OPEC+ meeting could switch oil regime

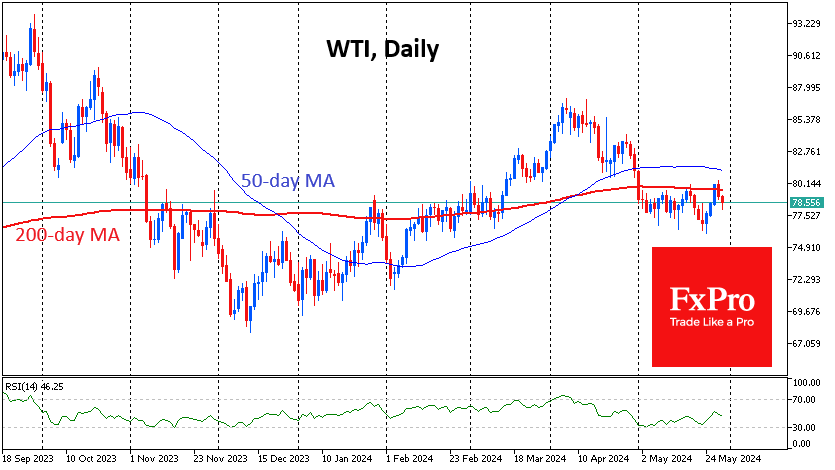

Oil declined for the second day in a row, reversing down from its 200-day moving average for the third time this month. An OPEC+ meeting is scheduled for this weekend with enough potential to break the tie.

Oil's upward trend that started in December stopped in April with an impressive 12% correction. But it failed to develop, and throughout May, we saw fluctuations around the $78 average level with increasing amplitude.

Technically, the failure to develop a rise above the 200-day average is a sign that the bears are in control. The same is evidenced by the 50-day average above price and reversing downward during May.

The news media has been thickening the colours by pointing out the fall in discipline within OPEC+, which is producing well above quota, so the market is not creating an oil shortage and lower inventories as the cartel's forecasts promise.

In 2014, Saudi Arabia, the leader of the cartel that provides the largest voluntary production cuts, had already surprised the world by suddenly expressing support for lifting the restrictions, which set off oil price wars.

But that strategy failed, eventually bringing the cartel to OPEC+, which includes members who agree on their production quotas but are officially in it, led by Russia.

So far, there is little sign that Saudi Arabia or Russia will return to the practice of oil wars. Nevertheless, for a rather fragile market, even a signal that no further cuts are expected and that the agreed quotas will be gradually raised could be a sufficient reason to sell off.

Special attention, in our view, should be paid to the support in the form of the 200-week moving average, which invariably triggered the cartel's response. It is now nearly $75. A decisive decline below it will indicate a change in the market regime.

The bullish scenario assumes that the price's proximity to the sensitive zone for the meeting will force OPEC+ to choose a tougher tone in its comments and promises, bringing oil back to growth. In this case, an important marker would be the ability to rise above $80.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)