Bitcoin pushes cryptos upwards

Market picture

The crypto market reached a capitalisation of $1.82 trillion in the early hours of trading on Monday. By the early European session, it had corrected to $1.8 trillion, but this is still more than 10% above the levels of a week earlier.

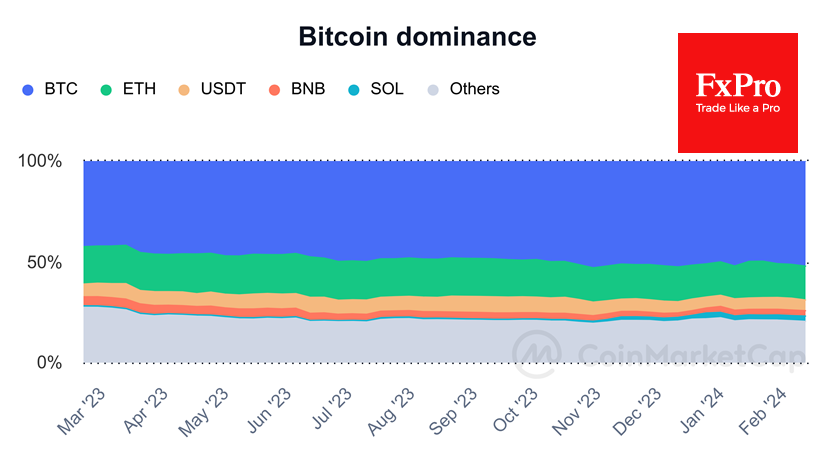

Bitcoin remains the most crucial growth driver, adding 12% in 7 days against about 8% for Ethereum, Solana, and Cardano - important drivers of the current cycle. Bitcoin now accounts for 52.6% of the entire crypto market, adding more than ten percentage points over the year and 1.5p. p. over the month.

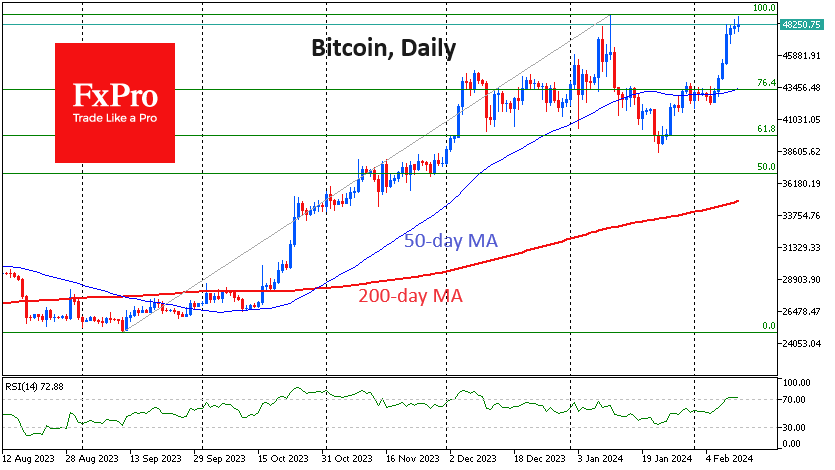

Bitcoin posted its seventh consecutive day of gains, but the strengthening slowed over the weekend. It also coincided with a move above 70 on the RSI on the daily timeframes, which could increase players' appetite for short-term profit-taking. Caution is also building as we approach the January peak. Bulls have clearly become more cautious, closing the week at the highest since December 2021.

News background

According to The Block, a month after launch, assets in the top nine spot bitcoin-ETFs exceeded 200,000 BTC ($9.5bn). The new bitcoin ETFs climbed to second place in the ranking of commodity exchange-traded funds in the US by assets, becoming a more popular investment vehicle than silver ETFs.

At the same time, the assets of Grayscale's GBTC fund have declined by 25% since 11 January, and in terms of trading volume, it has lost the lead to BlackRock's bitcoin ETF.

BlackRock, one of the largest investment companies in the US, plans to add more bitcoins to its investment portfolio. BlackRock now has 82,515 BTC on its balance sheet, worth about $4 billion. Interest in Bitcoin among investors remains high, according to the investment company's management.

Bankrupt cryptocurrency lender Genesis Global Trading has settled a lawsuit filed against it by the New York State Attorney General. Genesis will submit a plan of liquidation on 14 February.

The New York Attorney General's office has expanded its lawsuit against Digital Currency Group. The amount of fraud was three times the original estimate, exceeding $3bn.

According to a study by the Coinbase exchange, US residents could save at least $74 million (or $600 per household) in 2022 if they used cryptocurrencies rather than credit cards for payments. That includes businesses that paid $126 billion to process credit card transactions.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)