Crypto market tests range ceiling

Crypto market tests range ceiling

Market picture

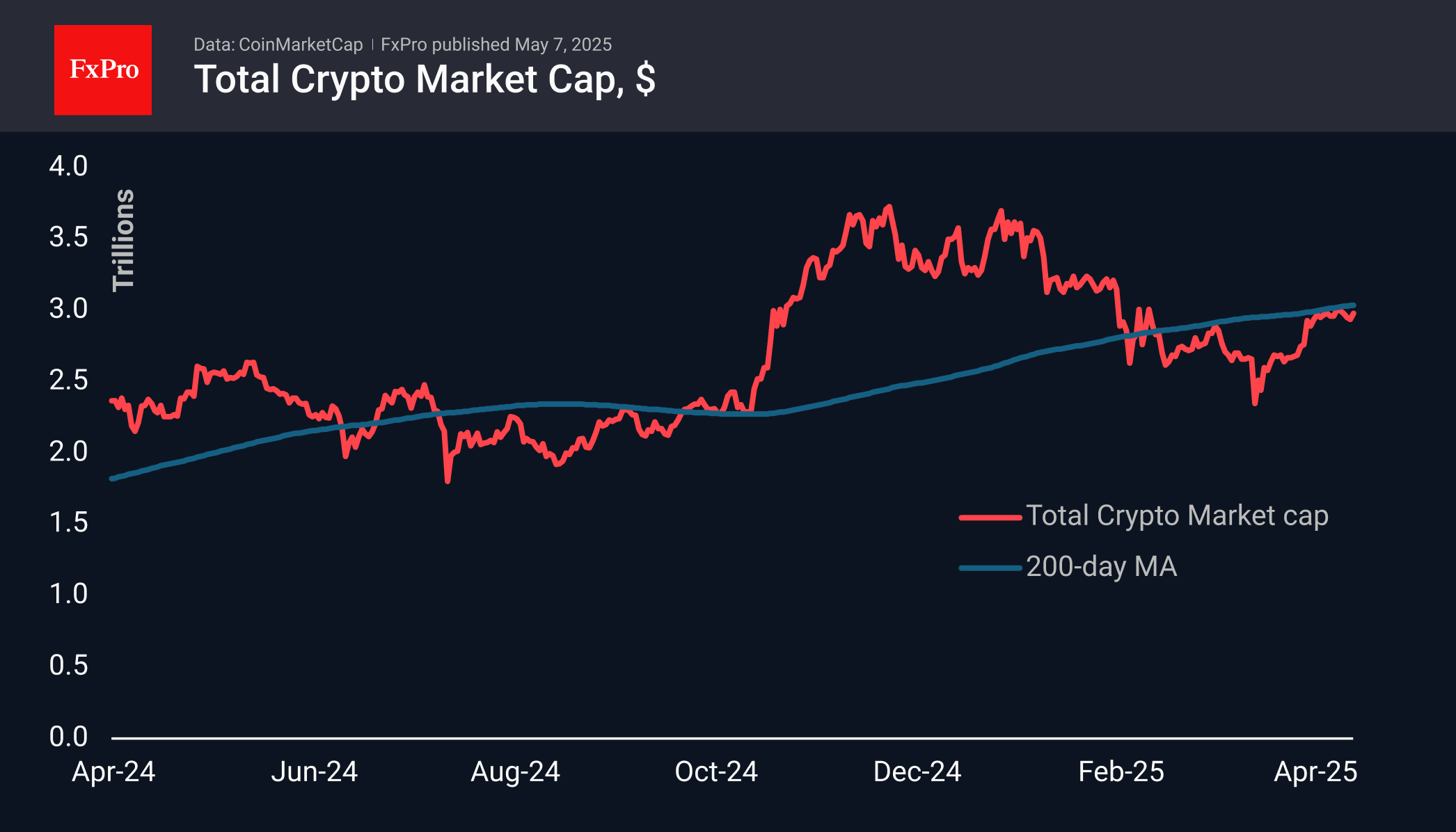

Market capitalisation rose 1.7% in the last 24 hours to $2.98 trillion, approaching the upper end of the consolidation range where the market has been hovering for almost two weeks. The previous consolidation in April took about the same amount of time before the last move up. Rest after the rise may favour further growth.

Greed characterised market sentiment on Tuesday, with the corresponding index rising to 67, repeating the highs of May 2.

Bitcoin rose significantly on reports of events in India and Pakistan, briefly surpassing the $97.5K level. This growth momentum has not yet found support in other assets - gold is getting cheaper, and the equity index is mostly down. Perhaps the assault on local highs will continue soon. A consolidation above $98K may trigger a growth scenario up to $112K.

News background

Riot Platforms, the fourth-largest bitcoin mining company by bitcoin reserves, mined 463 BTC in April and sold 475 BTC for $38.8 million. The firm sold coins from the reserve for the first time in about a year.

BlackRock's IBIT is the defining contribution to the ETF's positive performance. According to Lookonchain, BlackRock additionally purchased 5,613 BTC (over $529 million). The company now holds 620,252 BTC (worth over $58bn).

Bitwise investment director Matt Hougan said the crypto market could face difficulties this summer if the US Congress does not continue to work on profile bills. He noted a bill to regulate stablecoins, the passage of which has been delayed.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)