USDCAD pivots higher: Is this rebound sustainable?

USDCAD is on the move, climbing off a seven-month low after news broke that the White House struck a trade deal with the UK. Hopes are now rising that more international agreements could be on the horizon, but in the meantime all eyes will turn to the Canadian employment data as the jobless rate is expected to rise back to a three-year high of 6.8%.

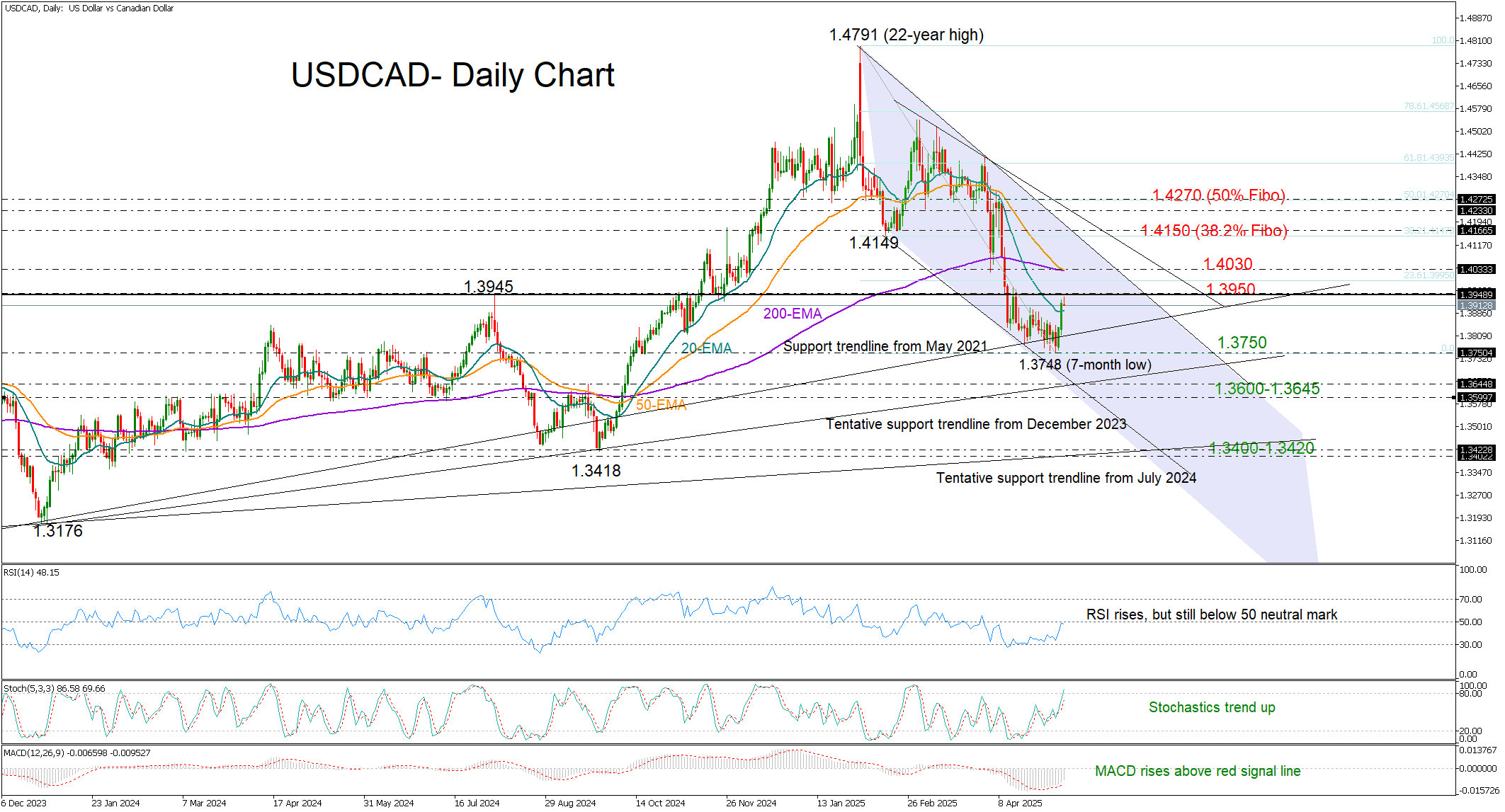

From a technical perspective, the rebound kicked in around the October 2024 base of 1.3750. Since then, the bulls have managed to push the pair above the 20-day exponential moving average (EMA) for the first time in seven months, signaling renewed upside interest.

Momentum indicators are starting to catch up, reinforcing the ongoing bullish action. But for a meaningful rally, a clear break above the upper band of the broad sideways trajectory at 1.3950 is essential. Even more important would be a move past the long-term EMAs at 1.4030. If that happens, momentum could accelerate toward the 1.4150 region, where the 38.2% Fibonacci retracement level of the latest downtrend lies, and then potentially stretch towards the 50% Fibo mark at 1.4272.

On the flip side, failure to hold above 1.3950 and a dip below the 20-day EMA at 1.3890 could squeeze the price back to the 1.3750 support zone. Note that the RSI is still hovering below its neutral 50 level, suggesting buyers haven’t fully taken control. A deeper pullback could find firmer ground at the rising trendline from December 2023 around 1.3645. If the 1.3600 round level gives way too, a more aggressive sell-off toward the August–September double-bottom area of 1.3420 could be on the cards.

In a nutshell, USDCAD has found some bullish momentum – but unless it can decisively clear the 1.3950–1.4030 barrier, the rebound may prove short-lived.