Gold unlocks another record high

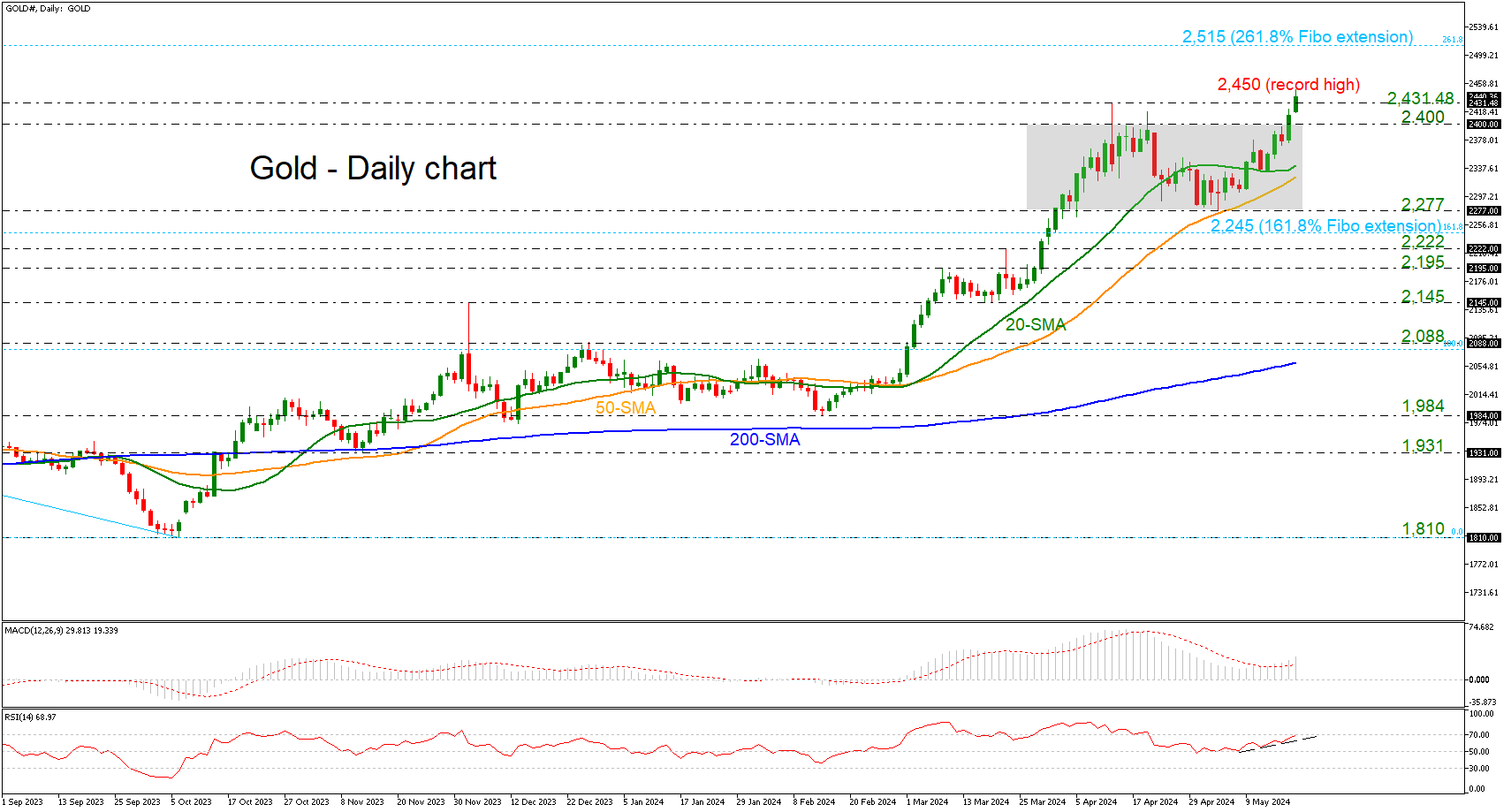

Gold prices skyrocketed to another fresh high of 2,450 earlier in the day, currently holding above the previous peak of 2,431.48.

This movement may be a sign of further increases during the next couple of days, with the technical oscillators suggesting more gains in the market. The MACD is strengthening its positive momentum above its trigger and zero lines, while the RSI is flirting with the 70 level, holding above the ascending trend line.

In the positive scenario, traders might pay attention to the 261.8% Fibonacci extension level of the downward wave from 2,079 to 1,810 at 2,515. A bounce higher could take a breather around the next round number of 2,600.

If the intraday’s high stands firm, though, the precious metal could plummet towards the 2,400-2,431.48 support area. The 20- and the 50-day simple moving averages (SMAs) at 2,342 and 2,326 might tackle selling pressures slightly lower at 2,277, which was the lower boundary of the consolidation area. Then, if the bears breach the latter level, the bearish move might pick up pace towards the 161.8% Fibonacci extension at 2,245.

All in all, the technical signals leave the door open to another upturn and if there is a closing day above 2,431.48, it could endorse gold’s buying interest.