EBC Markets Briefing | European stocks see peak negativity

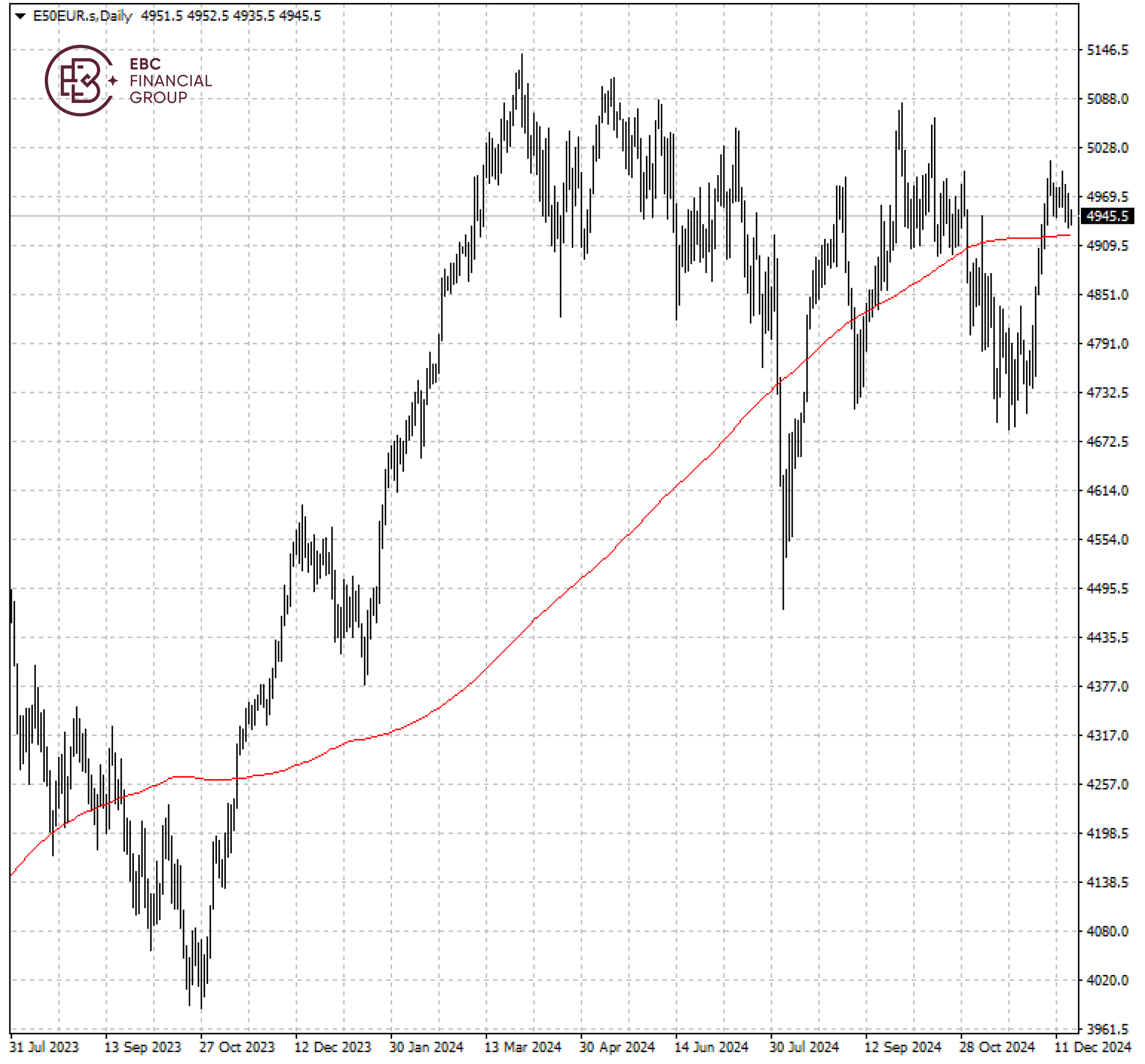

Europe’s STOXX 50 was flat on Tuesday as the severity of negative data shocks reduced. GDP growth in the eurozone in Q3 accelerated from 0.2% to 0.4%, partly driven by one-offs.

European stocks are set to underperform the US by the most in at least 25 years, MSCI data showed, while some forecasters expect sustained bad news to drag the euro below a parity with the dollar.

Contrarian traders argue that the undervalued assets are fully priced for more disappointment and could rally strongly if the geopolitical and economic backdrop brightens.

The ECB downgraded its growth forecasts last week, and cautious households are hanging onto their savings. Citi's economic surprise index for the bloc is below zero, showing data is widely missing expectations.

German stocks were an outlier, reaching a fresh all-time high earlier in the month. Market watchers are warming to beaten-down French stocks which could benefit from easing budget stresses.

BofA strategist Michael Hartnett predicts a "major correction" in US stocks in the first half of 2025 and expects European companies to attract more investment for this reason.

The STOXX 50 gained some strength and stayed above 200 SMA. However, the signs of lower high and lower low suggest that the index could be heading back to the 4,910 level.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.