Governor Bailey in the spotlight again

OVERNIGHT

Asian equity markets firmed overnight on reports of progress in US debt ceiling negotiations, leading to some easing of debt default fears. President Biden expressed confidence on reaching a deal, while House Speaker McCarthy said a deal is ‘doable’. Japan’s Nikkei equity index rose to a three-decade high. The only notable data release was an unexpected rise in the Australian unemployment rate to 3.7% from 3.5%, weighing on the Aussie dollar. In the UK, it was reported that PM Sunak will unveil a semiconductor partnership with Japan as well as inward investment during his visit to the G 7 summit in Hiroshima.

THE DAY AHEAD

Bank of England Governor Andrew Bailey is in the spotlight again today as he and Deputy Governors Dave Ramsden and Ben Broadbent testify to the Treasury Select Committee from 10:15BST on quantitative tightening (QT). MPs on the Committee are expected to ask about the role of quantitative easing (QE) in the rise in inflation and whether tightening will help bring inflation down. Markets will be looking for further clues on the likelihood of additional rises in interest rates, with investors currently pricing in another quarter-point increase. Yesterday, Governor Bailey reaffirmed that lower energy costs will drive headline inflation down this year,but he also noted uncertainty and upside risks to the inflation outlook due to potential second-round effects from domestic wages and prices.

Overnight (early Friday), we expect to see a further improvement in UK GfK consumer confidence to -28 in May from -30 in April. That would represent the highest level since early 2022. Consumer confidence fell particularly sharply last year due to the energy crisis, but has steadily recovered since last September’s low point, helped by lower energy costs and stronger labour demand.

US weekly jobless claims data and the Philadelphia Fed manufacturing survey are the main releases across the pond. Initial jobless claims have risen, providing evidence of a cooling labour market. Regional manufacturing surveys have been volatile, but have signalled a generally lower trend, although we see scope for an improvement in the Philly survey after last month’s unexpectedly weak outturn.

Japan’s national CPI data are forecast to show increases in both the headline and core (excluding fresh food) measures to 3.5% and 3.4%, respectively. The Bank of Japan’s stimulus policy measures, however, are expected to be maintained for now.

MARKETS

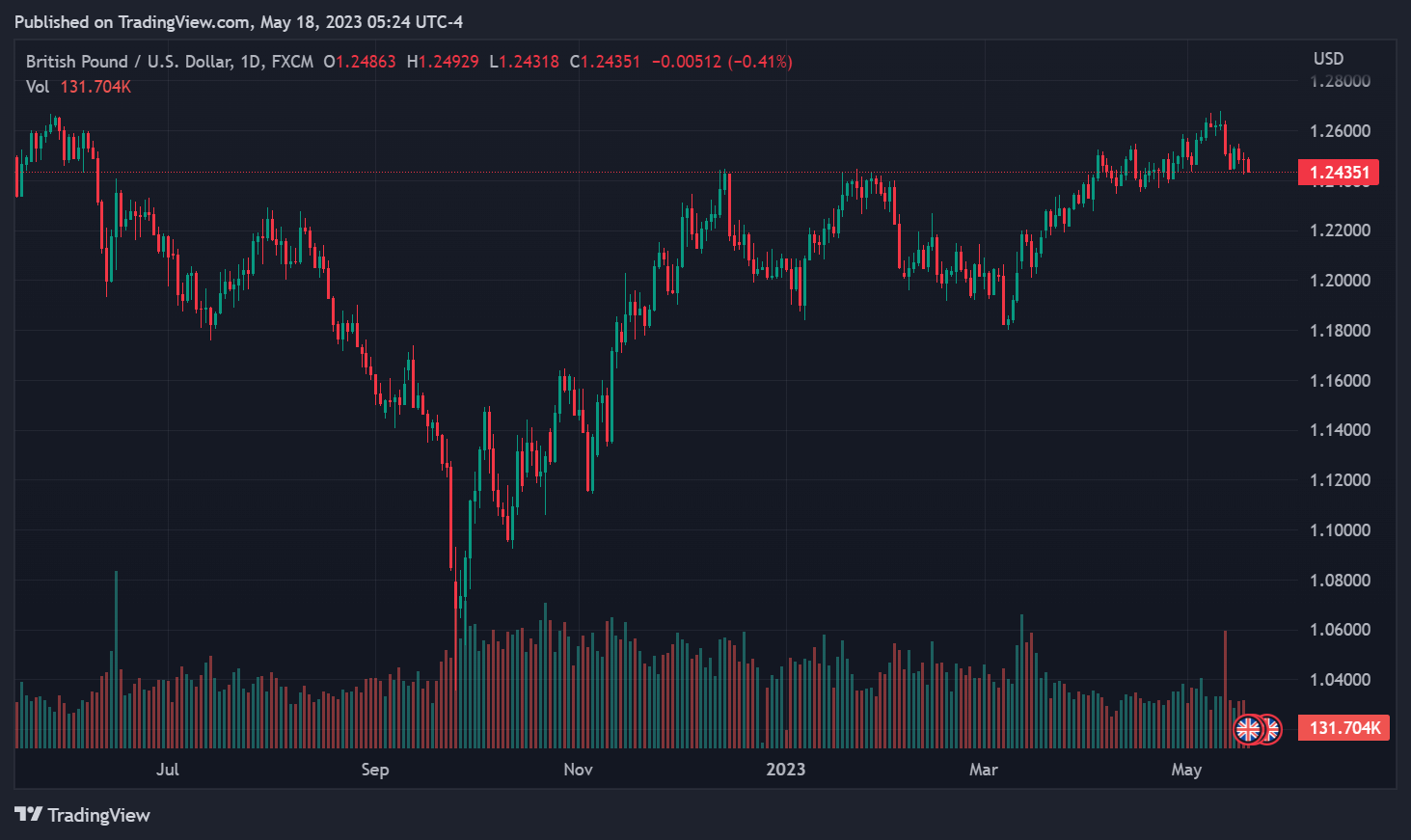

With no major UK data today, markets will likely be sensitive to BoE Governor Bailey’s remarks to the Treasury Select Committee. BoE Chief Economist Pill will also speak at a separate event. GBP/USD remains just below 1.25 and GBP/EUR at around 1.15.