Markets rattled on consumer sentiment

Markets rattled on consumer sentiment

The Nasdaq100 index lost over 4% from the start of the day Friday to mid-day Monday. As a mainstay, many media outlets are replicating the idea of traders' fears of tariffs that come into effect this week.

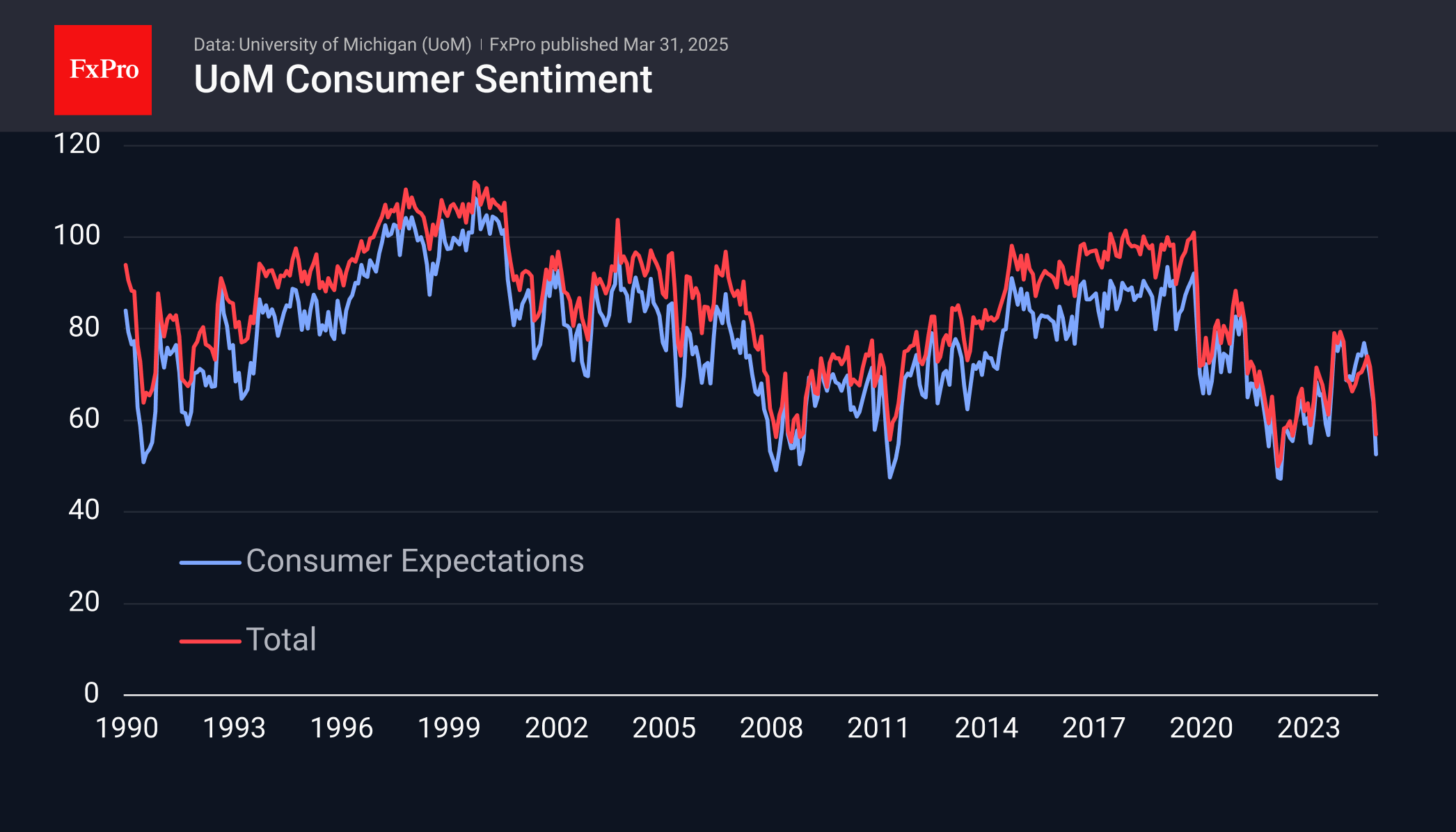

However, this is hardly news, and such a decline needs a driver. Friday's publication of the consumer sentiment index from the University of Michigan is quite suitable for this role. It contains alarming information for stock indices on all fronts.

The index lost almost 8 points over the month to 57.0. Below 60 was last seen in the second half of 2022, preventing the stock market from finding a pivot to return to growth. Regarding the outlook, consumers are at their most pessimistic in nearly three years. Like three years ago, stocks were starting to decline before signals from this index, but a rebound in sentiment is often a prerequisite for buyers in the stock market.

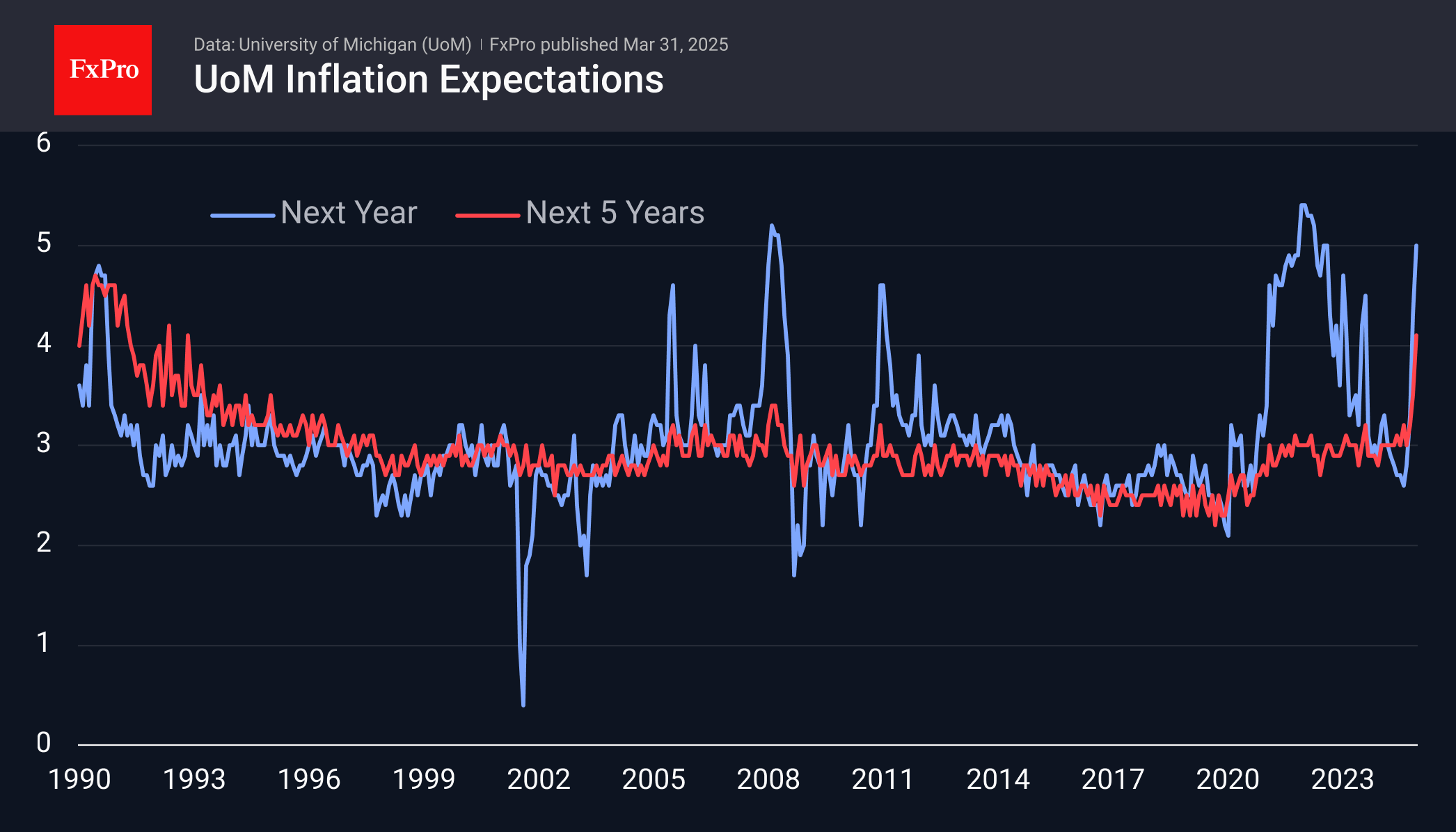

But the devil is in the details. The shocker was the soaring of five-year inflation expectations to 4.1%. That's the highest in more than 30 years and the sharpest three-month rise in the measurement history of the past 35 years. Clearly, inflation expectations have lost their anchor - a nightmare for central bankers.

Real inflation, or even inflation expectations, have the potential to stop the Fed from easing policy or to sharply limit such measures early on. They may become justified only when unemployment spikes, but by then, the markets could be in for a complete shake-up.

This is a double blow to markets, suggesting a shift of people to a savings-based consumption pattern, which is also evidenced by a rise in the savings rate and a simultaneous switch to a regime where the prices of ‘protective’ goods may accelerate due to an influx of demand.

Of course, the basic reason for the degradation of sentiment and the jump in price expectations is the fear of the consequences of tariff wars. However, this is a different level when sentiment affects consumers, not just markets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)