummeted by 17%, shaving $589 billion from the company’s valuation. Oracle and AMD stocks also fell sharply, followed by Alphabet and Microsoft, although Apple managed to rally. There seems to have been some rotation into value stocks, which includes tech stocks less driven by AI.

It also explains why the Dow Jones gained 0.65% even as the Nasdaq 100 lost almost 3.0%. US futures are edging higher today and European stocks are in the green too, suggesting a calmer mood.

There could be more volatility in store

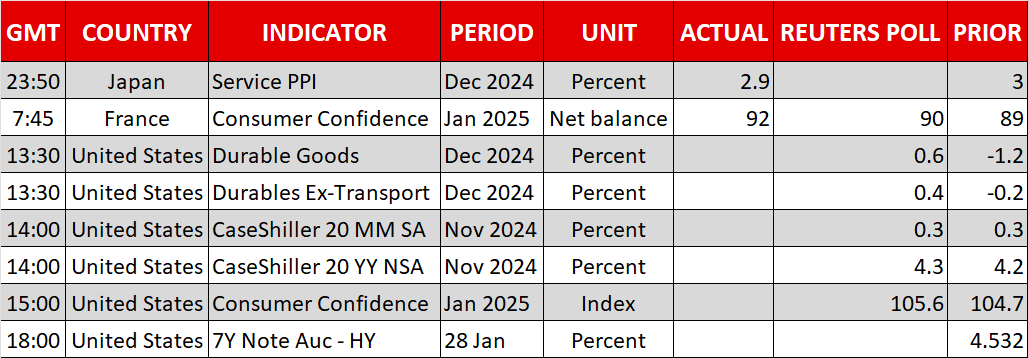

However, it may not be long before there’s another spike in volatility as the earnings season will get into full gear on Wednesday with Microsoft, Tesla and Facebook parent Meta Platform all due to report. In addition, both the Bank of Canada and Federal Reserve announce their latest policy decisions tomorrow, with the ECB continuing the central bank theme on Thursday.

It’s possible that the AI jitters have put markets in a more vulnerable state ahead of these crucial events. Any disappointment in tech earnings or unwavering hawkishness by the Fed could trigger another round of selloff in equity markets.

Tariff risks could be aiding dollar’s rebound

The Trump administration is talking tariffs again, adding to the sense of caution. US Treasury Secretary Scott Bessent is reportedly pushing for tariffs of 2.5% on all US imports, to gradually be lifted to 20%. President Trump later suggested that any tariffs would be “much bigger” than 2.5% and also revealed that Microsoft is in talks to buy Chinese-owned TikTok.

This throws out the window any hope that Trump has gone soft on China or that he’s not serious about high tariffs, and this is supporting safe-haven currencies like the US dollar, which is recovering today, while the yen and Swiss franc are slightly off from yesterday’s highs.

However, gold doesn’t appear to have benefited at all from the risk-off moves of the past 24 hours and Bitcoin was also hammered yesterday, although it’s since bounced back.