EURJPY bears stay in control

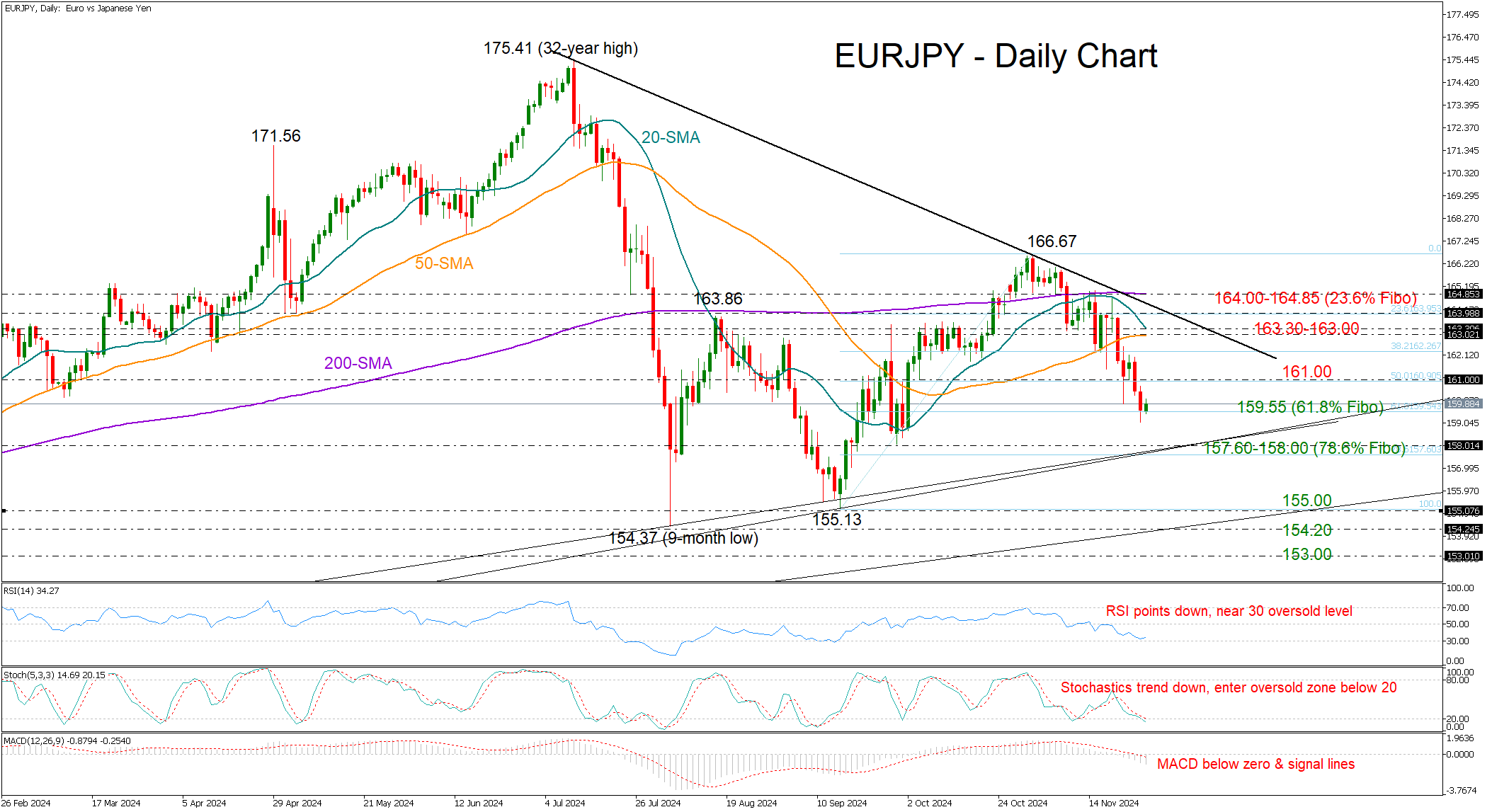

EURJPY is set to post its fourth consecutive negative week, having retraced more than half of its September-October uptrend to reach the 159.00 level on Wednesday.

The 61.8% Fibonacci retracement level of 159.55 came to offer some support, but it seems the bears are not ready to give up control. The RSI and the Stochastic show no signs of a positive reversal despite hanging near their oversold levels, and the MACD has just started a new negative cycle below its red signal and zero lines, all suggesting downside risks could stay alive. Moreover, it’s worthy to note that the 20-day simple moving average (SMA) couldn’t cross above the 200-day SMA.

If the selling continues, traders could look for support within the 157.60-158.00 region, where the 78.6% Fibonacci mark and the ascending trendlines from 2022 are positioned. A violation there could send the price spiraling toward September’s low of 155.13, with a deeper dive to 154.20 on the cards. Additional declines from there could possibly pause near 153.00.

On the flip side, if the bulls manage to push the pair above 161.00, resistance could emerge near the 20- and 50-day SMAs currently within the 163.00-163.30 zone. The resistance trendline from July’s top could be a more important barrier at 164.00, whilst the 200-day SMA could give the green light for a rally to October’s high of 166.67.

In summary, bearish pressure is likely to persist, especially if EURJPY drops below 157.60-158.00.

.jpg)