Crypto growth derailed

Market Picture

The cryptocurrency market failed to get on the growth rails, losing 0.7% in 24 hours to $2.44 trillion, near end-of-day levels on Wednesday. The positive effect of the soft inflation report was erased by the Fed's comparatively tightening stance, which suppressed appetite for risk assets. This is clearly visible in the demand for cryptocurrencies despite the rally in the S&P500 and Nasdaq100 indices.

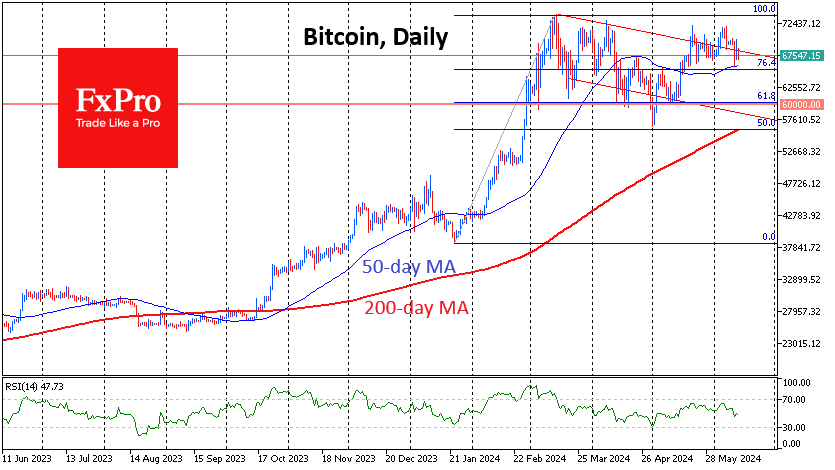

Cryptocurrency traders should prepare for the scenario: what doesn't rise, falls. The signal for the start of an active sell-off could be the decline of BTCUSD under $65.8K, where the area of the week's lows, the 50-day moving average, and the 76.4% Fibonacci retracement of the growth from the January lows to March peak are concentrated. The next support could be the $60K area.

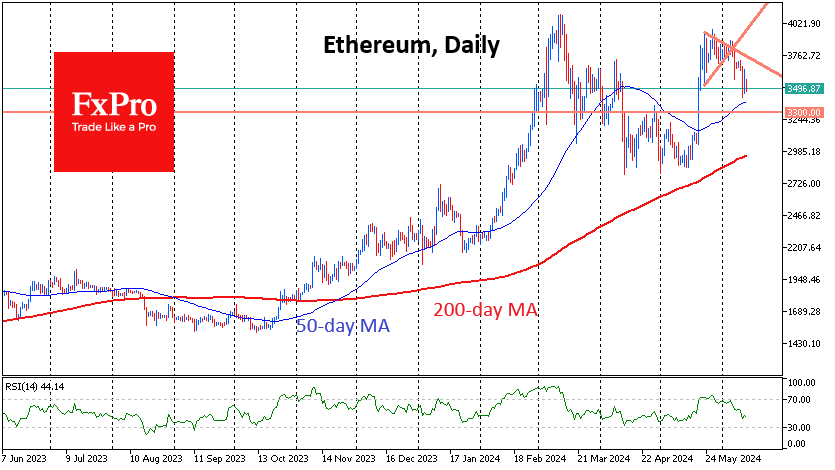

Ethereum has moved back below $3500 into the week's lows. A failure below $3300, the pivot area from March, will confirm bearish dominance. A failure below would open a direct path to $3000.

News background

Despite impressive inflows into spot bitcoin-ETFs, arbitrage strategies between the spot and derivatives markets have kept buying pressure in check, according to Glassnode. These involve longing in the spot market and shorting in futures on the same underlying asset that is trading at a premium.

K33 Research believes the significant inflows seen in the BTC-ETF may only partly reflect arbitrage between the spot and futures markets. It's more about demand than hedging.

CryptoQuant notes that transaction speeds on the Bitcoin network have fallen to levels of 13 years ago. BTC has failed to become the everyday payment asset its creator, Satoshi Nakamoto, dreamed of.

Ex-CEO of BitMEX Arthur Hayes and Real Vision CEO Raul Pal discussed promising altcoins, emphasising the potential of Solana (SOL) and Aptos (APT). Hayes is optimistic about Ethena (ENA), given the potential for the USDe stablecoin to "displace" USDT and USDC.

MN Trading founder Michael van de Poppe said that now is a good time for risk assets and urged buying altcoins.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)